LBI Weekly Holdings and Income report - Week 26 - week ending 26 January 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Lets take a look at what has been happening for LBI's basket of investments this week.

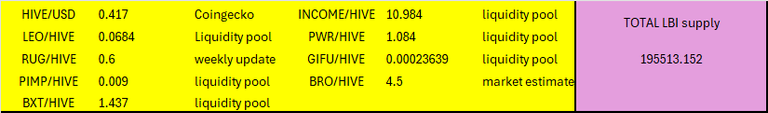

Here are the asset prices at the cutoff time for this report:

And here is last weeks report for comparison:

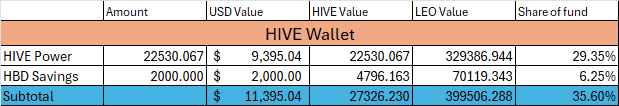

HIVE Wallet

Our HP grew by around 46 HIVE which is decent. The HP here in our main account is nearly 30% of our asset base at the moment. I have shuffled around our delegations a touch, to add a delegation in to the new GIFU project to earn some extra GIFU tokens each day. I'll add a some extra to bring this up to 2000 in a couple days when the other changes finalize. I like the GIFU project, and while we have a good sized stack, more is always good especially when we can earn them daily instead of buying them.

Not much other news here, no change for HBD, just holding it at 2000 for this part of the cycle.

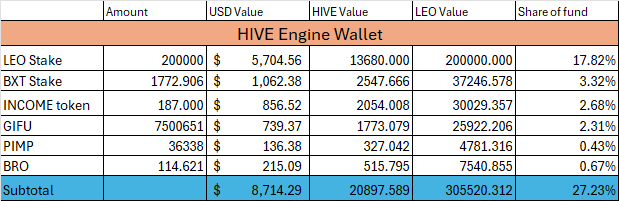

HIVE Engine wallet.

The big news here is the sell off that has happened for LEO. Our bag has dropped in value by $4000 in one week, and is now just 1/3 of its value from just a few weeks ago. I do think it is oversold currently, and if I had a decent chunk of liquid funds to use I would have been tempted to buy more. I guess that having all our assets tied up in long term positions that are not easily traded protects me from making any impulsive decisions. Have to just keep reminding myself that we are a "slow and steady" fund, and rash decisions are usually poor ones.

Just keep adding a little to the income producing tokens - mainly BXT and INCOME each week.

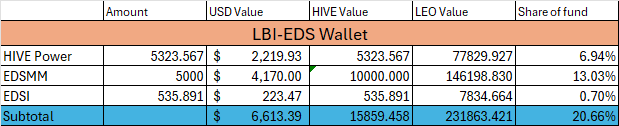

@lbi-eds wallet.

Not a lot to be said about this wallet. 22 EDSI added for the week, which is right on track for our expected 1200 we expect to gain over the year. This post we put out recently gives all the detail you may need about our EDSI wallet and plans.

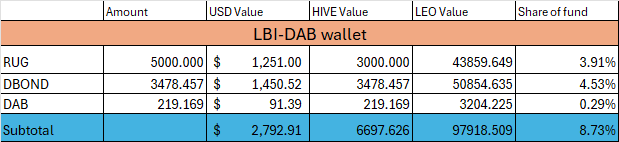

@lbi-dab wallet.

After a few smaller weeks, RUG had a much nicer payout this week, and we gained 55 DBOND this week. The price (in HIVE terms) is still way down on our entry, but the overall USD value of this wallet is doing just fine. So while on paper, RUG may look like a poor investment, in reality this wallet is on track and in good shape. Our long term goal is to grow our DAB (leading to higher income) and to this end we minted 9 DAB over the week. Solid.

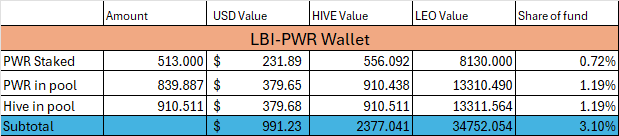

@lbi-pwr wallet.

PWR has been trading above peg for weeks now, ever since the addition of staking for PWR. Our growth here was a little slower with a couple of missed payouts from our delegation. I do have a plan to unstake our PWR when I have more HIVE to pair it with to boost the pool position. I was hoping to start that this week, but it was not to be as you will soon see. Income from this wallet is strong, and the pool APR is still very enticing.

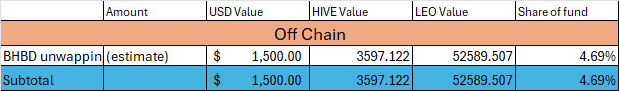

Off Chain.

Here is the disappointing news for the report. There is now change here. In the update post from two weeks ago I shared news that we could expect our HBD unwrap process would finally begin on the 22nd January. Well I can report that that has not eventuated at this point. I have pinged @khaleelkazi in the ticket to see if a new ETA is available, but have not heard back yet. I was hopeful that with a definite date given this would occur, but now we go back to patiently waiting for an update. I'll let you know what's happening as soon as I have more information.

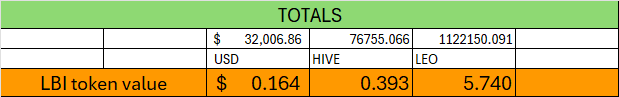

Totals

Big fluctuations in our totals this week. USD value is down significantly, due mostly to the drop in LEO value. This has also dragged the HIVE value down a bit, currently under 0.4 HIVE per LBI. The funds value in terms of LEO is way up, shooting from 3.879 last week to 5.740 this week. So, depending on which measure you prefer, it has either been a crap week, a slightly down week, or a great week. This is why I publish all three valuations daily, it's up to holders which measure they prefer. For me, my long term focus is the USD value, and holding over $30,000 currently, despite the significant drop of our key asset, is a good sign. LEO could go to zero overnight and we would still have a fund worth over $25,000.

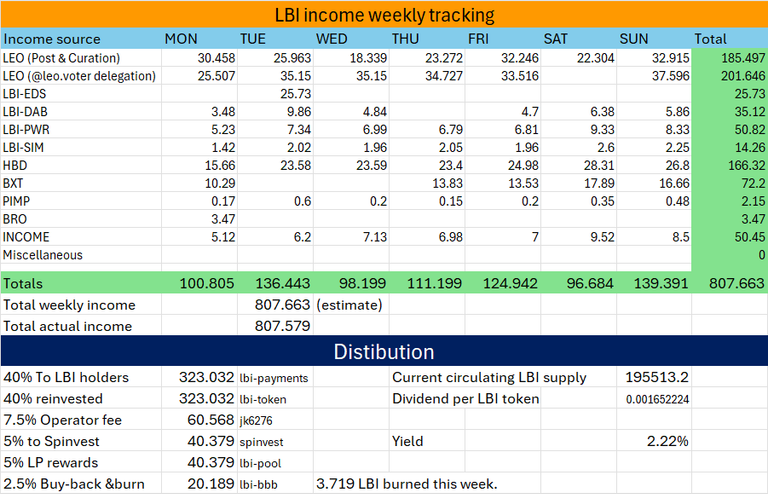

Income statement.

Here is where the drop for LEO works in our favor. Aside from LEO post and curation rewards, all our other income is HIVE based (or HBD). This means we get more LEO through the conversion of our HIVE income into LEO, boosting our payouts. This week topped 800 - which has not happened for months. Back previously when we were around 800, I was selling more HBD each week, and selling a decent chunk of our DBOND rewards to achieve this. Now, the 800 is more sustainable, without any tricks or manipulation.

The metric I look at on this sheet is the "Yield" figure. This works out the actual dividend you as LBI token holders get paid out - and it is growing. 2.22% APR is still small, in the scheme of things. But it is growing, and the fund is set up for this to grow over the long run. Our income will always trend upwards, as things like our EDSI and DAB assets are designed to grow. With an ever growing income, and a slightly deflationary token supply, dividend yield should trend higher over time. That's the design, lets watch over time if it works out that way.

If it works out as planned, hopefully we can all...

Conclusion

It has been an interesting week. LEO dumped, income is up, value's have fluctuated significantly and we go back to waiting to hear about our HBD unwrap. Let's see what sort of roller-coaster week we have ahead.

Thanks for the support everyone has given our content, it is always appreciated.

Cheers for now,

JK.

Posted Using INLEO

!BBH

That LEO dump was a bit of a bummer, but maybe it will go up as the 15th rolls around next month. We might be getting our HBD too, so that is good.

LEO definitely feels oversold, should come back I feel over 0.1 HIVE fairly soon, but who knows. The HBD unwrap is disappointing - I thought that having a date given that it was looking good. Hopefully just one last temporary delay, but I'm waiting for further information.

Thanks as always for dropping in and checking on these updates - it is nice to know someone is actually reading them.

Of Course!

My HBD unwrap finished a few months ago and I was waiting for my HIVE unwrap to start on the 22nd. The delay hit me too and I am now patiently waiting again.

Hello lbi-token!

It's nice to let you know that your article won 🥉 place.

Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You and your curator receive 0.0007 Lu (Lucoin) investment token and a 4.31% share of the reward from Daily Report 556. Additionally, you can also receive a unique LUBROWN token for taking 3rd place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART