Am I ready to Retire? Part 1, 2024 Gold MapleGram25 divisable blister pack

It was about almost 28 months ago that I realize the possibility of not being able to return to my job. My health had rapidly declined such that I could pose a risk to myself or worse someone else.

“Black birds tend to like shiny things.” ~ The Bloody Raven

Disability benefits will not last and at some point another source of funding albeit markedly less will kick in. That will be beyond my control. Things will have to change. With real inflation, recession and uncertainty early retirement at our current times is less than ideal. Without the security of my job things can easily get difficult. Then again, is anything really secure?

The new calculus is that I am forced to retire well before my intended retirement date. What can I control? What do I need to do? Lets go on a little journey to see if my current finances can allow me to reasonably 'Retire'.

And enjoy the expensive shiny along the way.

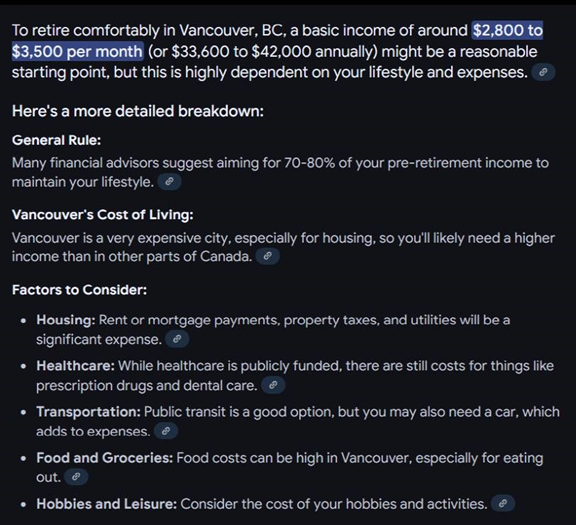

I asked Google AI; What would be a comfortable retirement income living in Vancouver BC?

The Result;

Interesting, then $33,600 to $42,000 shall be the target range, and anything more is a bonus.

Canada Pension Plan;

The maximum base benefit from the CPP ponzi is $760/month. My entitled benefit will be barely above $700/month with an extra $400/month supplementary benefit totaling $1,100/month. The previous years inflation adjustment is laughably 2.5%. This would just cover a little more than my monthly grocery expenses.

Municipal Pension Plan;

A much better run retirement fund compared to the CPP but this MPP fund relies a lot on income from a tepid commercial property market leases rather than on fresh contribution cash as the CPP. My benefit would be about $1,250CAD/month with an annual Cost-of-living adjustment (COLA) and a medical coverage perk.

RRSP/RRIF/IRA;

This is my own Tax sheltered, self contributed and self-directed retirement savings invested mostly in Mutual funds and ETFs of my choice. I am in the process of moving a significant amount from equities into cash equivalents leaving an Income & Dividend fund as my bare bones position. At only a market value $180k CAD I’m sure I could configure a modest supplementary income stream and still build some equity. I will draw only a minimum income $300.00 CAD/month to start.

As you will begin to see, my total revenue flows from multiple income streams. A principle I’ve learned years ago “…that a three legged chair is more stable than a two legged one.”

Rental Income A;

My home has a fully independent legal rental suite currently at an income of $1,050 CAD/month. This is well below the market rate of $3,055CAD/month and I haven’t raised her rental for the last five years since my tenant is another single mother relying on Social assistance and a part time income. Charging any more would take food cash from her family. Besides, we’ve become friends, and this is my way to pay-it-forward the same blessing someone extended to me when I was in a bind.

Rental Income trust B;

The property is a condominium in Trust between me and my siblings generating an indirect passive income. I can withdraw some capital if needed but there are specific rules to doing that but it’s primary purpose is to be financially self-sufficient with some capital growth.

I have a third real property is non-income but can appreciate in value and my foreseeable plan is to be buried in it. Burial plots are a hard asset that goes up with inflation. If necessary I, or my descendant could simply sell it.

Room & Board Income;

My younger adult son offers to pay me $300 CAD/month for the room & board plus pay for half my Car insurance. My elder son is currently unemployed. If I acted like a father I should do the tough love thing and boot them out for their own good, as a mom I’m letting them off cheap and the hugs are well worth it.

Investment Income from Savings;

Sheltered (TFSA) Tax Free Savings account; $20k CAD 50% in rotating 2.5% GICs and 50% Money Market Fund 2.3%, a small interest income of $480 CAD/year. This is my ERF Emergency Reserve Fund that served me well over the years. Meanwhile, my non sheltered checking account yield is negligible.

And finally the off-grid Central Bank of Ravenhill;

Cash on hand; $1,226 USD and $2,520 CAD, in case those credit cards and ATMs stop working just before a long weekend.

Gold Stack, in troy oz; shhh! 🙄

Silver Stack, in troy oz; top secret 🤐

My Crypto portfolio in USD; $28k USD

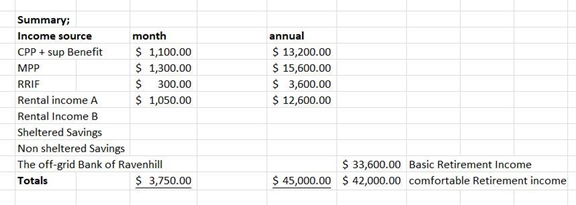

Summary of Retiring Income sources;

Let's add it all up for some totals...

And it looks like I can do this comfortably with a little margin to spare. Retirement looks affordable but that is only half the story. I will follow up with a later post that will deal with the Expenses side of my looming retirement.

It would be sensible to allow my other assets to accumulate as a reserve until needed as we know the effect of real world inflation.

I'm almost ready to join #silverbloggers, isn't that almost poetic?

So, are you ready to retire? 🍹

And thanks @punkysdad for putting me on the road to being Financially responsible.

By the way, it's HPUD. Powering up 111 Hive power!

Stacking Hive, Precious metals and fun for those dark stormy days!

The #piratesunday tag is the scurvy scheme of Captain @stokjockey for #silvergoldstackers pirates to proudly showcase their shiny booty and plunder for all to see. Landlubbers arrrh… welcomed to participate and be a Pirate at heart so open yer treasure chests an’ show us what booty yea got!

References & Sources

RCM Mint.ca 2024 Maplegram25 divisible blister pack.

Photos are my own shot with an aging 2018 Samsung SM-A530W or otherwise indicated.

P. Image under Pixabay

W. Wiki Commons

☠️🎃 Page Dividers by thekittygirl. ❄️🌞

Cameo Raven Brooch from The Black Wardrobe.

The 2024 Hive 0.999 Silver Round.

Physical precious metals bullion stacking is only a part of my personal overall financial strategy. Meanwhile, collecting numismatics are a different set of objectives and strategy. Unless you are a complete nutcase as I am please, do your research before deciding to buy into any bullion or numismatic products.

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!

I hope that things will turn out well for you, and you can get your early retirement. Well at least you already have some income stream that would. definitely help you get the cash when you retired

That 3500 USD is a huge sum of money here in my country, its like almost my whole salary for the whole year.

And some of your precious metals hoard will definitely a good safety net, incase something is happpening.

Glad to have aboard my blog @ekavieka

I am fortunate to have that I made financial goals and preparations early enough to get to this point. I admit there was some luck on a few investments that made a big difference. And my late mother gave me some capital when she downsized her home several years ago.

$3,500 USD is a lot of cash to me too and enough to buy one ounce of gold. It is equivalent to $5,010 CAD in my country of Canada.

My precious metals stack functions as my financial last line of defense, or fill in the gaps should things go wrong. Otherwise, I will gladly pass it on to my children as a family legacy.

On another note, I’ve lost count of how much silver bullion I have. I will have to do a physical count this summer.

!LUV

@ekavieka, @kerrislravenhill(4/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

Congratulations @kerrislravenhill! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Sending you good vibes!

I also just started what I plan to be regularly buying .25 ounce coins instead. I grabbed a 2025 Australian coin this week. I’ll plan on buying one every time my gold DCA savings hits that number. !PIMP

sending u bonus HSBI!

i also think I’m gonna realign my bitcoin/gold DCA ratio. It’s been heavier BTC but I think at this level where I’m at I’m gonna move it to favor gold more and go 50/50

Cheers! 🏴☠️

That plan sounds sensible @geneeverett

I never understood why the division between Gold and BTC is so black and white. I see these as complimentary having the same objectives and goals. I find the idea of crypto as digital cash is cool yet, I like gold as a vintage decentralized asset as I can feel it in my hands.

Thanks for the HSBI.

!PIMP

!PIZZA

Let’s go!

I skipped the half troy oz. and will be accumulating the ¼ oz. gold Maple leaf coins as well. That is a nice practical size with a very doable Affordability vs Premium tradeoff.

!LUV

@geneeverett, @kerrislravenhill(5/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

The Best Part of all this Young Lady @kerrislravenhill is......... Happy New Year by the Way !

It will soon be time for the RV and all the Speculation on what it will take to get by will be in the Rear View Mirror.

I am Not going to go into Details Here and bore everybody who may Read This, Just Trust in God.......

!LUV

!LADY

!PIZZA

@kerrislravenhill, @stokjockey(1/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

View or trade

LOHtokens.@stokjockey, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (1/5 calls)

Use !LADY command to share LOH! More details available in this post.

@stokjockey you know my RV would look more like this...

!PIZZA

!LADY

!LUV

@stokjockey, @kerrislravenhill(6/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

View or trade

LOHtokens.@kerrislravenhill, you successfully shared 0.1000 LOH with @stokjockey and you earned 0.1000 LOH as tips. (1/35 calls)

Use !LADY command to share LOH! More details available in this post.

That's what I'm Thinking Young Lady @kerrislravenhill

!LADY

$PIZZA slices delivered:

kerrislravenhill tipped trautenberk

@kerrislravenhill(6/10) tipped @silvertop

kerrislravenhill tipped geneeverett

stokjockey tipped kerrislravenhill

kerrislravenhill tipped stokjockey

Moon is coming

It's always nice to have Family on your side...

Thank God for that.

In my Executors career I have seen families become long divided and bitter even over seemingly trivial assets.

Making unsubstantiated claims without any proof other than of self-entitlement.

I tactfully remind everyone that I go with what is in contained therein the deceased’s last Will and Testament.

Well, that's always a plus... What's better to have, a Will or a Trust...???

A will, preferably notarized (Witnessed by an official like a notary public.)

👏👏👏💯

Welcome aboard my blog @yundie8710 and thank you.

I´ve been looking forward to retirement since I was 15. I'm 58 now. In my country, the retirement age is 65. And I hope to be able to stop working at 60 and have enough money to continue living happily.

!HUG

!HBITS

Retiring at 60 is a perfectly good goal @trutenberk if you had started saving and investing your retirement saving back when you were 15.

Some of my staff chose to continue to work past 65 years of age. Most continue for financial security reasons, some simply what to maintain their routine fearing that boredom will take away their quality of life. So, “Get a hobby!” !LOL, on Hive.

Each person does have a vision of what Retirement should look like for them. It is not simply stop working but choosing what you what to do.

!PIZZA

!LUV

@trautenberk, @kerrislravenhill(7/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

lolztoken.com

But I can see mine on my counter.

Credit: reddit

@trautenberk, I sent you an $LOLZ on behalf of kerrislravenhill

(1/6)

Retiring can definitely be a challenge…🙄

The 2 1/2% inflation they are claiming is truly laughable!

Sounds like you have several ideas how to make this work. You are planning that is the best at this point.👍😊

I’m still figuring the (OAS) Old Age Security part. It sounds like a financial supplement be better described as CPP 2.0 as an add-on fix to the rigid CPP policy. This support basically tops up the existing CPP benefit making up for a chunk of inflation. However the benefits can be clawed back depending on the recipient’s income for the previous year. I don’t know how much I qualify for here.

I’ve been conservative with my numbers in this calculation. So this picture can appear rosier than first stated.

Thanks for the comment @silvertop

!PIZZA

!LUV

@silvertop, @kerrislravenhill(8/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

Hopefully the CPP will bolster your retirement income......

I can understand that clawback, they do that here with property tax, retirement income shouldn't be taxed!👍😇😀

Health is the most important thing Kerris. Without it money means nothing, neither does your stack. I don’t know what exact health issues you have, but my prayers are with you.

True @silverD510 I have to step up my health game if I want to see my future Grand kids. And I want grand kids!

!PIMP

Please do Kerris, I consider you a friend and don’t want you going anywhere.

It is good to plan, sis! And it is great that it seems that everything will be okay!

#silverbloggers ... for those born 1965 and 1980 owards !LOL.. we both can join in!!!

