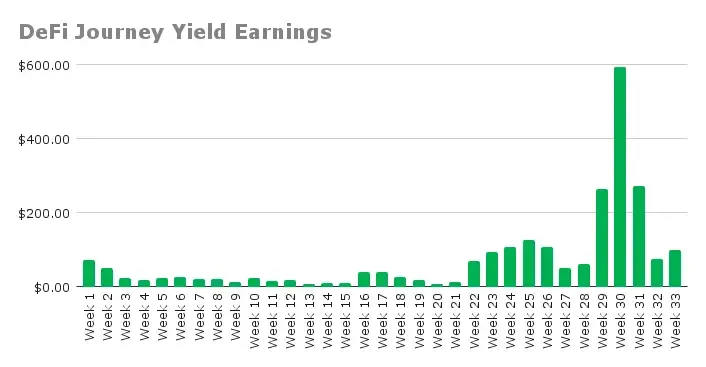

Dumptober Delivers Max Pain | DeFi Journey #33

The volatility and the bleeding continue. The DeFi portfolio has dropped another ~$700 in value, marking roughly --40% from its peak. Fees remain consistent, though I earned $99.42 in fees. The fact that yield continues printing, but it also highlights how quickly impermanent loss can erode any gains.

Week 33 TLDR:

- Weekly Fees Earned: $99.42

- Positions Closed: 0

- New Positions: 1 (CL200-4/USDT on BSC)

- Portfolio Status: Down ~40% from peak

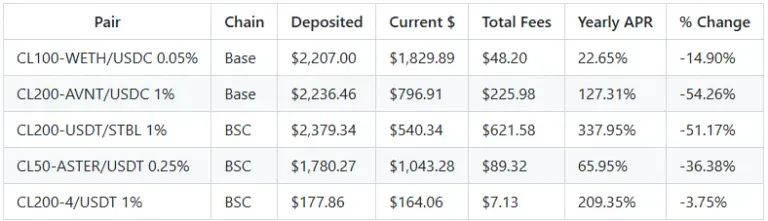

The numbers and impermanent loss paint a grim picture. Even with healthy fee APRs, the price moves on volatile pairs are wiping out dollar value at an alarming rate. Every position except the newest one is significantly underwater. AVNT is down 54.26%, USDT/STBL is down 51.17%. Nothing is safe from the downward pressure. High APR does not equal high return. The math is simple: fees minus price losses equals actual return. When a token falls faster than fees can accumulate, you lose money regardless of the APR display. Compounded by the fact that the sentiment across X\Twitter is grim. Some are calling Bitcoin's peak at $125K, arguing the market won't recover enough for an altseason this cycle. The Altcoin Season Index backs that up deep in Bitcoin season territory.

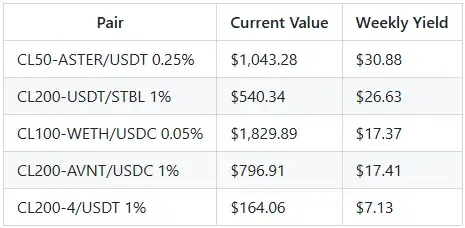

Week 33 Current Holdings

I won't be rage-quitting DeFi. My focus remains on yield compounding and liquidity exposure, even if that means portfolio drawdowns. The point of this journal is transparency through all cycles, not just the green ones. If Bitcoin breaks below $100K, the alt side will likely experience further 20--30% corrections.

- CL100-WETH/USDC (Base). Down 14.90% after accumulating $48.20 in total fees at a 22.65% yearly APR. ETH continues to be the market's barometer.

- CL200-AVNT/USDC (Base). The biggest loser at -54.26%. Deposited $2,236.46, now at $796.91. The position has earned $225.98 in total fees, but that's overshadowed by the $1,439.55 price decline. This week yielded just $17.41. The perps dex trade ($ASTER, $AVNT) worked for a few weeks, then collapsed.

- CL200-USDT/STBL (BSC). Down 51.17% overall despite a staggering 337.95% yearly APR. Deposited $2,379.34, now at $540.34. Total fees of $621.58 represent solid yield generation, but the $1,839 price decline is savage. This week contributed $26.63. The pair that looked so promising is now a cautionary tale: high fees don't compensate for capital erosion when the underlying assets decline sharply.

- CL50-ASTER/USDT (BSC). Down 36.38%. Deposited $1,780.27, current value $1,043.28. Generated $30.88 this week.

- CL200-4/USDT (BSC). The new position was entered on October 12. Only $177.86 deposited, currently at $164.06 with $7.13 in fees already earned. This meme token appears to be the main meme token of the BSC chain. Let's see how this one rides.

The Bottom Line

There is no sugarcoating this one; it's brutal out there. The portfolio's taken another $700 hit, sitting at roughly 40% down. But despite that, fees continue to accrue at decent levels. $99.42 this week proves that even in bear conditions, liquidity provision generates returns. Yield farming is about surviving the red weeks and compounding through them. If Bitcoin does break below $100k, I foresee more pain for my portfolio, but let's wait and see.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Substack

Posted Using INLEO

Alts really are getting slaughtered accross the board and the hasn't been any kind of altseason yet. I honestly can't tell if right now there are either generational buy opportunities or if everything is just dead in the water. I guess these swings make it all interesting also. Good luck with your results next week!