Yields Soar As BTC Smashes Past $100k | DeFi Journey #10

The bulls are back, and my DeFi portfolio felt the heat. BTC smashed through the $100K, shaking things up across my CLP DeFi positions. Also, my harvested yields nearly doubled, and I made some moves to capitalize on this week's crypto markets pump. Let us break down the action and see where my portfolio stands as of May 11, 2025.

Overall DeFi Portfolio

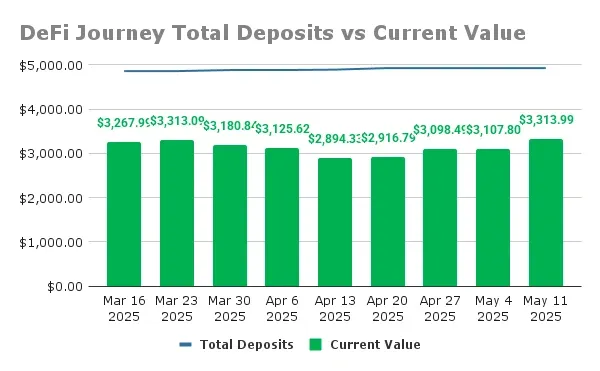

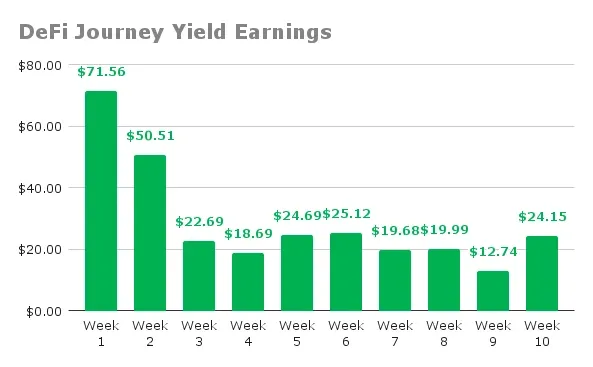

Technical analysis across multiple time frames (monthly, weekly, and daily) paints a bullish picture for BTC, with charts showing strong upward trends with range reclaims holding firm. All of this positive sentiment boosted my DeFi portfolio, with harvested yields climbing to $24.15, double last week's $12.74. It is amazing what one week can do as last week was the lowest yield harvested, and within a week, the yields have almost doubled. My total deposits remain unchanged at $4928.71, but the portfolio's current value, including my three remaining CLP positions and a new AAVE position, now sits at $3388.03. Total fees earned have crossed a milestone at $504.82, and my overall loss since starting has narrowed to -$1128.13. The market's upward momentum is finally starting to close the gap on my initial investment.

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

I harvested $11.54 this week, bringing total rewards to $202.86. The deposit remains $2213.00, and the current value rose for the second week, reaching $1342.91, yielding a 33.41% yearly APR. The price difference, including fees, improved to -$667.23 (-30.15%).

- In-Range: ✅

- Range Setup: $1204.29 - $2546.84 (75% wide)

- Rewards Farmed This Week: $11.54

- Total Rewards: $202.86

- Total Deposits: $2213.00

- Current Value: $1342.91

- Yearly APR: 33.41%

- Price Difference (Inc. Fees): -$667.23 (-30.15%)

CLP - WETH/USDC - Aerodrome Finance, Base

I harvested $6.20 this week, bringing total rewards to $187.22. The deposit remains $1663.40, and the current value rose for the second week, reaching $1004.01, yielding a 40.96% yearly APR. The price difference, including fees, improved to -$472.17 (-28.39%).

- In-Range: ✅

- Range Setup: $1202.37 - $2545.32 (75% wide)

- Rewards Farmed This Week: $6.20

- Total Rewards: $187.22

- Total Deposits: $1663.40

- Current Value: $1004.01

- Yearly APR: 40.96%

- Price Difference (Inc. Fees): -$472.17 (-28.39%)

CLP - USDC/cbBTC - Aerodrome Finance, Base

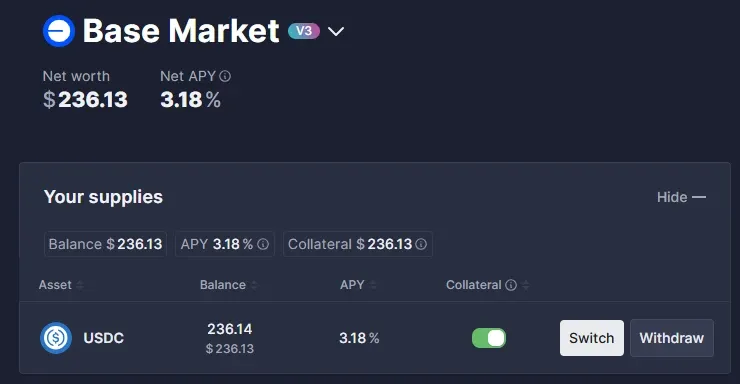

BTC's surge to $100K pushed this position out of range and I decided to cash out of the position in profit. This was my first exit since starting this DeFi journey. I harvested $0.39 this week before closing, with total rewards at $8.17. The deposit was $156.11, and I exited with a current value of $62.10, locking in a modest profit of $14.16 (+9.07%). I have moved these funds, along with the past three weeks' harvested yields, into AAVE USDC at a 3.17% yield, where they will sit until I spot a market pullback to redeploy.

- Status: Cashed Out

- Rewards Farmed This Week: $0.39

- Total Rewards: $8.17

- Total Deposits: $156.11

- Exit Value: $162.10

- Yearly APR: 26.01%

- Price Difference (Inc. Fees): $14.16 (+9.07%)

CLP - SOL/USDC - Orca, Solana

SOL's rally to $170 brought good news as this position is finally in the green! I harvested $6.03 this week, with total rewards at $102.50. The deposit remains $896.20, and the current value rose to $804.97, yielding a 51.88% yearly APR. The price difference is now positive at $11.27 (+1.26%). However, SOL's rapid climb means I will soon be out of range. I will decide next week whether to rebalance or cash out at a profit.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $6.03

- Total Rewards: $102.50

- Total Deposits: $896.20

- Current Value: $804.97

- Yearly APR: 51.88%

- Price Difference (Inc. Fees): +$11.27 (+1.26%)

AAVE USDC Position

With the USDC/cbBTC position closed, I have parked $236.13 (USDC/cbBTC exit value plus recent harvested yields) in AAVE USDC, earning a steady 3.17% yield. This low risk move lets me sit on the sidelines while I wait for potential market pullbacks. If BTC or ETH retrace to $90K or $2K; I will look to redeploy into a new CLP position.

Concluding Thoughts

With the crypto markets cooking, my DeFi portfolio is finally feeling the heat in a good way. Yields jumping to $24.15 and cashing out the USDC/cbBTC position for a $14.16 profit feels like a small victory. Also, this week saw me park funds in AAVE, which will give me flexibility for the next crypto pullback. Let us see what next week brings to the crypto markets.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO