🚨Bitcoin: What did the market leave us with this week?

🚨 Market Overview

Source CoinTrendzBot

Source CoinTrendzBot

Source CoinTrendzBot

This past week has been intense in the crypto world. Bitcoin continues to oscillate within the range I mentioned in previous posts, and while we've seen some attempts at recovery, the selling pressure remains strong. Currently, buyers have shown some resistance around 90K and 96K became the strongest support point, and as it has been consolidating at that last support I believe there will soon be a rally above 100K, the hard part will be holding it.

If there is one thing that became clear over the last few days, it is that the market is in a consolidation phase. We are not seeing an outright collapse, but neither are we seeing clear signs of a strong uptrend. Key levels have been quite respected: 96K acting as solid support, while the 101-103K zone has shown strong resistance with sellers dominating the game.

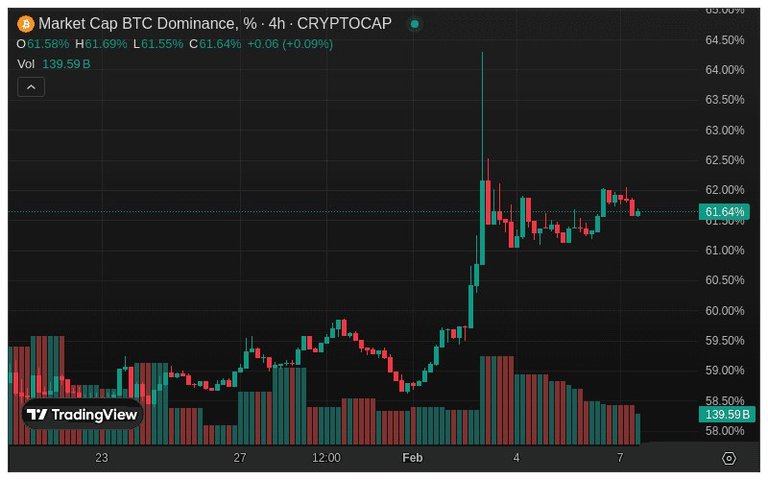

What's interesting is that despite this sideways movement, Bitcoin's dominance continues to increase. It recently hit 64.3% before pulling back to 61%. This reinforces the idea that altcoins continue to suffer. In fact, some have lost as much as 20% of their value in the last week, and those who entered shorts at the right time made nice gains. On the other hand, spot portfolios, including myself, have taken a big hit. I bought some altcoins looking for rebounds, and while some have provided interesting opportunities, the overall picture does not look favorable for an altcoins seasonal rally.

This is where the story gets interesting. There are analysts who believe we are in for a prolonged bullish phase, driven by growing institutional adoption and massive buying of BTC through ETFs. There is even talk that governments may start hoarding Bitcoin as a strategic reserve. Sounds good in theory, but this could also bring problems. Arthur Hayes, founder of BitMEX, warned that if a government starts stockpiling BTC as a reserve, this asset could end up becoming a political tool. And if in 2028 there is a change of power, it could simply be liquidated, generating a shock in the market.

On a technical level, I continue to watch the 96K area with a lot of interest. In recent days, the price has reacted strongly every time it has touched this level, but I would like to see another drop to mop up the remaining liquidity. If price returns to 96K and we see a good structure, it could be an opportunity for a long position. There is also the scenario where we go even lower, to 92K, before a rebound. It will all depend on how the global markets react.

Another key factor to monitor is the US unemployment report, which is released today. This data usually brings volatility, and in a ranging market like the current one, any surprise in the numbers could be the trigger for the next big move in Bitcoin.

So, are we in a bear market? I don't think so. But I don't see clear signs of an alternative season in the near term either. Everything points to us staying in this range while the market decides on its next big move.

How about you, how do you see the current outlook? Do you think bitcoin will stay above 100K or will we see another drop before a recovery?

Want to know more?

Every day I publish my analysis and my detailed opinion of the crypto ecosystem. If you want to dig deeper into this topic, let me know! Leave your reactions, comments or share your own thoughts on what's going on.

See you in the next post!

Author's advice

For a better reading and visualization of the publication use peakd.com

Buy Me A Coffee

Buy Me A Coffee

🌐 Socials:

Hello 👋 my name is Jelvys Triana and I am an Industrial Engineer in Cuba, cu. I invite you to follow me. When I'm not watching crypto news or trading, I'm studying programming and web application development with javascript, python and MySql.

@mowgl1ph, I'm refunding 0.004 HIVE and 0.000 HBD, because there are no comments to reward.