BlackRock elects Bitcoin as a protected investment against geopolitical events

In a whitepaper titled “Bitcoin: A Unique Diversifier,” dated September 17, investment giant BlackRock explored the potential of Bitcoin (BTC) as a hedge against geopolitical and monetary risks. Authored by Robert Mitchnick, Russell Brownback, and Samara Cohen, the report challenges traditional financial theories and highlights the distinctive features of Bitcoin.

Bitcoin’s Unique Diversification Potential

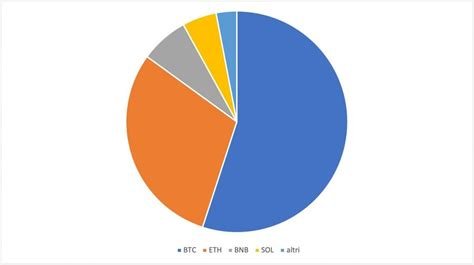

BlackRock's analysts argue that Bitcoin's “unique nature” sets it apart from conventional asset classifications like “risk-on” or “risk-off.” Unlike traditional assets such as stocks and bonds, Bitcoin exhibits long-term returns that don’t follow the same patterns, meaning it doesn’t correlate with the performance of other investments. This lack of correlation makes Bitcoin a valuable tool for diversification, helping to reduce overall portfolio risk.

Despite its long-term potential, Bitcoin can still show short-term volatility, occasionally moving in tandem with other assets like stocks. However, BlackRock emphasizes that these short-term price swings do not alter Bitcoin's long-term behavior, which remains distinct from other asset classes.

The whitepaper states:

“Although Bitcoin has been volatile and has shown brief episodes of co-movement with equities, its long-term correlation with both stocks and bonds has remained low, and its historical long-term returns have far outpaced those of all major asset classes.”

Factors Behind Bitcoin’s Diversification Benefits

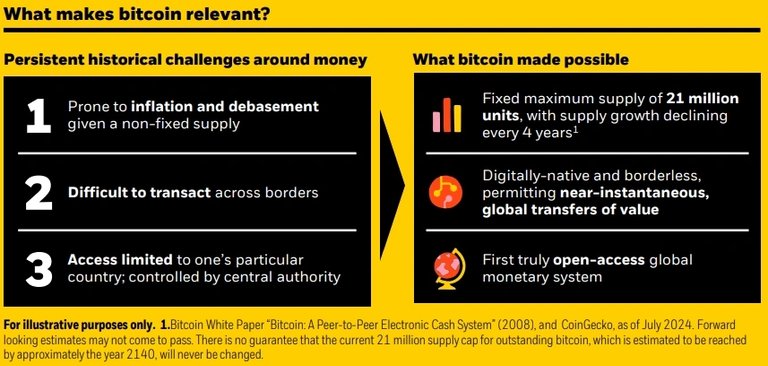

BlackRock attributes Bitcoin’s unique diversification advantages to several key factors: its scarcity, decentralized nature, and global accessibility. Unlike traditional currencies, Bitcoin has a fixed supply limit and can be transferred across the globe at minimal costs. These attributes make it distinct from fiat currencies, which can be printed or inflated by governments, thus losing value over time.

However, the report also acknowledges the risks associated with Bitcoin, including its volatility, regulatory challenges, and uncertainty surrounding its adoption as a global payment asset.

Bitcoin as a Hedge Against Global Risks

Despite these risks, BlackRock believes that Bitcoin’s unique characteristics make it a valuable diversification tool for investors, particularly in the current geopolitical and economic landscape. With rising tensions worldwide, concerns over U.S. debt and deficits, and increasing political instability, Bitcoin could serve as a hedge against these risks.

The report concludes:

“As the global investment community grapples with growing geopolitical tensions, concerns about U.S. debt and deficit levels, and rising political instability worldwide, Bitcoin can be seen as a unique diversifier against these risk factors.”

In sum, BlackRock's analysis suggests that Bitcoin offers a distinct opportunity for portfolio diversification, providing a hedge against both economic and political uncertainty. While Bitcoin carries inherent risks, its decentralized nature and non-correlation with traditional assets offer a new and potentially powerful way for investors to manage risk in a rapidly evolving financial environment.