Much !LUV sis!

!BBH

!LADY

@kerrislravenhill, @silversaver888(8/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

View or trade

LOHtokens.@silversaver888, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (9/50 calls)

Use !LADY command to share LOH! More details available in this post.

lolztoken.com

and accidentially won the Tour de France.

Credit: blumela

@kerrislravenhill, I sent you an $LOLZ on behalf of silversaver888

(3/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

I can see it now Sis, “Silverbloggers talking about #silverstacking.”

Always, with !LUV 🤗🌺❤️

!LADY

@silversaver888, @kerrislravenhill(9/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

Congratulations @kerrislravenhill! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

You have a good start in the right direction. Rely on God to guide you; those around you who have good knowledge of what to do and seek their council. Trust, for it will all work out!

Praying for you sis! Much !LUV🤗💜🌹😘😍 !LADY !HBIT

@kerrislravenhill, @elizabethbit(1/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

View or trade

LOHtokens.@elizabethbit, you successfully shared 0.1000 LOH with @kerrislravenhill and you earned 0.1000 LOH as tips. (2/35 calls)

Use !LADY command to share LOH! More details available in this post.

It may seem rather odd investing in a burial plot. But funeral costs can sure wipe out a lot of cash when making emotional decisions.

I hope I live long enough to have grand kids.

!LADY

!LUV

@elizabethbit, @kerrislravenhill(1/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

It's good to plan; we have begun thinking about a will and will get it done this year. Burial? Not yet, but it has crossed my mind.

No one ever plans to not be of this world but having something in place is a good idea. Look forward to those grandkids sis! !HOPE !HBIT🤗💜🌹

Good for you! No, I'm not ready to retire but I am from health issues thanks to the COVID vaccine. Multiple income steams is the key to survive, and you're doing that very well. If I could do it all again though, I would have invested more in rental properties like you did. They have their headaches, but the revenue is very nice to see every month. And I think you are a great mother for not booting your son, I wouldn't kick my son out either. That's tough love gone too far!

!BBH

!LUV

@kerrislravenhill, @thebighigg(4/10) sent you LUV. | tools | discord | community | HiveWiki | <>< daily

Your new share balance will be effective in the upcoming prize pool draws from now on, forever and ever...

DrawMatic shares last a lifetime!

The more shares you own, the higher your chance of winning in each and every upcoming draw! 😎

Any vacation destinations?

Not until everything in the crazy market settles.

!PIMP

Oh, I hope everything goes well.

With seeing $10,000 CAD of equity wiped out of my retirement savings over the last five days by the market turmoil I'm off to a rough start. Could be worse, I got more than enough left. I'll survive okay, but worry more of friends and family's welfare @angeluxx

Great post…

I need to calculate mine. I also have a good chunk in RRSP and about $50 k in TFSA… mostly Bitcoin ETF … I’d like to retire within 2 years

I still have 2 kids in University though … that’s is very Expensive these days.

https://brave-smoke.com

https://blurtplugin.online/account/

If you wanted to make an account on the blurt.blog blockchain, feel free to use my voucher code: BLURTL3K2J1H2G3F4

BE SURE TO BACK UP ALL YOUR DAMN KEYS

https://youtube.com/shorts/4x3y7Lhz2uw?feature=share

https://youtube.com/shorts/SVo15jYBu4E?feature=share

https://youtube.com/shorts/zDJGipGbFZI?feature=share

https://youtube.com/shorts/NXJmpX1Yyks?feature=share

https://youtube.com/shorts/Mj6ufAipX2k?feature=share

https://youtube.com/shorts/wXEaq7ACppQ?feature=share

https://youtube.com/shorts/YuQtML_7w4A?feature=share

https://youtube.com/shorts/xz040LZ5-CE?feature=share

https://youtube.com/shorts/sY1ckbsY2o0?feature=share

https://youtube.com/shorts/auQLvboAA9I?feature=share

https://youtube.com/shorts/JzmbII9Hbi4?feature=share

Share with all your friends. If i can help you with any of these things, let me know. Here are some places i also earn passive cryptocurrency...use the below links to make an account for free!

https://trustdice.win/faucet/?ref=u_bardsilver

code: u_bardsilver

https://freebitco.in/?r=55368859

https://firefaucet.win/ref/1444419