Uniiswap V3 Just Launched | How Are The First Days?

After more than a month from the official introduction the Uniswap V3 went live on May 5, 2021.

Just a few days have passed since the launch but lets taka a look how things are doings, especially since there was some interesting stuff introduced. Its is interesting to see them now live and how are users responding to this.

Just a reminder of some of the main new features of Uniswap V3:

- Concentrated liquidity

- Multiple fee tiers

What I found especially interesting is the concentrated liquidity that in theory should increase capital efficiency by a lot. Higher APR basically, but more competition and activity required by the liquidity providers. To a certain degree LPs would need to make price predictions as well.

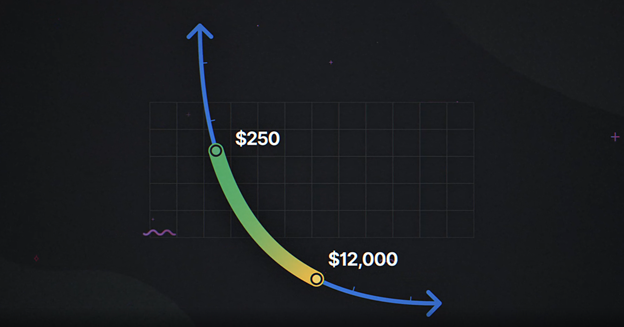

As the image above shows the range for the liquidity is 250$ to 12000. This is an example, not a specific coin. The liquidity provider can choose its range and maximize the fees earned for the period. If the pair exits the range, all the liquidity is swapped into one of the coins and no more fees are collected till the pair is back in the range of the liquidity.

Concentrated liquidity should be very efficient when it comes to stablecoins. Curve is now leading in the field, but with concentrated liquidity Uniswap can compete very well. For example, at the current model, when liquidity is provided for the DAI/USDC pair, only 0.5% is allocated in the range of 0.99 to 1.01$, that is actually the most traded zone. With concentrated liquidity, LPs can adjust their liquidity very tight in the range around 1$, that will boost their APR.

V3 will run in parallel with V2, LPs and users don’t need to switch to V3 if they don’t want to.

The Live Data

So how are the things above playing out?

