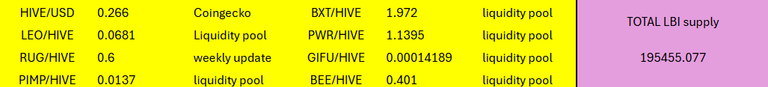

LBI Weekly Holdings and Income report - Week 41 - week ending 11 May 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

A bit to cover this week, so let's not waste time and dive right in.

And here is last weeks update post for comparison.

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-40-week-ending-04-may-2025-bee

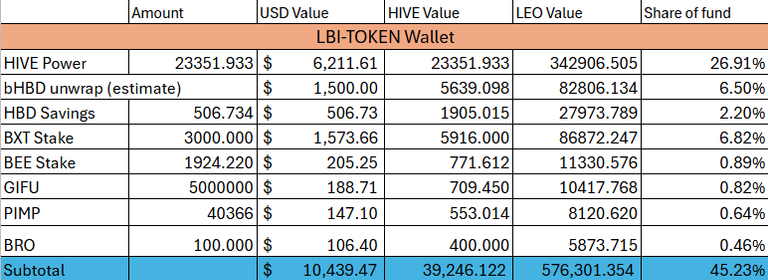

@lbi-token wallet

The main changes this week are that we have more BEE and less BRO. The BRO market went a bit nuts early in the week, between a committed buyer, a new LP paired with HIVE, it's existing NEOXIAN LP and a bunch of arb bots working overtime the price action went crazy. Seeing the opportunity, I managed to sell most of our BRO between 13 and 18 HIVE each, and then bought back some once the price settled back to 5. All in all, I think I pretty much pulled out everything we have invested in to BRO, and retained 100 tokens that are now basically a free-role. Took the initial investment out, and sit on 100 BRO happily as profits.

I added to the BEE position. We have our BEE delegated to @bee.voter and the APR is quite incredible really. You will see in the income statement how much it makes, but it runs at around 30% APR currently. I'm not sure how it is sustainable, but we are here for it while it lasts. BEE is a reasonable token with good liquidity by HE standards and a fairly stable price. There are other ways to earn from it, so if this crazy APR dries up it's not the end of the world.

The other news is that I have taken some small leases for our spare HP, on the Hive Engine lease market. These are running at around our current curation rate, so basically I'm swapping curation rewards paid as powered up HIVE for leasing rewards paid liquid daily. This will hurt our HP growth marginally, but boost our income.

All up, an $1100 increase in value for this wallet for the week.

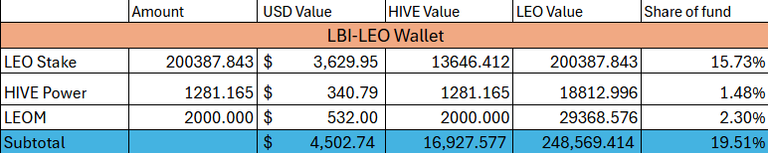

@lbi-leo wallet

No news from this wallet in terms of changes this week. A $500 gain in value, and around 80 LEO added to our stake, plus a few HP. Steady week, and the wallet holds almost 20% of our funds. It will be interesting to see if the launch of the upgraded LEODEX can gain traction and underpin some improvements for the LEO economy.

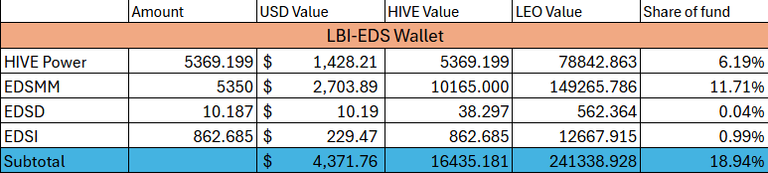

@lbi-eds

Interesting times for the EDS project. A big holder is looking to cash out, and the EDSI token is priced at our book value of 1 HIVE for the first time in ages. I've undelegated our HP in this wallet from @eds-vote, and will start a power-down asap. The intention is to use that power-down to buy as many EDSI as we can at 1 each, and maybe some more miners. We will see what happens, or if the market absorbs the big sale before we can get the funds available. If we can successfully buy a bunch of EDSI, this move will slow our growth a bit, but boost income.

The delegation expires in 3 days, then the power-down will be started so it's 10 days before we can enter the market.

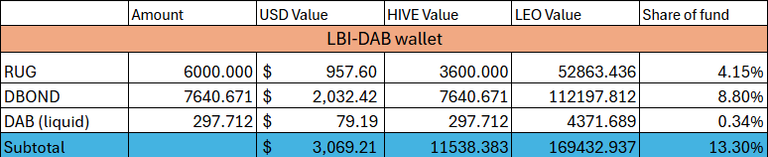

@lbi-dab wallet

Another project where the biggest holder is looking to exit. This week we sold some DAB, and bought more DBOND. I'm ok with the drop in income here as we have boosted incomes in other areas and can focus on growth for this wallet for now. We are down around 100 DAB, and up another 200 DBOND. The wallet gained $300 in value over the week, so it was a decent week.

I'd love to see some updates on RUG, it's been a while and I hold hope that it could have a turn-around if we move back into a proper alt-coin bull market.

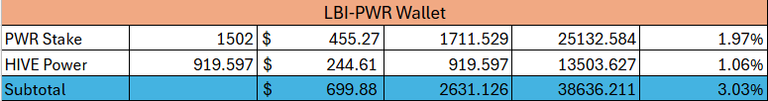

@lbi-pwr wallet

Another wallet with big changes this week. Most of it was covered off in the post I put out a few days ago so check that post for all the details. The TLDR is that we exited the pool, staked our PWR which is no longer pegged 1/1 with HIVE but rather backed by a basket of mostly off HIVE assets (mainly ETH). @empoderat seems to have picked the perfect time to buy ETH, with an average buy in at $1690 and a current ETH price at $2500, it looks like he picked the bottom to perfection.

I will say, if you want to keep track of all things PWR, consider giving the @lib-pwr account a follow. Each day I will thread some metrics of the PWR token, and plan a weekly update post specific to PWR and our wallet from that account. Any earnings from that content will be retained in the wallet to add to its growth. Hopefully, the content we put out will be informative and fill a bit of an information gap where Empo is time poor to update stats and such regularly. We shall see if it is worth my time.

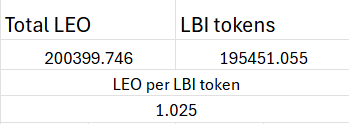

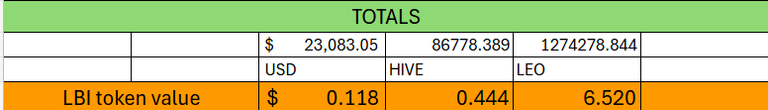

Totals

A nice week overall, increasing in value by $2500 roughly. The HIVE token value has been slowly creeping upwards, and the LEO valuation has been reasonably stable around the 6.5 LEO per LBI mark for a while. Things can change quickly however, and these prices could fluctuate a lot in the event of a LEO price increase.

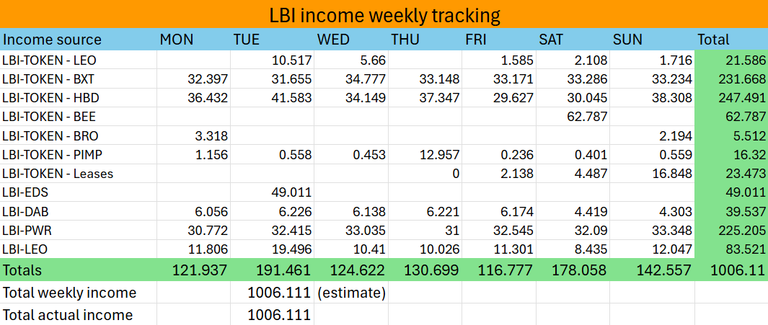

Income

A bit to pick apart here.

- Lease income has been added into the mix, and next weeks update will tell a better picture. All up, currently we have around 6760 HP leased out, and earning daily SWAP.HIVE. We should average around 8% APR for these leases, which is about what we would make from curation anyway.

- BEE income comes in once a week, in the form of a liquid HIVE transfer from @bee.drone for our @bee.voter delegation. It is really nice and I'm looking for ways to boost our BEE holdings.

- I didn't have to use any tricks to get to the 1000 mark for the week.

- I'd like to reduce our dependance on HBD so I can start to actually add to HBD savings and rebuild it.

- EDS, PWR and LEO wallets are all fairly reliable.

- DAB income is down, as a result of trading DAB for DBOND, but here we are sacrificing current income for higher growth.

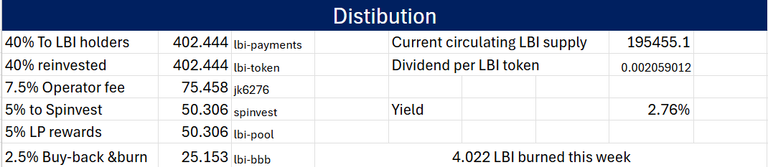

Distribution

- 400 LEO paid out as dividends again this week.

- APR on LBI sits at 2.76% - would love to see it higher but that will take time.

- Another 4.022 LBI burned this week.

Conclusion

Week 41's results are now on-chain for all to see. We keep plugging away and watching as the fund steadily does its thing. It feels like all the ingredients are pretty much in place now, and its just a matter of time before we see consistent growth in assets and income.

That's about it for this weeks update, have a great week everyone.

Remember to keep an eye out for the @lbi-pwr account as we keep track of how that exciting project develops.

Cheers,

JK.

Posted Using INLEO

Nice! Good to see the weekly income report. Keen to check the inleo.io thread for that Asset Backed Value! 🐴💰

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 74000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to post daily reports for @lbi-pwr you should:

@trumpman might add few more ideas for everyday upvotes.

PS try using #splinterlands #terracore for those reports, they might bring another upvote

!pimp

Hello lbi-token!

It's nice to let you know that your article will take 7th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 1.3 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 661 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART