LeoDEX The Future Of Decentralised Finance (DeFi)

LeoDEX The Future Of Decentralised Finance (DeFi)

Good morning Lion’s! welcome to Monday on the Eastern side of the globe, we had a wonderful mothers day yesterday and today we’re back onto market explainers. Don’t forget to Click HERE if you would like to create your own FREE InLeo account and start earning through creating content and sharing breaking news.

Recent changes to InLeo now enable the UI to be able to blog and write about any and all content that is relevant to you and can be shared across the Hive blockchain in many of it’s own stand alone communities.

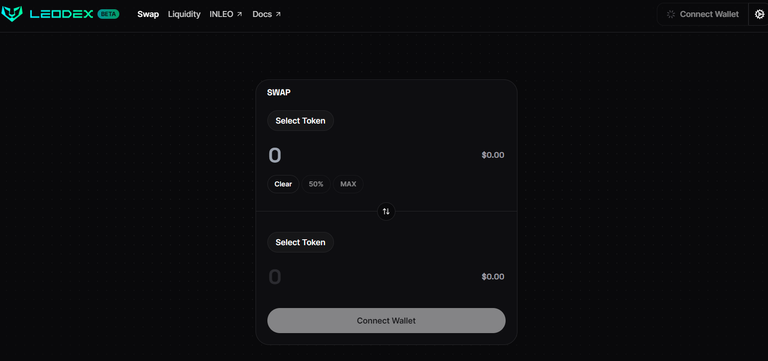

Today, we’re going to focus on Decentralised Finance (De-Fi) and covering Decentralised Exchanges (DEX) and Centralised Exchanges (CEX). All of which are important to understand and know about now that LeoDEX is live.

History of Decentralised Finance

In recent years the world of finance has witnessed a transformative change with the growth of Decentralized Finance (DeFi). De-Fi represents a shift in the current market offering a decentralized alternative to traditional financial services. Powered by blockchain technology. At the forefront of this change are decentralized exchanges (DEXs) and lending protocols, which challenge the dominance of their centralized counterparts.

Decentralized Finance (De-Fi)

De-Fi encompasses a broad spectrum of financial applications and services that operate on decentralized networks eliminating the need for intermediaries like banks or brokerage firms. These protocols leverage smart contracts which enable transparent and peer-to-peer transactions with enhanced security and accessibility. Unlike traditional finance where centralised authorities control the flow of funds, De-Fi empowers users to retain full custody of their assets and participate in a permissionless ecosystem.

Decentralized Exchanges (DEXs) vs. Centralized Exchanges

Centralized exchanges (CEXs) have long dominated the crypto currency trading landscape, offering liquidity and convenience. However, they are susceptible to hacks, regulatory scrutiny and custodial risks. In contrast, DEXs operate on decentralized networks facilitating peer-to-peer trading without relying on intermediaries. By eliminating central points of failure and custody risks. DEXs offer enhanced security and privacy to users. Popular DEXs like LeoDEX have gained traction showcasing the potential of decentralized trading platforms.

While CEXs provide liquidity through order books and market makers, DEXs rely on automated market-making (AMM) algorithms and liquidity pools. Users can swap tokens directly from their wallets, seamlessly executing trades without relinquishing control of their funds. However, DEXs often face challenges such as liquidity fragmentation and front-running attacks. Despite these hurdles DEXs continue to innovate by introducing new features like more variety of token swaps, yield farming and decentralized governance.

Yield Farming: Maximising Returns Through Liquidity Provision

Yield farming has emerged as a popular DeFi trend, enticing users to optimize their returns by providing liquidity to decentralized protocols. In essence, yield farming involves staking or locking up assets in liquidity pools to earn rewards in the form of additional tokens or fees. Farmers seek to maximize their yields by strategically allocating their assets across various DeFi platforms, chasing high-yield opportunities.

Yield farming protocols incentivize liquidity providers with governance tokens or protocol fees encouraging active participation and liquidity provision. However, yield farming carries inherent risks including impermanent loss, smart contract vulnerabilities and market volatility. Users must conduct thorough due diligence and risk assessment before engaging in yield farming activities.

LeoDEX The DEX of the Future

Decentralized finance represents a groundbreaking evolution in the financial landscape offering inclusive, transparent and censorship resistant alternatives to traditional banking systems. While centralised exchanges continue to dominate trading volumes decentralized exchanges such as LeoDEX are steadily gaining momentum by challenging the status quo and redefining the way we transact and interact with financial services.

As the DeFi ecosystem continues to mature and innovate, it holds the potential to democratize access to financial services and reshape the global economy for the better.

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha

!PIZZA

$PIZZA slices delivered:

@tin.aung.soe(1/10) tipped @melbourneswest