Legal Challenge Against SEC’s Authority Over NFTs

Artists Sue SEC Over NFT Regulation

In a notable legal development, two American artists have filed a lawsuit against the United States Securities and Exchange Commission (SEC) seeking judicial clarification on the agency’s authority over non-fungible tokens (NFTs). Brian Frye, an artist and law professor, and Jonathan Mann, known as “Song a Day Mann,” filed the complaint in the U.S. District Court for the Eastern District of Louisiana, targeting the SEC and its five commissioners.

Central Legal Questions

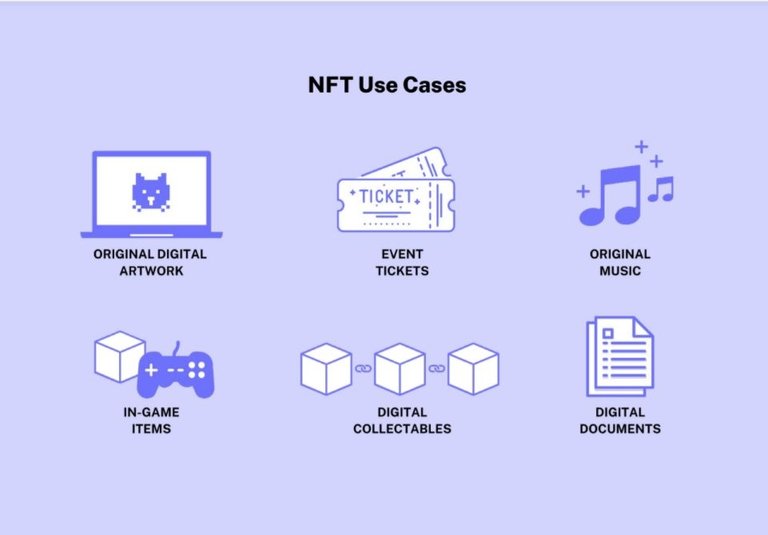

The lawsuit questions whether artists must register their NFT artworks with the SEC before public sale and whether they must disclose any associated risks to buyers. The plaintiffs’ attorneys compare NFTs to Taylor Swift concert tickets, arguing that, like NFTs, Swift’s tickets are resold in secondary markets and promoted by the artist. They contend that it would be unreasonable for the SEC to classify such tickets or collectibles as securities, highlighting a potential overreach of the SEC’s regulatory authority.

Request for Judicial Relief

The legal action seeks declaratory and injunctive relief to prevent what the plaintiffs describe as “unlawful enforcement actions” by the SEC against NFT projects. This lawsuit reflects the growing concern among artists about the SEC’s stance on digital art. True to his "Song a Day" brand, Jonathan Mann released a song titled "I'm Suing the SEC" and auctioned an NFT of the musical number.

Previous SEC Actions Against NFTs

The SEC’s first major enforcement action against an NFT project occurred about a year ago against Impact Theory, a YouTube channel and podcast studio. The SEC accused Impact Theory of marketing its "Founders Key" NFTs as investment opportunities, suggesting buyers could profit from the business’s success. Consequently, the SEC classified these NFTs as investment contracts subject to securities regulations, resulting in Impact Theory accepting certain penalties. The SEC later targeted Stoner Cats 2 LLC for an unregistered NFT offering that raised $8 million, which also ended in a settlement.

Artist Concerns Over SEC’s Approach

Frye and Mann's attorneys argue that the SEC's approach threatens the livelihoods of artists experimenting with or adopting rapidly growing technology. The complaint states: "Artists nationwide suddenly face the specter of the SEC attacking their distribution of visual or musical art as an unregistered securities offering. The SEC’s approach jeopardizes the creative freedom and financial stability of artists exploring new and evolving technology."

Parallels with Taylor Swift’s Sales

The lawsuit draws parallels with Taylor Swift's sales, arguing that just as Swift's fans might profit from buying her tickets or music, NFT buyers might also expect to profit. They challenge the logic of classifying NFTs as securities, raising concerns that artists' works might be treated similarly to the SEC’s handling of NFTs from Impact Theory and SC2. The attorneys state: "Imagine if the SEC decided that Taylor Swift's songs or collectibles were securities (or even just if released as NFTs) and ordered their destruction. It seems far-fetched, but it’s precisely what happened to Impact Theory and SC2."

Community Reactions

The lawsuit has sparked significant reactions within the Web3 community. Katherine Minarik, chief legal officer at Uniswap Labs, criticized the SEC’s approach as arbitrary and illegal, emphasizing the need for artists to protect their livelihoods. In a post on X, Minarik wrote: "We’ve reached a point where the SEC’s securities law enforcement is so arbitrary and illegal that artists have to sue the SEC directly to protect their livelihoods. The SEC is broken."

The Blockchain Association also supported the complaint, asserting that the SEC lacks authority over NFT art and should not expect artists to navigate complex securities laws when selling their creations. The group stated on X: "It’s unreasonable to expect musicians, designers, and other artists to hire lawyers to assess whether selling artwork will be deemed a securities offering by the SEC."

Conclusion

This legal challenge highlights the tensions between regulatory authorities and artists over the classification and regulation of NFTs. It underscores the need for clear guidelines and protections to ensure that innovative digital art practices can flourish without undue regulatory burdens.

Sending Love and Ecency Vote!