Uniswap Labs Launches Unichain Mainnet: A Major Leap for Layer 2 Scalability in DeFi

Uniswap Labs has officially deployed the Unichain mainnet, introducing a Layer 2 (L2) blockchain designed to enhance transaction efficiency, lower fees, and expand decentralized finance (DeFi) adoption.

The network has been in development and testing since October 2024 and is now fully operational, marking a significant milestone for Uniswap and the broader DeFi ecosystem.

With over 100 prominent crypto protocols—including Uniswap, Circle, Coinbase, Lido, and Morpho—committed to building on Unichain, the launch signals strong institutional and developer adoption from the outset.

Uniswap’s move into Layer 2 solutions underscores a larger industry trend toward improving Ethereum’s scalability while maintaining its decentralized ethos.

Unichain: A Layer 2 Network Designed for Speed and Cost Efficiency

Unichain is engineered to offer near-instant transaction finality and significantly reduced gas fees compared to Ethereum’s Layer 1 network.

During its testnet phase, Unichain demonstrated robust performance, processing:

- 95 million transactions, showcasing its capacity for high transaction throughput.

- 14.7 million smart contract deployments, signaling strong developer engagement.

Users on Unichain can:

- Swap assets, provide liquidity, and launch tokens with minimal transaction friction.

- Access DeFi applications without the burden of Ethereum’s higher gas fees.

- Leverage Uniswap v4’s upcoming features, such as customizable liquidity pools and advanced smart contract interactions.

For developers, Unichain offers a streamlined environment to:

- Deploy Uniswap v4 hooks, which allow for more flexible trading strategies.

- Integrate stablecoins like USDC for seamless payments and lending.

- Build new financial tools that take advantage of Unichain’s low fees and high-speed execution.

Uniswap’s long-awaited v4 update, initially expected in Q3 2024, has now been confirmed for 2025, further reinforcing its long-term commitment to DeFi innovation.

Decentralization and Cross-Chain Innovation: Unichain’s Long-Term Vision

From launch, Unichain is designed as a Stage 1 rollup, meaning it operates with a permissionless fault-proof system that guarantees transparent and verifiable transactions.

Over time, the Unichain Validation Network (UVN) will allow anyone to run a node and validate transactions, progressively increasing network decentralization.

Interoperability & Cross-Chain Transactions

Uniswap Labs is also placing a strong emphasis on cross-chain functionality, ensuring Unichain remains a core component of the broader blockchain ecosystem.

Key interoperability features include:

- Support for ERC-7683, a new Ethereum standard enabling faster, more secure cross-chain transactions.

- Integration with the Superchain framework, allowing for single-block message passing across multiple chains, significantly improving blockchain communication efficiency.

These upgrades position Unichain as a critical piece in Ethereum’s scaling roadmap, making cross-chain transactions more efficient, secure, and cost-effective.

Performance Enhancements and Future Upgrades

Unichain’s launch brings immediate improvements over Ethereum Layer 1, including:

- 1-second block times, ensuring rapid transaction finality.

- 95% lower gas fees, making DeFi far more accessible to retail users.

Future upgrades planned for Unichain include:

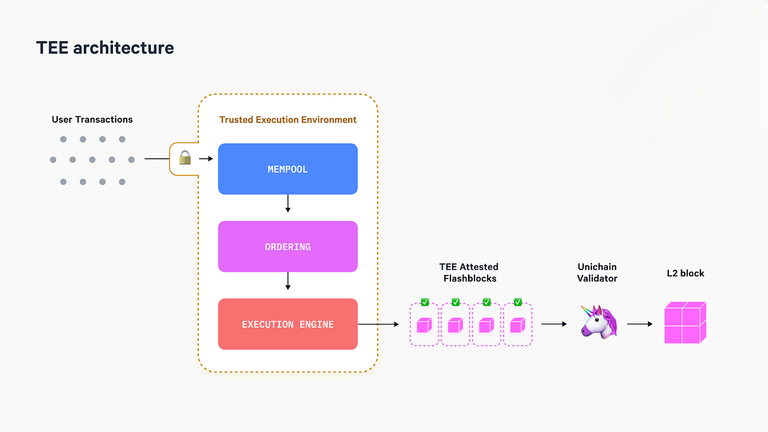

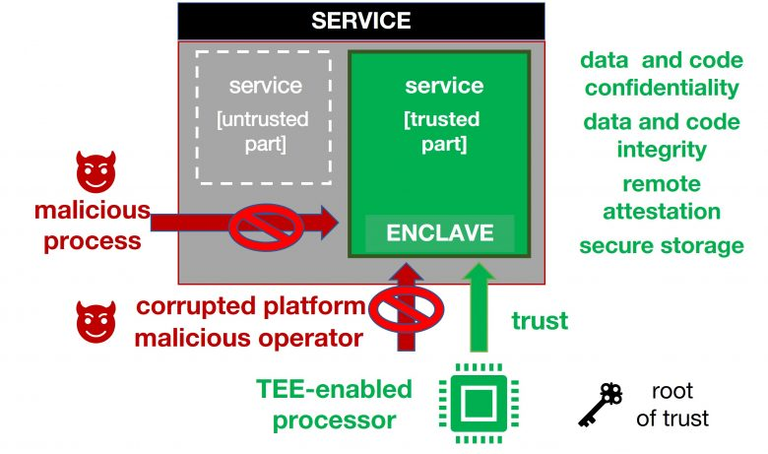

- TEE-based (Trusted Execution Environment) block building, which will optimize transaction processing while enhancing security.

- 250-millisecond effective block times, making transactions nearly instantaneous.

- Minimization of MEV (Maximal Extractable Value) inefficiencies, reducing the impact of front-running and unfair trading advantages.

These enhancements will solidify Unichain’s position as a high-performance DeFi infrastructure, capable of supporting mass adoption without compromising decentralization.

Unichain’s Impact: Broadening DeFi Participation and Industry Growth

With the official launch of Unichain, Uniswap Labs is positioning itself as a leader in Layer 2 innovation, offering a network that prioritizes low fees, fast block times, and community-driven governance.

The deployment of Unichain could significantly expand DeFi participation, particularly among:

- Retail traders seeking lower-cost transactions.

- Developers building next-generation DeFi applications with advanced features.

- Institutions exploring blockchain-based financial services.

By focusing on decentralization, interoperability, and efficiency, Uniswap Labs is laying the groundwork for a new era in decentralized finance, where Ethereum’s scalability challenges are mitigated without sacrificing security or decentralization.

As Unichain evolves, it may serve as a blueprint for future Layer 2 networks, demonstrating how blockchain infrastructure can balance speed, cost-efficiency, and decentralization in the pursuit of a more inclusive financial system.

Conclusion: A Transformative Step for Uniswap and the DeFi Ecosystem

Uniswap’s expansion into Layer 2 with Unichain represents a pivotal moment for DeFi.

By offering:

✔️ Near-instant transactions

✔️ Massively reduced fees

✔️ Decentralized validation over time

✔️ Seamless cross-chain compatibility

Uniswap is positioning itself as a key player in the next wave of blockchain innovation.

While Ethereum’s scaling challenges remain a central issue in the DeFi space, Unichain’s launch may provide a scalable solution that drives mainstream adoption.

With future upgrades planned and Uniswap v4 on the horizon, the impact of Unichain will be closely watched by the entire crypto industry—potentially shaping the future of decentralized trading and finance.

Fortuna che doveva rimanere soltanto Bitcoin… non sapevo che anche Uniswap avrebbe fatto la sua blockchain