Kicking Off April With A Yield Boost! | DeFi Journey #5

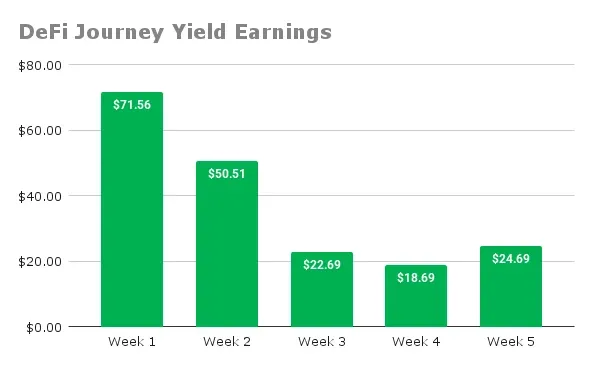

For the first time in a month, my weekly harvested fees actually went up! I harvested $24.69 this week, which feels like a little victory after four straight weeks of declines. Sure, the crypto markets are still a mess thanks to Trump's tariffs for wreaking havoc on both TradFi and crypto markets. If you've been following along, you know I've been at this since late January. The crypto markets have been brutal, especially for ETH, which makes up 75% of my DeFi portfolio.

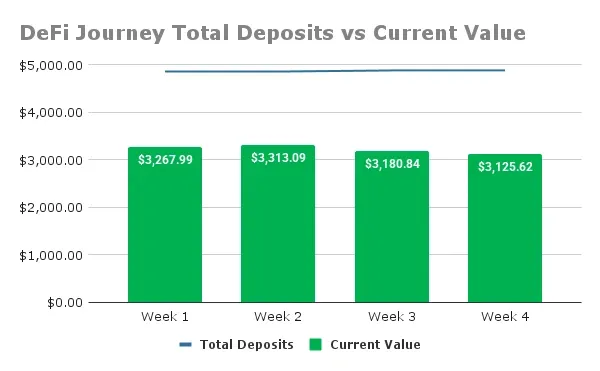

ETH has been a total pretender in this so-called bull market, and it continues to take a beating, while BTC has been more stable (if you can even call it that). However, with ETH continuing to decline, my portfolio's current value has decreased to $3125.62 with my total deposits remaining unchanged at $4883.67. Still, I'm in this for the long haul, and seeing my yields tick up this week gives me a bit of hope and all my positions have stayed in range so no rebalancing is needed.

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

I farmed $10.82 this week, bringing my total rewards to $170.12. My deposit here is still $2213.00, but the current value is down to $1324.35, with a yearly APR of 43.37%.

- In-Range: ✅

- Range Setup: $1698 - $2997 (56.8% wide)

- Rewards Farmed This Week: $10.82

- Total Rewards: $170.12

- Total Deposits: $2213.00

- Current Value: $1324.35

- Yearly APR: 43.37%

- Price Difference (Inc. Fees): -$718.53 (-32.47%)

CLP - WETH/USDC - Aerodrome Finance, Base

I farmed $5.81 this week, bringing my total rewards to $164.13. My deposit here is still $1663.40, but the current value is down to $988.59, with a yearly APR of 55.52%.

- In-Range: ✅

- Range Setup: $1706 - $3108 (60% wide)

- Rewards Farmed This Week: $5.81

- Total Rewards: $164.13

- Total Deposits: $1663.40

- Current Value: $988.59

- Yearly APR: 55.52%

- Price Difference (Inc. Fees): -$510.68 (-30.70%)

CLP - USDC/cbBTC - Aerodrome Finance, Base

This is my only CLP position in the green! I farmed $0.61 this week, bringing my total rewards to $3.35. My deposit here is still $134.97, but the current value is down to $133.37, with a yearly APR of 23.83%.

- In-Range: ✅

- Range Setup: $70604 - $100190 (35% wide)

- Rewards Farmed This Week: $0.61

- Total Rewards: $3.35

- Total Deposits: $134.97

- Current Value: $133.37

- Yearly APR: 23.83%

- Price Difference (Inc. Fees): $1.75 (1.3%)

CLP - SOL/USDC - Orca, Solana

I farmed $7.45 this week, bringing my total rewards to $61.47. My deposit here is still $872.30, but the current value is down to $675.65, with a yearly APR of 57.11%.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $7.45

- Total Rewards: $61.47

- Total Deposits: $872.30

- Current Value: $675.65

- Yearly APR: 57.11%

- Price Difference (Inc. Fees): -$135.18 (-15.50%)

Concluding Thoughts

I am super stoked that for the first time in a month, the yields harvested went up! The wide ranges I've set up mean lower APRs compared to tight ranges, but they've kept me in range and earning, which is a win in this volatile market. My total deposits versus the current value chart shows how brutal this bull market has been.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO