Trump’s Rate-Cut Dreams temporarily Dashed by Powell’s Resolve

Made using https://www.canva.com/

There are some things even President Trump cannot control, no I am not talking about the American President trying to control supply of Bitcoin, no, nopes, I am talking about something which made news this month, on him unable to pressure the Fed Chair, Jerome Powell to cut interest rates!

Made using https://www.canva.com/

President Trump had expressed his displeasure on Jerome Powell, not hurrying up to do what Trump thinks Fed should do, saying that Jerome was always wrong and late in cutting interest rates, and that it’s time to remove him!

Just see President Trump’s Social Truth post on this because it’s hard to express Trump’s way of putting things – only Trump can do it! The Trump offensive has a class of it’s own!

Market Panic Eases as Powell Holds His Ground

News was on that DXY fell to a 3 year all time low then, fearing Trump would remove Powell, and appoint a chair who would do his bidding.

However, now it’s pretty clear Trump won’t do any such thing because he does not have the authority of terminating the Fed Chair.

The Federal Reserve is an independent body that’s not meant to be controlled by the American Parliament and President, and Trump now is not aiming to remove Fed Chair.

So, DXY relaxes, getting out of being in panic mode!

There’s no more declines, initial uptick has come about with a bounce having taken place. So, the Dollar’s stopped bleeding to other major currencies.

Why Jerome Powell Is Holding Off on More Rate Cuts

So, Jerome sticks to his hawkish mode.

By now, everybody knows that Tariffs are bound to trigger inflation, so Jerome is waiting and watching the impact the Tariffs would have on inflation.

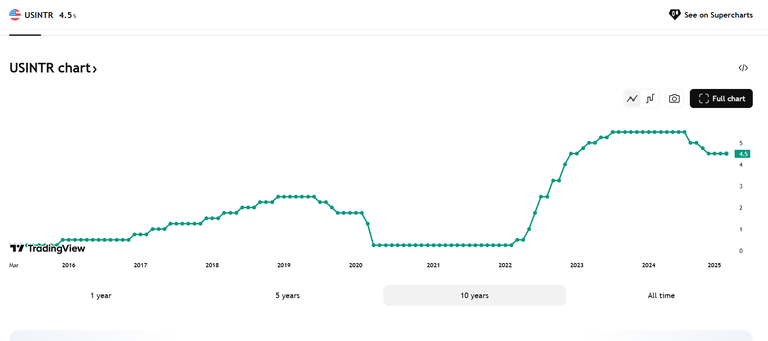

The fundamental theory here is – interest rate change monetary measures are done, according to inflation pulse of the economy. Fed has already cut interest rates from 5.5% to 4.5% having implemented rate cuts from the month of September to December 2024.

Rate cuts do increase money supply in the economy, as money credited through loans is easily available and move in the economy causing inflation. As more money propels demand for goods and services.

Tariffs are inflationary as well. They cause prices of products to rise very abruptly through purchasing power of people do not increase. It may even cause stagflation if it brings about recession that leads to layoffs!

Powell, currently feels that since inflation is likely to occur due to effects of Tariffs, Fed should not further add on to this inflation by cutting interest rates.

What Could Force the Fed to Cut Rates?

However, if US economy shows signs of weakness – increase in unemployment, decline in manufacturing, production and consumer demand and spending, FED may cut interest rates to strengthen economy.

Right now, FED’s going to wait and watch what’s going to be the impact of Trump’s Tariff on American Economy and inflation. Based on this, FED would evaluate suitability of cutting interest rates!

One thing is certain, if Trump’s Tariffs, impacts the economy negatively, i.e; that’s if companies make less revenues, less profits, there’s less production and sales. Then, FED may be forced to cut rates to prevent companies and businesses from defaulting on loans.

All this depends on how Trump’s Tariffs affects global trade, production, manufacturing, consumer demand and employment aspects of the economy. Also, how much of profits and losses businesses make due to all this phenomenon affecting the employment potential of business enterprises.

Posted Using INLEO

Congratulations @mintymile! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 4000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: