LBI Weekly Holdings and Income report - Week 37 - week ending 13 April 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

There has been some changes this week - our @lbi-leo wallet is all set now, a project we have held a decent position in is being wound down, and funds have been moved around a bit as a result, so there is a bit to talk about in this weeks update.

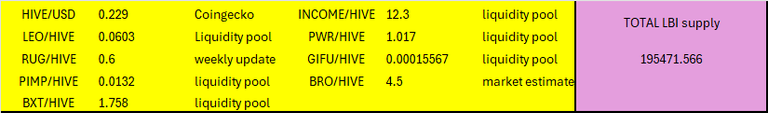

Here are the token prices at the report cut-off time:

And here is last weeks report link for comparisons:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-36-week-ending-6-april-2025-kit

Lets get into it.

@lbi-token wallet.

The INCOME project run by @ecoinstant that we have invested in since I took over the LBI fund has announced it is winding up. Dividends stopped and I started liquidating our holding. Over the week the majority of our position was sold, and since this report cut=off time, the remainder has sold. It's sad to see projects close down on HIVE, and INCOME was always a reliable source of, well, income for us. Eco has decided to close it, in part as a result of the curation drama's that have engulfed HIVE of late.

Over the week, we added around 50 HP, pulled the last HBD withdrawal to fund the LEO wallet set-up, and sold more than half our INCOME tokens. This wallet is now less than half of LBI's assets. The HBD savings will get rebuilt from here, with many of our other wallets now at "stand-alone" size and not needing to be further funded.

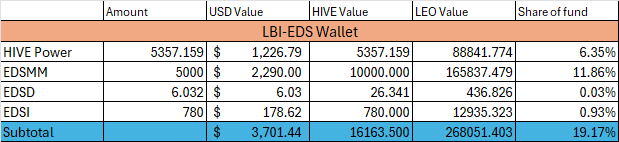

@lbi-eds wallet.

This is our second biggest wallet by assets, but probably our most boring. 20 EDSI added as usual, a little EDSD and HP also. Not much to say really, I didn't add funds or change anything for this wallet this week.

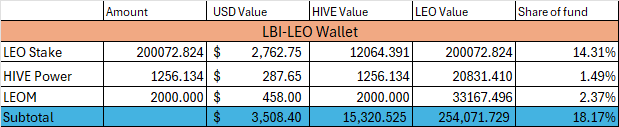

@lbi-leo wallet.

Our third wallet by size, currently, and now the set-up of this wallet is complete. We have 2000 LEOM, which is a long term investment in the future of the LEO token. Our LEO stake has returned to growth, and we will grow our HP in here also over time. No plans to add any more funds into this wallet, it is done now.

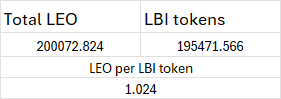

The LEO per LBI ratio moved ever so slightly this week, but not enough to be evident once it gets rounded off to 3 decimals. The wallet added 43 LEO stake for the week, and LBI token supply decreased by nearly 4 tokens (from the weekly burn) so this ratio will inevitably improve over time.

There is one negative to report, which I have tried to get attention to via feedback threads and a discord ticket. I'll link the latest thread/rant I made here and hope someone from the LEO team see's it. I hate having to give negative feedback about an aspect of a project we are heavily invested in for the long run, but it has got to be done so the problem gets addressed.

https://inleo.io/threads/view/lbi-token/re-lbi-token-2qre5lsag?referral=lbi-token

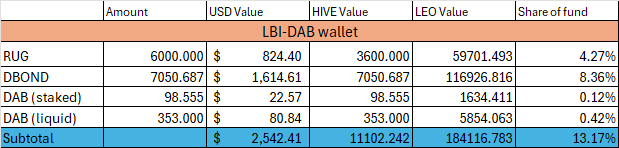

@lbi-dab wallet.

Just over 1000 DBONDS added this week, much of which came from funds freed up from selling INCOME tokens. We are now the fourth biggest wallet holding DBONDS, so our DAB mintage should accelerate over the weeks ahead. With the way the yield on DAB drops every week, we need to mint lots to just maintain our income. I have decided that now with our DBOND position being fairly large to unstake the DAB's that had been staked so we boost our income a bit. Losing dividends from INCOME cuts into our returns, and I'm looking for other places to make that up and keeping all our DAB liquid to earn daily HIVE is one way to do that.

I have bought some more DBOND since these numbers cut-off, and we are now up to 7300. One thing to keep an eye on with this position is that the biggest investor into the DAB project, @freecompliments, has indicated he will be liquidating all his position as he exits HIVE. It's firstly very sad to see him leave, he was really trying to build a community on HIVE. Secondly, it will be a huge impact to the DAB project as someone holding 15-20% of the entire projects assets looks to exit.

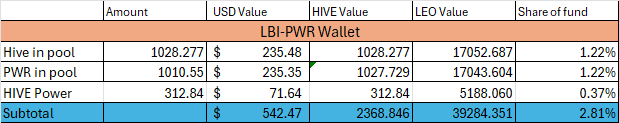

@lbi-pwr wallet.

Our smallest asset wallet has gotten a little bigger this week, with over 800 HIVE value added over the week. I'm really looking to keep adding funds to the LP position here, to replace the lost income from INCOME. This wallet will become our number one focus for adding funds to and growing it's position. I'll keep trying to find more funds to keep building the pool position, as well as growing this wallets HP.

The delegation from the main wallet will remain in place for quite a while, as it funds the bulk of this wallets organic growth. Over time, I'd like this wallet to build it's own HP, and grow to self-sufficiency. Over the coming months this wallet will be our number one growth focus.

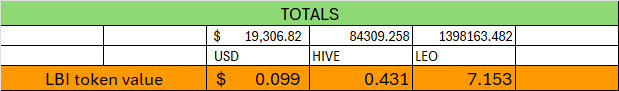

Totals

Overall for the week we have recovered a bit, back up close to $0.10 USD per LBI. The LEO value is down a bit, as LEO price has moved up a bit compared to HIVE. Still keen to see the fund move back over the $20K mark, but that depends on the crypto gods, and mainly the price of HIVE and LEO.

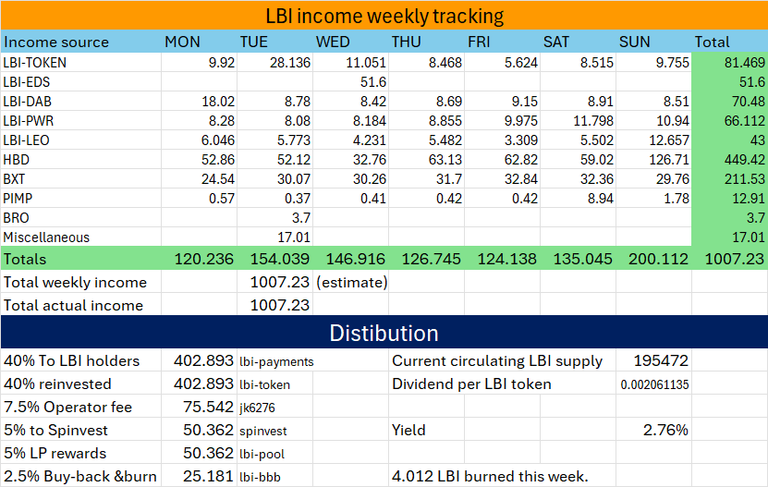

Income statement

We hit 1000 LEO income again, but once again I had to use significant amounts of liquid HBD to get there. I really hope to build up other incomes, most notably the @lbi-dab and @lbi-pwr wallets to take the pressure off selling HBD to maintain our income levels. Since this report I added a little more BXT also, so that should add a little to it's weekly contribution.

Overall, an interesting week for income, with INCOME disappearing from the report. I'm really hoping for more from the LEO wallet, so we shall see what this week brings.

402 LEO distributed to LBI holders this week for dividends, and 4.012 LBI tokens burned for the week. Onwards we march, taking challenges thrown at us in our stride, and continuing to find a way forward.

Conclusion.

A week with a significant amount of change for our investments. @lbi-leo is now set up, and over the next couple of weeks we shall see how it contributes to the fund. Lot's of DBOND added, and watching to see what happens with this project in times of change. It's sad to see INCOME go, but we have put those funds to work quickly in other areas.

Thanks for checking out this weeks update post,

Cheers,

JK.

Posted Using INLEO

Thanks for the update. I just added some more liquidity to the LBI/LEO pool.

Nice - As always I appreciate the support.

I'd love to see more LBI holders get involved in the pool - might need to figure a way to boost the APR some more.

Cheers mate.

I think I am supplying about 50% of it right now. Might be a little risky... 😃

There we go, just added more APR to the pool - hope that gets more people in.

This is what I told you and will keep saying it. They're focused on the new things abandoning the old ones. Please just cancel the delegation and use HP for other projects. It might give Inleo's team motivation to do something about our losses. This is money and we are loosing them because we put too much trust in a project.

I'm a huge fan of HBD stacking, but let's get more Hive before we build back our HBD savings (we have a decent income so compounding and adding rewards into savings will give us more than 15% APR which is far better than what we really got from delegation to @leo.voter)

Hello lbi-token!

It's nice to let you know that your article will take 9th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 1.1 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 633 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART