The best way to buy LEO exposure.

At the moment, the best way to buy LEO exposure right now is by buying LSTR tokens. The @leostrategy project has come a long way lately, and it's tokens are currently selling at a big discount to its asset backing.

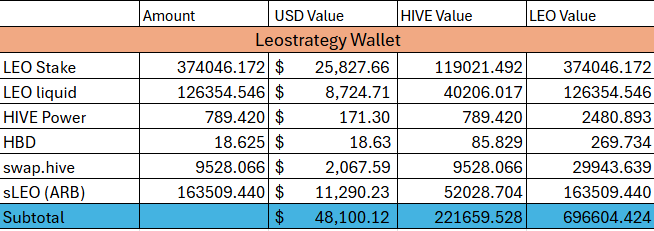

So let's take a look at a snapshot of the holdings Leostrategy have currently. I'll lay it out like it is one of our wallets, to make it clear. I've set this up simply to watch, and because I have put some of LBI's funds into LSTR.

A little while ago, the possibility of a deal for LBI to pick up a big position in LSTR was on the table. Anyway, that deal was not to be, but with the way markets have moved over the last few weeks (particularly LEO) has made LSTR a much more attractive proposition.

Let's look at some numbers:

(Disclaimer - this is a fast moving market at the moment, these numbers are correct at the time of this post, but could be outdated very quickly)

LEO is currently at 0.3182 HIVE

HIVE is currently at 0.217 USD

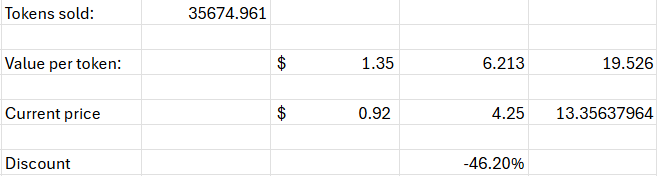

LSTR has currently sold 35674.961 tokens at 4.25 HIVE each.

Here is what @leostrategy's current asset holdings are:

Now lets work that out per token:

So, at the point of this snapshot, LSTR is currently being sold at a 46% discount to its asset backing. You can literally buy a token worth $1.35 for $0.92. Buying 1 LSTR right now is like paying swapping 13.356 LEO for 19.526 in LEO value.

I could not sit back and not buy some LSTR for LBI. We now own 1,400 LSTR and sit 4th on the rich-list. I sold LEO to buy them. Sorry, not sorry.

These 1,400 LSTR cost 5,950 HIVE. $1,288 in USD terms. I have used some of the proceeds from the LEO sales to top up other LBI divisions. Let's just use the current prices to work out how much LEO we used. Let's call it 18,700 LEO

If we value LSTR at its asset backed value rather than it's 4.25 HIVE market price currently, our tokens are worth 8698 HIVE, or 27336 LEO, or $1890 USD.

So LBI could book an instant value increase to our balance sheet of $602 if we value LSTR in our books at asset backed value rather than 4.25 HIVE each.

Buying LSTR is such a no-brainer at the moment.

Cheers,

JK.

P.S. Not financial advice obviously - just reporting what LBI has done, and will probably do more of.

Posted Using INLEO

I see a liquidity problem. How can I exit LSTR at its real value?

LSRT is basically an accumulating derivative of LEO, but it offers no yield. Why not have LEO that will distribute USDC?

Personally, I'll try to buy LSTR when it starts to run out.

There is a liquidity problem temporarily. Once they sell out of tokens, they are setting up a liquidity pool paired with LEO at its asset backed value. No more liquidity problem then.

I think it's going to be difficult to sold out this... Lots of tokens...

I bet they will be gone in a month or two. As Leo price goes up they become more undervalued

That is a lot of capital to be deployed. I still think that we need BTC to perform to reach that. a BTC over $120K in August would do the trick... We'll see..

The FOMO will be strong when it gets down to the last 25,000. I know it will be gone soon! Mark my words. lol

When will LBI price rise. Do LBI holders get anything? Thanks

4 weeks ago (6 July)LBI was worth $0.103 each. Today it is $0.164 each. As LEO climbs our USD and HIVE value increases. The LEO value of the fund drops, as all our non-LEO holdings are worth less LEO tokens - but the value of the fund goes up with LEO price increases.

The pool price (LBI/LEO) is currently below asset backing as several LBI holders have sold to buy LSTR.

Other than the asset value increases, LBI pays a small dividend each week coming from a small portion of our income, and the pool earns LEO rewards (plus the LBI in the pool also count for the dividend run)

As for "when will LBI price rise?" - Well, when will HIVE rise? When will LEO rise?

LBI has no inflation, we switched to a deflationary model 12 months ago. Every week we earn more PWR, more DAB, more EDSI, more HP and that growth is compounding.

I think this was a good move. Once they sell out of LSTR, we will see true price discovery and liquidity. It provides exposure to LBI holders without requiring them to sell their LBI or LEO. The more I look at it, the more I like it! 👍

Thanks, I see it as an obvious move. As soon as I have seen LBI holders selling their LBI and buying LSTR, it felt like a necessary move. Now, LBI holders are not missing out on LSTR exposure.

Does holding LSTR token make you owner of assets behind it? I mean can you opt out demanding your share of tokens acquired by the project like we can in our LBI project?

The assets back the value of the token. There is not a direct redemption arrangement where you can request your share of the funds directly. Once the initial sale is done, there will be a liquidity pool to provide a way to exit if desired.

That is exactly why I prefer LBI's approach - there are at least 2 ways of exit (redemption of assets and liquidity pool, I'm excluding H-E spot market). I understand there was a deal you saw and executed the trade, but I recommend you proceed with caution

Hello lbi-token!

It's nice to let you know that your article will take 12th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 0.1 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 744 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART