DTCC & Chainlink promote a partnership for fund tokenization

DTCC and Chainlink Partnership on Smart NAV Pilot Program

The Depository Trust and Clearing Corporation (DTCC), a U.S. financial services firm providing market infrastructure, has announced a partnership with Chainlink to execute a pilot program involving several major American banks. The primary aim of this initiative, named the Smart NAV Pilot, is to enhance the tokenization of traditional financial funds by establishing a standardized method for providing accurate Net Asset Value (NAV) data on blockchain.

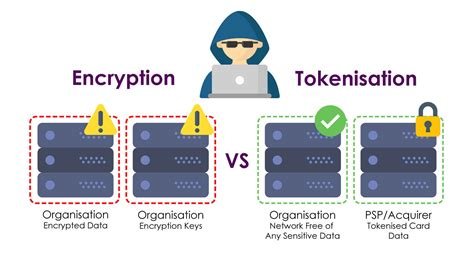

Utilizing Chainlink's Cross-Chain Interoperability Protocol

Chainlink's Cross-Chain Interoperability Protocol (CCIP) played a crucial role in achieving this goal, enabling interoperability across different blockchains. According to DTCC's report, the program successfully demonstrated the ability to supply structured data on-chain, paving the way for new use cases such as tokenized funds and "bulk consumer" smart contracts that contain data for multiple funds.

Benefits and Future Applications

The positive results from the pilot program open up numerous exciting possibilities in the financial sector. Potential applications include enhanced brokerage services, more automated data distribution, and easier access to historical fund data. The program also improved automated data management with minimal disruption to existing market practices, streamlined historical data retrieval without manual storage, and facilitated broader API solutions for pricing data.

Involvement of Major Financial Institutions

Prominent American financial institutions participated in the pilot, including American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JPMorgan, MFS Investment Management, Mid Atlantic Trust, State Street, and U.S. Bank.

Surge in Chainlink's Token Value

Following the release of the DTCC report, Chainlink's native token (LINK) saw a significant price surge, increasing by 20% within 24 hours and trading at $16.64. Over the past week, LINK recorded a gain of 16.11%, with a monthly growth of 22.57%. Over the last 12 months, LINK has experienced a robust growth of over 130%, reflecting the broader market recovery.

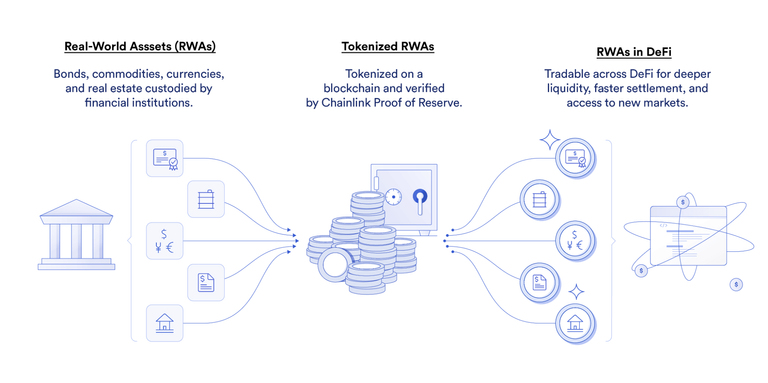

Growing Interest in Real World Asset Tokenization

DTCC's report comes at a time when major traditional financial institutions are showing a strong interest in the tokenization of real-world assets (RWAs). RWAs refer to tangible or financial assets in the real world used as collateral or underlying assets for tokens or financial products in the crypto world. Tokenization involves dividing an asset (e.g., a house, artwork, vehicle, or watch) into fractions via blockchain, allowing anyone to invest a portion of their capital in it.

Examples and Market Growth

Interest in RWAs is increasing. For instance, BlackRock launched a tokenized money market fund called BUIDL on Ethereum on March 19. This fund allows investors to purchase tokens representing shares of the fund, which primarily invests in assets like U.S. Treasury bills. Operating as an ERC-20 token, BUIDL is often referred to as a "digital liquidity fund" due to its digital nature on the Ethereum blockchain.

The Total Value Locked (TVL) for RWA protocols reached nearly $8 billion by the end of April, driven by significant user growth. Digital carbon market platforms like Toucan and KlimaDAO, as well as the real estate tokenization protocol Propy, have seen strong user growth. Tokenized Treasury securities have also increased in popularity, driven by high yields amid inflation and high interest rates in the U.S. The platform RWA.xyz reported a record $1.29 billion locked in tokenized Treasury securities and U.S. bonds, marking an 80% increase since the beginning of the year.

In March, Singapore-based fintech firm DigiFT announced its entry into the digital asset sector with the launch of U.S. Treasury bill deposit receipt tokens (DR).

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

!hiqvote

@libertycrypto27, the HiQ Smart Bot has recognized your request (1/2) and will start the voting trail.

In addition, @mikezillo gets !WEED from @hiq.redaktion.

For further questions, check out https://hiq-hive.com or join our Discord. And don't forget to vote HiQs fucking Witness! 😻

@mikezillo!

@hiq.smartbot passed you the virtual joint!If you do not want to receive these comments, please reply with !STOP