However, with the 60% enriched uranium stored at Fordow and utilizing only the existing centrifuges there, the nation could accumulate enough material for nine weapons within a three‐week period.

A dialogue featuring a prominent American physicist and nuclear arms authority delves into the successes of Israel’s operation and debates the potential need for U.S. military support."

However, extra oxygen via deep inhalation or supplemental tanks can ironically backfire, as cellular oxygen delivery relies more on the balance between oxygen and carbon dioxide.

The science centers on the oxygen–hemoglobin dissociation curve and the Bohr effect: increased CO2 encourages hemoglobin to release oxygen to tissues like muscles or the brain.

In practice, rapid deep breaths (hyperventilation) tend to lead to dizziness, lightheadedness, or even fainting because, while oxygen intake increases, the drop in CO2 restricts oxygen release to cells and shrinks cerebral blood flow.

This also explains why fast breathing during a panic attack leaves one feeling breathless—and why overbreathing can weaken performance by limiting oxygen delivery rather than enhancing it.

Conversely, slowing breathing gently can boost warmth in the extremities. Thus, while it might seem that upping oxygen is always beneficial, true cellular oxygenation is nuanced, largely dictated by the CO2 to O2 ratio.

Long-term benefits are achieved through disciplined, relaxed breathing practices rather than bursts of forced deep breaths. Effective training is simple.

Long-term improvements like less sleep need, enhanced endurance, and sharp mental clarity stem from a careful balance of disciplined practice combined with a focus on maintaining relaxation rather than forcefully pushing deeper breaths."

The Urgency of Conservation: Are Humans Worth Saving?

In a recent announcement, the United Nations released a striking report that highlighted a grave issue—the alarming reality that over a million species of animals and plants are on the brink of extinction. This dire situation has created an urgent call to action, provoking thought and debate about the broader implications of our ecological crisis. An interesting angle to this discussion emerges when we consider the potential fate of Homo sapiens, or humans, and whether we should be concerned about our own species amidst this mass extinction event.

In a whimsical yet poignant street interview segment, individuals were prompted to share their opinions on whether humans are worth saving. The responses ranged from earnest concern to indifferent attitudes, reflecting a spectrum of beliefs about human value in the context of environmental conservation.

A common sentiment among those interviewed was the recognition of humanity's unique position within the natural world. One interviewee spoke passionately about the lessons to be learned from extinct species like dinosaurs, pointing to history as a guide. They expressed a desire to avoid a similar fate for humans, indicating a collective responsibility to ensure the survival of our species.

However, the responses weren't all supportive of the cause. Another participant candidly stated, "If they're going extinct, it's very sad, but at the end of the day, I don't care." This sentiment raises intriguing questions about humanity’s place in the ecosystem and the implications of our potential extinction. For some people, the existence of human beings doesn’t hold the weight that one might expect—after all, the world existed long before us.

The conversations took a light-hearted turn when the interviews delved into the realm of sacrifice for the survival of humans. Responses varied widely, with one participant humorously evasive about what they would be willing to give up, while another offered a more tangible commitment of $50 a month to aid in the preservation of humanity.

The humorous tone can sometimes mask a deeper underlying concern—one that acknowledges the complexities of environmental conservation and economic stability. Many people see taxes allocated towards saving Homo sapiens as a lower priority compared to issues like infrastructure, homelessness, and community development.

The Bigger Picture: Conservation Beyond Homo Sapiens

The presented views serve as a microcosm of a larger debate surrounding conservation efforts. While some acknowledge the moral imperative to protect humanity, many individuals are compelled to prioritize other pressing community issues. The conversation about conserving our species, in light of the mass extinction crisis, forces us to reckon with fundamental questions about our role in nature and to contemplate what it truly means to coexist with other species.

Humor and skepticism aside, the seriousness of the extinction crisis cannot be overstated. The implications stretch beyond a single species—they touch on the health of ecosystems, biodiversity, and the delicate balance that sustains life as we know it. As we engage in this conversation, it becomes clear that both saving humans and preserving the myriad forms of life on this planet are essential pursuits, demanding collective action and conscientious thought.

Ultimately, the looming threat of extinction for countless species, including our own, demands our immediate attention and action. The United Nations' report serves as a stark reminder of the fragility of life on Earth and the interdependence that exists within the natural world. It compels us to consider our responsibilities, not just towards our own species, but also towards the myriad of creatures and ecosystems that share this planet with us.

As awareness grows around these pressing issues, it is essential to galvanize efforts to protect wildlife and promote sustainability—a task that requires collaboration and commitment from everyone. The future of Homo sapiens and the planet itself hinges on the actions we choose to take today.

End of Season is just about to happen in #splinterlands game, I made some nice GLINT and SPS, but rental costs were too high to compensate total gain. Anyway, good season so far.

Feliz inicio de semana comunidad, que sea una excelente semana para todos, que esté cargada de grandes oportunidades y bendiciones, para así poder llegar a al cima todos y ser grandes.

The GENIUS Act is good for “government and corporate crypto industry,” but it could be a disaster for the true values of crypto: freedom, decentralization, and individual empowerment.

It is a form of crypto domestication, not liberation.

Through this blog i have told that real relations of life are not found in any classroom or in a textbook, but they come only from living. From every trouble, every tear, every silence.

Life teaches us when to remain silent and when to speak. When to support someone and when to fight with ourselves. Every mistake becomes a lesson. Suffering opens a new door. The journey of life not only makes us a song but also makes us a better person.

2/🧵I can’t live in a house, Without a plant or a garden.People have what to look out for; mine is plant and garden.Planting is one thing I can’t do without; no matter how busy my schedule is,I always map out time to take care of my garden.

Good day all, maybe it's not only me holding the 'too fast grudge' against time. A new week, think positive, executive even better

#inleo #aliveanthriving #motivation

By merging public resources with private systems, it empowers developers to create scalable, reliable applications without operational burdens. The platform features dedicated RPCs along with comprehensive enterprise support."

Google is shifting its advertising model to target AI agents instead of humans. Its new protocol, Agent2Agent, enables bots to communicate and perform tasks like financial transactions. This reflects a broader trend where consumers delegate purchases to AI, forcing advertisers into a confusing and unstable new system.

#moviesonleo #television #review First part of Law & Order and Homicide: Life on the Street crossover inspired by JonBenét Ramsey case. (link in reply)

Ever since I started keeping a record of my cake recipes, I haven't lost any of them.

Two days ago, I noticed that I had lost the latest recipe I developed (Red Wine Red Velvet Cake), and I was a bit worried. It took me some time to create that recipe, and I received amazing reviews from those who tasted the cake. I need it for an order now.

So, I relaxed and created another one yesterday. I made some calculations for a perfect recipe, and in less than an hour, I was done with it.

I will be trying this new Red Wine Red Velvet Cake recipe soon.

My hope: It turns out better than the previous one I lost, even though it was awesome.

Note: The previous recipe was oil-based, while this new one is a butter-based recipe.

No registration or personal data is stored on this platform, as everything is open source. For immediate vault access, a secondary share is maintained on a server to co-sign instantly—this underpins the secure plugin framework.

Blockchain stores NFTs, it is special digital assets. And in the game, players can own the NFT. For example, in the sprinterlands, you can own a card that has specialties like mana, attack, health, and speed. These digital assets, called NFTs (non-fungible tokens), are tradable on the market and also are verifiable.

2/🧵 - Sleeping is a very necessary biological process that we undergo at a set frequency which takes care of our body in many ways along with the ability to provide support for our mental self too.

3/🧵 - Imagining a world where we don't require to sleep will be surely much different than the way it looks right now. Almost everything would change but two of the major changes would be boost in productivity and increased stress levels.

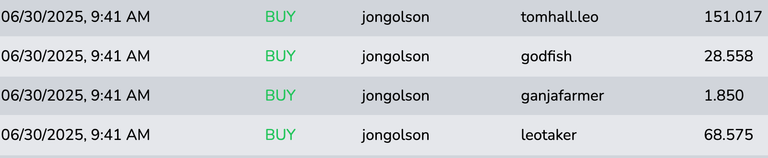

Every $LSTR being bought from us is going to be used yo buy $LEO:$0.02. We are a project thats heavily invested in making as $LEO:$0.02 as successful as possible!

I have changed the rules a bit. I won't be taking the rules too serious as of right now, but it'sa good idea to get into the habit of following the rules now 😉

Experiencing financial setbacks during early investments can be valuable. Significant losses from poor choices have served as lessons to avoid repeating those errors. Without learning from mistakes, progress cannot be achieved.

Scaling a business means taking massive action, not getting stuck in endless meetings. Many organizations hold sessions just for the sake of it, but they would benefit more from focusing on execution rather than discussion.

1/3🧵. #Threadstorm

Gardening is all about planting and taking care of the plant. It requires proper nurturing. My lemon tree was not growing untill I found the predator in it.

#outreach #photography #bugs #nature

2/3🧵. I planted a lemon tree, hoping to see it growing, but a little caterpillar was slowly grazing over the entire little plant. If was hard to notice as the nature allow it to camouflage in the green leaves.

Effective strategies indeed—it's worth giving them a try.

"Envision devoting every day to evolving into a better version at work and home. Place reminders around you—a note in the car, a sticky message, or a phone alert.

It highlights that not everyone will naturally align with the culture, which is acceptable, while ensuring that any new hire is an authentic match rather than someone who needs to be transformed.

I don't understand, if we've 4Leo in breakdown, what does it mean??? Will we receive 2 as it's rules of Blockchain that we'll get 50% and 50% send to curator!!!!

The first social media site, Six Degrees, allowed users to create a profile and add other users as friends; it existed from 1997 to 2001. About the same time, blogging and instant messaging became popular. ICQ was an early instant messaging program, which was soon followed by AOL Instant Messenger. Myspace began in 2003, and for a time was the largest social media website in the world. It set the template for social media sites such as Facebook and Twitter.

You can try publishing through other frontends like Peakd or Ecency for now and see if you'll get support until you go premium since upvote isn't guaranteed without being premium here.

Great. Try using it then. Also ensure to use relevant tags of the community and other free tags in your posts, it helps.

At least some of them give L2 tokens.

Tesla’s Dominance in AI and the Auto Industry: A Detailed Overview

Tesla and its visionary leader, Elon Musk, continue to impress experts and analysts alike, establishing themselves at the cutting edge of not only the automotive industry but also in artificial intelligence (AI). Recent discussions in the All-In podcast covered how well-positioned Tesla is, alongside Google, to dominate the AI landscape due to their unique approach to building a full stack in computing.

This article delves into the insights shared in the podcast, expert analyses on Tesla's current standing in the auto industry, and a deep dive into the concerns regarding competitors, particularly BYD, in the burgeoning electric vehicle (EV) market.

The podcast highlighted a critical perspective on why Tesla and Google are considered frontrunners in the AI race. Analyst Chamath Palihapitiya pointed out that both companies are closest to achieving a vertically integrated technology stack. This means they are not just developing algorithms or integrated components individually, but are building complementary systems that seamlessly work together.

Elon Musk's insights emphasized a mentality of constant vigilance; he maintains an assumption that Tesla is losing, despite its advancements, underpinning a culture of continued innovation and improvement.

This approach allows Tesla to innovate in areas like real-world AI – something where they outshine Google, historically more focused on theoretical research in autonomous driving. Larry Goldberg, an AI expert who joined the podcast discussion, supported this, asserting that Tesla’s practical experience with real-world scenarios provides them an unprecedented edge.

Tesla’s Inference Chips: Ahead of Competition

In addition to software, Tesla has made incredible strides in hardware development. The company is currently producing the best inference compute chips in the world, surpassing even Nvidia, the industry leader. The upcoming AI5 chip, which is already in early production, is expected to significantly enhance Tesla's capabilities in autonomous driving and robotics.

Tesla’s hardware strategy includes the development of their supercomputer, Dojo, which will interact efficiently with both their AI models and their own custom chips. The ongoing improvements in these chips are tied directly to their vision of creating robust AI solutions that seamlessly operate within their full stack.

Market Perspectives: Tesla vs. BYD

While Tesla’s market position appears strong, especially concerning the looming robo-taxi movement, analysts like Alex Potter from Piper Sandler have raised concerns about other players in the market, particularly BYD.

Despite initial perceptions of BYD as a formidable competitor due to their volume of sales and market presence in China, recent reports indicate that the company may be struggling more than anticipated. Observations have emerged regarding their production schedules and financial health, revealing that BYD is postponing capacity expansions and facing significant pressure on margins.

Goldberg brought attention to alarming indicators such as BYD's delays in paying suppliers, potentially leading to extreme financial stress. This complexity makes it crucial for investors and industry watchers to assess BYD's real performance metrics and sustainability in a rapidly evolving market.

The discourse from the All-In podcast and the subsequent analysis underscores a crucial turning point in the auto industry and AI. With Tesla’s ambitious roadmap and investment in both powerful AI and hardware solutions, they continue to lead the charge in innovation that could redefine transportation.

As competitors like BYD face internal challenges and uncertainties, it’s vital for stakeholders to remain discerning of market signals and navigate the evolving landscape carefully. Tesla's advancements illustrate a blend of strategic foresight coupled with robust engineering prowess, making them not just a player but potentially the leader in the race towards AI and autonomous driving technologies.

With the imminent rollout of the AI5 chip and the operation of their ambitious projects, Tesla stands ready to reshape the automotive and AI industries, while competitors must grapple with emerging economic realities and market dynamics.

The Courage of a Replacement Player: Kevin Millar's Journey in MLB

Early Days in Baseball

Kevin Millar’s journey in Major League Baseball (MLB) began in relative obscurity. Drafted as an undrafted player, he emerged from the St. Paul Saints in 1993, where he and three other players signed contracts for a mere $5,000, which amounted to approximately $500 after deductions. These humble beginnings set the stage for a career path filled with unforeseen challenges, particularly during the infamous baseball strike in the early '90s.

As Millar recalls, entering spring training felt overwhelming. Surrounded by two hundred hopefuls, many hailing from the Dominican Republic and Venezuela, he quickly realized that he was just a small fish in an enormous pond. This environment prepared him for the drastic decisions he would soon have to make when the player strike hit—decisions that transcended the boundaries of baseball and addressed fundamental questions of survival.

When the MLB strike occurred, many players faced difficult choices. For Millar, the matter was simple: if he did not play, he would be out of a job. Feeling compelled to make a living in an industry with limited opportunities, he accepted an invitation to be a replacement player, a decision that would come with unforeseen consequences in his career.

Millar emphasizes that he didn’t view his participation as crossing a picket line or betraying his fellow players. He describes the environment—players pressured by the realities of life without the substantial financial backing that some major league players enjoyed. While many players sat on the sidelines, secure in their wealth, Millar found himself in a tough spot, leaning on the need for immediate income over any ideological convictions related to labor disputes.

As Kevin Millar transitioned to the big leagues, the label of “replacement player” followed him. Being part of this group meant facing judgment from peers who often did not understand the context of his decisions. He passionately shares that this title carried stigma—many viewed "replacement players" as opportunists without recognizing the genuine struggle beneath that label.

Millar passionately recounts how, throughout his career, he felt the weight of negative perceptions and was frequently judged without knowing his story. He recalls instances when he had to confront opinions and attitudes stemming from misunderstandings, all while leading teams with positivity and resilience. He saw himself as a leader who brought together players from various backgrounds despite the baggage he carried as a former replacement.

