Markets in Panic Mode: Crude Oil Collapse Reflects Global Economic Jitters

Created using Microsoft Designer AI Generator and Canva

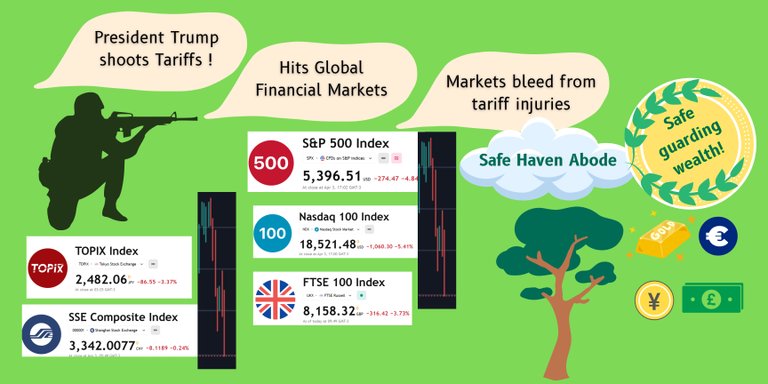

Trump’s Tariff Shock Sends Global Markets into a Tailspin

Created using Canva

Markets unmistakably entered a panic mode after April 2nd, triggered by Donald Trump’s now-infamous "Liberation Day Tariff" impositions. These new tariffs were notably severe—Vietnam, for instance, faced a 44% tariff, while China was hit with a staggering 54%.

The news spread quickly across financial media, framing Trump as a major contributor to the ongoing global economic turbulence.

I have explained this in my earlier post which you can read here -:

Alternate Safe Haven Assets That Shined Amid Tariff Turmoil and USD Decline

But beyond the headlines, one significant signal of market distress was the steep fall in crude oil prices—from $72 per barrel down to a low of $59—since April 2nd.

This decline signals that markets expect a recession. With Trump’s tariff strategy threatening global trade, the resulting economic slowdown is expected to reduce demand for crude oil, causing the sharp drop in prices.

Markets’ Hopes Dashed as Harsh Tariffs Become a Reality  Created using Canva

Created using Canva

There was initial hope that President Trump would refrain from implementing aggressive tariffs. However, that hope evaporated on April 2nd when the U.S. announced sweeping tariffs affecting products from 180 countries.

Now, China appears poised to retaliate with its own set of tariffs on American imports—likely triggering a chain reaction that will drive up global product prices and further unsettle financial markets.

How Tariff-Driven Inflation Fuels Recession Risk

Created using Canva

The inflation caused by these tariffs is stagflationary in nature—a dangerous blend of stagnant growth and rising prices.

Tariffs increase the cost of goods. Producers are then faced with two choices: pass the increased cost on to consumers or absorb the hit to their profit margins.

If prices go up, consumer demand declines.

If companies absorb costs, profitability suffers—potentially freezing expansion and investment.

Either scenario paves the way toward economic recession.

The Recession-Stagflation Trap Unfolds

When product prices increase while wages remain stagnant, it leads to a classic recession scenario. But if price hikes coincide with rising unemployment, the economy tips into stagflation.

Manufacturers who choose not to pass on tariff-related costs may preserve affordability for consumers, but their profit margins will shrink. This often forces companies to delay investments, halt hiring, and implement layoffs—further slowing economic activity.

Crude Oil Prices Reflect Global Sentiment on Economic Slowdown

The dramatic drop in crude oil prices underscores the market's growing conviction that an economic slowdown is imminent. Lower oil demand typically signals reduced industrial activity, travel, and production—all early indicators of recession.

Crude Oil May Stabilize as Essential Economic Activity Continues

Despite signs of recession, a total economic halt is unlikely. Core demand for essential goods and services will persist. Countries that can manufacture products efficiently and at low costs—like China and Vietnam—are likely to benefit from this shift in global production focus.

A complete collapse in oil prices, like what occurred during the COVID-19 lockdown in April 2020 (when prices dropped to -$30), is not expected. That historic crash happened due to a total shutdown of global activity.

After that plunge, crude oil prices steadily recovered:

- By April 2021: $62 per barrel

- By October 2021: $86 per barrel

This price increase mirrored a global recovery—but also rising inflation concerns.

Now, with prices once again falling, it’s likely that crude oil will soon find a bottom and begin to stabilize.

The Organization of the Petroleum Exporting Countries (OPEC) will likely step in to regulate supply based on demand, helping to keep prices within a sustainable range.

Hope you enjoyed reading my post. You can read my other articles on Trump's Liberation Day Tariffs here -:

Trump's Liberation Day Tariffs: Misguided, Mismatched, and Market-Disturbing

Alternate Safe Haven Assets That Shined Amid Tariff Turmoil and USD Decline

Trump's Tariff Monster unleashes fire in the Trumponomics Era!!

25% Tariff = 100% Trouble: Why Your Car (and Love Life) Costs More

Trump’s Trade War Knockout: Markets Brace for April 2nd Tariff Bombshell

Trump’s Trade War Knockout: Markets Brace for April 2nd Tariff Bombshell

Trump’s Liberation Day Tariffs: Will Markets Sink as Investors Flee to Safety?

Posted Using INLEO