China continues to buy massive amounts of gold: global economic strategy?

The People's Bank of China continues to acquire large quantities of gold, thereby contributing to its price increase. However, the reasons behind this accumulation of precious metal raise more than a few concerns. Let's delve into why.

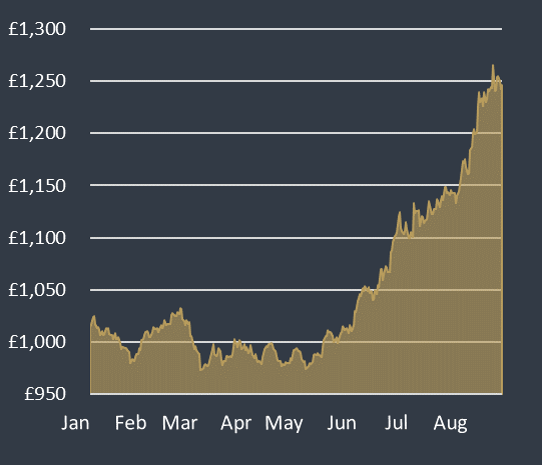

Gold Rush to New Records

China's frenzy for gold has recently propelled the price of the precious metal to new all-time highs. In April, its value surpassed $2,400 per ounce, reaching unprecedented levels. Since the beginning of the year, the price has increased by 12% compared to the same period the previous year. When considering all of 2023, the increase was even more remarkable at 40%.

Gold has long been considered a reliable crisis indicator: when fear of excessive inflation grows, its price rises. Investors seek to diversify their risks accordingly.

Cryptocurrencies have also been considered a means of diversification for some time. This is especially true for Bitcoin and Ethereum, but also for new meme coins like Sponge V2, which could rightfully join this group.

Record Prices Despite Low Inflation

Despite numerous crises in recent years, the situation has at least partially calmed on the inflation front. Nevertheless, the price of gold remains at very high levels.

The responsibilities of the most powerful and populous Asian nation, China, are evident. In China, not only the central bank but also funds and private investors continue to buy gold in record quantities. But what are the strategic reasons behind this sudden passion for the precious metal?

First and foremost, this policy could stem from concerns related to national security. Despite the rising price of the dollar, China continues to buy gold, resulting in its price increase as demand outpaces supply.

This phenomenon can be interpreted as an attempt by the Beijing government to strengthen its economic and security position, reducing its dependence on the dollar and the United States. In doing so, China could protect itself from potential global financial or political instabilities and increase the diversification of its reserves.

More Gold, Less Dependency?

In particular, China's goal seems to be to reduce the dependence of its currency reserves on the dollar. The country is thus following the path taken by other nations and is driven by the concern that the United States may adopt restrictive measures, such as freezing dollar-denominated reserves, in the event of geopolitical tensions or conflicts.

A concrete example of this possibility was observed in the case of Russia, with the freezing of its dollar-denominated reserves being a sanction tool used by the USA and other Western countries in response to the attack on Ukraine.

This scenario could prompt China to diversify its currency reserves, thus reducing its vulnerability to potential punitive actions by the United States or other international actors.

In addition to gold purchases, it is noted that the People's Bank of China is increasingly selling US Treasury securities, with the volume decreasing by about a third over the past two years.

Unlike countries like Germany, China has a very low percentage of gold in its currency reserves, but everything suggests that it is seeking to change this situation to increase its financial security.

Private Investors Have Little Choice

Chinese private investors are also increasingly interested in gold, a phenomenon that can be attributed, in large part, to the ongoing real estate crisis in the country. Furthermore, the stock market currently fails to meet investors' expectations, while strict controls limit access to foreign financial markets.

All these factors are driving towards gold as a valid investment alternative.

Signs of War in Asia?

To suggest less reassuring hypotheses, the strategy of the People's Bank of China can also be interpreted as preparation for war. The fewer US Treasury securities and currencies China holds, the less it would be influenced by sanctions in the event of an attack on Taiwan.

This is why the frenzy of the Chinese gold rush is causing concerns among several experts. China is seeking to reduce its dependence on the dollar and therefore on the United States, making the price of gold increasingly a barometer of the global security situation.

USE #BILPCOIN OR #BPC TO EARN BILPCOIN

By @hivewatchers @adm @logic @cwow2 @solominer @steemcleaners and gang join Blurt it has no downvotes

https://www.publish0x.com/the-dark-side-of-hive

https://blurt.blog/burn/@bilpcoinbpc/vdqyh-the-dark-side-of-hive-hivewacthers-and-gang-are-killing-and-burn-time

STOP THE DOWNVOTE ABUSE ON HIVE

Via Tenor

Credit: lolzbot

Earn Crypto for your Memes @ HiveMe.me!

lolztoken.com

ERROR: Joke failed.

@bpcvoter3, You need more $LOLZ to use this command. The minimum requirement is 0.0 LOLZ.

You can get more $LOLZ on HE.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Well, I somewhat agree with your conclusion. Really an informative blog.

Sending love and Ecency Vote!

with this new feature of Ecency you can create polls for your posts to establish a deeper connection with your followers!

Grazie Mike per tenerci aggiornati su tantissimi argomenti interessanti. Secondo me il tuo blog è uno dei più belli ed utili qui su HIVE. Per quanto riguarda l'oro sono sorpreso che ci sia tutta questa corsa ad accaparrarselo.. comunque se qualche anno fa l'ha comprato anche Warren Buffet che non era un sostenitore dell'oro come investimento, vuol dire che in questa decade bisognava comprare anche un poco di oro.