Amid these challenges, Millar nurtured relationships with fellow players, many of whom became friends over shared experiences. He recalls numerous conversations where he had to remind his peers that not all decisions stemmed from a place of privilege and that every player had unique circumstances driving their choices.

In a sport that often emphasizes machismo and competition, Millar’s approach stands out. He emphasizes understanding and compassion. His story serves as a testament to the struggles of countless players not just attempting to make it but also fighting to earn a livelihood in a volatile industry.

As he reflects on his time in baseball, Millar expresses pride in his ability to lead, despite whatever unfavorable labels were attached to him. He credits his success to this skill, drawing an insightful parallel between difficult times at the start of his career and the collaborative spirit needed in a clubhouse. By merging personalities, egos, and different backgrounds, he asserts that he was able to create an atmosphere conducive to winning, regardless of the challenges posed by his past.

Millar today, as a father and husband, humorously claims titles like “father of the year” and “husband of the year,” yet he acknowledges that these are perceived with skepticism—not unlike the doubts he faced in baseball. However, the journey remains central to his identity, a badge of honor in his quest to forge his own path, while others cast shadows on it.

In recounting his experiences, Kevin Millar highlights the importance of sharing one’s story and understanding the nuances behind difficult choices. A replacement player label may have followed him, but it did not define him. Navigating through misjudgments and societal pressures, Millar emerged as a figure of resilience—showing that behind every label is a deeper story that deserves to be told. His message resonates in a world all too quick to judge, reinforcing the necessity of empathy, leadership, and unwavering dedication to one’s journey.

The Financial Enigma of BYD: Profitability or Illusion?

BYD, a leading name in the electric vehicle (EV) market, is purportedly navigating through stormy financial waters. Recent reports suggest that the company has been selling cars at a loss, sparking concerns about its long-term viability in a highly competitive landscape dominated by Tesla and other automakers.

Reports indicate that BYD has recently slowed its production and expansion plans, a possible indicator that the company's previous sales growth may be faltering. Sources claim that BYD has reduced shifts at several factories and postponed plans for new production lines. Such moves could imply that even after slashing prices in an effort to boost sales, the automaker faces an increasing inventory of unsold vehicles.

These price cuts have reached up to 35%, a significant reduction for vehicles ranging from around $10,000 to $50,000. Such drastic measures raise alarm bells about the company’s competition status in the Chinese market, particularly since their offerings are substantially discounted when compared to rivals. This raises questions: if BYD's vehicles are so affordable, why the need for steep discounts?

Critics argue that BYD's business model is overly complicated, making it challenging to discern the health of its core electric vehicle segment. The company does not separately report financials for its various business units, including its battery cell supply division. This has led to concerns that the profits obtained from battery production are effectively propping up the losses incurred in the EV business.

Interestingly, the bestselling vehicle in China is the Tesla Model Y—an electric vehicle priced two to three times higher than many of BYD’s cheapest offerings. Notably, Tesla is managing to sell its vehicles profitably, while BYD’s success in sales numbers could be misleading, given that a significant portion of its offerings still consists of internal combustion engine vehicles which are often marketed as “electrified” vehicles.

On the surface, BYD appears to be expanding profitably. Recent financial reports indicated that the company saw its net profit jump by 33% year-over-year in 2024, with a reported revenue of approximately 777 billion yuan. However, industry analysts argue that a 5.4% profit margin—although higher than the industrial average of 2%—mask deeper issues, particularly relating to BYD's cash flow and supplier payments.

Moreover, the financial complexities deepen when considering how BYD categorizes revenues: automobile sales are bundled with battery supply revenues. This could potentially inflate the perceived profitability of their automotive division, making it look like revenues cover losses in electric vehicle sales when they might not.

Recent estimates suggest that the average sale price for a BYD vehicle is around 124,900 yuan, equating to approximately $17,400. However, the costs associated with producing these vehicles, including taxes and hidden costs, may negate any potential profits. Analysis suggests that each vehicle might incur hidden costs of up to 20,000 yuan, while the profit generated before accounting for overhead stood at only 19,500 yuan. This paradox casts doubt on the financial health of the EV segment.

Comparative analysis with other manufacturers, such as Great Wall Motors and Nio, further highlights BYD’s precarious financial situation. While BYD sells a mix of electric and internal combustion vehicles, its financial complexity does not lend itself well to profitability, particularly as consumer preferences shift away from traditional vehicles.

Future Prospects and Potential Deception

The future is uncertain for BYD, especially if key indicators such as the company’s extended supplier payment terms—sometimes up to a year—hint at cash flow problems. The potential for cooking the books is an allegation that hovers ominously over the company, raising critical questions about its transparency and future direction.

While it is clear that BYD has an array of issues to address, it remains a key player in the electric vehicle market, striving to carve out a significant niche. Whether the company can mitigate the risks from its extensive complexity and regain profitability remains to be seen.

In summation, BYD stands at a critical juncture, facing a myriad of challenges ranging from aggressive competition to internal financial complexities. As skepticism around the company's profitability continues to grow, stakeholders and analysts alike will need to scrutinize financial reports closely, ensuring transparency and accountability in a rapidly evolving market. It is essential for BYD to clarify its financial standing and strategically simplify its operations to secure its position in the competitive landscape of electric mobility.

Tesla's Transformative Journey: The Autonomous and AI Revolution

In recent discussions surrounding Tesla, a notable sentiment has emerged from long-standing analysts and investors alike — a shared belief that the company's ambitious $1 trillion autonomous journey and AI narrative is officially unfolding. This excitement underscores the significance of forthcoming developments that can demonstrate a quicker ramp-up than many currently anticipate.

A pivotal indicator mentioned is the potential expansion of the geo-fenced area for Tesla's robo-taxi service. If reports suggesting an expansion to include Giga Texas by June 28th transpire, it would serve as a robust signal of progress for Tesla’s autonomous capabilities. This aspect is particularly crucial for institutional investors who remain acutely focused on the expansion of Tesla's geo-fenced areas as evidence of the company’s enhanced confidence in its technology and strategies. As institutional interest in Tesla heightens, the focus remains on how quickly these geofencing areas can grow as a precursor to significant adoption and profitability.

The conversation shifted towards Elon Musk, who has historically been a point of concern for investors. However, recent observations indicate that Musk appears to be more laser-focused on Tesla’s core mission of robotics and autonomy. Analysts have pointed out that the manner in which Musk is prioritizing Tesla's initiatives, particularly surrounding the launch of the robo-taxi service, showcases a shift towards a more responsible and carefully managed rollout strategy. The current environment is marked by cautious optimism as Musk's focus on Tesla aligns with the broader narrative that a pivotal moment is at hand for the company.

The discussions also touched on the hesitancy among certain analysts and institutions to invest heavily in Tesla without significant earnings growth. Traditionally, around 60% to 70% of institutional investors would wait for tangible growth metrics, whereas a shift is visible now, with a considerable portion recognizing the potential in Tesla’s future. This change reflects a growing acknowledgment of Tesla as an emerging leader not just in electric vehicles but also in the AI landscape, a sentiment that directly ties to how Tesla is perceived within the technological revolution currently taking place.

The conversation strongly emphasized that Tesla is not merely an electric vehicle manufacturer but is instead a prominent player in the AI domain. Analysts pointed out that while many view Tesla through the conventional lens of automotive sales and earnings, the company is redefining itself as a key player in artificial intelligence and robotics. Tesla's role in the broader AI narrative encompasses autonomy as just one component of a larger strategy that includes robotic applications and solutions.

Tesla is positioning itself to be among the most undervalued AI firms in the market. The autonomous taxi system is only the first chapter in a much larger unfolding story that connects Tesla to the burgeoning fields of robotics and physical AI. By aligning its future trajectory towards these broader applications, Tesla is not just revolutionizing transportation but is also laying the groundwork for a more expansive impact on various sectors reliant on AI.

Further enhancing the discussion was the introduction of the AI30 ETF, which highlights leading AI companies, including Tesla and Nvidia. Analysts foresee the potential for substantial growth in investments focusing on AI technologies, affirming that institutional investors are eager to tap into this advancing sector. The ETF aims to capture the momentum generated by AI advancements while diversifying investment exposure among leading AI players.

As Tesla navigates its transformative path, the evolution of its autonomous capabilities and the inclusion of AI in its product lineup are set to redefine the financial landscape. As the conversation shifts from skepticism to a burgeoning recognition of potential, now is an opportune time for investors to engage with Tesla's growth story. The developments on the horizon offer not just an invitation to participate in Tesla's unfolding narrative but also a chance to witness the convergence of autonomous technology and artificial intelligence, paving the way for what could be a revolutionary era in human-technology interaction.

Reflections on the 2003 ALCS and the Boston Red Sox

The atmosphere of a clubhouse is a unique combination of camaraderie, vulnerability, and pure emotion, especially after a gut-wrenching game. The conversation dives deep into this very tar pit of feelings, specifically focusing on the aftermath of Game 7 of the 2003 American League Championship Series (ALCS), where the Boston Red Sox faced the New York Yankees.

The scene was tragic for the Red Sox. As one player recalled, “Tears. You got grown men crying.” The pain was palpable for a team that had been striving for success — a glimpse of the championship seemed close but was snatched away in an instant. It was a heartbreaking loss that marked the end of what many had hoped could be a magical season, a dream yet to be fulfilled as the Red Sox had not won a World Series title since 1918.

In this post-loss clubhouse sentiment, there was a sense of disbelief, particularly after the game had stretched into extra innings against a fierce rival, the Yankees. Acknowledging the intensity of the moment, the player reminisced about standing on first base and trying to communicate with teammates as the events unfolded at a breakneck pace. The sound of the crowd and the feeling of the stadium electrified the failure, and once it was over, it was clear that despair had taken over.

Then came the aftermath, as the reflection turned to resilience. Season-ending losses can sometimes stoke a fire of determination. The players began to analyze that painful defeat, knowing that they needed to harness it, not discard it. One notable aspect discussed was the rebounding spirit of the team. A year later, the Red Sox found themselves in another ALCS against the Yankees - this time, in a totally different psychological and situational frame. One player spoke of the pivotal shift in mindset necessary to overcome what was once deemed insurmountable — "Tough times don’t last; tough people do."

The recollection of how the team derived strength from that painful experience in 2003 set the stage for an unbelievable turnaround in 2004. “You can’t come back from being down 0-3,” stated the player, employing the blanket belief pervasive in baseball that such comebacks are impossible. Yet, against that narrative, the Red Sox stood ready to face their rivals once more.

What stood out was the dynamic of leadership within the team. The player on the mic, known for his ability to compartmentalize and navigate through the emotional fortitude, spoke candidly about his methods. Rather than mentally spiraling over the 0-3 deficit, the focus was on winning just one game. “Just get me one,” the player echoed as a personal strategy. This simple but effective ambition acted as a bedrock for the team’s strategy going forward.

In a poignant moment, he reflected on how harsh articles, like one that labeled the team "frauds," incited a fierce resolve within them. The bitterness of those comments sparked a rallying cry. In what seemed like a mundane moment in a clubhouse, this player gave a spontaneous and intense speech that united the team under an unexpected banner of defiance. Confronting insults with a sense of humor, they reframed victimhood into a challenge, leading them to seize the day, game by game.

The discussion naturally turned towards momentum in sports, which is a concept that endlessly fascinates athletes and fans alike. The player emphasized how shifting circumstances can revitalize a team, especially when they have no expectations to fulfill and can play freely. They highlighted how sports — be it baseball or basketball — teem with unpredictable swings, especially when a team enters a match with the mindset of being the underdog.

The 2004 team, fueled by resolve and transformation from their painful past, began to dismantle the psychological barriers set by their previous failures. The idea was to play without fear, demonstrating that a shift in mindset can overturn the heaviest of burdens.

As the dialogue concluded, the player articulated a profound appreciation for the path travelled from despair to redemption. The heartaches of the past lingered, yet they provided the foundation for resilience and grit. The evolution from the heartbreaking loss of 2003 to eventually winning the World Series in 2004 encapsulates the beauty and unpredictability of sports, serving as a reminder that sometimes, it’s not just victory that defines a journey, but how one navigates through loss. In both life and sports, one must not fear loss but rather embrace the lessons it brings and the strength it builds.

The Future of Robo Taxis: A Deep Dive into Tesla's Journey

The advent of robo taxis, particularly those produced by Tesla, has inspired immense optimism among enthusiasts and investors alike. Many believe that the company's stock is primed to skyrocket—projecting value increments to as high as $3,000 per share by next year. Yet, the world outside this enthusiastic echo chamber appears more cautious. The disconnect between tech enthusiasts and skeptics presents an exciting narrative worth exploring.

To better understand these differing perspectives, this article delves into the dynamics of the robo taxi market, Tesla's position within it, and the critical reception from industry giants and media outlets.

Recently, the CEO of Show Me, a competitor to Tesla's Model Y, publicly acknowledged Tesla's strides in autonomous vehicle technology, particularly regarding its Full Self-Driving (FSD) capabilities. After the unveiling of Show Me Yu7, regarded as a strong contender against the Model Y, CEO Le Jun paid homage to Tesla's breakthrough achievements, notably its first autonomous vehicle delivery. He expressed admiration for Tesla's innovation and the next step it represents in electrification and automation.

Such respect for Tesla is notably more prevalent in the Chinese market, where competitive pressures abound yet admiration for the company's leadership in technology persists.

In stark contrast to the laudations from international counterparts, some of the skepticism surrounding Tesla's approach comes from traditional automotive leaders, such as Ford. Ford's representatives insist that the pursuit of a robust autonomous vehicle system necessitates the use of complex sensors like LiDAR to ensure safety and reliability. This belief reinforces a divide between those who support a more technologically conservative approach and Tesla's promise of relying primarily on camera-based systems.

A closer inspection of recent reporting, especially from reputable media like Forbes, reveals that Tesla has faced criticism for failing to meet its own ambitious timelines for the launch of its robo taxi service. An article emphasized the need for supervisory oversight, asserting that removing a safety driver from the vehicle–a critical milestone–has proven elusive.

The article presents a frequently missed nuance: the transition to fully autonomous driving without a safety driver is fraught with challenges and risks. Various companies, such as Waymo and Cruise, have successfully tested their vehicles in unsupervised environments, while Tesla continues working toward that goal. Critics argue that while Tesla did demonstrate a remarkable delivery without a human operator at the wheel, it still necessitated a safety supervisor in the vehicle—a point not lost on the cynics.

Despite this criticism, there's a compelling argument to be made for Tesla's unique approach to training its autonomous systems. Unlike its competitors, Tesla relies heavily on machine learning and vast amounts of driver data accrued over countless miles instead of traditional maps and LIDAR.

Navigating the Critique of Safety Responsibility

Unease surrounding Tesla's public assertions about full autonomy ties back to the very definitions of "safety drivers" and "supervisors." In traditional autonomous fleet deployments, the human role typically involves immediate intervention capabilities. Tesla's deployment model, featuring a supervisor in the passenger seat rather than at the controls, raises questions about its adherence to safety standards.

Understanding whether this arrangement equates to genuine unsupervised capability remains critical. If it appears as an act of confidence, some critics argue it may draw controversy for its lack of traditional supervisory controls. As the conversation unfolds, it highlights a broader debate about the ethical obligations involved in developing a fully autonomous vehicle.

The Path Forward: Balancing Promises and Reality

As Tesla continues its evolution within the automotive landscape, industry stakeholders are left wondering about the real readiness of robo taxis. There’s recognition that deploying vehicles sans a safety driver represents a monumental leap in safety assurance—a claim that remains unproven to those who prioritize tangible evidence of safety in deployment.

Moreover, the criticism extends beyond static safety considerations; factors such as reducing distractions, improving reflexes, and maintaining focus on the road emphasize numerous advantages of autonomous driving that even traditional drivers currently lack. The primary target remains ensuring that these improvements consistently lead to lower accident rates—a challenge that informs both public perception and investor confidence.

Conclusion: The Duality of Enthusiasm and Skepticism

In summary, the journey toward fully autonomous vehicles remains a complicated mix of optimism and skepticism. While many eagerly anticipate Tesla's future, buoyed by rapid developments and self-driving technology advancements, others urge caution, reminding stakeholders that safety and reliability must always come first.

The robo taxi landscape is just beginning to take shape, making it essential for all participants—business leaders, investors, and consumers alike—to keep a close eye on advancements, public perceptions, and the broader implications of these vehicular innovations. Only time will tell whether the promise of a safe, autonomous, and innovative transportation solution will be fully realized or remain an aspirational dream.

Nothing Personal: The Conversation with Kevin Malar

Introduction

On June 30th, a memorable episode of Nothing Personal featured Kevin Malar, a prominent figure in the baseball world known for his unique experiences both on and off the field. Malar's journey from an undrafted player to a beloved athlete and now a media personality is filled with remarkable anecdotes, insights on the game, and a genuine reflection on life’s challenges.

The episode opened with Malar humorously addressing a mix-up that led to him missing a prior appearance on the show. This light-hearted exchange quickly turned into a discussion about the importance of punctuality, particularly in the high-stakes environment of Major League Baseball (MLB), where timing can be everything.

Malar's commitment to being organized was evident as he reminisced about his days as a player. He shared stories of being early to the field, showcasing his work ethic, which stemmed from being an undrafted player always feeling the pressure to prove himself.

The conversation shifted to Malar's early career and the competitive atmosphere in MLB. He discussed how every player should play with the fear of losing their job—a sentiment particularly resonant for someone who had to push through numerous challenges in his journey. Malar's upbringing in Los Angeles during the gang violence era helped shape his perspective, instilling a drive unlike any other.

Reflecting on his years with the Florida Marlins and later the Boston Red Sox, Malar conveyed a sense of gratitude for every moment spent in the big leagues, underscoring how competition fueled his passion for the game.

Malar recounted a pivotal moment when he was set to sign with a Japanese team after the 2002 season. However, the Boston Red Sox claimed him off waivers, which changed the course of his career. The ensuing trade discussion highlighted the complexities of player transactions and how business decisions often intertwine with personal aspirations.

This incident not only solidified Malar’s place in MLB but inadvertently contributed to a pivotal moment in the Red Sox’s history, the 2003 ALCS against the New York Yankees.

The nostalgia of Malar's experiences during the 2003 ALCS was palpable as he reflected on how the series unfolded. He painted a vivid picture of the heart-wrenching loss to the Yankees in game seven, which left many players, including himself, in tears. Malar’s underdog perspective allowed him to channel his frustrations into motivation, a driving force that would later influence the iconic 2004 Red Sox comeback.

The narrative seamlessly evolved into a discussion about resilience. Malar recalled the unlikelihood of coming back from a 3-0 series deficit, a feat that history would come to remember. His unwavering dedication to retaining team morale in difficult situations shone through during this storytelling moment.

As the discussion progressed, Malar tackled shifts in player behavior and league culture, particularly regarding celebrations and unwritten rules in baseball.

He expressed a mix of acceptance and nostalgia for the sport's evolution, illustrating how the modern game has adapted to embrace showmanship that was once frowned upon. Malar noted the importance of evolution in sports while pointing out that some changes can be difficult to embrace fully, especially for those who played in a different era.

An intriguing aspect of the episode focused on Malar's transition into sports media. He spoke candidly about the fine line between critical analysis and favoritism as a broadcaster. His commitment to accountability in the game was clear; he emphasized the responsibility of players and ownership alike when discussing their performances on-air.

Exploring the tension between media commentary and player sentiments, Malar highlighted the complexities that arise from a public platform, emphasizing the importance of balanced discussions rather than harsh criticisms that can have real-world consequences for athletes.

Towards the end of the conversation, Malar showcased his humorous personality, balancing a life of media engagement with personal responsibilities as a father and husband. His anecdotes, whether they were about his frugal teammates or memorable moments during games, underscored a more relatable side of the athlete.

He also offered insight into the analytical culture permeating MLB today, reflecting on how younger generations engage with data and metrics in ways that differ from his traditional experiences, emphasizing the need for players to stay grounded amid such changes.

Kevin Malar's journey through baseball, punctuated by personal anecdotes and reflections on teamwork, competition, and growth, paints a remarkable picture of life inside and outside the diamond. As Nothing Personal continues to delve into the stories behind the game, Malar's insights remind us of the passion that baseball evokes and the importance of personal connections in shaping one’s legacy.

Tesla's Groundbreaking Autonomy: A Fork in the Road for the Auto Industry

Tesla has achieved yet another remarkable milestone in its quest for full automation, recently completing the world’s first fully autonomous vehicle delivery. A car successfully drove itself from the production line to a customer’s home, marking a significant advancement in Tesla's autonomous driving technology. As the narrative unfolds, the implications of this event may set a profound precedent for the automotive industry, especially against the backdrop of competitors like Ford and Waymo.

Elon Musk announced this groundbreaking achievement, stating, “Kapow, the first fully autonomous delivery of Tesla from factory to customer's home across town, including highway, was just completed a day ahead of schedule.” This moment is not merely about the delivery itself, but also a profound demonstration of Tesla's advanced capabilities in autonomous driving systems—capabilities that competitors like Waymo have yet to achieve.

In this instance, Tesla’s vehicle completed a self-directed journey without any human intervention, a feat that further solidifies Tesla's position at the forefront of autonomous vehicle manufacturing. While Waymo has garnered attention with its multiple robo-taxi rides, Tesla’s capacity to seamlessly combine vehicle manufacturing with autonomous operation presents a distinct edge.

This innovation isn’t just a technical achievement; it could potentially lower delivery costs for Tesla customers near production facilities. However, the more significant takeaway is the demonstration of Tesla's mastery over its proprietary technology. Unlike Waymo, which adapts existing vehicles, Tesla controls the entire process—from manufacturing to software, which allows for a more integrated and optimized approach to autonomy.

As the industry evolves, Tesla’s direct-to-consumer autonomous deliveries could illustrate a model where vehicles return for servicing on their own, further building on the idea of efficiency and user convenience. It raises questions about how traditional manufacturers will adapt in this rapidly changing landscape.

While Tesla strides toward scalability and innovation, Ford seems to be steering toward what some may consider a dead end. Reports indicate that Ford is considering a reliance on LiDAR technology for their vehicles, as opposed to trusting the camera and AI systems that Tesla advocates. Without an understanding of the limitations that such approaches impose, Ford's decision may very well be a significant mistake.

The inclination to partner with Waymo rather than Tesla may stem from a misconception that LiDAR is a superior technology. However, Tesla’s capacity for further innovation and adaptability in using camera systems could eclipse these efforts as the industry determines the best path ahead.

Tesla has illustrated that while competitors may have started earlier, their technological superiority prioritizes seamless integration over simply fitting cars with sensors. The limitations of Waymo’s geo-fenced system contrast sharply with Tesla’s ability to navigate public roads without predefined routes.

There’s a growing understanding within the industry that autonomous driving systems must be scalable and versatile. Current systems that rely on restrictive geo-fencing could hinder automotive and technological progress in the future. As the demand for advanced autonomous capabilities grows, so too will the need for adaptable systems that can operate broadly rather than in isolated, urban settings.

In light of these developments, it’s clear that the future belongs to systems that can adapt and evolve, as opposed to those constrained by limitations and traditional approaches. Elon Musk has claimed that the future of AI-driven vehicles will render human drivers obsolete, emphasizing that autonomous systems will surpass human capabilities in terms of safety and efficiency.

As Tesla takes more decisive steps toward realizing this vision of full autonomy, traditional automakers like Ford may find themselves at a crossroads: continue on their current trajectory or pivot to embrace the transformative capabilities that Tesla has showcased.

Tesla's recent autonomous delivery is far more than a milestone; it marks a significant moment in the ongoing evolution of the automotive industry. With competitors grappling with their own strategic choices, all eyes are on how they respond to Tesla's groundbreaking innovations. As robotic driving technology continues to advance, the divide between companies that embrace full autonomy and those that remain tethered to outdated methods will profoundly shape the landscape of personal transportation in years to come.

As this story unfolds, it will be fascinating to see if companies like Ford can adapt or if they will be left in the dust by a rapidly evolving Tesla ecosystem. The choices made today may very well dictate the fortunes of the traditional automotive giants in the near future.

The Tragic Fire and Sinking of a Cargo Ship in Alaska: An Analysis

In a shocking incident in the North Pacific Ocean, a cargo ship named Morning Midas caught fire while carrying approximately 3,000 new vehicles, including 70 fully electric cars and 680 hybrids. This event has spurred widespread media coverage and significant public interest, especially amid ongoing debates over the safety of electric vehicles (EVs). The impact of this incident has raised questions about the nature of vehicle fires at sea and the responsibility of media outlets in their reporting.

Weeks before its sinking, the Morning Midas experienced a raging fire that ultimately led to the crew abandoning ship after failing to extinguish it. The blaze was reported to have been intense enough to render the ship "dead in the water," floating approximately 415 miles from land before it succumbed to the water, sinking into a depth of 16,400 feet. The vessel was laden with fuel — 350 metric tons of marine gas oil and 15,000 tons of low sulfur fuel oil — raising concerns about potential pollution in the pristine Alaskan waters.

The U.S. Coast Guard assured that no visible pollution was detected and dispatched vessels equipped with pollution control to monitor the area. Fortunately, the crew managed to evacuate safely, which is a silver lining in an otherwise tragic event.

Media Coverage: The Good, The Bad, and The Misleading

Media coverage of the cargo ship incident has varied widely, with outlets such as CBS News and Bloomberg both reporting that the ship was carrying electric vehicles. Headlines have sensationalized the situation, some suggesting that the electric vehicles were directly responsible for the fire. However, a closer analysis reveals that only 70 out of 3,000 vehicles were electric, and the remaining vehicles were predominately traditional combustion models.

The lack of clear details about the cause of the initial fire has led to speculation. Past experiences show that many ship fires involving car carriers have not been originated by EVs, as highlighted by previous incidents where vehicles labeled as electric were not found to be at fault. For instance, a similar event reported earlier involved a different freighter where despite the presence of EVs, none were found to have ignited during the fire.

It is essential to set the record straight regarding the safety of electric vehicles in comparison to traditional combustion engine vehicles. It is well-documented that internal combustion engines are more susceptible to incidents of fire, mainly due to the inherent risks associated with gasoline. In contrast, although lithium-ion batteries present a hazard under certain conditions, they do not pose a greater risk than gasoline vehicles on average.

The media’s eagerness to attribute blame to electric vehicles reflects a larger narrative that often overlooks well-researched facts. Despite their best efforts at drawing in audience attention through fear and sensationalism, the reality is that the cause of the fire remains unknown and should not be hastily attributed to one class of vehicles.

As discussions continue to fill the airwaves and online spaces, it is crucial for consumers and enthusiasts alike to critically evaluate the information presented to them. Misleading headlines and exaggerated claims may bolster certain preconceived notions but do not aid in understanding this incident or developments related to vehicle safety.

We must also acknowledge the role that community support plays in addressing these ongoing dialogues. Contributors, patrons, and various community members provide the resources necessary to explore these events further and investigate the truth behind such situations. The thanks and appreciation for support not only affirm the endeavors of content creators but also strengthen the collective discourse around emerging technologies in transportation.

Conclusion: A Call for Calm and Rational Assessment

Despite the tragic nature of the cargo ship incident off Alaska, it provides an opportunity for reflection on the intricacies of media reporting, public perception, and the ongoing evolution of vehicle safety. As we move forward, it is vital that we prioritize accurate understanding, dispel fears driven by misleading information, and engage constructively in discussions about the future of electric vehicles.

Consideration should be given to the need for more robust reporting standards, the importance of transparency in safety assessments, and a focus on fostering informed conversations that contribute positively to the perception of electric mobility in all its forms.

As we sit at the crossroads of a tumultuous baseball season, the New York Mets, fresh off one of the worst weekends in their franchise history, are facing a significant upheaval. In the latest episode of “Boomer and Gio,” hosted by Boomer Esiason and Gregg Giannotti, the team delves deep into the disastrous state of the Mets following a humiliating series against the Pittsburgh Pirates—a series where they were outscored 30-4.

Despite still sitting in a playoff spot, the Mets’ recent performance raises alarm bells. They have lost 13 out of their last 16 games, with both pitching and batting struggles contributing to a seemingly lifeless demeanor on the field. Boomer begins by expressing his disgust, emphasizing the stark contrast between the Mets’ lofty payroll of $325 million and their current performance level. The Pirates, a team with a mere $90 million payroll, managed to sweep the Mets, which calls into question the financial investment and overall team strategy.

Geographically, the Mets are only a game and a half away from first place, which adds layers of frustration for fans and analysts alike. The dismal showing, especially against a team that had only 32 wins going into the series, is deemed "completely unacceptable." The co-hosts agree that with such a high payroll, expiring expectations should come with accountability.

Discussions around team meetings emerged, highlighting the ineffectiveness of trying to spark energy when performance issues seem deeper rooted than mere morale. Despite previous team meetings producing a beneficial response, this latest meeting appears to have had little impact. The feeling among players and managers is a shared disappointment; Carlos Mendoza, the Mets’ manager, has tried various tactics to rekindle competitiveness but to no avail.

Echoing feelings of frustration, Boomer reminisces about a time in baseball when players thrived under strict conditions, referencing legendary coach Paul Brown's hard-nosed approach. The contrast is stark when looking at how the current Mets, with high-profile players, seem to lack that edge, raising questions about their hunger to compete.

Key players like Pete Alonso, Francisco Lindor, and Jeff McNeil are currently performing below expectations, contributing to an overall lackluster offense that can’t seem to capitalize under pressure. The co-hosts critique the inefficiency of scoring in essential moments, with the Mets reportedly performing poorly with runners in scoring positions.

The conversation turns more serious when discussing the pitching rotation. After a stretch where the staff looked impressive, injuries and performance issues have left them vulnerable. The notable decline in quality pitching has led to losses that spiral out of control, causing a cascading effect on offense and overall confidence.

Both Boomer and Gio express incredulity at the drastic drop in team performance. The Mets’ starter rotations that once instilled confidence have faltered drastically, contributing to a bleak outlook. The duo acknowledges that while every team faces challenges throughout the season, the disparity in performances, especially against weaker opponents like the Pirates, is unforgivable.

Gio adds that the anxiety surrounding a potential playoff miss is palpable, indicating that if the team ends the season without a postseason berth, significant changes might become necessary. However, the discussion remains focused on the present—how to redeem the season going forward, especially with the upcoming matchups against teams that could either stabilize the slide or exacerbate the issue.

As they wrap up their analysis, the conversation shifts toward the proactive steps the team must take moving ahead. They agree that a singular focus on the upcoming series against the Milwaukee Brewers is critical, recognizing that the pressures of the season are heavy but also part of the baseball landscape.

In a powerful conclusion, both hosts underscore the importance of not carrying the frustrations of one series into another, using it as an opportunity to refocus and restart. While the past weekend was certainly one for the history books, the potential for turnaround remains alive—albeit tenuous—for the Mets as they navigate the rest of the season.

In a season defined by potential, the questions surrounding whether the Mets can pool their talents effectively remain front and center. The podcast serves as both a critique and a hopeful rallying cry for a fanbase in desperate need of redemption.

Fueron suficientes para otra extraordinaria salida de Framber Valdéz, lo que alejó a los siderales en la punta de la división oeste de la liga Americana..!

En 7 entradas, espació 4 incogibles, otorgó un boleto y pasó por la guillotina a 8 contrarios, con lo cual redujo su efectividad a 2 carreras por cada 9 innings lanzados..!

What's up, everyone? It was a busy day for me, and I needed to accomplish a lot of tasks today, and I became exhausted. A little headache is also troubling me, but it's not so bad, and till now I think after sleep everything will be fine. But still, I have some tasks left to do before going to sleep. What about you? How was your day?

An extensive overview of TRON is available via the #TRON Portal, offering on-chain data, ecosystem insights, and additional metrics for a complete perspective.

TBH, it's better than I expected.

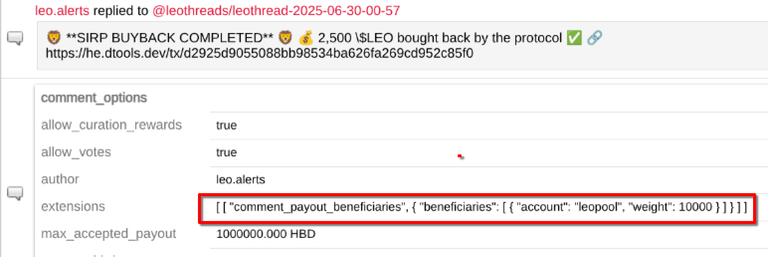

If this trend remains, 1700 :6 x 365 = 103K new LEO in 1 year.

I know, with LEO prices surging, qty will drop.

But $'s maybe not so much

Hollywood vs. AI: The Battle for Copyright Control

As the landscape of entertainment continues to evolve, a significant shift has emerged regarding the utilization of artificial intelligence (AI) in creative endeavors. The ongoing discussions between Hollywood and AI companies indicate a growing tension rooted in copyright law, intellectual property rights, and the implications of using copyrighted materials for training AI models.

A recent ruling by a California federal judge has marked a turning point in this ongoing debate. The decision granted AI companies, such as Anthropic—the firm behind Claude AI—the right to train their models on copyrighted works without obtaining explicit consent from creators, provided these works are obtained legally. This ruling has introduced a potential loophole, allowing companies to bypass traditional licensing deals that could be costly.

This situation highlights a complex legal framework where copyrighted materials can be used to develop AI models under certain conditions. The implications of this ruling have left Hollywood executives anxious about the future of their intellectual properties. The prevailing sentiment is that the balance of power has shifted in favor of AI companies, raising questions about what it means for the creative industries.

During discussions, both hosts drew parallels between AI learning and human learning. The debate centers around whether AI's training processes, which involve analyzing vast arrays of information and styles, could be equated to traditional artistic methods. They argue that just as artists often learn by replicating the works of masters, AI processes data to create new outputs based on learned patterns.

However, concerns arise when discussing the originality of what AI produces—does it cross the line between inspiration and outright copying? Critics argue that while AI might remix existing ideas, it lacks the nuanced understanding that human creators possess, making its outputs potentially problematic.

A notable point of contention lies in the irony that many artists who decry the rise of AI have often created derivative works based on popular characters and styles. This hypocrisy raises questions about the nature of originality in art and how closely it can be tied to copyright. The hosts remarked that while AI can produce outputs at unprecedented speeds, allowing it to learn from existing copyrighted material can undermine the value of artistic labor.

The conversation also touched on the idea that, as AI advances, it could redefine the boundaries of creativity, blurring the lines that traditionally separate original ideas from derivative ones. This scenario could compel Hollywood to reassess how it engages with both AI technologies and the very essence of intellectual property.

The panelists argued that Hollywood must adapt to the rapid evolution of AI if it seeks to maintain its relevance. There is an inherent risk that, without clear guidelines regulating the use of AI in creativity, the industry might become saturated with works generated from pre-existing materials. This could diminish the incentive for creators and potentially threaten the foundation of copyright law itself.

As discussions of AI in Hollywood continue, the hosts proposed that if AI can produce "new" content from existing materials without proper attribution or compensation, the implications for creative ownership could be severe. This transformation raises further questions about the need for digital rights management systems that can ensure ownership while acknowledging the role of AI in the creative process.

While the benefits of using AI as a creative tool are acknowledged, the need for regulatory frameworks and ethical considerations remains paramount. There is a consensus that some guardrails are essential to prevent potential exploitation of artists’ works. The panelist remarked on the importance of safeguarding creators’ rights while permitting the beneficial use of AI technologies to enhance artistic expression.

As the entertainment landscape grapples with these emerging challenges, it is clear that the balance between embracing innovation and protecting creative rights will shape the future of both Hollywood and the broader creative community.

The evolution of AI presents unprecedented opportunities and risks for the entertainment industry, setting the stage for an ongoing debate about copyright laws, artistic integrity, and the future of creativity. As these discussions take center stage in Hollywood, it is evident that finding a harmonious approach to integrating AI and preserving the rights of creators will determine the trajectory of both sectors moving forward.

With the rapid pace of technological advancement, stakeholders in the entertainment industry will need to navigate these complexities carefully, ensuring that both innovation and creative rights are protected in this new era of AI-powered creativity.

Market Analysis: Understanding the Current Economic Landscape

The financial markets have recently experienced a significant surge, with notable indexes such as the S&P 500, Nasdaq, and Nasdaq 100 reaching new record highs. This development marks the best quarterly performance for the technology sector since the second quarter of 2020, raising questions about the underlying factors contributing to this rally and its potential longevity.

This remarkable uptrend is characterized as the "most hated V-shaped rally." Following a dramatic decline in April, many investors became hesitant to commit to equities, leading to widespread liquidations during the lows. However, historical patterns indicate that significant recoveries often occur when volatility indicators, such as the VIX, drop from above 60 to below 30. These indicators suggest that we may have reached a definitive low point.

Moreover, the market environment has improved, with tariff impacts being less severe than initially anticipated, and inflation showing more moderation than expected. Interestingly, the bond market reflects a belief that the Federal Reserve is lagging behind its targets. With the two-year Treasury yield signaling more dovish sentiments, based on the ten-year Treasury yield declining to 4.2%, analysts see a favorable backdrop for equities.

A prominent concern remains the $3.3 trillion increment to national deficits, raising questions about the sustainability of US debt. Yet, current market dynamics illustrate that investors do not perceive the US balance sheet as entirely reliant on its budget alone. The value of U.S. natural resources, real estate, and gold contributes to a more nuanced view of the nation’s financial health, helping maintain market stability even amid large deficits.

Stablecoins, which total approximately $250 billion today, are another factor. As a potential replacement for foreign buyers of Treasuries, their growth could enhance the dollar's dominance. However, stablecoins constitute a relatively small portion of the nearly $10 trillion circulating supply of dollars, indicating a possible direction for the future but also raising questions about stability.

A crucial aspect of the bond market's functioning is confidence. Despite concerns, the market has yet to demonstrate a lack of faith in US debt sustainability. This situation can pivot unexpectedly due to changes in investor sentiment—a notion that financial experts heed. Jamie Dimon, known for his acumen in economics, has expressed caution regarding future confidence in the bond markets.

