LBI Weekly Holdings and Income report - Week 39 - week ending 27 April 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

It's been a week where it feels like things have been creeping up a bit - which is nice for a change. HIVE and LEO are both up a touch on last week, so let's see how that has affected LBI's values.

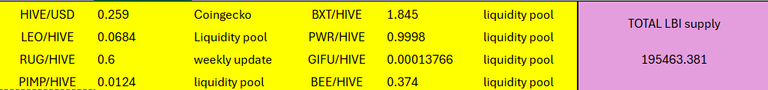

Prices at cut-off time:

Here is last weeks report for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-38-week-ending-20-april-2025-knl

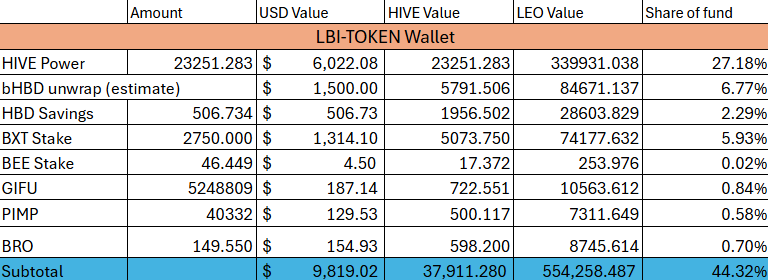

@lbi-token wallet

A solid week for this wallet, with $700 gained in value over the week. Aside from GIFU, everything else did ok, holding in price while HIVE rose. You may notice I have added BEE into the balance sheet this week. There are some interesting delegation programs that reward for BEE delegation, so I'm going to build up it as another asset to chase some returns. Won't be allocating big money to it, just testing things out really, so we shall see how it goes.

Our HP grew by 50 this week, which is a very standard week for us. Overall, a nice week.

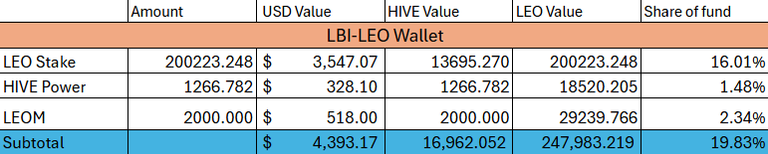

@lbi-leo wallet

The LEO wallet gained in value this week, enough to move it ahead of the EDS wallet to be our second biggest wallet by value. In terms of Dollar value, it gained $690, or 18%. As this wallet is mostly LEO, and with HIVE increasing in price while the LEO/HIVE ratio also improved (for LEO) that translates into a very good week. Over the week, we grew our LEO stake by almost 100, and added 7 HP also. Now that this wallets set-up is well and truly done, we can see that it has a pathway to grow our LEO, and HP each week, and add some to the income mix which you will see below.

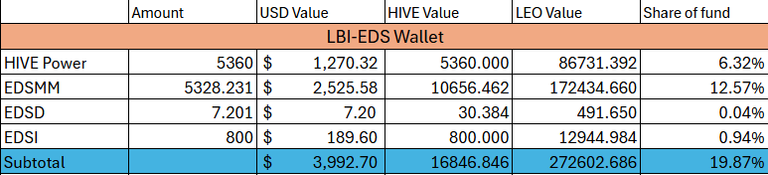

@lbi-eds wallet

Slipping to third place by wallet size does not mean a bad week for the EDS wallet, it still gained $380 in value for the week. Everything is going smoothly here, with our usual 20 EDSI added to the tally, and a little EDSD also.

A little commentary on the EDSD I think. This plan to sell off our EDSI minted above 20 each week is working. The good part is that when HIVE's price is up, we can cash in a little by getting more EDSD (the HIVE we get for selling a few EDSI gets more HBD so more EDSD). When HIVE's price is low, we can't buy as much EDSD, however the ones we do have will mint more EDSI. So, either way this works for us - win/win.

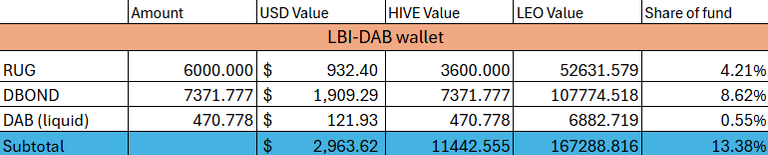

@lbi-dab wallet

I've started this week to sell some of the DAB we mint each week, to buy more DBOND. The yield on DAB drops each week, and DBONDS are fully backed 1/1 with HIVE. We value both on our books at 1 HIVE each. Selling some DAB above 1 HIVE to buy DBONDs below 1 HIVE makes sense. I'd rather sacrifice a bit of yield now to boost our DAB mintage rate in the long run.

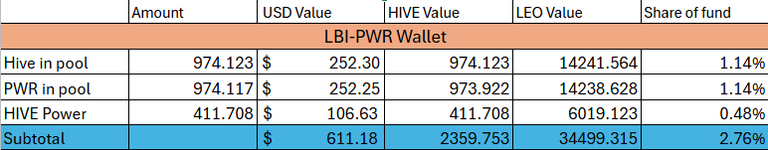

@lbi-pwr wallet

Last but not least is our PWR wallet. From last week I have got the remaining liquid PWR back in to the pool, and stabilized this wallet. Each day I use 2 HIVE from the income to go to the income wallet, and compound the rest. The wallet gains around 7 HIVE in value total each day (mostly from the @empo.voter delegation from the token wallet). Would love to grow this wallet faster, but it will just be growth from compounding now for a bit. So long as I can resist the urge to pull funds out of the pool to buy other things, we should be good.

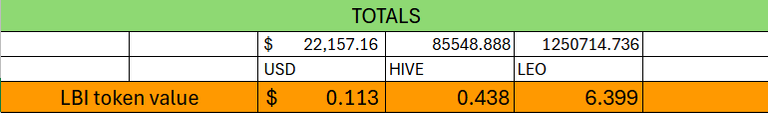

Totals.

Over the week, the total fund has grown by $2000, or 10% up which is lovely. The value per token is up in USD terms, relatively flat in HIVE terms and down in LEO. This is completely expected when LEO outperforms HIVE in price, as it has done over the last week.

Happy to see us trending back in the right direction after many weeks of declines.

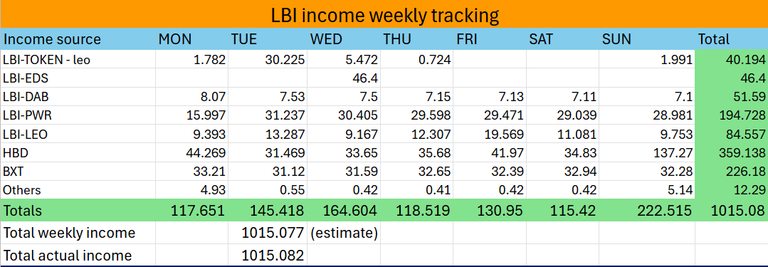

Income report.

We made it over 1000 LEO for another week. Still using more HBD than I would like to get there, but it's still a win. You can see that the BXT contribution is strong, and I have been pulling 2 HIVE per day from PWR to get a good tally also. Others will cover smaller token income, like PIMP, BRO and the new BEE delegation.

If LEO keeps trending up against HIVE it will be harder and harder to maintain 1000 per week, but I'll give it a crack.

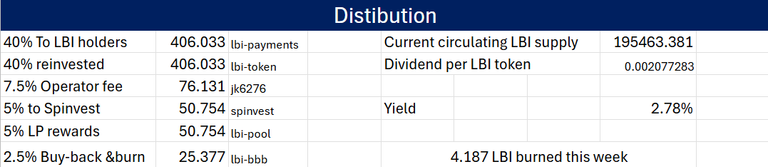

Lastly, we have our distributions. As you can see we have sent over 400 LEO again this week to go out as dividends, and compounded back into assets the same amount. The dividend yield is still small at 2.78%, but it's important to remember that yield is on top of our compounding asset growth. The other way to boost your yield is to get your LBI into the liquidity pool, paired with LEO.

4.187 LBI burned for the week. Every week we have a few less LBI tokens to share the fund amongst.

I am aware that the dividend run that should have happened last night has not in fact happened. I've contacted the bot coder to give it a kick back in action. Feels like a number of automation things around HIVE are glitchy at the moment, so we shall see. Rest assured it is a know issue.

Conclusions

Up weeks are always more fun, and putting out this report is more enjoyable when values are up. In the big picture, we are on track and all our wallets have growth and income plans in place and working as intended.

Not much more needs to be said really, except thanks for checking this weeks update and enjoy your week ahead everyone.

Cheers,

JK.

Posted Using INLEO

I'm a little bit worried about announced changes to PWR, however I agree with the reasoning that the current situation will be hard to maintain further. Don't know if the step is right but one needs to be taken either way

Yes, every project similar issues, I think it's connected with H-E nodes. I'm wondering if VSC might change that

Thanks for the report and dividends,

First time there is "bid" value in HE that is close to actual value.

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 72000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Hello lbi-token!

It's nice to let you know that your article will take 7th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 0.6 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 647 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART