Defi Yields Soar To New Multi-Month High | DeFi Journey #16

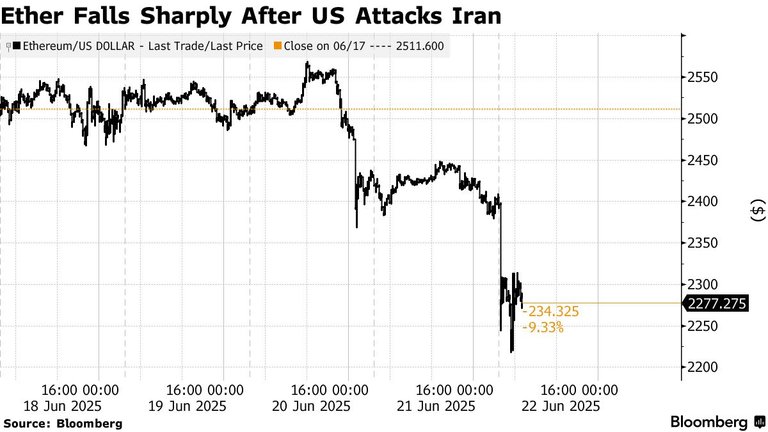

After rebalancing my ETH CLP positions to tighter ranges last week, I hit my best yield-farming week in three months until Trump confirmed US bombs hit three Iranian nuclear sites. That spooked every market, and ETH tanked from its highs to $2.2K, knocking my ETH positions out of range yesterday. BTC didn't drop as hard and showed some resiliency as its hovering around $102K.

ETH is in a shaky post, if it holds, we might see a recovery, but a slide below could mean more pain. The market's on again is on a knifes edge, with geopolitical wars rattling TradFi stocks and crypto alike. We've seen this before: big news hits, prices wobble, then either bounce or break. Right now, it feels like BTC might lead any recovery, but I'm not holding my breath until things settle.

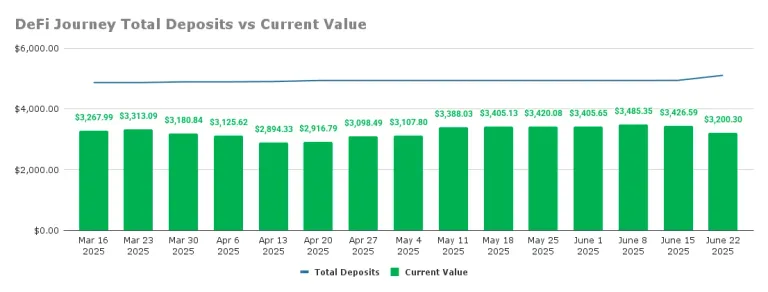

Overall DeFi Portfolio

With yields jumping to $39.3, I pulled out of my Aave vault and opened a new WBTC/WETH CLP on Arbitrum, inspired by the announcement of Leo token will be moving to Arbitrum One. In his recent post, @khaleelkazi, unveiled the launch of Leo 2.0 and with its relaunch the Leo token will be moving to Arbitrum layer 2 chain on Eth. This new CLP position with a $316.38 deposit, aiming to hedge token divergence with two correlated crypto majors. I also reinvested $5.98 into my SOL CLP, boosting its deposit, since the CLP position is still holding strong with its wide range, and I am looking to capitalize on the SOL price drop. With all these moves, my total deposits have risen to $5099.01, with my portfolios current value at $3200.30. s

CLP - WETH/USDC (0.04%) - Base

The tighter range paid off this week with $16.52 harvested, pushing total rewards to $216.76. The deposit remains unchanged at $1663.40, with the current value at $913.27, yielding a 33.48% APR.

- In-Range: ❌

- Range Setup: $2303.11 - $2813.00 (20% wide)

- Rewards Farmed This Week: $16.52

- Total Rewards: $216.76

- Total Deposits: $1663.40

- Current Value: $913.27

- Yearly APR: 33.48%

- Price Difference (Inc. Fees): -$533.27 (-32.07%)

CLP - ETH/USDT (0.05%) - PancakeSwap, Binance Smart Chain

This position also benefitted from a tighter range with $16.93 harvested, bringing total rewards to $240.19. The deposit stays $2213.00, with the current value at $1219.95, yielding a 27.92% APR.

- In-Range: ❌

- Range Setup: $2306.79 - $2817.49 (20% wide)

- Rewards Farmed This Week: $16.93

- Total Rewards: $240.19

- Total Deposits: $2213.00

- Current Value: $1219.95

- Yearly APR: 27.92%

- Price Difference (Inc. Fees): -$752.86 (-34.02%)

CLP - SOL/USDC (0.04%) - Orca, Solana

This position kept rolling with its wide range and resulted in $5.85 harvested, pushing total rewards to $135.69. I added $5.98, moving the deposit to $906.23, and the current value is $750.80, yielding a 44.72% APR. Also, with SOL price drop the position has now moved into the red. Previously this was the only DeFi position in the green.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $5.85

- Total Rewards: $135.69

- Total Deposits: $906.23

- Current Value: $750.80

- Yearly APR: 44.72%

- Price Difference (Inc. Fees): -$19.74 (-2.18%)

CLP - WBTC/WETH (0.01%) - Arbitrum

My new CLP position started with a $316.38 deposit. This is also the only DeFi position I have using two correlated tokens feels instead of one token with USDC/USDT. The strategy is to help mitigate impermanent loss and divergence risk.

- In-Range: ✅

- Range Setup: 41.14 -- 50.25 (20%)

- Rewards Farmed This Week: n/a -- new position

- Total Rewards: n/a -- new position

- Total Deposits: $316.38

- Current Value: $315.92

- Yearly APR: n/a -- new position

- Price Difference (Inc. Fees): -$0.46 (-0.15%)

Aave USDC Position

I pulled out of AAVE this week, dropping the vault to $0 as I redeployed into the new Arbitrum position. The 4.50% yield was solid, but the market shift felt like a cue to move.

Concluding Thoughts

This week's $39.3 yield is a win, driven by SOL and those tight ETH ranges before the crash. The US Iran news threw a wrench in things. If ETH recover to $2.3K will see my positions back online and earning yield. The new WBTC/WETH bet on Arbitrum is an interesting play inspired by the Leo 2.0 token announcement, but I like the correlation between two crypto majors. The next 2-3 weeks seems pivotal with the July 9 tariff deadline looming, and now more geopolitical tensions and it will be interesting to see what further impacts it will have on the crypto markets.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO