LBI Weekly Holdings and Income report - Week 34 - week ending 23 March 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

It's been a pretty flat week overall for the markets, feels like things have stagnated and I'm not sure we see much more of a bull market for alts. Maybe HIVE's brief run up over $0.60 a little while back was it for this bull market? Anyway, lets see how our week has gone:

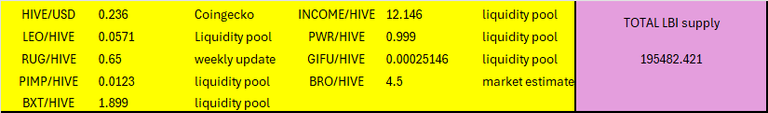

Asset prices at cutoff time for this report:

Here is a link to last weeks report:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-33-week-ending-16-march-2025-a62

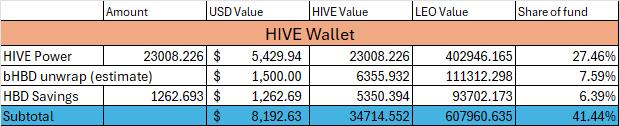

HIVE Wallet

Well, we added 62.5 HIVE for the week, which is pretty standard really. The coming week will be lower I expect as I didn't get an extra post done this week. HBD balance has dropped, as I'm pulling funds out from savings to set up the new @lbi-leo wallet. Each week, as our LEO gets moved over, I'll shift some HBD over also to get that wallet set up nicely.

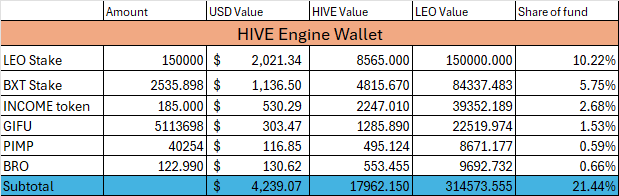

HIVE Engine wallet.

The first part of our LEO move has been done, 3 to go. Aside from that, the main move here was that I bought a bunch of BXT to bring us up to 2500. This was the target I set for us for the year, and we have hit it in March. Focus will shift to some of our other major goals. Aside from that, there is not much happening with our HE wallet here.

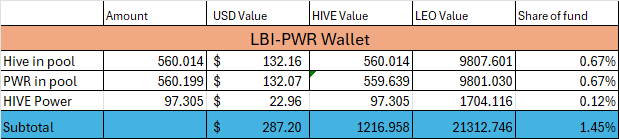

@lbi-pwr wallet.

Here is where I stole money from to buy the BXT mentioned above. Our income from this wallet will be down while I rebuild its position, but we generate a good amount of PWR each day to rebuild quickly. Approaching our first 100 HP in the wallet, and I'll use spare funds whenever I can to get the LP back up.

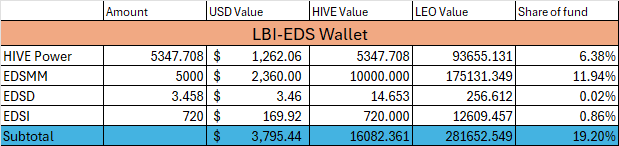

@lbi-eds wallet.

Just chugging along, doing it's thing. Added 20 EDSI, and a small amount of EDSD and HP as usual this week. The yield on our EDSI tokens is likely to drop by a few percent, as SSUK put out a discussion post from @eddie-earner with a realistic look at the model, and a likely need to drop the rate of return on EDSI to make it more sustainable. Likely to decrease APR by 3% (from 20% to 17% roughly). Overall, this does not change our plans here, but it may present opportunities to put some funds in to buying more EDSI if the price reacts badly to the move. I'll keep an eye, but the plan for now is unchanged.

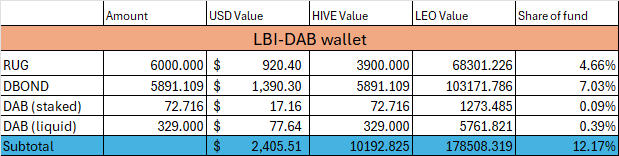

@lbi-dab wallet.

We added 14.43 DAB this week, which is a little lower than last week. Mining rewards have an element of luck to them, so these fluctuations are to be expected. I did buy a couple hundred more DBONDS this week, moving us above our good friend and LBI OG @bozz into position 5 on the DBOND rich-list. I do have my sights set on position 2 in the long run, but that is still a fair way away, and would require significant buying over the coming months. @freecompliments in position 1 is miles ahead of the pack, and we just don't have those kind of funds to catch them.

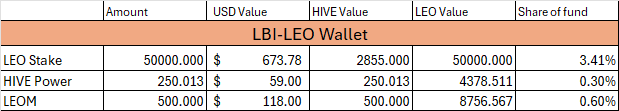

@lbi-leo wallet.

This is the debut of the new LEO wallet, with the first 50K LEO added, along with some funds (from the HBD savings) put into HP and LEOM. After considering feedback from @dagger212 on last weeks report, I am happy to announce that we will not sell any of our 200,000 LEO to set this wallet up. LBI is, and will always remain, a LEO based fund. Money to buy miners and start a HP balance will come from HBD withdrawals rather than from selling LEO. What dagger said makes sense the more I think it over, selling LEO to HIVE at these prices isn't the right move. Anyway, this wallet will build over the next few weeks till all our LEO is in here, and a solid amount of HP and LEOM also.

The plan with the income that this wallet generates is pretty straightforward. 1/3 will go to @lbi-income for our weekly income split, 1/3 will be staked to get our LEO stake growing again, and 1/3 will get traded to HIVE to boost HP. 50% of our HP will be delegated to @leo.voter, and 50% will be retained to earn curation rewards.

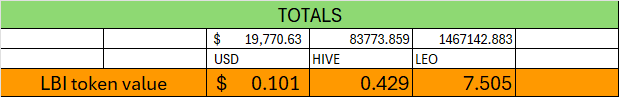

Totals

Despite all the reshuffling, token values overall are pretty stable. Dollar value of the fund is down a touch, HIVE value is up slightly, and LEO value is very slightly up on last week. A little sad to see the fund drop back under $20,000 but it is what it is.

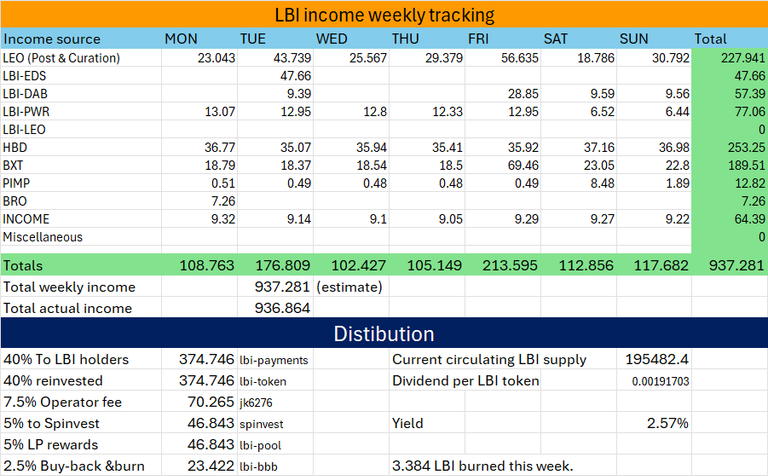

Income statement.

Income overall was good this week, pushing back up over 900 for the week. BXT had a big day, with a one off oversized payout on Friday. PWR dropped a bit as I took funds out of the LP. DAB was patchy, but any missed days always get repaid. Overall, a decent week with income heading back towards the 1000 per week level. This week will see the new LEO wallet start to contribute, we got our first mining reward this morning and curation will kick in near the end of the week.

374 LEO distributed to LBI holders, and 3.384 LBI burned for the week.

Conclusion.

The first week of the restructure to set up the new LEO dedicated wallet is done. Three more weeks until it is set up fully, and then we can see how this new set up goes. The planning for LBI is done looking ahead for years, and providing HIVE is still operating and still has users, we should be in a very strong position in a few years.

One thing I told @dagger212 I'd do is keep track of the LEO per LBI token (ignoring all our other assets) as growing that was the original premise of LBI, and now with the new wallet we can get back to that in some form. For this report, there are 200,000 LEO we own, and 195482.4 LBI in circulation giving a LEO per LBI ratio of 1.023 this week.

Thanks for checking out this weeks report, and following our progress. Have a great week everyone.

Cheers,

JK.

Posted Using INLEO

I'll rise my concerns about keeping the Leo. One thing is selling current holdings, the other one is keeping on building it. Selling Leo at current prices may seem like a bad idea, but getting more Leo is worse.

LEO lost 90% of value since we started, Leo curation rewards are crap. HP delegation rewards are unstable.

Considering the above I would not delegate more

I get it, but no matter which way things go, some LBI token holders will disagree. We have a holder base that consists of a range of people from "LEO sucks and we should exit it all, rebrand and walk away from LEO" Through to "LEO is the best thing on HIVE, I can't believe you'd even think of selling any"

Keeping such a diverse base of holders happy is a challenge. I do think that if we can section off our LEO positions, and let it grow over time, that's our best bet for being positioned if LEO succeeds. The wallet will have around 15% of LBI's assets once its done, and I think that is fair.

As for the delegation, we have not had any leo.voter delegation for a while, and setting one back up from this new wallet will be a steady process.

Anyway, I get that some people will be unhappy with growing our LEO, but to be fair we are still a LEO Based Investment fund, and should be trying to build a LEO position.

I'm trying to look forward, and lots of crypto lost 90% or more, but to their credit LEO are still here and still trying to build something. The potential to recover some of that loss is worth pursuing.