Financial education should begin from childhood

For many of us in this part of the world, I think that we were never exposed to full-blown lectures and advice on financial prudence and the art of money-making. For most, especially those on tye average and lower levels economic scale, it came naturally. We did not always get everything we wanted, and we couldn't keep every gift of cash that we received because our parents took them from us in the guise of saving them for our later use.

When it comes to money and all things finance, I have always been smart and knowledgeable. But maybe, I think that my I was eager about it when my big brother saved so much money, thar when it was Christmas time, he went and got himself lots of clothes and shoes and other things and didn't just have to rely on the pair of trouser, shoes and shirt my parents would surely get us for the season. Maybe that was it. Or maybe not.

I always knew the importance of money and differentiating between my needs and wants and spending wisely. I knew that my parents couldn't give me everything I wanted even if they tried to, they had too many responsibilities on them. Many times, I'd watch as both my parents returned from their respective jobs and would take the time to plan and budget the family needs that extended beyond the nuclear household. I'd watch as sometimes they were stripped off every penny in order to meet our wants. And although they never complained, I was wise enough to know that some of my desires had to be put on hold or I could get something doing to help myself. It was enough lesson for a child like me.

But, within the age bracket, when I wasn't allowed to work but received monetary gifts from people, I got a wooden box and put my money into it. When I began to take jobs for delivery, tutoring, ushering services, etc, I knew I had to manage the funds and budget, save some, and just keep growing it.

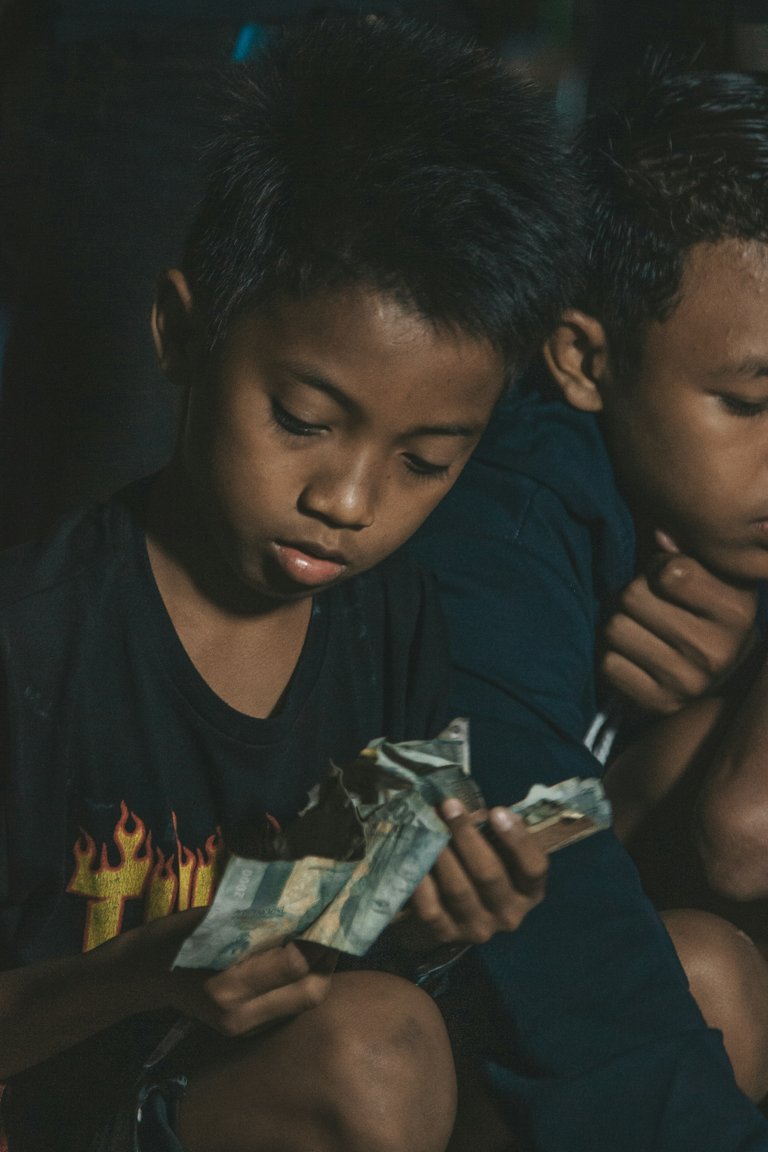

What I'm saying in essence is that there's no better time to teach/learn financial literacy than from childhood. As soon as a child knows just what money is and what it's capable of, he/she can be taught the basics of it. There's this phrase that says 'catch them young', and it makes sense anyhow you think of it. Children easily would jump at the idea of them getting what they want. If the child keeps talking about a particular item, making them save up their cash gifts or cash rewards for the very purpose of getting that item would have them excited. And trust me, you may not find even an adult who would be as dedicated to a goal as the child would be.

If at the young ages, they are taught to save, as time goes on, they could be taugt to prioritize their wants and so on. If at this delicate stage of their life they grasp this habit, then the rest will be a walk in the park because this basic knowledge will open them up to more profound ones.

I hope that this was interesting to read. Thanks for coming around.