The year-end target for the S&P 500 is projected at 6600, which implies a potential increase of about 8% from its recent closing. Skepticism persists regarding this optimistic outlook, yet several analysts posit that the market's historical resilience amid five major shocks—the COVID-19 pandemic, supply chain disruptions, inflationary pressures, rapid rate hikes, and tariff implications—has established a platform for sustained earnings growth.

In a parallel discussion, Jim Chanos draws comparisons between the current AI boom and the dot-com bubble, citing the involvement of significant capital expenditure in technology infrastructure. While acknowledging the transformative potential of AI, he warns of possible rapid shifts in the market's dynamics, similar to the volatility experienced during the late 1990s and early 2000s.

In conclusion, while the financial markets are riding a wave of optimism buoyed by improving indicators and robust earnings growth, caution is warranted. Understanding the interplay between confidence, market dynamics, and the evolving economic context will be critical for investors navigating this transformative landscape. The resilience demonstrated by earnings growth in the face of multiple shocks suggests potential for further upside; however, the shadows of volatility and sentiment in both bond and equity markets remain a pressing concern. As the economy continues to evolve, monitoring these elements will play a vital role in determining future market trajectories.

Over the past two decades, private equity (PE) has transformed from an obscure niche within finance into a well-known powerhouse that dominates discussions about wealth creation and investment strategies. Twenty years ago, the average person likely had little awareness of what private equity entailed; it was often seen as an opportunity only for those unable to secure positions in hedge funds, where the perceived "real money" was made. Today, however, private equity has expanded to over twenty times its size from the year 2000, with numerous billionaires amassing immense fortunes through the acquisition of thousands of businesses.

Yet, this hyper-growth brings with it a myriad of problems. Private equity, which once thrived on its understated nature and small scale, now faces significant threats—most notably from itself. As the landscape grows more competitive, PE firms find themselves grappling with diminishing opportunities for lucrative deals, soaring fees, and returns that fail to justify the associated risks. The shifting realities of the private equity landscape indicate that what was once a viable investment vehicle is becoming increasingly untenable.

At its core, private equity refers to investments made in businesses or assets that aren’t publicly traded. While anyone can technically become a private equity investor by putting money into a local cafe, it is the larger dedicated funds that attract significant capital from wealthy investors to acquire entire companies. These firms leverage investor money by adding their own capital and borrowing extensively, creating substantial pools of capital for acquisitions.

The process of creating returns in private equity relies heavily on the management and optimization of portfolio companies. Once a PE firm acquires a business, they may encourage that company to leverage itself further by taking out loans to pay back the PE firm through special dividends. Herein lies a critical issue: if the companies struggle, not only could their debts go unpaid, but the repercussions could also spiral to affect the investors indirectly, who may be left with unfulfilled obligations.

Leverage plays a crucial role in the private equity business model. The strategy involves layers of debt at various stages—companies taking loans against leveraged assets, which were themselves acquired using borrowed funds. This results in a convoluted system of indebtedness that risks overwhelming entities at every level.

Moreover, the secondary market for private equity shares—where stakes in these firms can be sold for liquidity—faces complications of its own. The firms involved in buying these stakes often utilize debt, leading to an even more intricate web of financial obligations that can quickly spiral out of control.

Recent trends indicate that the once-thriving private equity industry is now under pressure. With soaring interest rates, increased supply of businesses as baby boomers sell their companies, and wiser business owners, finding attractive acquisition targets has become increasingly difficult. This has driven up acquisition multiples, diminishing potential returns and leading firms to pursue riskier investments.

As investors grow more skeptical and demand for private equity recedes, fundraising is projected to hit its lowest level in over ten years. Notably, prestigious institutions like Harvard are reportedly offloading private equity stakes, reflecting a broader unease regarding the sector's sustainability and prospects.

The troubling aspect of a faltering private equity scene is its potential ramifications extending to ordinary people. With trillions of dollars tied up in loans linked to underperforming businesses, a systemic collapse could pose risks to banks, pension funds, and the average investor. While the current landscape is not quite as perilous as the 2008 mortgage crisis, it nonetheless bears the hallmarks of a gathering storm.

The evolution of private equity illustrates the complexities inherent in financial markets—what once promised strong returns amid little competition is now fraught with challenges. The very mechanisms designed to propel successful investing in the sector have morphed into potential liabilities threatening the broader economy. As the industry stands at a crossroads, it faces pivotal decisions that could steer its course for years to come. The awareness of ordinary investors to these dynamics is crucial, as declining performance in private equity could ripple across the financial system, demanding scrutiny and understanding of how money truly works.

Navigating Market Uncertainties: Key Insights from the Fool 24 Investment Roundtable

Federal Reserve Actions and Inflation Data Impact

Last week’s Federal Reserve meeting saw no change in interest rates but a slight deceleration in quantitative tightening. This development has left many investors uncertain about future interest rate paths. Inflation remains a central concern, with the Personal Consumption Expenditures (PCE) Price Index scheduled for release. Unlike the Consumer Price Index (CPI), the Fed pays close attention to the PCE as an inflation gauge. The key question for markets is whether inflation will continue to rise as fast as before or moderate, ultimately influencing the Fed’s policy direction and potential recession risks.

Housing Market Dynamics and Investor Considerations

Housing and homebuilding data are also in focus, with upcoming releases including the Case-Shiller Home Price Index and new home sales figures. The housing market has experienced significant price appreciation, with some areas seeing nearly 40% increases since 2020. However, rising mortgage rates have created a market lock-up, where homeowners hesitate to move due to the cost of refinancing. Homebuilders face a challenging near-term outlook amidst these cycles, especially with rising costs and subdued demand.

KB Home’s upcoming earnings report will offer critical signals about the sector’s trajectory. While sentiment has been muted, cyclical downturns in homebuilders have historically presented buying opportunities for long-term investors due to structural supply shortages and regional demographic trends. Investors should consider the cyclical nature of homebuilders and their own portfolio exposures, balancing growth potential with near-term volatility risks.

Momentum Stock Challenges: The Trade Desk and Netflix

The Trade Desk (TTD) represents a case study of momentum investing discomfort. After a rare earnings and revenue miss, the stock plummeted by about 50% in a few weeks, shaking investor confidence. Management's shift to a new AI-based ad platform triggered uncertainty during a transitional phase. Historically, momentum investors sharply pull back at early signs of weakness, yet long-term prospects hinge on operational execution and successful customer migration to the improved platform. Analogies to Netflix’s early crises in 2011 highlight that recovery and long-term compounding are possible but require patience.

Netflix, now a cash-generative powerhouse, is demonstrating growth in its ad-supported segment, which already accounts for a majority of new sign-ups and might be more profitable per viewer than traditional tiers. This pivot suggests a future where content investment and diversified subscriber monetization strategies could sustain growth and eventually lead to a dividend initiation. However, opinions differ on the timing and scale of potential dividends, reflecting ongoing debates about balancing reinvestment with shareholder returns.

Ethical and Political Values in Investing: Real-World Cases

Investors increasingly weigh ethical and political considerations in their purchase decisions. While some question whether this trend is genuinely rising or simply more visible due to information flow, phenomena like boycotts, proxy campaigns, and brand loyalty shifts reflect this dynamic. Tesla’s sales fluctuations in Germany and France, partly attributed to public backlash, contrast with strong sales in China, illustrating regional variations linked to political sentiments.

ESG investing continues to evolve. Interestingly, some “green” funds have integrated oil and gas exposure, reflecting the complexity of balancing environmental, social, and governance factors. The diversity of approaches within ESG underscores the importance of focusing on actual outcomes rather than rhetoric or labels alone.

Market Response to Tariff News and Trade Policy Uncertainty