5 Must-Know Crypto Tools For Every Trader and Investor

Image credit: Michael Hogue/Staff artist/source: medium

The crypto market moves fast, blink, and you might miss a major price swing or find yourself in a terrible trade position, or worse, get drained for not taking extra security measures.

Whether you're a day trader glued to the charts or a long-term investor playing the patience game with compounding interests, having the right tools can make all the difference. Reliable data, security measures, and automation help you stay ahead of the curve. From tracking yields to analyzing blockchain activities, these tools aren’t just handy, they’re essential. Since crypto never sleeps, using technology to make smarter decisions and manage risks is the key to staying profitable in this high-speed market.

So what are these Must-Know tools I speak of?

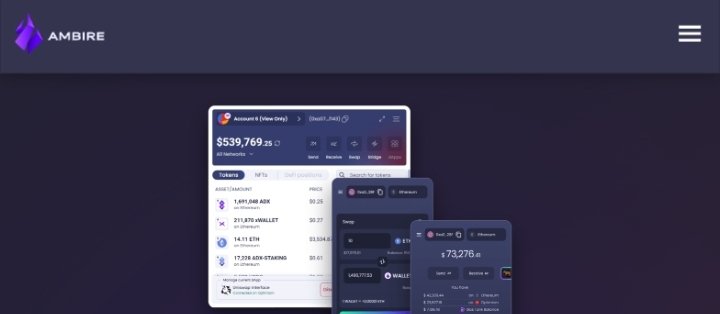

1. Ambire Wallet; Your Handy Toolbox

Every crypto trader and investor needs a good wallet, and that’s why this list starts with one. Think of it like a toolbox—having the right one makes every job easier. Or like a well-organized workspace, where everything is within reach and nothing slows you down. In the crypto world, your wallet is that essential starting point. It’s where you store assets, execute trades, and interact with blockchain applications. Without a reliable wallet, even the best trading strategies become frustrating. That’s why Ambire Wallet leads the list, offering a smarter, more flexible way to manage your assets securely and efficiently.

Ambire Wallet is a smart crypto wallet designed to make managing digital assets easier and more secure. Unlike traditional wallets, it offers built-in features like automated gas management solutions, transaction batching, and multi-chain support, making it a powerful tool for both beginners and experienced traders and investors.

One of its standout features, which I personally love is its flexible gas payment solution. Instead of leaving users to the nightmares of needing native tokens for gas payments, Ambire allows payments in stablecoins or other supported assets, removing a common barrier for crypto transactions. For example, if a user wants to swap tokens on Ethereum but doesn’t have ETH for gas, they can pay the fee using a supported token of their choice like USDC, directly from their wallet. This makes transactions smoother, reducing the need for constant token swaps and ensuring users never get stuck due to insufficient gas funds.

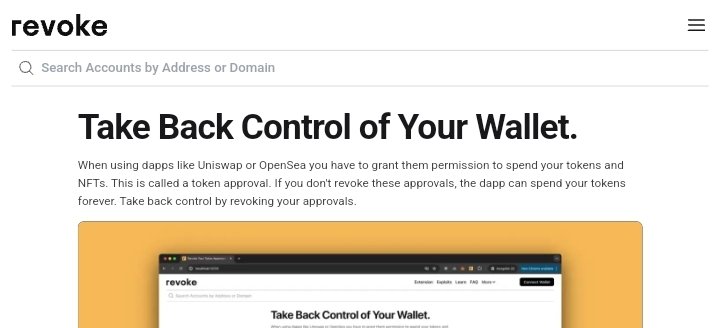

2. Revoke.cash: Protecting Your Crypto from Unwanted Access

Security is a top priority in crypto, and one of the biggest risks traders and investors face is lingering token approvals. When you interact with decentralized applications, you often grant them permission to access your funds indefinitely. Over time, these forgotten approvals can become vulnerabilities, leaving your assets exposed to potential exploits. That’s where Revoke.cash comes in. It acts like a security checkpoint, allowing you to review and revoke unnecessary permissions, reducing the risk of malicious smart contracts draining your wallet.

Revoke.cash makes this process simple by scanning your wallet for active approvals across multiple blockchains. Instead of manually checking each transaction, you get a clear overview of which dApps have access to your assets and can revoke permissions with a single click. This is useful even while interacting with familiar platforms, as even legitimate projects can later be compromised. By regularly using Revoke.cash, traders and investors can take control of their security, minimizing exposure to potential threats and ensuring that only safe contracts have connection approvals.

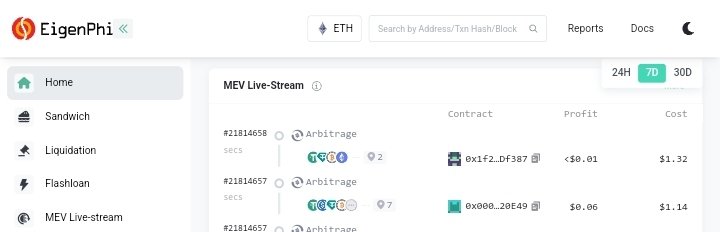

3. EigenPhi: Fishing for Profitable Opportunities in DeFi

Now we’re in the river, casting our line, hoping for a big catch. But in crypto, not all the fish are easy to spot—some are hiding beneath the surface, waiting to be reeled in by those who know where to look. That’s where EigenPhi comes in. It’s a powerful analytics tool designed to uncover hidden opportunities in DeFi, helping traders and investors track complex on-chain activities like arbitrage, sandwich attacks, and MEV (Maximal Extractable Value) strategies. If you want to fish for profits in the DeFi waters, EigenPhi gives you the right gear.

EigenPhi specializes in breaking down blockchain transactions, giving users insights into how money moves behind the scenes. By analyzing real-time data, it helps traders understand how sophisticated players extract value from the market and how to position themselves accordingly. Whether you’re looking to capitalize on arbitrage opportunities or avoid being front-run by MEV bots, EigenPhi provides the data you need to make informed decisions. With crypto markets becoming increasingly competitive, having access to this level of transparency can be the difference between making the catch of the day or going home empty-handed.

4. ArbitrageScanner: Catching Profitable Gaps Before They Disappear

In crypto, price differences between exchanges can be like fleeting opportunities—here one second, gone the next. Spotting and capitalizing on these gaps requires speed, precision, and the right tools. That’s where ArbitrageScanner comes in. It’s designed to help traders detect price discrepancies across multiple platforms, making it easier to execute profitable arbitrage trades before the market corrects itself. Whether you're scanning centralized or decentralized exchanges, this tool gives you a real-time edge in the hunt for risk-free profits.

ArbitrageScanner continuously monitors price movements, highlighting potential arbitrage opportunities based on real-time data. It filters out false positives, calculates potential gains after fees, and it requires no wallet connection, how awesome right?

With market conditions changing by the second, manual arbitrage is nearly impossible, but tools like this help traders stay ahead of the curve. For those looking to profit from inefficiencies in the market, ArbitrageScanner acts like a high-speed radar, pinpointing opportunities that might otherwise go unnoticed.

5. YieldWatch: Keeping an Eye on Your DeFi Earnings

Gotta watch those peas grow, right? In DeFi, your investments are like little seeds — staking, farming, and lending them can lead to impressive yields, but only if you keep track of everything and make timely adjustments. Well, YieldWatch comes in to make the process a lot easier. It’s a portfolio tracker designed specifically for DeFi users, helping them monitor their earnings, liquidity pool positions, and staked assets across multiple platforms. Instead of manually checking different protocols, YieldWatch brings everything into one easy-to-read dashboard, so you always know how your harvest is coming along.

Currently supported chains are Binance Smart Chain(BSC), Polygon and Fantom.

With real-time tracking and detailed analytics, YieldWatch gives users insights into their rewards, fees, and overall portfolio performance. Whether you’re farming high-APY pools or staking tokens for passive income, it helps you stay on top of your profits and losses. DeFi can be complex, with different protocols offering varying yields and lock-up periods, YieldWatch steps in to simplify the process of managing all that income opportunities. By keeping a close eye on your earnings, you can make better decisions on when to reinvest, adjust strategies, or cash out for that BMW you've always wanted, ensuring you don’t just plant seeds but actually reap the rewards.

Well, that's 5 as promised. Now that you know it, make a difference.

Start strong with Ambire Wallet, stay safe with Revoke.cash, track those MEVs bots with EigenPhi, do even better arbitrage tracking with ArbitrageScanner and ensure your seeds are growing healthily with YieldWatch.

Posted Using INLEO