Bitcoin Miners' Reserves Hit 14-Year Low Amid Changing Market Dynamics

Decline in Reserves

As of June 19, 2024, Bitcoin miners' reserves have plummeted to their lowest level in over 14 years, reaching 1.90 million BTC. This marks a significant drop from earlier levels, highlighting a long-term trend where miners hold fewer Bitcoin on their balance sheets.

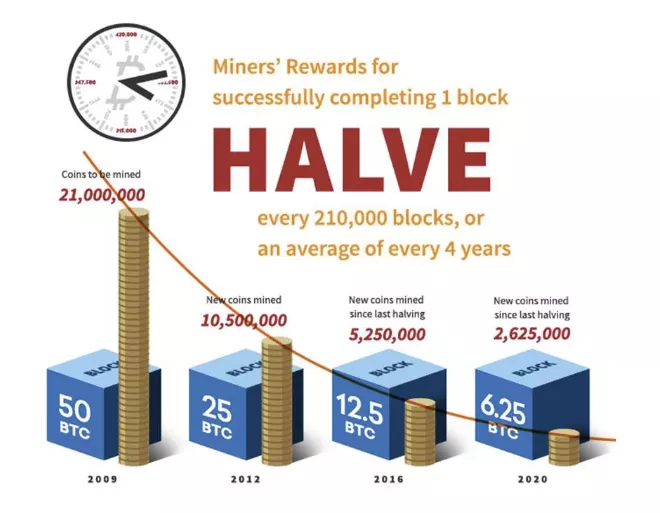

Halving Impact

The recent reduction in reserves is partly due to the Bitcoin halving event on April 20, 2024, which cut mining rewards from 6.25 BTC to 3.125 BTC. This halving, occurring approximately every four years, substantially impacts miners' operations by reducing their rewards. Lucas Outumuro, Head of Research at IntoTheBlock, noted that halving events typically lead to a gradual decrease in miners' Bitcoin accumulation, thereby not causing immediate sales pressure.

Value of Reserves

Despite the drop in the number of Bitcoin held by miners, the fiat value of these holdings remains near historical highs, around $135 billion, due to the increased price of Bitcoin.

Miners’ Adaptation and Financial Strategies

Sascha Grumbach, CEO of Green Mining DAO, pointed out that contemporary miners have learned from past cycles, avoiding over-leveraging and excessive accumulation of Bitcoin, strategies that previously proved detrimental. This adaptation reflects a shift towards maintaining financial stability over long-term hoarding of Bitcoin.

Market Capitalization Growth

While miners' reserves have decreased, the market capitalization of publicly traded mining companies in the U.S. has surged, hitting a record $22.8 billion by June 15, 2024. Companies like Core Scientific, TeraWulf, and IREN have seen substantial stock price increases of 117%, 80%, and 70%, respectively. However, these gains contrast with declining revenue and reserves, illustrating the broader impact of the halving and market dynamics.

Shift in Miner Strategies

Analysis by Glassnode indicates a persistent decline in miner balances, suggesting a shift towards financial stability rather than long-term Bitcoin accumulation. This extended period of selling is the longest since 2017, as highlighted by James Van Stratten, lead analyst at CryptoSlate. The miners' market has entered its 33rd day of capitulation, with historical averages indicating such periods last around 41 days.

Challenges Post-Halving

The halving has halved daily revenue for miners from approximately 900 BTC to 450 BTC, with network fees providing minimal additional income. The highly competitive nature of mining now means only the most efficient operations can maintain profitability. Even large publicly traded mining firms are selling off their coins to stay operational, as indicated by on-chain data.

Recent Sales and Market Impact

CryptoQuant reported that miners sold 1,200 BTC through over-the-counter (OTC) trades, primarily initiated by Marathon Digital, the largest publicly traded mining company. Consequently, Bitcoin's price fell by 2% on June 18, settling around $65,152, and has since dipped further to approximately $64,000. This decline is exacerbated by reduced holdings from hedge funds, intensifying downward pressure on the market.

Conclusion

The significant reduction in Bitcoin miners' reserves to a 14-year low underscores the changing landscape of the mining industry, influenced by halving events and market dynamics. Despite the decrease in Bitcoin holdings, the value in fiat remains high due to rising prices. The industry is witnessing a shift towards more sustainable financial practices, with miners adapting to the evolving market conditions while grappling with the impacts of reduced rewards and increased competition.

Sending an Ecency vote!

Congratulations @mikezillo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 100000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP