ETH Breaks Out As Yields Drop | DeFi Journey #11

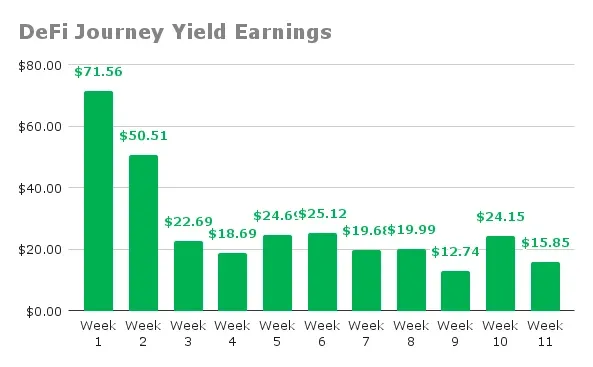

My DeFi portfolio hit a rough patch this week, with harvested yields dropping nearly $9 from last week's 2-month high. ETH has been hovering above my upper bound CLP positions of $2.5K, leaving me farming yields for only half the week while it chopped in a tight range. After ETH struggled for four years, it's showing rare strength with two green weeks in a row, and it may be gearing up for a huge push. The ETH charts suggest resistance around $2.7K, so we must monitor its price action over the forthcoming week. Meanwhile, SOL is holding steady near $176, close to my SOL CLP's upper bound of $180.

Overall DeFi Portfolio

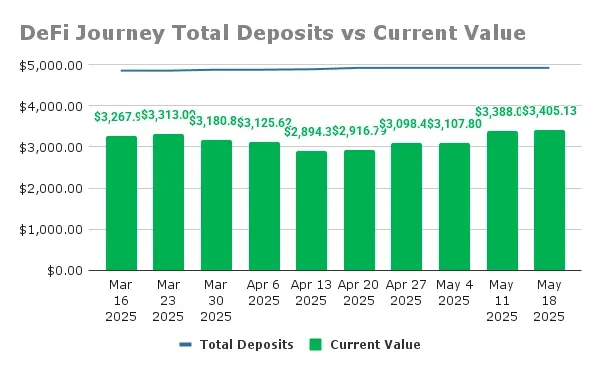

My harvested yields this week dropped to $15.85, a sharp drop from last week's $24.15. This reflects ETH's exit from my CLP ranges, limiting my farming to just the SOL/USDC position. I've moved $14.65 of this week's yield into my AAVE USDC vault, bringing its total to $250. As I wrote in last weeks update, I'm parking any harvested yields in liquid USDC, monitoring the market before deciding next moves. My portfolio's total deposits remain unchanged at $4928.71, while the portfolio's current value increased slightly to $3405.13, which includes the AAVE USDC vault.

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

ETH's climb past $2.5K knocked this position out of range early in the week. I harvested $5.78 this week, with total rewards at $208.64. The deposit remains unchanged at $2213.00, and the current value increased to $1343.59, yielding a 32.12% APR.

- In-Range: ❌

- Range Setup: $1204.29 - $2546.84 (75% wide)

- Rewards Farmed This Week: $5.78

- Total Rewards: $208.64

- Total Deposits: $2213.00

- Current Value: $1343.59

- Yearly APR: 32.12%

- Price Difference (Inc. Fees): -$660.77 (-29.86%)

CLP - WETH/USDC - Aerodrome Finance, Base

This position also fell out of range as ETH continued dominance for the second week running. I harvested $3.23 this week, with total rewards at $190.45. The deposit remains unchanged at $1663.40, and the current value increased to $1004.30, yielding a 38.95% APR.

- In-Range: ❌

- Range Setup: $1202.37 - $2545.32 (75% wide)

- Rewards Farmed This Week: $3.23

- Total Rewards: $190.45

- Total Deposits: $1663.40

- Current Value: $1004.30

- Yearly APR: 38.95%

- Price Difference (Inc. Fees): -$468.55 (-28.17%)

CLP - SOL/USDC - Orca, Solana

SOL's rally to $176 keeps this as my only active CLP. I harvested $6.84 this week, pushing total rewards to $109.34. The deposit remains $896.20, with the current value at $806.33, yielding a 50.92% APR.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $6.84

- Total Rewards: $109.34

- Total Deposits: $896.20

- Current Value: $806.33

- Yearly APR: 50.92%

- Price Difference (Inc. Fees): +$19.47 (+2.17%)

AAVE USDC Position

My AAVE vault now holds $250 after adding $14.65 from this week's yield, and its earning a small 3.53% yield. These funds are liquid, as I can remove or supply them when I am ready to deploy it.

Concluding Thoughts

ETH's potential breakout above $2.7K has felt like forever since we've seen this kind of strength from ETH. SOL's price action near the upper limit of my CLP position has got me nervous, but it has been consistently in range for almost two months. The parking of USDC funds in AAVE gives me flexibility, and I'm watching the market to see if there is any sign of a pullback, but its all bullish sentiment at the moment so I will hold tight.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

https://www.reddit.com/r/ethereum/comments/1kqez7u/eth_breaks_out_as_yields_drop_defi_journey/

This post has been shared on Reddit by @guurry123 through the HivePosh initiative.