Good News & Bad News

The gods want new victims. FED prepares to raise interest rates once again. The recession in Europe became concrete with the negative growth in the first quarter and rapidly falling inflation rates. There is no obvious problem with growth in the US economy, but the FED expects a slight recession towards the end of the year.

Uneasiness has increased while the medium-term uptrend continues in equity markets and crypto. The Nasdaq 100 index failed to pass the 15.200 level in its second attempt. If this level is not passed in the third attempt, we may witness a trend change in technology stocks.

Ethereum dropped about 4% yesterday. Bitcoin dominance, which was 40% at the beginning of the year, has exceeded 50%. Bitcoin bulls try to hold the critical support/resistance level of 30k. Yesterday, the yield on US ten-year bonds rose above 5% again. Bitcoin and Ethereum could nearly double from the bottom in an environment with a high risk-free return. This situation shows the strength and potential of the crypto market.

Futures pricing shows that market players are almost certain to see an additional 25 basis points increase in US interest rates. FED's "two more increases" rhetoric has not yet been reflected in prices. In the USA, consumer headline inflation and core inflation are separated. While headline inflation is declining rapidly, rigidity is observed in core inflation. Core inflation in producer prices decreased to 2.8% at the end of May. In the first half of last year, inflation was high worldwide. Therefore, inflation declined rapidly in the first half of this year due to the base effect. The base effect on inflation will disappear in the year's second half. The FED may be holding things tight for this reason.

Interest rate hikes harm crypto prices. On the other hand, it should be remembered that every rise has a descent. High-interest rates allow the Fed to intervene in a possible recession. The same is true for the European central bank. But the job of the European Central Bank is much more difficult. The economic slowdown is already evident. On the other hand, the economic slowdown brought along a rapid decline in inflation. Producer prices in Europe are already negative. It wouldn't be surprising if US inflation fell into negative within a few months. In this case, FED can make a U-turn.

In today's conjuncture, where uncertainty prevails in the markets, the power of crypto is tested. The bulls need to protect the positions they have won. Bitcoin price has been above 30k for two weeks, and the longer it can stay here, the better. The 1800-1850 range is a critical support zone in Ethereum. High-interest rates and the actions taken by the SEC in the USA are factors that reduce risk appetite. These days, even the crypto's holding on to its current position can be seen as a success. Once conditions become supportive, market enthusiasm will take a little while to build up.

Some infrastructure improvements are yielding results despite the bear market. With the launch of the decentralized microblogging project Threads, the price of Leo more than doubled. Elon Musk's changes in Twitter policies may also have contributed to the investor interest in Threads.

In Splinterlands, too, the infrastructure is constantly evolving. The fact that it became a core element of the reward mechanism eventually led to a price increase in SPS. Although the growth is limited to 15%, it may continue. Currently, the daily rent for 1 SPS is around 0.008 DEC. These numbers show that SPS holders now receive an additional 13% annual income from the delegation. Players must accumulate SPS to take full advantage of the income potential of their cards. Otherwise, they have to rent SPS power.

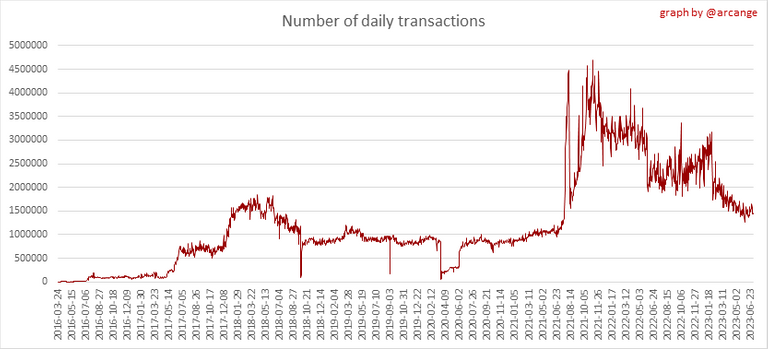

The bear market we are in has once again revealed the impact of the flow of funds on crypto network activity. Infrastructures have developed in the last two years, and many new play-to-earn games have been introduced. Below we see the daily transaction count statistics generated by @arcange. Transaction volumes declined during the bear market.

The number of transactions is at the level Steemit reached in the first months 2018. Hive's predecessor Steemit had a market cap of over $1 billion at the time. Now, Hive's market value is one-seventh of that value. We can evaluate the difference as rationalization or as underpricing.

TL;DR

As time progresses, value accumulates on crypto networks. Because although the infrastructure is developed, the price does not increase due to market conditions. Rising interest rates are also delaying the realization of the potential value accumulated on crypto networks. When the wind direction changes, users involved in crypto networks will encounter much more mature infrastructures and sustainable financial conditions. It will be interesting to observe.

Thank you for reading.

Cover Image Source: Midjourney App

I could have been more intentional about SPS in 2021 if I read the whitepaper enough. Now I could have just made back some income by delegating it. 13% annual income for delegation is really decent