Defi Yields Dip But I’m Still Pushing Forward | DeFi Journey #18

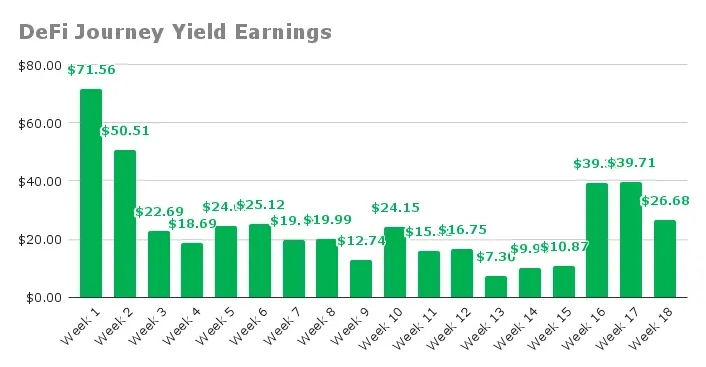

This week hit me with a yield earnings drop for the first time in weeks. I earned $26.68 in fees, down 30% from last week's $39.71, which is not a shock after April and May. For now, starting July, above $3 per day feels like a win, and I am using it as a springboard to chase $5, then $10 daily from yield farming fees.

I have been digging into yield opportunities, and it is clear that the big wins come from sorting through liquidity pools with solid total value locked and decent APYs on DefiLlama. I have been eyeing stablecoin pairs like USDC/USDT that offer steady returns without the impermanent loss headache, which provide low-risk, steady gains.

Portfolio Overview

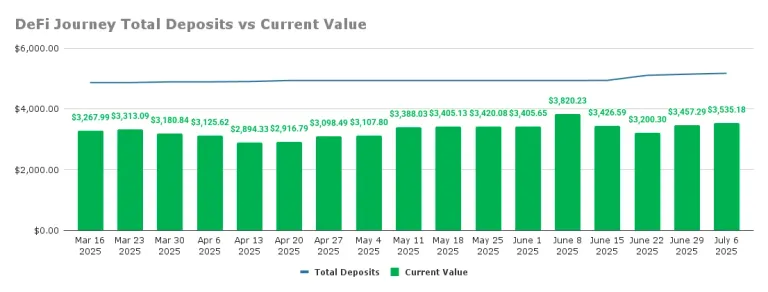

June $107.17 in fees set a solid foundation, and I am still hitting $3 daily despite this dip, and I am aiming for $5 next. I added $8.78 to my SOL/USDC and $23.11 to WBTC/WETH CLP pools. My strategy for increasing these two positions is to rebalance my portfolio so I shift away from being heavily weighted in ETH. Total deposits now stand at $5167.18, with a portfolio value of $3535.18. Total fees earned hit $634.39, which brings my overall loss to -$-$1009.85. I am slowly but surely building here, and getting under the $1k loss will be crucial.

CLP - WETH/USDC (0.04%) - Base

This position stayed in range, yielding $8.95 this week. Total rewards are at $225.71, with the $1663.40 deposit unchanged and current value at $998.28.

- In-Range: ✅

- Range Setup: $2303.11 - $2813.00 (20% wide)

- Rewards Farmed This Week: $8.95

- Total Rewards: $225.71

- Total Deposits: $1663.40

- Current Value: $998.28

- Yearly APR: 31.71%

- Price Difference (Inc. Fees): -$439.41 (-26.42%)

CLP - ETH/USDT (0.05%) - PancakeSwap, Binance Smart Chain

This CLP position netted $13.34, pushing total rewards to $252.53. The $2213.00 deposit holds, and the current value is $1334.97.

- In-Range: ✅

- Range Setup: $2306.79 - $2817.49 (20% wide)

- Rewards Farmed This Week: $12.34

- Total Rewards: $252.53

- Total Deposits: $2213.00

- Current Value: $1334.97

- Yearly APR: 26.70%

- Price Difference (Inc. Fees): -$625.50 (-28.26%)

CLP - SOL/USDC (0.04%) - Orca, Solana

SOL keeps earning, adding $3.58 to my $139.27 in total rewards. I upped the deposit to $915.01, and the current value is $799.91, and I am $85 from my $1K deposit target I set for this pool.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $3.58

- Total Rewards: $139.27

- Total Deposits: $915.01

- Current Value: $799.91

- Yearly APR: 40.75%

- Price Difference (Inc. Fees): $24.17 (2.64%)

CLP - WBTC/WETH (0.01%) - Arbitrum

I added $23.11 to this CLP position, which brings the total deposits to $375.77. It stayed in range, earning $1.81 this week, with a current value of $402.02.

- In-Range: ✅

- Range Setup: 41.14 - 50.25 (20%)

- Rewards Farmed This Week: $1.81

- Total Rewards: $4.64

- Total Deposits: $375.77

- Current Value: $402.02

- Yearly APR: 31.90%

- Price Difference (Inc. Fees): $30.89 (8.22%)

Concluding Thoughts

This week's $26.68 yield is lower than I expected, especially after the last two positive updates, but I am not phased. ETH and BTC's stability keep my CLP positions alive and yielding, and I am sticking to my $5 then $10 daily targets, pushing SOL/USDC and WBTC/WETH to $1K.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO

Congratulations @mercurial9! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: