LBI earnings and holding REPORT - Year 05 | Week 30

Welcome to this weeks LBI token earnings and holding post

What is LBI?

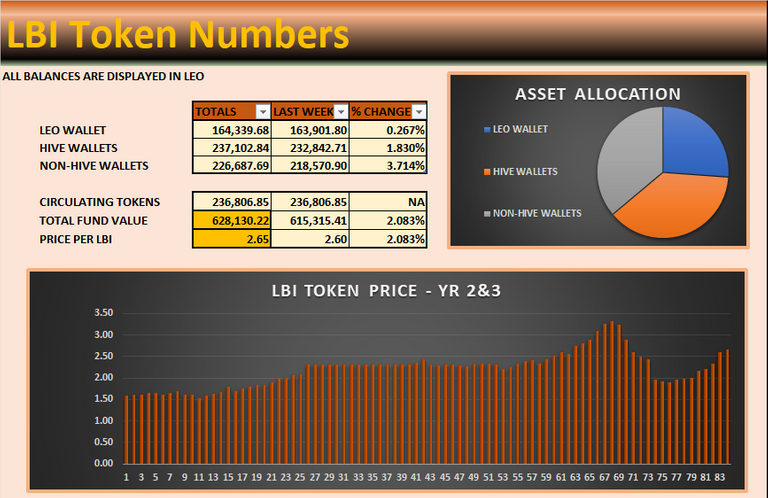

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

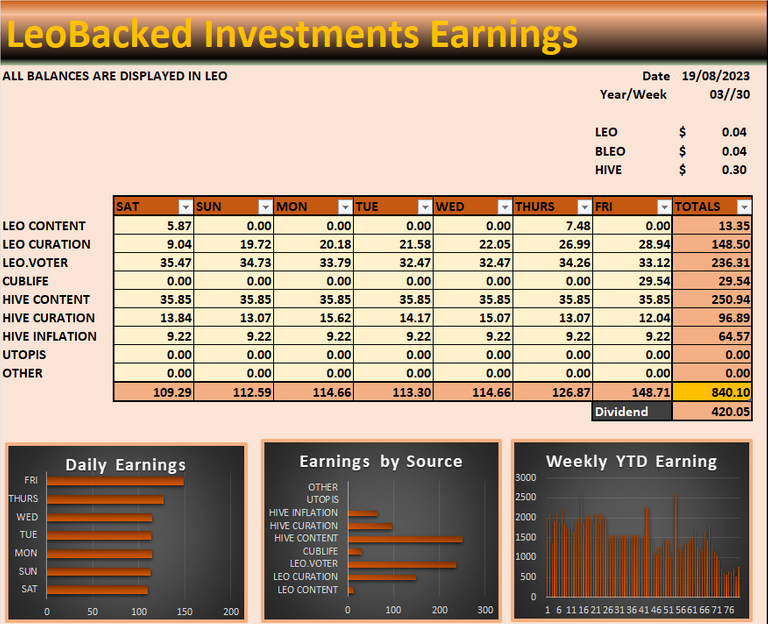

Earnings this week were pretty decent at 840 LEO, this has been around 600-700 this past few months so nice to see it getting higher again. HIVE content was our highest earner, leo.voter rewards followed close after and LEO curation came in at 3rd highest earner.

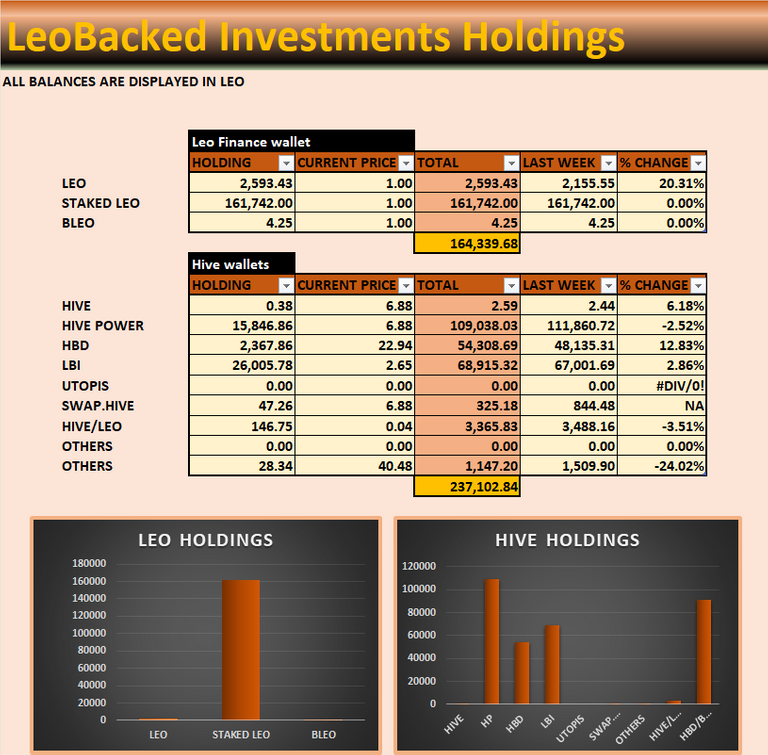

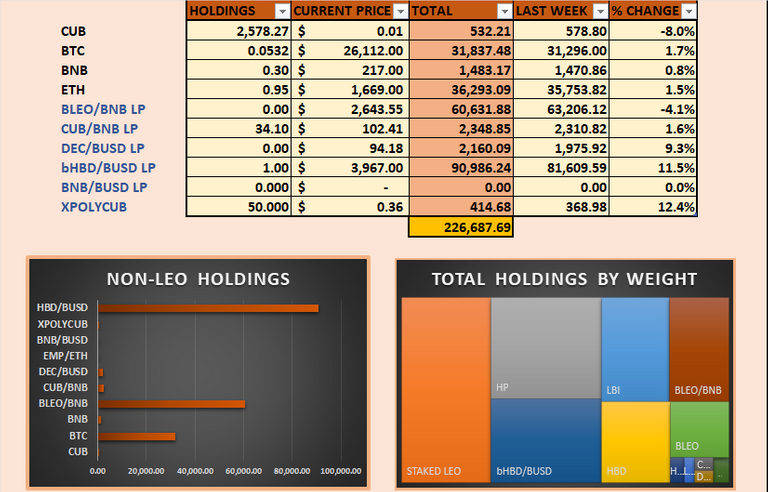

Most of our HIVE and non-HIVE holdings went sideways this week. Things went up and other stuff went down when valued in LEO but overall, its balanced out ok with LEO. Everything is down around 10% but we're going layers deep into ratios between, non-hive (BTC,BUSD) to HIVE to hive-engine (LEO) to find the LBI liquidation value.

Overall, LEO is down alot this week as is the rest of the market and with a long time before the next bull market, we could be in for alot of pain going forward. The LEO price is 4.2 cents at the time of writing which is -97% from its all-time high. This 97% price drip from just looking at the chart is not something to really be overly concerned about, most cryptos are down 90% and LEOfinance is a super low marketcap token so its swings will always be greater but im concerned about the LEO inflation rate. It could be very easy for LEOfinance to hit new-time high marketcap valuations next cycle but per token?, I think it's very doubtful unless 80-90% were staked are locked up somehow as buying demand needs to be greater than supply for the value to increase.

Quick update on CUBlife. Life got in the way yesterday and was not able to get that post uploaded. The price of CUB has now declined to $0.009 so im not really sure what to do with this going forward. A few people suggested that we convert it into a growth only but this would go against it being and an income token and if it be better to just merge it to LBI. I plan to leave it for a few weeks and think about it, no point in doing something fast when we have months before the next bull market starts.

Update on CUBlife dividends, these will cost 20% of total harvests in dev costs poer month, maybe 25% now CUB dropped to under 1 cent and when APY is already under 10%, we can't take that hit. Another option is to do payments monthly but this has to be done manually by me and takes some time. We'll let it a few more weeks, see if the price of CUB bounces back to at least 1 cent and see if our LP increase in value. Just right now, its not looking great. Luckly, each CL token is already worth 3-4x what they were issued for.

Thanks for checking out this weeks LBI report and staying up to date, Have a great week.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Let's just use dividends of CL into reinvestment until a said date since we don't get divs automatically. I don't like merging with LBI - if you're willing to go with that option show us the pros and cons.

Personally, i would prefer to return to manual div payout once a month since Jan 2024

Compounding each week is easy enough.

Can always rely on an LBI report to make me feel horrendous about my LEO investment choices 😂.

I thought I sugar coated it 🤣