RE: LeoThread 2025-08-17 16:31

You are viewing a single comment's thread:

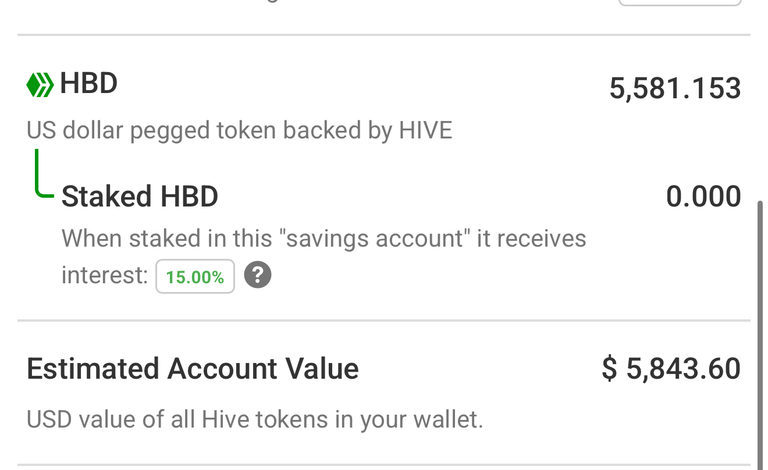

The @leostrategy account is holding $5,500 HBD in reserves

The 6 month reserve of HBD is kept to guarantee that weekly dividends are always paid on time

43,000 SURGE have been sold so far. The 6 month dividend obligation on this 43k SURGE = $3,225

As more SURGE sells, LeoStrategy will continue to maintain enough HBD reserves to pay 6 months of dividends. When SURGE’s presale is fully sold out, that’s 37,500 in HBD that will be held as reserves

The reserves get continuously added to from excess market making profits / Strategic ATMs

0

0

0.000

It's good to know how things are planned, thanks for the info 👍

Do you spect big moves from whales getting in?

Sorry if it's a Boeotian question, lol, but could - or will - LeoStrategy also buy $SURGE as a part of their reserves - as it's more yield generating than the $HBD, and has exposure to the upside the HBD lacks?

No worries lol

Nope I don’t see them doing this. The reserves are for purely dividend payments which are done in HBD

hmmm intersting... why couldn't it be staked HBD with some sort of daily unstakingbmethod to pay out the dividends... surely there's a way to capture that 15% yield for some of the HBD holding no?

Yes they'll probably end up doing this

eah I would think so.

This is a very good idea. The unstaking period is low enough. Keeping enough funds for the next dividend payout and staking the rest is a good idea IMO.

Yeah that's what I was thinking 🤔 would be a shame to not take advantage of that... but maybe there are some mechanics I'm unaware of.

I don't remember finding any details about some other mechanic involved. Staking HBD should work out fine.

yeah me neither