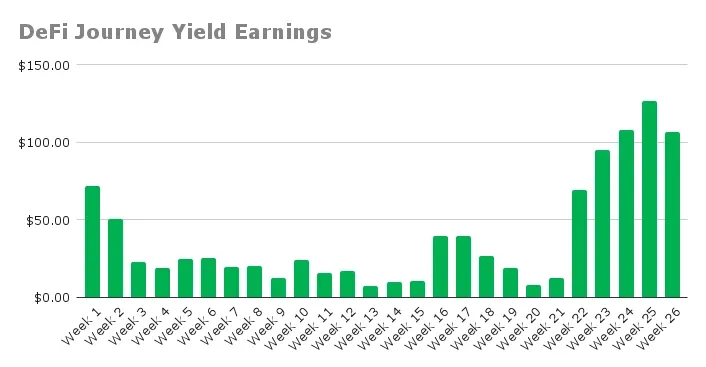

$500 Farmed In August (And What It Taught Me About Crypto Defi) | DeFi Journey #26

You know that feeling when you're riding high one moment, then crypto decides to humble you the next? Yeah... welcome to my August. I just wrapped up what should've been a victory lap. $504 in DeFi yields for the month, and I should be celebrating, right? Instead, I'm staring at positions that swung from +$300 to -$100 in what feels like a heartbeat. That's crypto for you. It giveth, and boy does it taketh away.

Week 26 - The Numbers

This week alone pulled in another $106.69 in yields, pushing my monthly total over that magical $500 mark. See, when you're yield farming, you're playing two games simultaneously. There are the fees you're collecting, that steady drip of income that feels so satisfying to track. Then there are the underlying asset prices, and this week, crypto markets were down. The whole market dropped nearly 10%.

- Yields Farmed: $106.69

- New Positions Entered: 0

- Positions Closed: 1

- Total Deposits: $6202.46

- Current Value: $6090.46

- Total Fees Farmed (Open Positions): $253.81

- Price Difference (Inc. Fees): $141.81 (+2.29%)

Recap of Exited Positions

SOL/USDC 0.04% - Orca

Take my SOL/USDC position on Orca. This CLP position was consistently farming fees week after week. But this past week? SOL couldn't decide if it wanted to be $190 or $210, bouncing around like a pinball. After 48-hour waiting period, I finally closed the position with a respectable 11.11% gain ($101.64 profit including fees). That's crypto for you when even your best setups have expiration dates. The market doesn't care about your track record.

- Date Entered: 2025-07-30 14:50

- Date Exited: 2025-08-31 19:00

- Total Deposits: $915.06

- Exit Value: $962.05

- Weekly Yields Farmed: $8.74

- Total Fees Farmed: $54.65

- Overall Price Difference (Inc. Fees): $101.64 (+11.11%)

CLP Yield Farming Strategies

CL1-USDT/WBNB 0.01% - BSC

Not everything was doom and gloom, though. While everything else was struggling with price drops this past week, BNB dropped a measly 0.3%. I made $31.33 in fees this week and am sitting pretty with almost $90 in total profit.

- Date Entered: 2025-08-15 7:30

- In Range: Yes

- Range: $799.80 to $901.77 (12%)

- Weekly Yield Farmed: $31.33

- Total Deposits: $2170.83

- Current Value: $2179.98

- Current APR: 78.04%

- Price Difference (Inc. Fees): $85.71 (+3.95%)

CL2000-USDC/AERO 1% - Base

Then there's AERO... oh, AERO. Down 19% in a week, which knocked $200 off the position's value. However, it still farmed $33.19 in fees this week. Even though it suffered the most, it is still generating income, and that's DeFi for you...can your position generate enough yield to offset impermanent loss?

- Date Entered: 2025-08-09 10:20

- In Range: Yes

- Range: $0.85 to $1.88 (80%)

- Weekly Yield Farmed: $33.19

- Total Deposits: $2251.21

- Current Value: $2316.67

- Current APR: 104.20%

- Price Difference (Inc. Fees): $209.28 (+9.30%)

CL10-ARB/USDC 0.05% - Arbitrum

ARB tanked 13% this week, pushing this position into negative territory at -$153.18. But it still farmed $33.43 in fees. That's crypto in a nutshell. You can be right about the yield opportunity and wrong about the price action simultaneously. Both things can be true, and both will mess with your emotions if you let them.

- Date Entered: 2025-08-24 9:30

- In Range: Yes

- Range: $0.499 to $0.745 (40%)

- Weekly Yield Farmed: $33.43

- Total Deposits: $1780.42

- Current Value: $1,593.81

- Current APR: 92.46%

- Price Difference (Inc. Fees): -$153.18 (-8.60%)

Looking Forward

Historically, September is when things tend to get messy. Maybe it's psychological, maybe it's seasonal patterns. So what am I doing? Nothing. And that feels weird. I'm not adding new positions. I'm not increasing existing ones. The yields I have farmed this week are sitting on the sidelines. Sometimes the best move is no move. When volatility is high and direction is unclear, preserving capital becomes more important than chasing yields. There will always be another opportunity, but there might not be another you if you blow up your account chasing the last trade.

Concluding Thoughts

Hitting my first $500 month felt amazing, but I am also reminded how volatile crypto and DeFi can be. The hardest part isn't the technical stuff, such as setting ranges, calculating APRs, and monitoring positions. It's learning to celebrate the wins without getting emotional and absorb the losses without getting reckless. August showed me both sides of this game. The $500 in yields proved that DeFi works, but the volatile price swings make me realise why risk management matters more than any single month's performance.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Substack

Posted Using INLEO

Congratulations @mercurial9! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 85000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: