Bitcoin 12.1 Billion Expiry Caution

Bitcoin 12.1 Billion Expiry Caution

Today in the cryptocurrency market Bitcoin and Ethereum options worth over USD 14 billion reach their expiration. With traders closely watching price action, this event has the potential to influence the market’s cycle for months.

What is Bitcoin Options Expiry

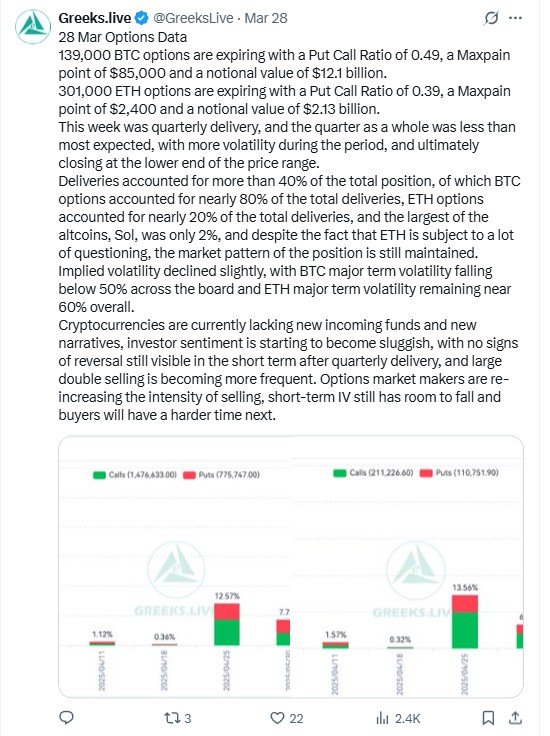

According to data from Greeks.live today’s expiry includes approximately 139,000 Bitcoin options contracts with a notional value of USD 12.1 billion. Ethereum is also seeing an expiration, with 301,000 options contracts worth about USD 2.13 billion.

One of the key metrics traders consider during an options expiry is the put call ratio. For Bitcoin, this ratio stands at 0.49, suggesting a higher number of call options (bullish bets) relative to put options (bearish bets). Ethereum’s ratio is even lower at 0.39. further indicating a market leaning towards call options. However, the sheer volume of expiring options means volatility is likely regardless of sentiment.

A critical concept is called the max paint point the price which the biggest number of options end being worthless. For Bitcoin this figure is around the USD 85,000 mark and for Ethereum it is USD 2,400.

large expirations often push asset prices toward these max pain points due to the actions of market makers and institutional traders managing risk exposure. Given that Bitcoin has recently declined by 3% to trade around $85,000, this suggests price movements may be influenced by the dynamics surrounding today’s expiry.

Where does Bitcoin currently sit?

Bitcoin’s current trading positions looks to be at the max pain point which indicates that options related positioning may be causing shifts in its price. The broader market however, is also dealing with external pressures.

Continued uncertainty over new tariffs by U.S. President Donald Trump has contributed to Bitcoin’s downturn, alongside other macroeconomic factors affecting risk appetite. This adds another issue to the markets.

What happens after they expire?

Large options expirations tend to cause short term market volatility as traders adjust positions. However, the bigger question is whether today’s expiry will trigger a broader market shift. There are three potential scenarios for Bitcoin post-expiry:

Greeks.live has cautioned that selling pressure is increasing across the cryptocurrency market, making a post-expiry bounce uncertain. Investors may face a challenging environment heading into the second quarter of 2025 unless a new catalyst emerges to drive bullish momentum.

But at this stage it is anyones guess!

Let us know your thoughts in the comments section below

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using INLEO

Does this mean expired Bitcoin will disappear?