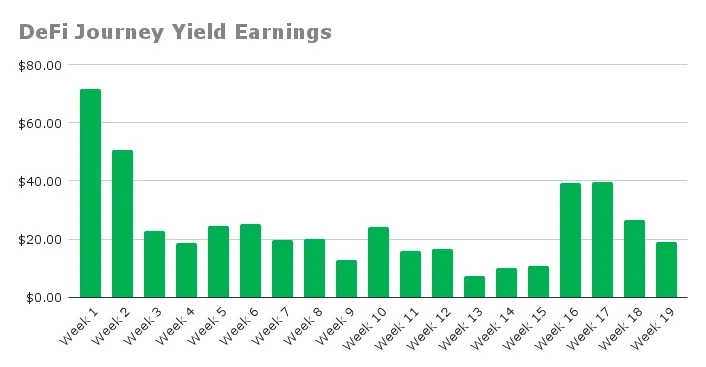

Week 19 Update | DeFi Journey #19

This week saw my DeFi yields come crashing after BTC hit a new all-time high of $118K and ETH pushed towards $3K. With the crypto markets pumping, three of my four concentrated liquidity positions (CLPs) got knocked out of range, slashing my fees by 30% to just $19.10 this past week. I'm not going to complain as we may at the onset another bull run kicking off in this 2025 cycle, which is great for crypto, even if it's a headache for my yields right now. Nonetheless, I am barely holding onto $3 per day, but I do foresee that being slashed with the current state of the market.

Portfolio Overview

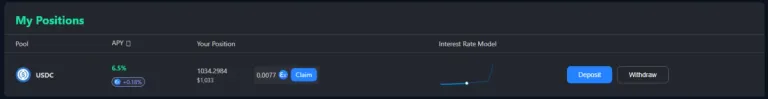

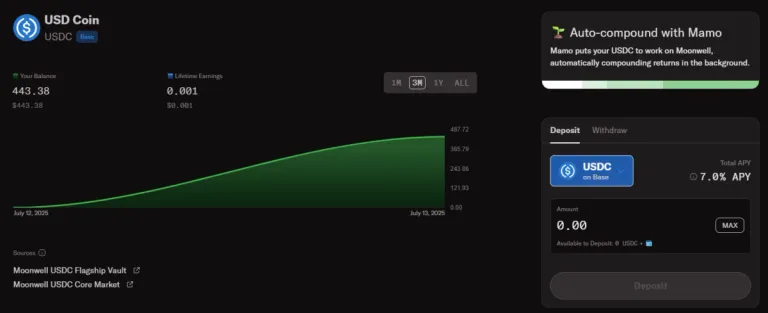

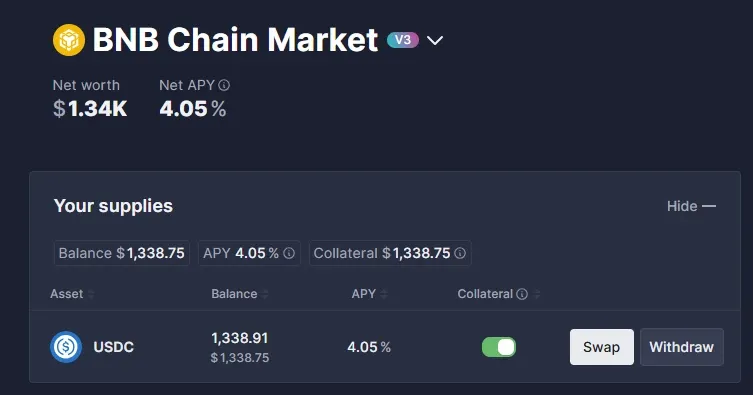

What this means is that crypto prices are climbing fast and showing no signs of slowing. I've been scanning liquidity pools for solid total value locked and APYs, focusing on stablecoin pairs like USDC/USDT that deliver 5-15% returns without impermanent loss. The dips in fees this week do sting, but as always looking out for the next opportunity. I have closed three CLPs (ETH/USDT, WETH/USDC, and WBTC/WETH) that went out of range this week and therefore locked in impermanent loss on two ETH positions and moved the USDC into savings platforms. The three CLP positions I closed, I withdrew the USDC and have opened up USDC yield savings accounts on the following platforms:

- Extra Finance (Base Chain): $1034.29 at 6.5% savings yield

- Moonwell (Base Chain): $443.38 at 7% savings yield

- Aave (Binance Smart Chain): $1,338.91 at 4.05% savings yield

I'll hold here until BTC pulls back to $105K or ETH to $2.5K, which are the key weekly and daily support levels worth watching.

Recap of CLP Positions

ETH/USDT (0.05%) - PancakeSwap, Binance Smart Chain

In its last week, it yielded $6, ending with a $1377.80 USDC withdrawal. Total fees were $261.62, but the loss hit -$573.58. Opened January 31st with $2213 deposit and therefore a clear loser.

- Final Yield: $6

- Total Rewards: $261.62

- Total Deposits: $2213

- Withdrawal Value: $1377.80

- P&L: -$573.58

WETH/USDC (0.04%) - Base

Yielded $6 in its final week, closing with $1028.88 USDC. Total fees were $231.03, with a -$403.49 loss. Started January 31st with $1,663.40 and another losing position.

- Final Yield: $6

- Total Rewards: $231.03

- Total Deposits: $1663.40

- Withdrawal Value: $1028.88

- P&L: -$403.49

CLP - WBTC/WETH (0.01%) - Arbitrum

Earned $1 in its last week, closing with $439.91 USDC. Total fees were $5.51, locking in a $69.55 gain. Opened June 22nd with $375.77, this correlated pair paid off and locking in a decent profit.

- Final Yield: $1

- Total Rewards: $5.51

- Total Deposits: $375.77

- Withdrawal Value: $439.91

- P&L: $69.55

CLP - SOL/USDC (0.04%) - Orca, Solana

This is my lone survivor, thanks to its wide range. It earned $3.82 this week, lifting total rewards to $143.09. I added $2.13, pushing deposits to $917.14, with a current value of $818.47. It's in profit at $44.42 overall, so I'm leaving the range alone to keep farming.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $3.82

- Total Rewards: $143.09

- Total Deposits: $917.14

- Current Value: $818.47

- Yearly APR: 39.76%

- Price Difference (Inc. Fees): $44.42 (4.84%)

Concluding Thoughts

While this week saw another decrease in yields, but I'm not sweating it. The crypto markets continue to show positive price momentum, but it also means that I have locked impermanent losses on two of my ETH CLP positions, but did manage to snag a small win with WBTC/WETH. For the moment, 70% of my DeFi portfolio is locked in USDC savings vaults, and I will continue sitting tight while waiting for any BTC or ETH pullbacks.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO