LBI Weekly Holdings and Income report - Week 44 - week ending 1 June 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Changes for our wallet this week, with a long running saga coming to an end. Value's are down a bit with Hive and LEO both dropping, plus an adjustment downwards of an asset also hitting the bottom line a bit.

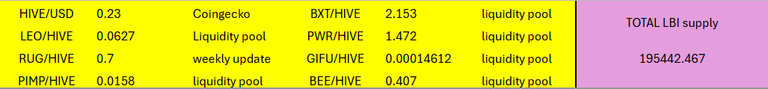

Here are the prices at cut-off time:

And here is last weeks report for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-43-week-ending-25-may-2025

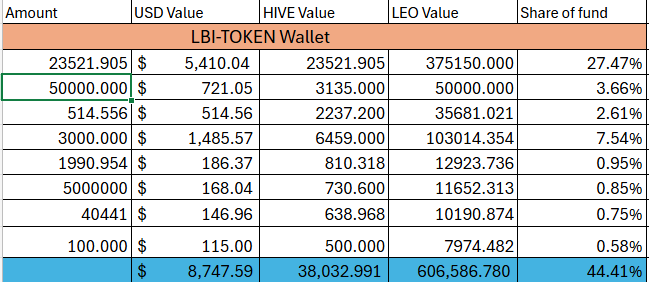

@lbi-token wallet.

Our bHBD unwrap, which we have been waiting for a long time for has been finalized this week. In the end, the LEO team have given LEO to compensate for losses, rather than HBD. The amount is less than what I was expecting, with a current value of just over $700 compared to $1500 which was our book value (estimate). It is what it is, so lets just move on. I put out a post a couple of days ago about this, so won't go into more detail here - go to that post for more info.

Note that the "LEO in storage" entry above is the funds from this unwrap, and they are currently in @lbi-storage wallet. Everything else is down a bit also, so this wallets value drops by $2000 for the week.

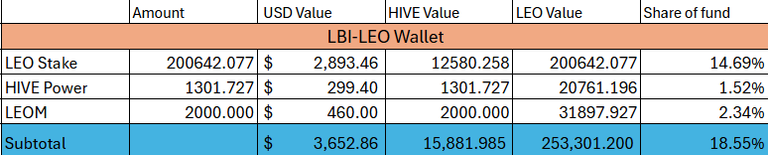

@lbi-leo wallet

A steady week for this wallet, with no news to report. Income is stable and asset growth is happening, slowly. Not much more to report this week.

@lbi-eds wallet

Steady for this wallet also. Added some EDSMM again this week. We are up to 6000 now, which will mint us around 1200 EDSI per year, for the next 16 or so years. We bought a few cheap EDSI this week, and minted our usual so added a total of 40 over the week. Will keep buying the miners till they are all gone from the market, and then stop the power-down and redelegate to eds-vote.

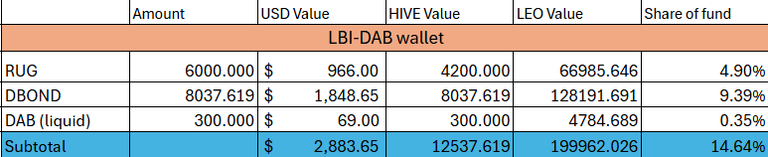

@lbi-dab wallet

Continuing with the strategy of selling all minted DAB, and buying more DBOND with the funds. Also bought a few more from other funds, so we ended up adding 220 DBOND for the week. For this wallet we are prioritizing long term growth over short term income, and we continue to do so while we can. While ever it is possible to buy an asset that is fully 1:1 backed with HIVE for under 1, it makes sense to do so.

@lbi-pwr wallet

Added some funds in here this week, to start rebuilding the LP position. With the changes to the PWR project, particularly around staking APR, I think building diversified sources of growth for this wallet is best. Added 10 PWR to our stake, HP is over 1000 and the pool is up. PWR is trading above its asset backing, and the wallet creeps over 4% of the total fund. A bright spot for us this week.

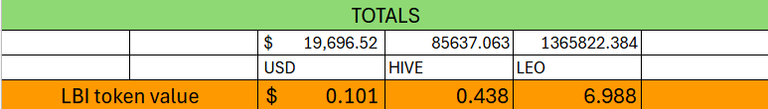

Totals

Down under $20000 in value, which is really disappointing. It is feeling like we have done a lot with this project over the last 44 weeks to get nowhere. However that is not the case, income is well up, and our growth prospects are much better. We have built up a solid base across several different HIVE based projects, and are ready to restart our off-chain investments. We have held our Dollar value stable despite our biggest holding more than halving in value over the time. LEO's tokenomics are set to be shaken up, with an end to inflation and hopefully better days ahead. All in all, I don't think we are doing too bad despite the asset value on paper being around where it was at the start of this new phase of LBI 44 weeks ago.

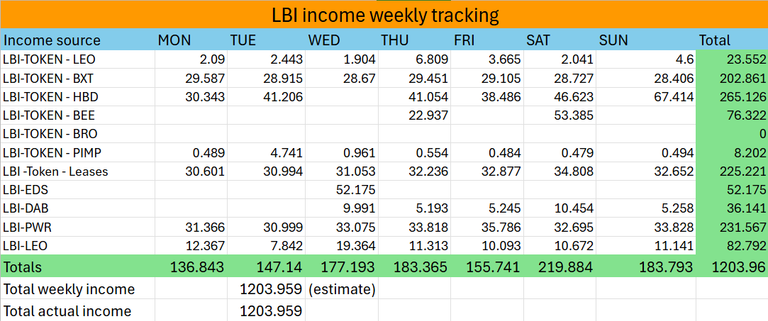

Income

We hit the 1200 mark for the first time. Everything did pretty much as expected, and I did utilize some HBD from post payouts to get us over the 1200 mark. All in all, a solid week for income, with not much more needing to be said.

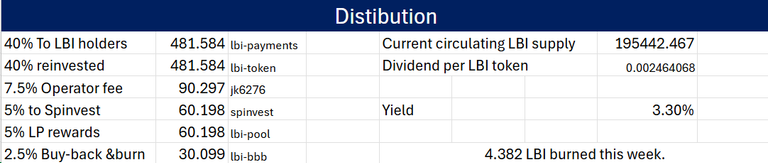

481 LEO sent out for dividends this week, giving holders a yield of 3.3%. Remember that this yield is using only 40% of the total income generated, so I'm pretty pleased with that. Short term goal is to keep hitting 1200, hopefully easier each week. That is heavily dependant on the LEO price, if it goes up hitting 1200 becomes harder, but what we do hit is worth more in HIVE and $$ terms.

4.382 LBI burned this week - every week the supply is going down a bit.

The LBI/LEO liquidity pool is growing deeper, and hold over 45000 LEO matched with equal value of LBI tokens. The price available in the pool is close to our asset backed value, so it is a decent way to buy small amounts of LBI. The APR for those providing liquidity into the pool is still over 10%, and remember that LBI in the pool still counts for the dividend each week so you get to double dip this way.

Conclusion

An interesting week for us. The long wait for the BHBD unwrap has come to an end, and we are sitting on a chunk of liquid LEO waiting for a new home. Likely this will get staked on LEODEX so we can earn a share of that platforms revenue. I have started to get an off-chain wallet re-established, and will report on that progress later in the week.

Onwards.

Thanks for checking out this weeks LBI update,

Cheers,

JK.

Posted Using INLEO

Thanks for the update!

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 77000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: