Choppy Markets | DeFi Journey #4

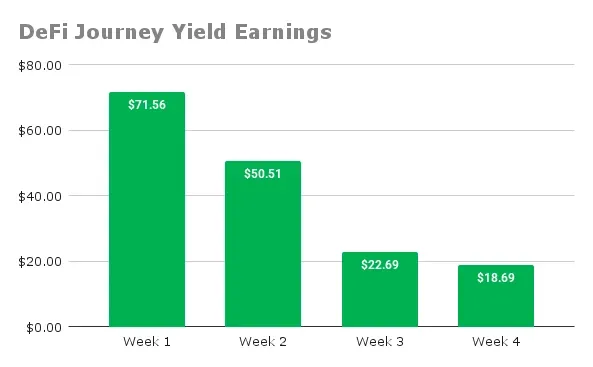

I've been at this for eight weeks now, and honestly, it's been a wild ride. The crypto markets are still choppy, and my harvest rewards ($18.69) dipped again for the fourth week in a row. Nonetheless, I made it through the entire month of March without needing to rebalance any of my CLPs. That's a win in my book, especially with how messy the crypto markets have been. Let's dive into the details and unpack what's been going on.

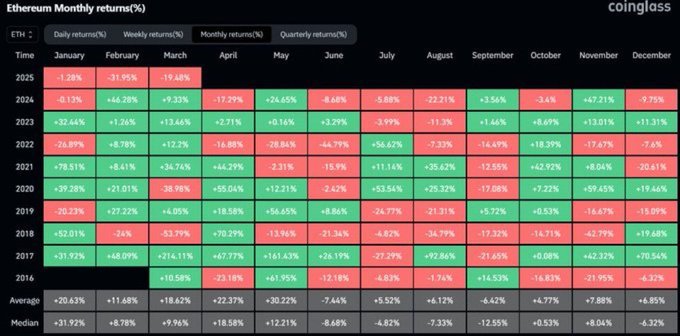

ETH has been an absolute pretender in this bull market. It's down 43.62% for Q1 2025, which is a brutal contrast to the 60% gains it saw in Q1 2024. I entered my CLP positions back when ETH was at $3300, and I had to rebalance them at the end of February when it dropped to $2400 and throughout March it continued to drop (current price: $1841) and the ETF continues to experience negative outflows.

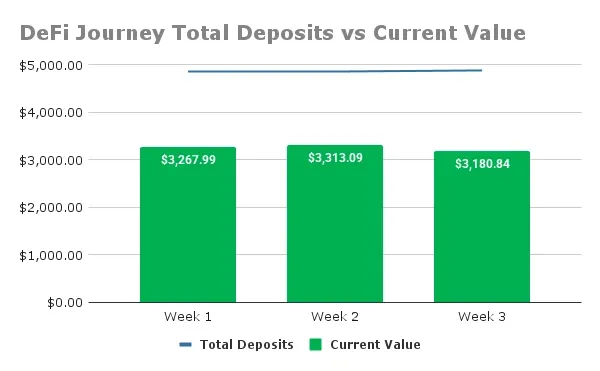

Despite all that, I harvested $163.45 in fees across all my CLP positions for March. This past week, I increased up my SOL/USDC and USDC/cbBTC positions by $23.59, bringing my total deposits to $4883.67. The current value of my DeFi portfolio is $3180.84, which isn't surprising since 50% of my liquidity pools are tied to ETH. It's been a rough quarter for ETH, but I'm still bullish on it for the long haul.

CLP - ETH/USDT - PancakeSwap, Binance Smart Chain

I farmed $7.30 this week, which pushed my total rewards to $159.30. My deposit started at $2213.00, but the current value is $1343.60 and a yearly APR of 45.56%.

- In-Range: ✅

- Range Setup: $1698 - $2997 (56.8% wide)

- Rewards Farmed This Week: $7.30

- Total Rewards: $159.30

- Total Deposits: $2213.00

- Current Value: $1343.60

- Yearly APR: 45.56%

- Price Difference (Inc. Fees): -$710.10 (-32.09%)

CLP - WETH/USDC - Aerodrome Finance, Base

I earned $5.99 this week, bringing my total rewards to $158.32. The deposit is $1663.40, but the current value is $1004.49 and a yearly APR of 59.93%.

- In-Range: ✅

- Range Setup: $1706 - $3108 (60% wide)

- Rewards Farmed This Week: $5.99

- Total Rewards: $158.32

- Total Deposits: $1663.40

- Current Value: $1004.49

- Yearly APR: 59.93%

- Price Difference (Inc. Fees): -$500.59 (-30.09%)

CLP - SOL/USDC - Orca, Solana

I earned $4.86 this week, bringing my total rewards to $54.02. The deposit is $872.30 (increased by $5.5), but the current value is $699.55 and a yearly APR of 59.28%.

- In-Range: ✅

- Range Setup: $97 - $180 (59.4% wide)

- Rewards Farmed This Week: $4.86

- Total Rewards: $54.02

- Total Deposits: $872.30

- Current Value: $699.55

- Yearly APR: 59.28%

- Price Difference (Inc. Fees): -$118.73 (-13.61%)

CLP - USDC/cbBTC - Aerodrome Finance, Base

I earned $0.54 this week, bringing my total rewards to $2.74. The deposit is $134.97 (increased by $18.09), but the current value is $133.20 and a yearly APR of 23.81%.

- In-Range: ✅

- Range Setup: $70604 - $100190 (35% wide)

- Rewards Farmed This Week: $0.54

- Total Rewards: $2.74

- Total Deposits: $134.97

- Current Value: $133.20

- Yearly APR: 23.81%

- Price Difference (Inc. Fees): $0.97 (0.72%)

Concluding Thoughts

Looking at my DeFi journey so far, I've learned a ton. My total deposits are $4883.67, but the current portfolio value is $3,180.84, which doesn't look good but I'm in this for the long game. My yield earnings have dropped over the weeks: $71.56 in Week 1, $50.51 in Week 2, $22.69 in Week 3, and now $18.69 in Week 4. This is all to be expected because of wide ranges - the APR yields are significantly lower than tight ranges. I haven't added any new positions this week, but I've been eyeing the Sonic DeFi platform (rebranded from Fantom). It's seeing a lot of action, with TVL nearing $1 billion. I've added it to my watchlist as the next platform to explore, but I'm focusing on growing my USDC/cbBTC position first. As I wrote about in this weeks SPS technical review -- the macro uncertainties (Trump's tariffs continue to wreak havoc) make the market conditions cautious overall.

Thank you for reading and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter

Posted Using INLEO