Increased Speculation on Bitcoin Ahead of FOMC Meeting

Bitcoin's Market Activity

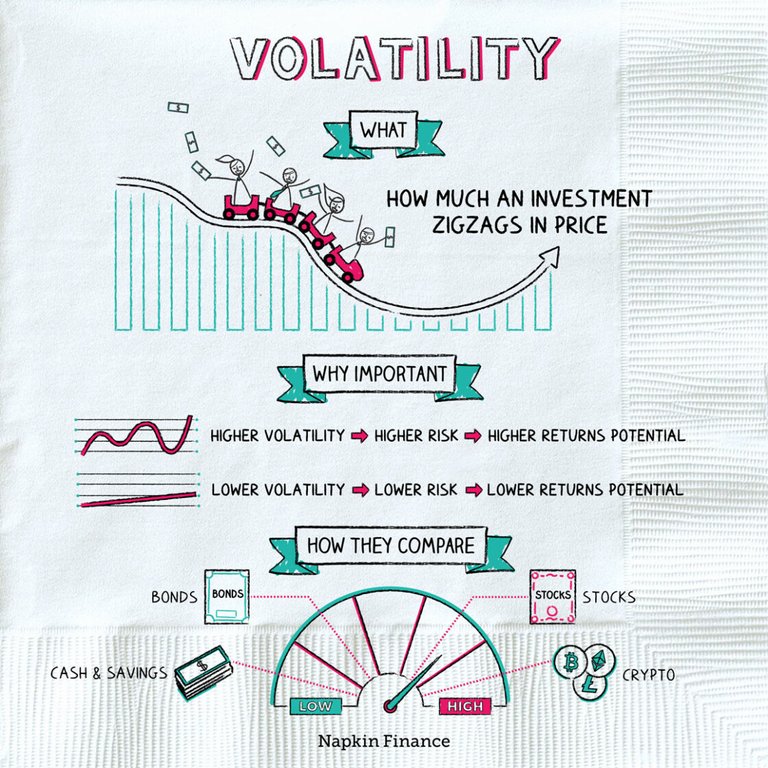

Bitcoin is experiencing heightened speculative activity as traders anticipate the outcome of the Federal Open Market Committee (FOMC) meeting scheduled for today, June 12. This meeting is expected to provide critical insights into U.S. interest rate trends. The week leading up to the meeting has seen significant volatility, with open interest in the derivatives market hitting new highs.

Impact of FOMC Uncertainty on Bitcoin's Volatility

The crypto market is bracing for increased volatility ahead of the FOMC meeting. Traders are actively placing bets on Bitcoin's price movement, driven by the uncertainty surrounding the meeting's outcomes. Open interest (OI), which measures the volume of active long and short positions, has reached unprecedented levels, indicating a high degree of speculative trading.

Open interest increases the likelihood of significant market movements as traders attempt to optimize their risk-reward ratio through aggressive trading strategies. Higher OI suggests that these positions exert substantial influence on the spot market, potentially leading to more pronounced price swings.

Analyst Insights on Bitcoin's Open Interest

Crypto analyst and influencer Ali Martinez highlighted that Bitcoin's open interest has reached an all-time high of $18.75 billion. This surge in OI is seen as an indicator of strong market sentiment and the potential for increased volatility. Martinez noted:

"Bitcoin's open interest is hovering around its historical peak at $18.75 billion! This signifies heightened trading activity and a robust market sentiment for BTC, with a strong potential to trigger greater volatility."

Bitcoin Price Analysis Ahead of FOMC Meeting

Market analysts have been anticipating a volatile week leading up to the FOMC meeting, which is set to determine the Federal Reserve's interest rate targets. Historically, these meetings have significantly impacted Bitcoin's price, often leading to increased volatility and a rise in open interest.

In a recent post on social media, Martinez observed that Bitcoin tends to bounce back following FOMC meetings. Currently, Bitcoin is trading below $67,000, experiencing a sharp decline. However, if the historical pattern holds, a post-meeting rebound could potentially drive the price up to $73,000.

Summary

The anticipation of the FOMC meeting has triggered a wave of speculative trading in Bitcoin, leading to record levels of open interest and increased volatility. As traders position themselves ahead of the meeting's outcomes, the market is poised for significant price movements, continuing a trend observed during previous FOMC meetings.