The common pitfalls that erode accounts include:

❌ Lack of a clear plan

❌ Overextending position sizes

❌ Underestimating market volatility

❌ Attempting to immediately recover losses

❌ Exiting winning trades prematurely

The Early Tides of World War I: A Harrowing Overview

Europe had barely settled into the chaos of war, yet the grim toll was already evident. Within three short months of conflict, hundreds of thousands of young men had lost their lives in unimaginable ways. Each nation involved spun narratives of heroic valor and villainous enemy portrayals to fuel morale at home. However, a disconnect soon emerged between the public's perception and the harsh realities unfolding on the battlefields.

The week began with Russian forces crossing the Vistula River, attempting to thwart German advancements aimed at capturing Warsaw. Meanwhile, the Austrians, after breaking free from the siege at Przemsyl, found themselves severely battered by the Russians at the River San. Farther west, British troops landed in the quiet Belgian town of Ypres, where pivotal military maneuvers were about to unfold.

In a strategic move, German Army Chief of Staff Falkenhayn organized a new army under the Duke of Wurttemberg to bolster the right flank of their forces in Flanders, which encompasses parts of Belgium and Northern France. Many of these new troops were inexperienced reservists or young recruits who had not received adequate training, setting the stage for disastrous outcomes in their first engagements.

The primary point of action was the narrow corridor on the Western Front. On October 18, British forces began advancing from Ypres toward Menin—territory firmly under German control. Initial skirmishes lacked significant impact, but the tension mounted as British reconnaissance reported large formations of German troops approaching, prompting a strategic withdrawal to a defensible ridge overlooking Ypres.

This region would soon be known as the Ypres salient, a combat zone protruding dangerously amongst enemy lines, susceptible to attacks from multiple directions. Over the ensuing four years, the Ypres salient would witness some of the most brutal battles in human history.

On October 20, the Germans launched a full-frontal assault along the frontlines—24 divisions against 19, with a heavy concentration of 14 German divisions targeting just seven British ones in the assault around Ypres. Outnumbered in troops and artillery, the British countered with their formidable machine gun strengths and rapid rifle fire, managing to withstand the onslaught. The famed "mad minute" technique utilized by British soldiers, involving hitting multiple targets rapidly with their bolt-action rifles, created a devastating illusion for German troops who mistook the rifle fire for machine guns.

Repeated German assaults, characterized by poorly coordinated massed formations, led to catastrophic casualties. Such attacks echoed the earlier futile attempts by the French at the Battle of the Frontiers, showcasing a destructive persistence that ultimately failed to break the British line, with the Ypres salient firmly held.

The cemetery of the German volunteer corps nearby Langemarck tells a grave story, housing the remains of 25,000 student soldiers who fell victim to these incompetently planned assaults—an event lamentably termed the "Massacre of the Innocents." These young volunteers charged into combat with an inflated belief in their superiority over British forces, misled by the propaganda that filled their ears.

British General Smith-Dorrien remarked on the stark discrepancy between the realities faced by soldiers at the front and the perceptions held by civilians back in England. He noted their irrational fears of invasion while being blissfully unaware of the perils faced by troops along the thin, strained lines in Belgium. The situation had deteriorated into a stalemate that would plague the front for years to come.

To the north, the beleaguered remnants of the Belgian army valiantly held the line at Nieuport against German encroachments, while further east, the conflict shifted pace. The Russian army, after weeks of preparation, began launching counterattacks, inching toward a potential encirclement of German forces—who had underestimated their resolve and capabilities.

Austrian Chief of Staff Conrad’s ill-fated attempts to regain lost ground culminated in yet another retreat, as his forces suffered significant losses. The battle for Przemsyl remained unresolved, with Russian troops closing in yet again on this pivotal fortress.

In the Pacific Theater, the Japanese maintained a tight blockade of the German port of Tsingtao. In a dramatic naval encounter, a German torpedo boat sank the Japanese cruiser Takachiho, succeeding briefly in its escapade but ultimately failing to return home unscathed.

As brutal as the battles were, a significant non-combat event unfolded: the signing of the Manifesto of the 93. This proclamation, backed by 93 prominent German figures, proclaimed total support for the German war effort and attempted to counter the claims of enemy propaganda. It starkly contrasted a minimal counter-manifesto from pacifist Professor Nicolai, which barely garnered attention.

A Glimpse Ahead: The Cost of War

By the week's end, as Austrian forces found themselves retreating, and the Germans withdrew under pressure, the overarching sentiment painted a grim picture. The ongoing clashes resulted in massive losses, particularly among those too young or ill-equipped for the carnage of war.

British Chancellor of the Exchequer Lloyd George, in a speech heralded as legendary, framed the war as a noble endeavor to end military tyranny in Europe, promising a brighter future for the peoples of allied nations. Yet, as history would show, the disillusionment that would surface by the war’s conclusion proved his words to be aspirational at best, as the true costs of victory became glaringly apparent.

In presenting the harsh realities of this chapter in history, the truth remains: the sacrifices made in this conflict, while attempting to stave off greater calamities, were delivered at an unimaginable cost—foreshadowing the trials still ahead. The battlegrounds had become a theater of slaughter, yet the world's perception remained persistently unrealistic. As the conflict continued to unfold, its consequences would echo for generations to come.

We will talk about non-fungible tokens and how they are reshaping the art world. This is a kind of new digital revolution, and NFT is based on blockchain. It is changing the traditional art system. For example, if you have any blockchain-based digital asset, then it will change the perspective on how you sell, buy, and own. This seems like a technical term, but it has a great impact on the artists and the collectors who invest in the NFTS.

Before initiating an options trade, consider these key questions:

🧠 Is the maximum loss understood?

📉 Are the Greeks fully comprehended?

📋 Does a written trading plan exist?

💰 Is the trading capital that of funds that can be

Focus on your strengths, not your weaknesses.

Focus on your character, not your reputation.

Focus on your blessings, not your misfortunes.

― Roy T. Bennett

1/🧵we are supposed to learn from the past because failure to do that will cause it to repeat itself. What is that past you are afraid that will repeat itself? If is within your power will you change it?

2/🧵That one history that will repeat itself is war. Just hearing the name, I am scared. I have not witnessed one before, but from what I am seeing in action movies and stories my grandpa told about war, it is not something that should repeat itself. The loss of life, no shelter and no food for people. It is not something I will want to experience. There is nothing as sweet as living together in peace and harmony, no matter our country, religion and norms. We should take away our differences, and there should not be discrimination among us. We should always allow peace to ruin. Going to war can never be the best thing; we can sort out our differences without war.

3/🧵we are supposed to learn from the past because failure to do that will cause it to repeat itself. What is that past you are afraid that will repeat itself? If is within your power will you change it? I will be so delighted to read your thoughts on this post below is link to my post.

agreed. It’s only a good reason if it keep delegators happy and we keep the hive power.

If I were picking it would be 100% threads going forward. Threads is amazing I think the best way to be on hive. I still post though because thats where most people vote still.

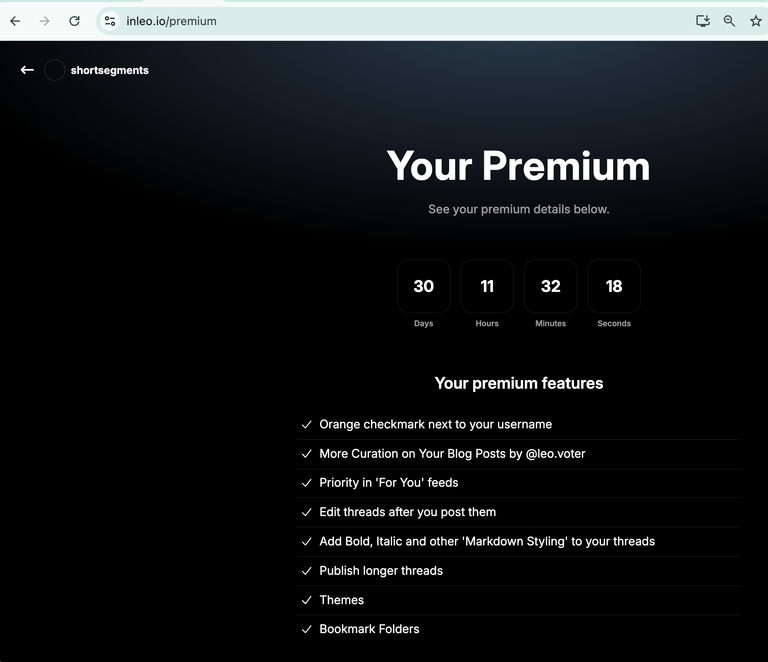

I can't afford premium as I am building my HP which is essential for now. I guess I am not going to get benefit of that. I feel threads can be curated if not people wont post if they are not curated isn't it?

That's actually really good to know! I haven't been keeping up lately... But yeah, I need to get back to some regular posting, just have not had the motivation lately.

Emotions stem from life—memories, love, loss, faith. Crypto joins not as a soul connector, but a distraction. Cold, logical, a promise of freedom and rebellion, yet distant from the heart.

The future of Bitcoin Cash (BCH) is debated, with potential for growth due to faster transaction times and lower fees, but hindered by limited adoption and use cases. Factors like adoption rates, competition, regulation, and technology will influence its future. Only time will tell if BCH can overcome challenges and become a leading cryptocurrency.

When discussing home ownership, many people in the UK often assume that buying a house is the ultimate goal. Yet, as financial expert Jason Butler points out, this mindset may not hold true for everyone. The reality is that the housing market is undergoing significant changes, presenting crucial considerations for prospective buyers and current homeowners alike.

Jason Butler, an independent personal finance expert affiliated with the Financial Times, emphasizes that we are currently in a buyer's market. Although some sellers may not yet recognize this shift, the cost of borrowing has increased significantly, pushing many would-be homeowners to reassess their choices. Rising interest rates and the effects of the pandemic have made it undeniably harder for individuals, especially first-time buyers, to enter the housing market.

Butler acknowledges that it is essential to take a closer look at the notion that purchasing property is always a sound investment. While the long-term payoff may seem appealing, the immediate financial strain—especially with current interest rates—creates a more complex picture.

For many people, especially young professionals, renting may be the more financially prudent option. Butler offers the example of his daughter, a 24-year-old software engineer in Cambridge, who pays a substantial monthly rent for her one-bedroom flat. While this represents a high percentage of her income, renting provides her with flexibility during a critical career-building phase. As she establishes her foothold in the tech industry, she avoids the burdens of maintenance and additional costs associated with home ownership.

In many cases, individuals can benefit from renting, especially if their living situation is temporary or if they are still figuring out their long-term goals. Butler notes that renting allows people to save money and invest in their professional development while avoiding the financial pitfalls of homeownership in a volatile market.

Making Informed Decisions: Tools for Success

When contemplating whether to rent or buy, Butler advocates for the use of online tools and calculators, such as the Rent vs. Buy calculator from Smart Money Tools. Such resources allow individuals to assess their unique financial situations, taking into account factors like potential mortgage rates, deposits, growth rates, and rental costs.

The calculator ultimately helps prospective buyers understand the critical point at which purchasing a property may yield better financial returns than renting, considering their specific circumstances.

Nevertheless, it’s important to do thorough research and not rush the decision-making process. Butler advises assessing the broader market and maintaining significant financial awareness. He encourages first-time buyers to focus on understanding their numbers, avoiding the anxiety-driven decision to rush into a purchase.

When it comes to homeownership, potential buyers should consider all associated costs, including maintenance and repairs. Butler suggests a rough rule of thumb: estimate an additional 10% of your monthly mortgage payment to cover maintenance and unexpected repairs. Many first-time buyers neglect these ongoing costs, focusing solely on the mortgage itself.

Furthermore, a thorough home inspection is essential when considering a purchase. Prospective buyers should check critical systems, such as plumbing and heating, to avoid unforeseen expenses. These considerations can make or break homeownership experiences.

For young individuals fearful of missing out in the housing market, Butler advises patience. Motivated sellers—those facing financial distress or other pressures—present a prime opportunity for negotiation. By utilizing research, the housing sector appears more welcoming for first-time buyers who are ready to seize opportunities.

Butler also reminds individuals to be savvy with their finances during this process. It’s vital to save money diligently and avoid unnecessary expenditures to bolster financial readiness for homeownership.

Final Thoughts: Building Wealth through Informed Choices

Ultimately, Butler reiterates that while owning a home is often touted as a route to wealth, it is not a guaranteed investment. The truth is that homes are a means of securing stable living and flexible opportunities that can transcend traditional financial returns.

Would-be homeowners need to be patient, educated, and motivated. Success in real estate comes down to understanding the market, recognizing personal circumstances, and being prepared to act when opportunities arise.

Many aspiring YouTubers decide to quit right before they achieve significant growth, often unaware of the imminent breakthrough just around the corner. If you find yourself feeling stuck or contemplating quitting your YouTube journey, you may be closer to success than you realize. In this article, we will explore the six major signs that proficient creators commonly experience before they skyrocket in popularity.

A critical mindset transformation is essential for anyone aspiring to grow on YouTube. The undeniably harmful notion that success happens overnight must be discarded. Instead, focus on understanding that YouTube’s growth mechanisms are not driven by luck or algorithms but rather by people. The ability to tailor your content—titles, thumbnails, and video formats—to resonate with your audience is a key factor in creating successful videos.

By concentrating on your audience's needs and emotions, you can substantially increase your chances of expanding your reach and influence.

The first sign hinting at imminent success is your comprehension of content psychology. As a dedicated creator, you are likely already engrossed in strategic thinking. Yet, the significant shift comes when you genuinely perceive YouTube not as a platform for your self-expression but as a means to solve your audience's problems. Every viral video captivates the audience by fulfilling a specific desire—whether it’s offering entertainment, education, or inspiration. For example, think about Mr. Beast, whose videos don’t just showcase extravagant challenges; they evoke curiosity and surprise.

Once you start aligning your content with your audience's perspectives, you'll notice a surge in recommendations and clicks.

The second sign is a noticeable rise in your watch time and retention rates. YouTube’s primary aim is to keep viewers engaged for as long as possible, so if your audience is watching your videos longer than before, it’s a green light indicating that the platform may promote your content further. Even marginal increases in these metrics can signify that you’re nearing a breakthrough.

Sign #3: Solid Click-Through Rate (CTR)

A solid click-through rate can demonstrate heightened viewer interest. Ask yourself why you chose to click on this video—likely the title and thumbnail played crucial roles. Generally, a CTR exceeding 5% indicates strong viewer interest. YouTube Studio provides easy access to this data, simplifying the process of tracking your video performance.

If your CTR is below 5%, it could be time to reevaluate your title and thumbnail approach. Learning to entice viewers to click is a vital skill that can significantly impact your growth trajectory.

Sign #4: Increased Comments and Shares

Engagement metrics, such as comments and shares, serve as litmus tests for the effectiveness of your content. When people actively comment or share your videos, it’s a clear indication that your messages are resonating with them. Creators often don't go viral because of algorithms; they go viral when audiences rally to share and promote their content. Enhanced engagement demonstrates that you are on a path to wider visibility.

Regularly posting new content, even if it isn’t on a daily basis, is imperative for generating steady growth. Whether you gain 10 subscribers a day or just one, each incremental gain builds momentum. Too many creators abandon their channels just when they are beginning to accumulate traction. A consistent posting schedule fosters audience loyalty and drives growth.

The final sign to recognize is the feeling of wanting to quit despite continuing your efforts. Many successful YouTubers have experienced discouraging moments, facing periods of stagnant growth and self-doubt. Nonetheless, those who persevere through these challenges will ultimately achieve success. If you’ve battled with thoughts of quitting yet still find the motivation to create and improve, you are closer to a breakthrough than you realize.

In conclusion, if you resonate with one or more of these six signs, you are on the verge of experiencing significant growth on YouTube. However, there is a final mistake that keeps countless creators from flourishing, even if they excel in all other areas. You must identify and correct this issue to unlock your potential effectively.

For a deeper exploration of this common pitfall and strategies to overcome it, consider watching the next related video. Remember, perseverance and understanding your audience are pivotal, and the YouTube community is cheering you on. Happy creating!

Embracing Frugality for Financial Freedom: The Journey of Tanner Firl

Tanner Firl is not your average 29-year-old. Living in Minneapolis, Minnesota, he embodies the spirit of frugality, ranking within the top percentages of the most frugal individuals in America. With aspirations to retire by the age of 35, Tanner has embraced a lifestyle that prioritizes saving and living minimally, allowing him to accumulate a substantial nest egg of $380,000 for retirement.

Tanner’s commitment to frugality is evident in the details of his life. From acquiring free furniture on Craigslist to opting for second-hand running shoes, he experiences joy from a lifestyle that avoids unnecessary spending. Despite societal expectations that often equate happiness with material possessions, Tanner asserts that he feels no sense of missing out. Instead, he finds fulfillment in simpler pleasures, such as regular board game gatherings and enjoying time with his family.

Tanner lives with his wife, child, and their three cats in a modest home in south Minneapolis. He has been the primary income earner in the household, while his wife contributes in kind. Together, they practice a staggering savings rate of approximately 50% of their income, a hallmark of those participating in the FIRE (Financial Independence, Retire Early) movement. This mindset allows them to maintain a life that suits their values while still preparing for their financial future.

Tanner’s investment strategy showcases his dedication to financial independence. He holds $221,000 in a personal brokerage account, $57,000 in a Roth IRA, $26,000 in a health savings account, and $75,000 in a 401K. His objective for retirement might not appear conventional; while many set rigged financial targets, Tanner’s lower threshold for retirement is set at $625,000, based on an estimated annual expenditure of $25,000. Though this figure may seem meager, Tanner’s strategy is flexible, acknowledging that life’s uncertainties can alter financial needs over time.

Growing up, Tanner was instilled with frugal values. Experiences at a bowling alley where even a gumball was considered a treat shaped his perspective on spending. He and his siblings engaged in newspaper delivery routes; earning their own spending money cemented their understanding of work and financial independence. After graduating from college, he even made a calculated choice to delay repaying a small loan from his parents in order to invest in his future.

However, this commitment to saving eventually led to an unhealthy obsession with money. Tanner experienced anxiety over his financial goals, prioritizing early retirement to the detriment of other life milestones, such as starting a family. After much reflection, he shifted his mindset to focus on enjoying the present while still pursuing his financial objectives.

Tanner's resourcefulness is core to his financial success. By renting out a portion of his home on Airbnb, he has significantly reduced his mortgage burdens. His grocery strategies are equally inventive, emphasizing balance between healthy eating and the cost of living. He advocates for budget-friendly nutrition, suggesting staples like beans and rice as inexpensive, nutritious options. Tanner also draws on resources such as Ruby’s Pantry, a nonprofit that helps combat food waste by providing affordable groceries.

He has cultivated a reputation among friends and family as a thrifty individual, often being the recipient of free items that others would consider waste. This network of support has allowed Tanner and his family to obtain necessities and enrich their lives without financial strain.

The True Meaning of Life and Fulfillment

Amid Tanner's frugality lies a profound truth: many fulfilling experiences in life do not require financial expenditure. Running, listening to podcasts, board gaming, and spending quality time with loved ones are just some of the low-cost hobbies that Tanner cherishes.

In Tanner’s view, the FIRE movement symbolizes a lifestyle choice that is sometimes misinterpreted as entirely ascetic. He emphasizes that saving money is not simply about stockpiling wealth. Instead, it’s a way to purchase freedom—the freedom to choose how to invest time in personal interests and relationships rather than being tied down by financial obligations.

In conclusion, Tanner Firl’s journey reflects an inspiring balance of frugality and fulfillment. By embracing a lifestyle that prioritizes saving without sacrificing joy, he has forged a unique path towards financial independence. For those seeking a similar legacy, his experiences serve as a powerful reminder that true wealth lies not in excess but rather in the freedom to live life on one’s own terms.

Understanding the Job Market: Low Unemployment vs. Limited Opportunities

The juxtaposition of low unemployment rates and the difficulty in finding employment has become a perplexing reality for many. Despite the current U.S. unemployment rate sitting at 4.2%, with similar trends in Europe indicating low unemployment figures, people are increasingly frustrated by their job search experiences. Recent significant layoffs at large corporations such as Microsoft, EY, and Walmart further complicate this scenario and raise a key question: Why is it so hard to find a job right now?

In March 2025, the U.S. economy added 228,000 new jobs. With job growth surpassing expectations and unemployment remaining low, the apparent health of the labor market contrasts sharply with individual job-seeking experiences. Many are finding themselves applying for dozens, if not hundreds, of positions before even securing an interview.

An example highlighted in a Financial Times article tells the story of an applicant, Dominic, who transitioned from a Human Resources professional to delivering packages for Amazon out of sheer necessity. This disparity suggests a disconnect between macroeconomic indicators and personal experiences on the job hunt.

To understand the current landscape, one must look back to the pandemic. As COVID-19 restrictions eased, consumer demand surged. Companies, particularly in the tech industry, ramped up hiring in anticipation of sustained growth. This led to a peak scenario where there were two jobs available for every job seeker, prompting many to leave their positions seeking better opportunities—a phenomenon dubbed "The Great Resignation."

However, cascading global issues began to surface post-2021. Events such as the war in Ukraine and rising inflation forced companies to be more conservative with their hiring practices. The initial optimism waned quickly, leading to a general slowdown in recruitment and an uptick in layoffs.

While the tech sector has seen significant layoffs, the broader trend in various industries has been a deceleration of hiring rather than outright terminations. Companies have adopted a "hoarding staff" mentality—essentially avoiding mass layoffs while opting to let attrition gradually reduce their workforce.

The monthly hiring rate in early 2025 was the slowest for that period in over a decade. Consequently, job seekers find the environment hyper-competitive, as reported data indicates that applicants can face an average of 200 competitors for digital and IT positions—making job acquisition significantly more challenging.

Despite the U3 unemployment rate being touted at 4.2%, this figure can be misleading. The U3 metric considers only those actively seeking work in the past four weeks, meaning many individuals who have given up or are underemployed are excluded. Critically, if one has stopped looking for a job, they no longer count as unemployed, resulting in an artificially low statistic.

Expanded measures indicate that the real unemployment rate may be much higher—potentially around 7.8%—though this, too, does not account for numerous factors surrounding labor force participation. This discrepancy raises skepticism about the accuracy of reported figures and the differing experiences faced by job seekers.

This issue isn’t isolated to the United States; similar trends can be observed elsewhere. In Canada, the labor force participation rate has hit record lows, with more people opting to disengage entirely from the job market, further obscuring true unemployment numbers.

A troubling parallel has emerged in the UK, where the quality of collected labor market data has diminished, leading to uncertainty about actual unemployment figures. If governments have little incentive to portray grim realities, the question remains: How can we trust the existing data regarding job availability?

Many job seekers are experiencing significant emotional distress, exacerbated by the lack of responses from employers. Automated replies can leave applicants feeling entirely disregarded, fostering a sense of futility. Innovations such as AI-assisted tools for interviews highlight the desperation felt amid a perceived rigged system, where competition for positions is fierce, and success rates are low.

Additionally, "ghost jobs," or positions that companies list without the intention of hiring, contribute to a frustrating cycle of application processes that yield little to no outcomes for hopeful candidates.

The current job market dynamics create a worrying scenario particularly for young graduates. With substantial reductions in hiring at entry-level positions, long-term implications may ensue, such as a deficit of qualified candidates for essential roles in the future.

The labor market is fraught with uncertainties, casting shadows over prospects for millions. As we navigate through these complexities, it's important to recognize that low unemployment rates may not reflect the reality of the job search experience. While the landscape of employment continues to evolve, it remains crucial to understand and question the narratives perpetuated by conventional statistics.

In conclusion, job seekers are encouraged to stay resilient and informed amidst a rapidly changing environment, recognizing that the competition is not a reflection of their abilities but rather a manifestation of deeper systemic issues within the job market.

The Unfolding Drama in AI Hardware: IO vs. Altman IO

In an unexpected twist in the tech world, a contentious legal battle has emerged between two AI hardware companies both bearing the name IO. The lawsuit, stemming from trademark disputes and accusations of intellectual property theft, represents a proxy conflict between two major players: OpenAI and Google. This situation not only raises questions about the future of a new AI hardware product but also unveils a rivalry that extends beyond mere corporate interests.

The first company, simply referred to as IO, is a Google-backed startup that has generated buzz with its early innovations and secured $62 million in funding. Their product—a digital assistant that operates without a screen based on voice commands—promises a revolution in personal computing. This idea, however, isn’t entirely new; similar devices have struggled to find market acceptance, raising skepticism about IO's viability.

On the other side, is Altman IO, acquired by OpenAI for a hefty $6.5 billion last week. Spearheaded by Sir Johnny Ive, known for his significant contributions to Apple's iconic designs, Altman IO's entry into the market is marred by controversy. Following the acquisition, the company announced its plans for a voice-controlled AI device also branded as IO, further complicating matters.

The lawsuit revolves around allegations that Altman IO engaged in underhanded tactics during the development of its product. Documented claims suggest that both Sam Altman and Johnny Ive were aware of IO’s technology, having met with them in the past and declined investment opportunities. Furthermore, it has been alleged that they continued to monitor IO's progress and, crucially, requested design files even after expressing disinterest.

In a remarkable turn of events, Altman not only rejected IO's proposals but reportedly threatened to pursue legal action against them if they continued to use the name “IO.” This move has been characterized as aggressive and unprovoked, casting a shadow over the reputations involved, especially that of Ive, whose legacy in innovation could now be tainted by association with these tactics.

As the lawsuit unfolds, it calls into question the ownership of the IO brand in a rapidly evolving tech landscape. With the original IO already possessing a registered trademark and a product ready to ship, the potential ramifications are significant for both companies and the broader AI hardware market. The dispute also highlights the challenges of distinguishing brands in an industry filled with similar nomenclature and burgeoning inventions.

The battle for the name IO could determine the future identity of either brand, with implications not just for market penetration but for investment and innovation strategies moving forward.

Predictably, the reactions to this lawsuit have ranged from amusement to concern over ethical conduct in the tech industry. As the case progresses, it may serve as an important reminder about the dangers of competitive aggression among major players, along with the necessity for clear branding that respects existing identities in the marketplace.

Despite the initial setbacks for Altman IO, the backing of OpenAI and the design genius of Ive provide formidable strength. The future remains uncertain, not only for the two entities involved but for potential consumers who may find themselves choosing between competing products from companies linked by controversy.

As the legal saga plays out, one thing is clear: the competition in AI hardware is only beginning. The tussle between IO and Altman IO sets the stage for brands to navigate complex legal and ethical landscapes while striving for innovation. Whether the best hardware ultimately prevails remains a topic of intense speculation and discussion within the tech community.

The broader implications, however, rely on one fundamental truth: in tech, as in life, the details may define the victor in an arena that is quickly evolving and increasingly competitive. The world will be watching closely as this story develops, with more revelations expected to emerge from this high-stakes courtroom drama.

Five Pieces of Life Advice That Can Transform Your Perspective

In a recent discussion, an individual asked for a list of five top pieces of life advice. While the question may seem simple, the responses explored deeper psychological insights and personal growth strategies. Here is a summary of those key life lessons that can guide anyone seeking a more fulfilling existence.

The first piece of advice is centered around understanding that many situations in life are not as personal as we believe them to be. The idea is to stop taking things personally, recognizing that others' actions and words often stem from their own experiences and emotions rather than being a direct reflection of us. By adopting this mindset, we can create a distance from negativity and emotional upheaval that often arises from perceived slights or offenses.

Alongside the first lesson is the concept that "nobody's keeping score." This advice encourages individuals not to dwell on grievances or perceived imbalances in relationships, as most people are not as focused on these dynamics as we might think. By releasing the need to keep track of who did what, we can foster healthier relationships free from unnecessary resentment and competition.

The third piece of advice emphasizes the importance of contemplating not just the outcomes we desire but also how we want our future to feel. When planning for the future, the emotional aspect can often be overlooked. It’s crucial to reflect on feelings like fulfillment, joy, and value in our work and relationships rather than merely defining success through achievements alone. This holistic approach allows us to align our goals with our emotional needs, providing a clearer path to happiness and satisfaction.

Another important lesson shared is the value in paying attention to our surprising emotions. They often stem from deeper insights that can reveal our innermost beliefs and fears. The speaker shared a poignant story from their past, illustrating how a surprising feeling of insecurity about a friend's success offered valuable insights into their own self-worth and evolving identity. By recognizing and questioning these emotions, one can gain profound insights into personal growth and relationships.

Lastly, the speaker advised the practice of meditation, highlighting its transformative benefits even when one's practice feels imperfect. Regular meditation encourages mindfulness and attention to one’s thoughts and feelings, which can lead to greater understanding and peace. While the method may vary for everyone, the key takeaway is to cultivate a habit that fosters introspection and calm.

The discussion also touched upon the challenges of choosing between a passion that currently doesn’t generate income and a job that fulfills financial needs but lacks joy. The speaker emphasized the necessity of finding balance—while it’s essential to meet financial obligations, pursuing passion concurrently can lead to personal growth and eventual career transitions.

Additionally, the fear of starting something new can be daunting, but the speaker noted that the way to overcome that fear is simply by starting. Embracing discomfort and trying new things builds resilience and creativity, making it easier to tackle bigger changes down the road.

These five pieces of advice provide a solid foundation for anyone looking to navigate the complexities of life with greater ease and confidence. By recognizing that it’s not about you, releasing the need for scorekeeping, contemplating emotional futures, paying attention to surprising emotions, and incorporating meditation, individuals can redefine their paths. Most importantly, starting new ventures and pursuing passions can ultimately lead to a more fulfilled and enriched life.

Unlocking Views from First World Countries on YouTube

Getting views from developed countries such as the US, UK, Canada, Australia, and New Zealand can greatly enhance your revenue from YouTube videos. In this guide, we will explore effective methods for attracting and retaining views from these affluent nations. By focusing on high-paying viewers, your YouTube channel can significantly increase its earnings.

The revenue from ads varies dramatically based on the location of your viewers. Videos featuring a majority of US viewers can earn far more than those concentrated in developing nations. For example, a video that garners 100,000 views from India may make about $50 to $200, while a video with only 10,000 views from the US could earn anywhere from $1,000 to $3,000. The primary reason for this disparity lies in the cost per thousand views (RPM) that advertisers are willing to pay, influenced by the purchasing power of audiences in different areas.

In addition to increased ad revenue, attracting views from affluent nations can lead to lucrative sponsorships and collaboration opportunities with brands eager to reach these audiences. These companies understand the commerce potential of viewers in wealthier countries; thus, they may pay higher rates for video promotions.

Crafting Content for Your Target Audience

To attract views from these countries, the topics you cover in your videos must resonate with the respective audiences. If your content is tailored to the interests of viewers in the US or UK, you are more likely to attract them. Strategies include using Google Trends to identify topics that are currently appealing in those regions.

Visit Trends Google to explore trending topics by country. This tool provides insights into what subjects are capturing attention and can guide you in creating relevant content that resonates with your desired audience.

Optimize Your Posting Schedule

Time zones play a critical role in ensuring your videos reach the right audience when they are most active. Posting while your target audience in another country is asleep will diminish engagement. Understanding these time differences and strategically scheduling your uploads will help maximize your video's reach and performance.

YouTube allows creators to target specific locations when uploading videos. Access this feature by selecting the video's location settings during the upload process, directing your content toward specific regional demographics. Note that you can only target one location per video, so it’s essential to choose wisely based on your current content.

Collaborate with Local Creators

Partnering with creators located in your target countries can expand your reach. By collaborating, you can showcase your channel to a new audience who may be interested in your content. Connecting with creators can be done through email—most YouTubers provide this in their channel’s description or contact information.

Search Engine Optimization (SEO) is crucial for making your videos discoverable. Properly incorporating relevant keywords into titles, descriptions, and tags can help your video rank higher in searches, ultimately driving more traffic. Investing time into mastering SEO techniques can pay dividends in attracting the right viewers for your content over time.

Consider YouTube Advertising

Another effective approach is to utilize YouTube Ads to promote your videos. The ad system allows you to target specific demographics, ensuring that your content reaches the audience you want. Setting up and managing ads can be an invaluable tool in your viewer recruitment arsenal.

Among the various strategies, YouTube SEO stands out as an effective long-term method to attract viewers organically. However, a combination of targeted content creation, collaborative efforts, strategic posting times, and ad services can create a well-rounded approach to increasing your viewership from first world countries. By applying these methods, you can begin to see impactful results that will elevate your YouTube channel's earnings and influence.

Whether you are new to the platform or looking to refine your existing channel, focusing on high-paying viewers can transform your YouTube experience. To dive deeper into each of these methods, consider engaging in free training resources that can provide further insights into successfully leveraging YouTube for monetary gain.

My Wealth Building Journey: Four Transformations to Financial Well-Being

Having graduated high school, I picked up Rich Dad Poor Dad, a concise yet impactful book that became the catalyst for my wealth-building journey. While my path was fraught with mistakes and expenses—especially during my time at university—I have since built a portfolio valued at $200,000 in stocks and closed on my first rental property. Now, I'd like to take a moment to share how I evolved from penny-pinching to effortlessly saving money after 15 years of persistence.

In my early days of saving, I stumbled upon the FIRE (Financial Independence, Retire Early) movement. Enthusiastically, I saved between 60% to 80% of my income, sometimes to the point of discomfort. I even went without internet for two years and lived in a rundown apartment plagued by flies for a year just to save a couple of thousand dollars. This extreme frugality was not only unsustainable; it did little for my overall happiness.

The turning point came when I met my wife, who had a contrasting philosophy toward spending and saving. Instead of hesitating over big purchases, she encouraged me to enjoy life and spend money wisely. This blend of financial philosophies has allowed me to strike a balance. Now, I save about 45% of my income while also being able to treat myself occasionally.

Finding that equilibrium is crucial, particularly for those earning a good income yet feeling perpetually broke. It's vital to remember that financial happiness lies not solely in frugality but in a balanced approach to spending and saving.

The Shift from Attachment to Detachment

Many individuals focused on financial independence, like I was, often stress over every dollar saved. Saving money became an almost obsessive endeavor: calculating budgets, checking stock prices, and scrutinizing investments. However, over the years, I've learned an invaluable lesson—money flows more readily when you are not obsessively chasing it.

Instead of fixating on day trading or meticulous market analysis—which proved detrimental to my financial success—I've shifted my focus to long-term investments such as a solid selection of ETFs. The moment I started to prioritize being of service and focusing on the bigger picture rather than specific numbers, my financial landscape shifted for the better.

Detaching from the dollar amount allowed me to explore income-generating avenues without the fear of failure. By embodying a mindset of value addition rather than dollar fixation, I noticed improvements both in personal finance and my YouTube channel. The content that thrived was always the authentic, unscripted videos, reinforcing the notion that passion coupled with utility generates the most positive outcomes.

In my early phases, I often felt inadequate due to a perceived lack of skills and resources. Various online gurus contributed to this mindset, leading me into a futile chase for knowledge while undermining my self-confidence. It was not until a coach pointed out that "everything works, but not everything works for you" that I realized I needed to leverage my unique strengths rather than mimic others.

The realization that everything I needed was already within me was liberating. For the first time, I embraced my existing potential instead of chasing superficial skills that didn't resonate with my identity. The focus shifted from relentless pursuit to being present in the moment.

Understanding this transformation helped me cultivate self-accountability and shed the burden of baseless comparisons. Saving money became less about pressure and more about aligning with my true self and values.

Moving from Doing to Being

Initially, I believed that success was defined by a series of actions—copying the behavior of others who appeared successful. However, learning to embrace uncertainty revealed that true fulfillment comes from understanding oneself. Life isn’t an exam where you can cheat your way to success.

Defining myself by my habits and aspirations led me to consider the characteristics of my ideal self. I reflected on what that person would embody—hard work, humility, kindness, and resilience. This introspection made me realize that nothing was preventing me from becoming that version of myself today.

Once I shifted my perspective from "doing" to "being," a new flow of financial opportunities arose. I started to maximize my income through avenues that were authentic to me, and my financial situation improved as I aligned my actions with my inner self.

After 15 years of navigating the complex landscape of saving and investing, I've come to understand that true wealth-building extends beyond tactics and methods. Instead, it’s about becoming the right person who embodies the traits and values that attract financial abundance.

So, who is that right person for you? Reflect on your own aspirations and characteristics. Are you nurturing the habits and behaviors that encourage financial success? If you're interested in further exploring this journey or sharing your experiences, I'd love to connect.

As I continue to evolve in this journey, I invite you to join me. Let's navigate the complexities of wealth building together.

In a poignant reflection on modern housing struggles, a woman shares her life experiences after moving to a new home in the woods, where she is navigating the complexities of living in a tent. Despite having two jobs that provide her with a significantly better income than in her past marriage, she finds herself without a traditional place to live due to exorbitant rental prices and limited housing inventory.

The narrator's current situation stems from a need to vacate a seasonal rental costing $1,800 per month. This is not a sustainable option, especially when she has numerous belongings needing storage. In an effort to avoid quitting her jobs, she opts to embrace a temporary outdoor lifestyle, utilizing camping gear collected during the pandemic. With twinkling lights and a positive attitude, she aims to romanticize her experience in the tent, acknowledging the difficulties but also trying to find joy in the simplicity of her surroundings.

The stark reality she presents highlights issues many face in the housing market: the dominance of Airbnbs, individuals owning multiple properties without renting them, and a general reluctance to rent to single individuals, especially older ones. This reluctance may stem from concerns over job stability in a volatile economy. Despite her capacity to afford rent, finding a home remains elusive.

Living in a tent, as the narrator shares, offers a glimpse into an alternative lifestyle that questions the traditional American dream of homeownership. They demonstrate how daily life continues with adaptations, cooking with basic appliances and utilizing outdoor utilities like a composting toilet and shower. She expresses admiration for the resilience and creativity in making such a life work, likening their decision to relinquish the burdens of traditional homeownership to a form of liberation from financial panic.

The narrator, alongside others living in similar conditions, relays the emotional and physical toll of their circumstances. Recognizing their shared struggle, the community of tent-dwellers reflects a broader societal issue that sees many displaced or disillusioned with the dream of stability in housing.

As she outlines the challenges of homeownership today, the stark increase in housing prices is highlighted. What once was an attainable dream now feels out of reach, with starter homes ballooning in cost from $200,000 to $400,000 in just a few years. Coupled with high-interest rates soaring above 7%, many aspiring homeowners find the odds stacked against them. The anxiety of financial obligations, including insurance and property taxes that feel like a second mortgage, adds to the despair of those seeking stable living conditions.

Despite the challenging landscape, the narrator encourages others to think flexibly about their housing options. She advocates for considering smaller, older properties that might require renovations, or even purchasing land where incremental development is possible. The necessity of evaluating finances—paying off debts, saving, and preparing for emergencies—becomes a pivotal part of navigating this housing crisis.

Moreover, the narrator shares ideas about alternate living situations, from sharing homes with family and friends to exploring innovative options like manufactured homes or “shed to homes.” These suggestions encourage a sense of community and resourcefulness, highlighting that practical approaches can lead to greater financial stability.

Ultimately, the narrative serves as a call to resilience and creativity in a world where housing options feel constrained. The recognition that others share in these struggles fosters a sense of solidarity. The individual encourages dialogue on these issues while reminding her audience that adaptability is essential. Diverse solutions will work for different people, and finding a way forward should be a shared journey.

As we move forward into uncertain times, her story is a microcosm of the larger challenges faced across America, urging many to rethink traditional notions of home and stability. In closing, she emphasizes the importance of staying encouraged while navigating these complex realities, inviting conversations that foster understanding and mutual support.

Embracing the Niches: Finding Your Path to Success

The current climate of content creation invites us to explore a myriad of niche ideas, especially as commemoration dates like the Fourth of July approach. With the winds cooperating for a calm atmosphere, it’s the perfect time to consider the opportunities surrounding holiday niches. The particulars of this holiday, like fireworks, recipes, and travel plans for family outings, could serve as launching points for anyone seeking a niche to establish or grow.

As summer unfolds, many people are drawn to activities centered around travel, food, and leisure, which makes this an opportune moment to identify niches that align with these interests. However, the key to success lies in recognizing that each niche is only saturated if you follow the crowd rather than chart your own course.

The Spectrum of Niches: From Swimming to Holidays

The conversation about niches should focus on the vast array of possibilities rather than the fear of saturation. The perspective towards swimming can be illustrative; while there are many seeking swimming lessons, each instructor's unique approach offers an opportunity to resonate with different audiences. Content creation rooted in personal interests, hobbies, and skills can lead to enduring success.

The importance of building content that reflects a genuine passion cannot be overstated. Each person’s journey toward finding the right niche can be marred by the misconception that perfection is needed at the outset. This often results in procrastination, leading to missed opportunities for growth.

Understanding Your Roadblocks: The Question of Success

The conversation takes a reflective turn when asking what stands between you and the success you envision. Early in his journey, the speaker admits to getting bogged down by perfectionism and monetary motivations that stemmed from a desire to emulate others perceived as successful.

This tendency to focus on money above all else can lead to compromises that ultimately derail someone from their genuine path. Therefore, it is crucial to diagnose the reasons behind the hurdles stopping you from making progress.

The Importance of Purpose: Why Are You Here?

When initiating your journey, establishing a clear purpose is paramount. Instead of singularly chasing financial gain, consider the value you can provide to others. Money should not be the end goal but rather a byproduct of helping others and sharing valuable insights. By shifting the focus to helping and supporting others, the path to success often becomes clearer and more achievable.

As you hone in on your purpose, reflect on personal experiences that shape your narrative. People are more likely to connect with your content if they find authenticity within your story. This human element is fundamental, especially when creating content on platforms where users are accustomed to skepticism.

Differentiating Yourself in a Competitive Landscape

Despite the crowded nature of many content niches, success often hinges on your ability to tell your unique story. While there may be numerous voices discussing popular subjects, your individual experience will make your insights distinct.

For instance, someone passionate about sports can draw from their past, including trials and successes, to offer a fresh viewpoint that others in the field might not have. The ability to leverage personal storytelling to create relatable content cannot be understated, as it fosters stronger connections with the audience.

Overcoming the Critique: Are You Ready to Push Forward?

In the quest for success, it is easy to fall into the trap of comparison—a toxic mental blockade that can stifle creativity. When evaluating your progress, do not merely look at metrics like subscribers or views, but assess whether your content is truly valuable. The reflection should go deeper; would you consume your own content if you weren’t the creator?

In an era where many content creators seem to achieve success with minimal effort, you must be willing to engage in increased output and go beyond the norm. Invest in developing skills across multiple platforms, reaching across YouTube, TikTok, or other social media without fear or hesitation.

Commitment to Excellence: Outworking the Competition

The crux of creating successful content lies in your willingness to put in the work. Many aspiring creators engage in self-limiting behavior by doing the bare minimum. Instead, commit to accelerating your efforts by producing content consistently. Acknowledge that true success often requires intensity and commitment beyond the typical standards.

When challenges arise, focus not on the barriers but on the solutions. Re-evaluate tasks, be it content creation or personal habits, and maximize the potential of your limited time. Form skillful practices that embody efficiency while also doubling down on your commitment to create valuable content for the audience you wish to serve.

Conclusion: Paving Your Path Toward Success

Navigating the world of online content creation can be daunting, but by approaching it with a clear purpose, harnessing the power of storytelling, and committing to ongoing effort and evolution, anyone can find their niche and thrive.

Ask yourself if you’re truly willing to do what it takes to succeed: to become better, to connect deeply, and to help others while adding your voice to the larger conversation. Remember, the landscape is rich with opportunity, and with determination and self-honesty, you can ultimately carve out a space that reflects both your passion and expertise. Commit to the journey, be ready to adapt, and embrace the empowering challenge that lies ahead.

Understanding the YouTube Algorithm vs. Audience Behavior

In the ever-evolving landscape of YouTube, creators often grapple with the concept of the algorithm and how it affects their content's reach. A common refrain among creators is to replace the term "algorithm" with "audience." While this perspective holds some merit, it's crucial to delve deeper into the particulars of how the algorithm functions and its limitations in relation to audience behavior.

One of the significant issues with the algorithm versus audience analogy is the assumption of omniscience. While YouTube's algorithms are sophisticated and powerful, they are not infallible. They operate within defined parameters and are influenced by the content posted, the audience tested, and the volatility of viewer preferences over time. As a creator, it’s essential to recognize that your channel's visibility is not solely based on audience engagement but also on the algorithm's testing and validation processes.

Creators often experience a phenomenon where views spike and then plateau—a situation humorously dubbed “getting cabbaged.” This behavior indicates that the algorithm is executing a series of tests and that initial viewer engagement may not translate into long-term visibility. The reasons for this can be twofold: either the content fails to resonate with the subset of viewers it was tested against, or the algorithm determines that further testing is unwarranted due to insufficient data.

Reworking Content

To overcome such hurdles, creators can revitalize previous content in innovative formats that appeal to new audiences. A tool like Nexus Clips can streamlining this process, allowing creators to edit and repurpose existing material into new, engaging formats.

A significant disparity exists between larger and smaller channels on YouTube. Larger channels enjoy increased testing opportunities, providing them with a statistical advantage in delivering satisfying content based on previous viewer satisfaction. This phenomenon can be likened to a favorite vendor at a farmer's market—frequent visitations garner trust and expectation from the audience.

Even with the algorithm favoring established channels, experimentation with new content varieties remains vital. Smaller channels often face the challenge of creating captivating titles and thumbnails that engage viewers. The harsh reality is that certain creative approaches may only succeed due to established audience familiarity and social proof, leaving emerging creators at a disadvantage.

Content Value Over Clickbait

Navigating these complexities requires smaller channels to focus on the inherent value their videos provide. Creators must deeply understand their audience's needs and preferences while being mindful that catchy titles alone might not suffice. Continuous engagement and consistency in content delivery will eventually foster viewer familiarity and trust.

In a sea of endless videos, creators may find their content buried beneath newer uploads, illustrating the colossal impact of content volume on discoverability. YouTube’s recommendation system aims to keep viewers engaged by suggesting diverse content, which sometimes results in prior favored videos going unnoticed for extended periods.

Consistency as a Remedy

To counteract this issue, consistency becomes key. By establishing a predictable publishing schedule, creators can enhance viewer anticipation, eventually leading to higher engagement rates and better algorithmic promotion.

In summary, while substituting "algorithm" with "audience" can simplify discussions around content distribution, it doesn’t capture the full spectrum of factors influencing a creator's success on YouTube. Understanding the interplay between algorithmic testing and audience behavior is crucial for optimizing content strategy and boosting visibility. Continuous adaptation, content rework, and an unwavering focus on viewer preferences will be the guiding principles for creators aiming to enhance their presence on the platform.

It’s a journey many endure—grappling with physical ailments that spiral into a mental struggle. A heartfelt outpouring captures the essence of such struggles, especially when individuals face long-term health problems.

The speaker finds themselves caught in a cycle of frustration as they face years of physical difficulties that have taken their toll. Battling injuries stemming from incidents as far back as 2018, they express feelings of hopelessness. Despite efforts to regain their health, the speaker acknowledges the futility of continuous attempts to mend injuries that have persisted without substantial recovery.

In an unrelenting attempt to seek professional help, they share their concerns about the limitations of health insurance, which only covers the first few physiotherapy sessions. As their financial resources dwindle, the prospect of affording additional treatment weighs heavily. From physiotherapy to potential surgery, the myriad of options remains a daunting task—one that requires funding and time.

The most poignant part of their message revolves around the decision to part with beloved belongings—an emotional concession in pursuit of better health. Each item mentioned in their collection holds sentimental value. Yet, the choice reflects a newfound understanding that health takes precedence over material possessions. The speaker reveals they are open to selling their prized items to secure the financial means necessary for recovery.

Their excitement about a selective charity auction illustrates a balanced perspective—healing can happen alongside community support. The notion reflects an inherent desire to keep some treasured items while also expressing flexibility towards those with lesser emotional ties.

In the quest for answers, the speaker reaches out to potential local therapists and trainers. They express an ongoing need for in-person assistance, as this facilitates a deeper understanding of their unique situation. There’s a recognition of their limitations, particularly regarding self-management—a common pitfall in their attempts to rebuild strength.

Again, their plea for assistance is rooted in desperation, but also in hope. The speaker contemplates the role of professional guidance that combines direct pressure with restraint to avoid over-exertion. Over time, they have learned the importance of moderation—a lesson that eluded them in earlier attempts to reclaim their physical well-being.

The sentiment evolves into a discussion about quality of life. It’s a theme that reverberates throughout their narrative—functionality should not come at the expense of joy. Acknowledging the societal expectations to be productive and a "good worker drone," the speaker emphasizes that life's enjoyment should not diminish due to ongoing health struggles.

Their experience reflects a universal truth: facing chronic pain and fatigue can cloud the simplest pleasures in life. They resolutely express the need for change, hoping that with the right guidance, they may reclaim their sense of enjoyment and freedom.

As the speaker reaches out for support, they’re not shy about their vulnerability. Thankfulness resonates throughout the dialogue as they recognize the kindness of those who offer advice, even if it isn't always actionable. The challenge remains, though, in navigating online helps versus the necessity for local, tangible support.

The speaker's candidness about feeling like a failure after years of health struggles is a powerful acknowledgment. Frustration surfaces, not just for the ongoing physical issues, but for the mental toll it has exacted. Yet, there is an underlying understanding that addressing these feelings is part of their healing process.

While grappling with negativity, the speaker encapsulates an honest struggle to remain hopeful. Acknowledging their frustration, they maintain that open communication is vital. They also understand that vulnerability and honesty may not always be welcome in discussions, but these revelations aim to foster understanding.

In conclusion, the speaker remains hopeful that addressing their health issues can lead to a turnaround—a chance to re-engage with life meaningfully, embracing both the pain and the potential for healing. Though struggles lie ahead, their determination to seek a better quality of life is evident, and the journey is ongoing.

Cryptocurrencies have emerged as one of the most talked-about innovations of our time, touted as a revolutionary form of money that could disrupt traditional financial systems. However, beneath the surface lies a troubling ideology characterized by hostility toward governments, banks, and established financial systems. This article aims to dismantle the myth of cryptocurrencies as a valuable asset, highlighting their volatility, risks, and the underlying motivations of their proponents.

At their core, cryptocurrencies are built on a foundation of disdain for traditional financial structures. They exist as a counter-narrative against regulatory oversight and institutional authority. However, while proponents argue that this decentralized system provides freedom from traditional constraints, the reality is that cryptocurrencies deliver little to no inherent value. They exist without stability, proof of worth, or a foundational backing. The production of cryptocurrencies often involves complex algorithms and massive energy consumption but lacks any guarantee of their value as tangible commodities.

The assertion that cryptocurrencies can function as money is fundamentally flawed. With numerous digital currencies available, none exhibit the stable characteristics needed to serve as an effective medium of exchange. Their extreme volatility makes them unreliable for transactions, as individuals can face drastically different valuations in short time spans. This instability undermines cryptocurrencies' ability to serve as a store of value, one of the primary roles of any currency.

While conventional currencies are scrutinized for inflation and strive for stability, cryptocurrencies attract investors precisely due to their instability. This inherent contradiction means they cannot fulfill the basic functions of money. Instead, they become speculative assets devoid of the mundanity and reliability that traditional fiat currencies provide.

One of the few areas where cryptocurrencies prove useful is in facilitating illicit activities. Their design allows for anonymity, making them appealing for trading in illegal goods, money laundering, and fraud. While blockchain technology is often praised for its transparency, the reality is that anonymous dealings cannot be traced without the necessary access codes. In this way, cryptocurrencies become tools for those seeking to evade laws and taxes, drawing a stark connection between financial illicitness and the cryptocurrency community.

This association extends further into political realms, with a noticeable link between cryptocurrency advocates and far-right ideologies that favor a dismantling of governmental control. The ideology driving these cryptocurrencies encourages a culture of distrust, undermining the social contract that supports stable societies.

Lack of Regulation and Consumer Protections

The absence of a regulatory infrastructure surrounding cryptocurrencies poses a significant risk for users. Unlike traditional banking systems, which provide safeguards like deposit insurance and legal recourse for errors, cryptocurrency holders are left unprotected. In a downturn or crisis, individuals are exposed to full risk without the safety nets afforded by government-backed currencies.

This systemic absence of oversight fosters exploitation, allowing malicious actors to flourish in an unregulated environment. Moreover, the implications of widespread cryptocurrency adoption extend to national monetary policies, threatening the control central banks exercise over money supply and potentially paving the way for rampant inflation.

Ultimately, the burden of risk lies squarely with the individual user. In contrast to traditional financial systems that bear much of the risk, cryptocurrency users are left vulnerable to various threats, including loss of access, theft, or fraud, with no central authority to turn to for help. This reality reflects a broader neoliberal agenda that shifts risk away from institutions onto individuals without providing the necessary support mechanisms.

Throughout this exploration, it becomes evident that cryptocurrencies are more an exercise in financial speculation than a viable currency. They embody a dogmatic belief system that overlooks the foundational principles essential for any currency to succeed. As tensions continue to rise around cryptocurrency use, society must consider the implications of supporting a system built on instability and hostility.

In conclusion, engaging with cryptocurrencies requires a clear understanding of their risks and realities. They stand as speculative instruments rather than genuine money that can fulfill real-world needs. Individuals must exercise extreme caution when considering any investment in cryptocurrency, as the potential for loss is high, and the ramifications of a failing system could be dire. For those intrigued by the financial prospects of cryptocurrencies, a mandated framework of regulations and consumer protections is essential to prevent exploitation and safeguard the interests of everyday users.

10 Eye-Opening Financial Facts That Could Transform Your Perspective on Wealth

In today’s fast-paced world, understanding the true workings of money is crucial for financial empowerment. Many may think that hard work alone is the pathway to wealth, but the truth is more complex. Here, we dive into ten insightful financial facts that may radically alter how you perceive your finances, highlighting the realities of inflation, taxation, and investment strategies.

Inflation is often referred to as the “silent thief,” affecting the value of your money without overt signs. On average, inflation diminishes your purchasing power by about 2 to 3% each year. To put this in perspective, if you keep $100,000 under your mattress today, ten years from now, its value in terms of buying power could dwindle to a mere $750. While it may seem negligible at first, over the decades, inflation can significantly impact your financial stability. This underscores the importance of investing rather than merely saving.

It might seem illogical, but many wealthy individuals actually pay lower tax rates than middle-class earners. The primary reason is that a substantial portion of their income is derived from investments — such as stocks and real estate — which are taxed at lower capital gains rates. In contrast, a person earning $60,000 from a traditional job may find themselves paying a higher tax percentage. This structural disparity is one of the pivotal factors contributing to the widening wealth gap.

Shockingly, financial literacy is rarely included in school curriculums. Most students graduate without learning essential skills such as budgeting, tax preparation, or investment strategies. Research shows that over 70% of adults felt they were never equipped with the knowledge to manage their finances effectively. The consequence is often a cycle of overspending, debt accumulation, and dependency on expensive loans or credit options.

The marketing allure of credit cards often conceals their potential pitfalls. While they offer convenience, rewards, and other perks, credit cards can also present exorbitant interest rates, frequently exceeding 20%. If a cardholder only makes minimum payments on a $5,000 balance, they may find themselves trapped in debt for decades, paying off thousands in interest. This model benefits credit card companies significantly, making it imperative to navigate credit wisely.

When you deposit money in a bank, it doesn’t just sit idle. Banks utilize your deposited funds to create more wealth through a practice known as fractional reserve banking, allowing them to lend out your money multiple times over. This means they profit from the interest on loans while compensating you with meager returns. Understanding this can help you make smarter decisions about where to keep your money.

Owning a home is often deemed a hallmark of financial success, but it might not always be a sound investment. Many homes do not appreciate as expected, and the costs associated with maintenance, taxes, and interest can make ownership more expensive than renting—especially if you plan to move within a short timeframe. It's essential to recognize that a home should primarily serve as a living space, rather than a guaranteed investment.

The Decline of the Dollar

The U.S. dollar has lost over 90% of its value since the establishment of the Federal Reserve in 1913. This erosion of purchasing power does not imply goods are merely becoming more expensive; rather, it's a reflection of your money's diminishing value. Failing to invest could mean a continuous loss of wealth over time.

A staggering 60% of people find themselves unable to cover a $1,000 emergency expense through savings. Such financial vulnerability indicates that unexpected costs—a car repair, medical bill, or job loss—could easily plunge individuals into debt. Establishing a safety net, ideally amounting to three to six months of living expenses, is crucial for long-term financial stability.

Investment strategies should focus on time rather than timing. The notion of buying low and selling high is appealing, yet many investors miss the most prosperous market days while attempting to time their decisions. Historical data shows that missing just the ten best days in the stock market dramatically affects overall returns. Long-term investing is the key to building wealth.

Described by Albert Einstein as the "eighth wonder of the world," compound interest is a powerful tool in finance. It allows your money to earn interest on both the principal amount and the accumulated interest over time. The earlier you start investing, the more you can take advantage of this phenomenon, making it essential to kickstart your investment journey as soon as possible.

These ten financial insights offer a fresh perspective on saving, spending, and wealth building. If any of these facts resonate with you or challenge your understanding of personal finance, consider sharing your thoughts. Remember, enhancing your financial acumen is not merely about working harder; it’s also about thinking smarter. Embrace the journey towards financial freedom!

The Axis of Upheaval: Analyzing the Inaction of Anti-Western Regimes in Iran's Conflict

For years, the potential emergence of an "axis of upheaval," composed of China, Russia, Iran, and North Korea, has haunted Western strategists. This coalition, characterized by its anti-Western rhetoric and shared authoritarian interests, appeared to be coalescing into a formidable force—particularly in the wake of geopolitical shifts induced by the war in Ukraine. However, recent events, particularly Iran's confrontation with Israel, have revealed fissures within this alliance, leading to questions about its robustness and reliability.

On June 13, 2023, Israel conducted striking operations against Iran’s nuclear capability, prompting the U.S. to join in with direct attacks against the Islamic Republic. To the surprise of many, the anticipated support from the axis of upheaval was conspicuously absent. Instead of responding decisively to the attacks, key players, including Russia, China, and North Korea, largely remained silent or issued mere condemnations without taking actionable steps.

Critics could argue that the absence of military backing for Iran from its allies was not unexpected, given the lack of formal mutual defense agreements binding these nations. This line of reasoning might downplay the significance of Iran's perceived alliances. Yet, the expectation of support was rooted in previous partnerships and shared interests, especially in countering U.S. influence.

Iran had aided Russia during its dire military engagements in Ukraine, supplying crucial drones and munitions. This undercurrent of reciprocity could lead one to assume that Iran could expect similar assistive measures during its own time of crisis. Yet, contrary to these expectations, Iran found itself abandoned when support was most needed.

When assessing the motivations of Russia, one sees a government that focuses heavily on transactional diplomacy. While Moscow and Tehran had seemed close due to their shared geopolitical aims—such as the survival of Bashar al-Assad in Syria—the relationship has proved one-sided. Despite Iran facilitating military support to Russia during its struggles, this partnership has not led to significant military assistance from Russia to Iran in times of conflict.

Reports indicate that Iran has persistently sought advanced weapons systems from Russia, including air defense technology, only to be met with refusal. This paints a picture of a reluctant ally pursuing its geopolitical goals over the security of a partner. Moreover, Russian interests—particularly in maintaining favorable relations with Israel and the Gulf states—appear prioritized over support for Iran.

While some may question why Russia failed to act, it is essential to consider the Kremlin's own military fatigue, dealing with ongoing challenges in Ukraine and their ramifications on Russia’s ability to engage elsewhere.

On the other side, China’s approach to supporting Iran has also been notably restrained. Despite being the largest importer of Iranian oil and a major economic partner, Beijing has been careful not to overextend its support—especially given its relationships with affluent Gulf states like Saudi Arabia and the UAE.