Rough Week | DeFi Journey #6

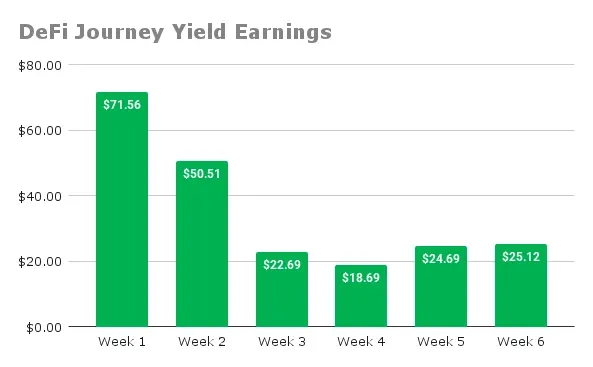

Despite the crypto markets being an absolute mess, I still managed to increase my harvested yields, pulling in $25.12 in fees this past week. That is a small win, but my portfolio took a massive hit thanks to Trump's back-and-forth on trade war tariffs. I covered the latest trade war tariffs debacle in this week's SPS technical analysis review. Let us unpack what went down this week in my DeFi journey.

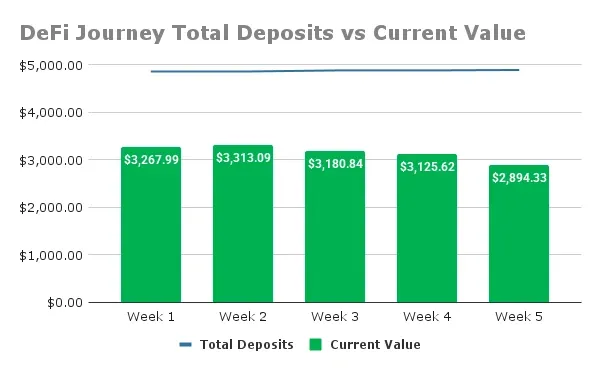

First off, this week was a bloodbath for my portfolio. My total deposits ticked up slightly by $10 to $4893.47, but the current value of my DeFi portfolio plummeted to $2894.33. That is almost $2k down from my deposits, which is not easy reading. The main culprit? ETH, which makes up 75% of my portfolio, broke down to $1.4k to $1.5k range. For the first time in two months, both of my ETH CLP positions went out of range. I usually wait 24-48 hours before rebalancing, but this time I held off for 72 hours (in the hope that ETH would increase), locking in more impermanent loss. I had to reset both ETH positions with even wider ranges - 75% wide ($1.2k to $2.5k).

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

This position went out of range as ETH tanked, so I rebalanced it to a new range of $1.2k to $2.5k. I harvested $2.41 this week, bringing my total rewards to $172.53. My deposit is still $2213.00, but the current value dropped to $1165.41, with a yearly APR of 39.62%.

- In-Range: ✅ (back in range)

- Range Setup: $1204.29 - $2546.84 (75% wide)

- Rewards Farmed This Week: $2.41

- Total Rewards: $172.53

- Total Deposits: $2213.00

- Current Value: $1165.41

- Yearly APR: 39.62%

- Price Difference (Inc. Fees): -$875.06 (-39.54%)

CLP - WETH/USDC - Aerodrome Finance, Base

This one also went out of range, so I rebalanced to the same $1.2k to $2.5k range. I farmed $2.80 this week, pushing my total rewards to $166.93. The deposit is $1663.40, but the current value is down to $872.09, with a yearly APR of 50.88%.

- In-Range: ✅ (back in range)

- Range Setup: $1202.37 - $2545.32 (75% wide)

- Rewards Farmed This Week: $2.80

- Total Rewards: $166.93

- Total Deposits: $1663.40

- Current Value: $872.09

- Yearly APR: 50.88%

- Price Difference (Inc. Fees): -$624.38 (-37.54%)

CLP - USDC/cbBTC - Aerodrome Finance, Base

This remains my only CLP position in the green. With a range of $70604 to $100190, I harvested $2.22 this week, bringing total rewards to $5.87. My deposit is $141.11 (increased by $6.11), and the current value is $140.43, with a yearly APR of 31.91%.

- In-Range: ✅

- Range Setup: $70604 - $100190 (35% wide)

- Rewards Farmed This Week: $2.22

- Total Rewards: $5.87

- Total Deposits: $141.11

- Current Value: $140.43

- Yearly APR: 31.91%

- Price Difference (Inc. Fees): $4.89 (3.47%)

CLP - SOL/USDC - Orca, Solana

Finally, the star of the show in my DeFi portfolio. This CLP position stayed in range with its setup of $97 to $180, and it accounted for nearly 75% of my harvested yields. I pulled in $17.69 this week, bringing my total rewards to $79.16. My deposit is still $875.96 (increased by $3.66), and the current value is $716.40, with a yearly APR of 63.24%.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $17.69

- Total Rewards: $79.16

- Total Deposits: $875.96

- Current Value: $716.40

- Yearly APR: 63.24%

- Price Difference (Inc. Fees): -$80.40 (-9.18%)

Concluding Thoughts

Looking at my yield earnings, I am at $25.12 this week, up slightly from last week's $24.69. It is a small victory, but I will take it considering the state of the crypto market. This past week reminded me of the risks (impermanent loss) in DeFi. Sometimes I wonder if I would be better off just HODLing my tokens instead of taking on this extra risk. But DeFi is a key part of my long-term crypto strategy, and I am committed to harvesting yields, even when it is tough. The SOL Position carried me, and I am hoping that ETH stops being a pretender and starts coming to the party soon.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO

Solid hustle in the face of market madness! $25.12 in fees is nothing to sneeze at. Hope ETH joins the party soon and turns things around for you. Keep riding those DeFi waves! 🌊🚀