SPS Market Analysis Sep 12 – Sep 18 2025 | Splinterlands #475

This past week, the FMOC meeting caused a right old havoc in the crypto markets. Nonetheless the regulatory pathway continues to forge forward in this bull run with the SEC's revised rules to pave the way for new spot crypto ETFs, including XRP and Dogecoin cryptocurrencies. In news of trying to stay relevant, former SEC Chair Gary Gensler raised concerns about altcoin speculation, highlighting the ongoing tension between innovation and regulatory oversight and enforcement. While Gemini successfully debuted on NASDAQ with shares spiking 45% on opening day, these kinds of moves continue to underscore the accelerating convergence between traditional finance and crypto infrastructure.

Market performance remained mixed with Bitcoin bouncing after the Fed's 25 basis point rate cut, though digital currencies experienced volatility around the announcement. EY's stablecoin report highlighted regulatory policies as the key catalyst for the rising adoption of stablecoins, projecting that stablecoins could power 5-10% of global payments by 2030. With a relatively volatile week in crypto, how did this impact SPS?

SPS Weekly Performance Overview

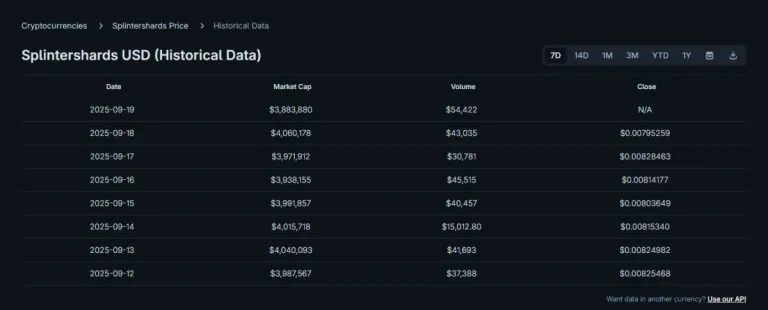

The technical picture remains definitively bearish following another failed attempt to establish any meaningful support with SPS delivering another week of range-bound weakness, falling from $0.00825 to $0.00795, which is a 3.6% decline that extends the downtrend from earlier highs. The market cap slid from $4.04M to $3.91m, reflecting the underlying weakness. More troubling is the failure to hold any meaningful bounce after touching weekly lows around $0.00795. This inability to sustain recovery attempts indicates sellers are stepping in at higher levels, creating overhead resistance.

Market Analysis - Trends

The correlation to Bitcoin remains loose, with SPS failing to benefit from any positive crypto momentum. Also, the splinterlands ecosystem faces significant structural challenges based on recent announcements. The upcoming exponential decay model for SPS rewards represents a shift from high immediate rewards to long-term sustainability. While the DAO's 90% approval shows community support, it essentially admits the current reward system is unsustainable, creating uncertainty about future SPS demand.

There was a splinterlands Town Hall yesterday in which it was revealed the game is in building mode with new content planned for late 2025/early 2026. However, markets tend to price in current reality rather than future promises.

Market Analysis - Volumes & Liquidity

The volume profile this week highlighted the token's liquidity challenges. Average daily volume through the week sat around $30k, well below the levels needed for healthy price discovery.

The DEX volume of averaging $1k on most days shows minimal organic trading activity outside centralized exchanges. This concentration of volume creates additional risks during periods of market stress.

Market Analysis - Support & Resistance

Technical levels have shifted lower following the breakdown from previous support zones. The $0.00795 area now represents immediate support, though it is already being tested and showing signs of weakness. The former support zone around $0.00825 has become resistance, creating a ceiling for any bounce attempts.

Below current levels, the next meaningful support does not appear until the $0.0077-$0.0078 area based on previous price action. A break of the current $0.00795 level would likely trigger stops and target that lower zone relatively quickly. On the upside, any recovery faces immediate resistance at $0.00810, then more significant resistance at $0.00825. The key invalidation level for the bearish thesis remains a decisive close above $0.00835, which would suggest the breakdown was false.

Concluding Thoughts

SPS continues demonstrating why trading weak assets in weak market conditions is problematic. While the broader crypto market shows signs of institutional adoption and regulatory progress, SPS remains trapped in its own cycle of declining price action. The fundamental challenges facing splinterlands, from reward system sustainability to the pausing of Survival Mode 2.0, do not provide the narrative for positivity. The technical picture offers little hope for bulls in the near term. With support levels failing and volume indicating distribution rather than accumulation, the path of least resistance remains lower. Until we see genuine interest return, the downtrend is likely to continue.

Are you new to splinterlands and want to learn to play the game? Check out my Ultimate Guide to Splinterlands: A Collection of Articles and Guides. If you enjoy reading my splinterlands content, please follow and support me by signing up to play splinterlands through my affiliate link: https://splinterlands.com?ref=mercurial9.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Substack

Posted Using INLEO

Thanks for sharing! - @mango-juice