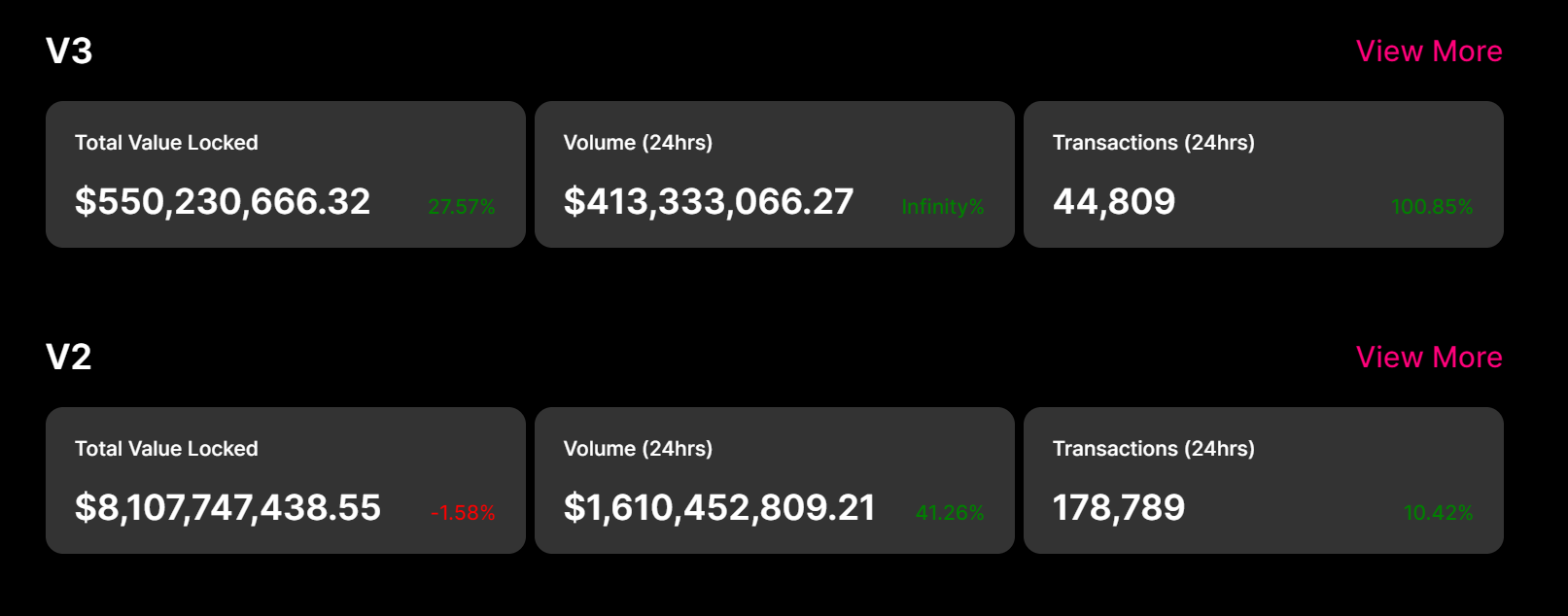

First data on the TVL and trading volume for V2 vs V3.

https://migrate.uniswap.info/home

As we can see after a few days V2 is still dominant in TVL with more than 8B VS 550M on V3. Just a 7% of the TVL have moved to V3.

In terms of trading volume there is more than 400M trading volume on V3, compared to the 1.6B on V2. The share in trading volume is bigger than the TVL, meaning LPs on V3 should be having some nice fees in these first days.

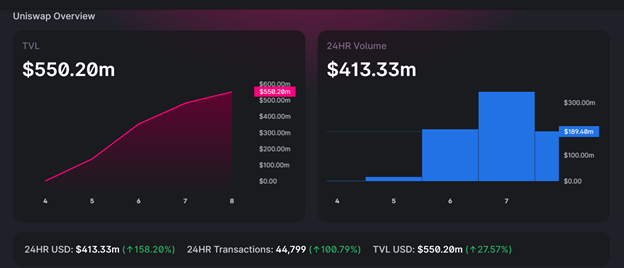

Here is how the progress looks in the first days.

Overall, it’s a obviously up trend, but not an explosive growth. LPs seems to be more careful and don’t want to transition fast.

How Is The Concentrated Liquidity Playing Out

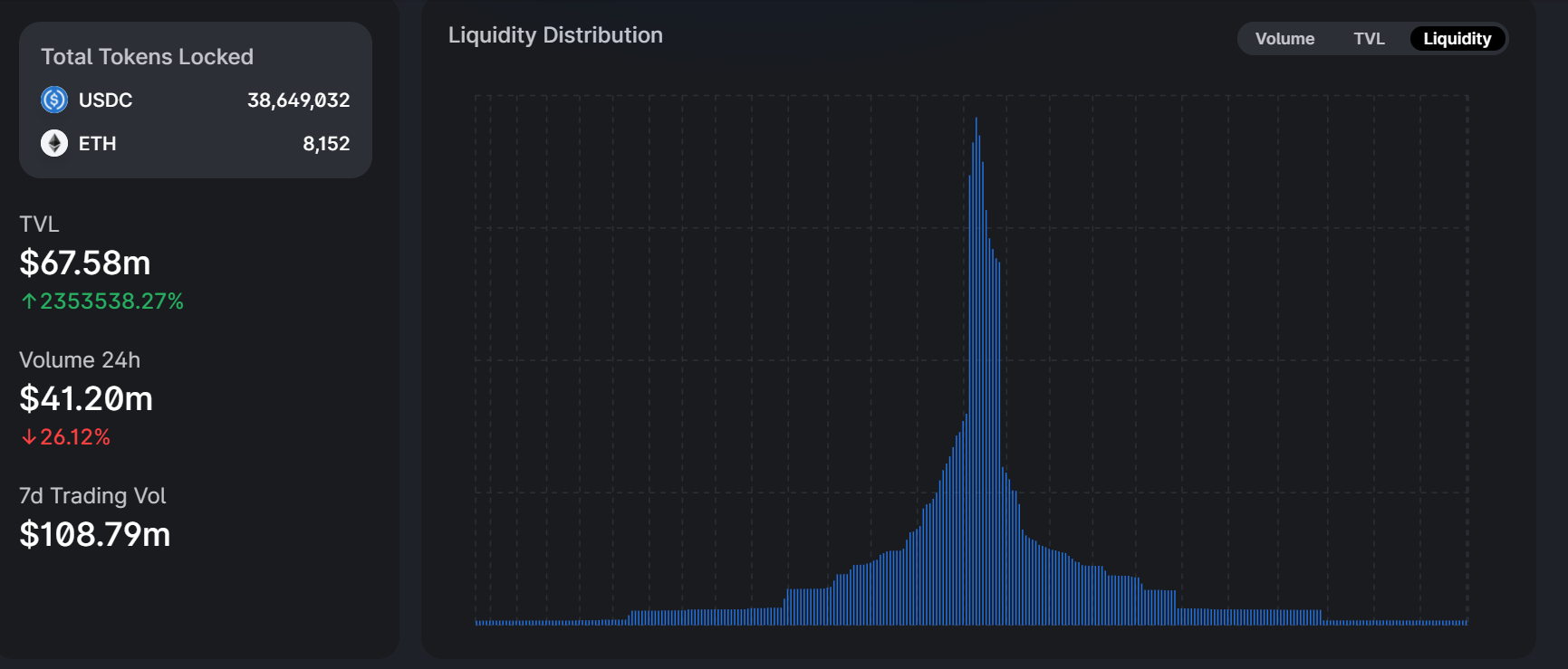

If we look at the liquidity distribution for the USDC-ETH pair, that has the most liquidity on V3, things look like this.

Well, quite the tower here. The highest liquidity is distributed just around the price range.

Left on the chart, prices are higher, right they are lower. From the liquidity distribution, we notice more liquidity is put in the higher numbers for the ETH price, meaning the majority of the liquidity providers expect the price to go up.

Its quite amazing to see how LPs react to this new system. Obviously much more dynamics and capital movement in V3 vs V2. This might give the average user a disadvantage, since the more you optimize your liquidity the highest the APY, and automation will have a big role here. (aka bots)

I expect that with time services will appear where you can stake your liquidity and let them adjust it for a maximum capital efficiency.

Liquidity distribution on stablecoins

How is the liquidity on stablecoins playing out?

Stablecoins were the pools where it was expected for the maximum effect in capital efficiency. Since they are stable the liquidity can be in a very tight range around the 1$ mark.

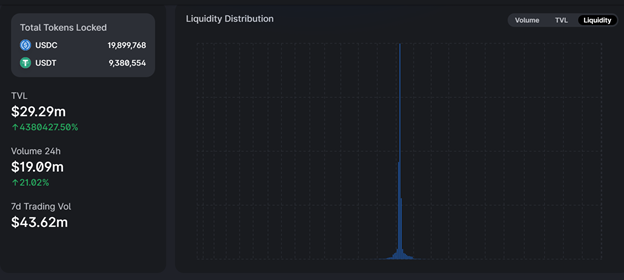

Here is the chart for the USDC-USDT pool.

This is quite amazing. Almost a straight line 😊.

As expected most of the liquidity is provided around the 1$ mark. What this means large swaps between stable to stable coins can be made with low slippage. As more and more liquidity is being added, larger swaps can be made. For now the pool has only 30M. A reminder that curve has billions in liquidity in stable coins, so it is expected this pool to grow by a lot.

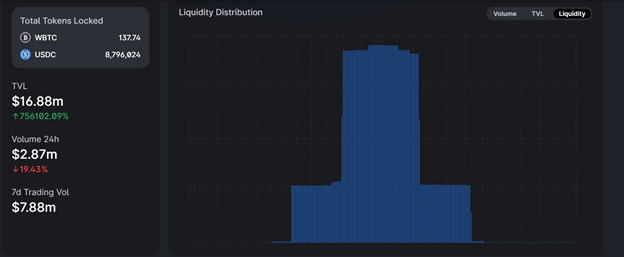

What about Bitcoin?

The Bitcoin liquidity distribution is the most even out from all the above. Meaning LPs can really tell where will the price of BTC go, so they have spread it out equally in the range. The pool is still small, only 16M in TVL so this might not be telling the whole story.

Its interesting to watch how the Uniswap V3 is playing out in real time.

From the above we can conclude that there is a healthy amount of liquidity that has transitioned to V3 in the first few days. A total of 7% of the TVL. In terms of volume, the share is higher with almost 1:1 ratio TVL to volume, meaning higher fees for LPs.

The liquidity distribution is probably the most interesting part.

For the stablecoins we can see a very concentrated liquidity around the 1$.

For ETH we can see a lot of liquidity around the current price, meaning LPs are following the price with their ranges. A slightly more liquidity is added for higher ETH prices, signaling an expectation for the ETH price to go up.

For BTC a more even out distribution of the liquidity.

These are still very early days of Uniswap V3, with not a lot of liquidity in the individual pools, meaning the data should be taken with reserve. As the TVL grows more reliable will be the data and the distribution of the liquidity across the pools.

Charts source the Uniswap V3 app

All the best

@dalz

Posted Using LeoFinance Beta