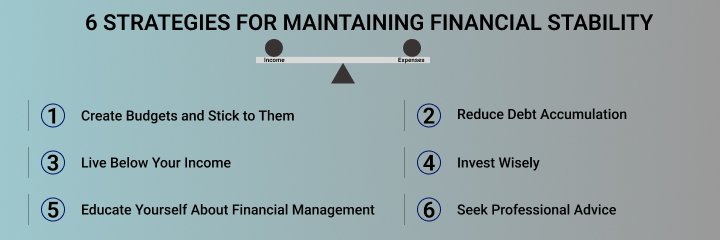

6 STRATEGIES FOR MAINTAINING FINANCIAL STABILITY

Hello everyone! It’s another beautiful day to explore in the Hive community. I remain your girl, @katezauka.

First, I’d like to salute the management of the Hive Reachout Team for their awesome initiative in coming up with such amazing topics. These are not just writing prompts; I see them as educational systems that everyone truly needs to equip themselves with.

I say this because I know many people, myself included, struggle financially simply because they don’t fully understand the topic, "Strategies for Maintaining Financial Stability." Thankfully, after diving into this topic, I believe my financial lifestyle will change for the better.

So, without wasting any time, I’d love to share my insights and experiences. But before then, What is financial stability?

In a simple term; Financial stability is a state whereby an individual maintain a balance between his/her income and expenses. After thorough research, here are six (6) strategies that I believe can help you and I maintain financial stability as we earn from the Hive blockchain and other extra sources of income:

1. Create Budgets and Stick to Them

One common mistake I’ve noticed is that people either don’t create budgets or fail to stick to them. A budget is essential for maintaining financial stability. It ensures you plan how your money is spent and prevents overspending. To succeed financially, create a budget and spend within it.

2. Reduce Debt Accumulation

Unfortunately, some people live lavishly on debt, borrowing money or buying things on credit just to satisfy their wants. Often, the money they expect may not even cover their debts, leading to a cycle of financial stress.

I used to be in this situation until I resolved to reduce debt to the bare minimum. Debt drains not only your finances but also your peace of mind.

3. Live Below Your Income

If you want to maintain financial stability, always spend less than you earn. This allows you to save more and avoid unnecessary financial stress. Focus on your needs rather than your wants. Identify what’s truly essential and let go of items or expenses you can do without.

4. Invest Wisely

Many wealthy people today are successful because of wise investments. Investing is a critical tool for building financial stability.

As you spend on your needs, set aside a percentage of your income—at least 10%—for investments. Over time, these investments can grow your income and help secure your financial future.

5. Educate Yourself About Financial Management

There’s a saying, “If you are not informed, you are deformed.” This is not far from the truth when it comes to finances. Financial knowledge is a powerful tool, and it’s easier than ever to acquire. Thanks to the internet, YouTube, social media platforms, and Hive communities like @Hive-Reachout, where you can learn how to manage your finances effectively from other community members. Equip yourself with the right information. it’s a must for maintaining financial stability.

6. Seek Professional Advice

I strongly believe in the power of mentorship. The financial challenges overwhelming you today have likely been experienced by someone else before.

Seeking professional advice can save you time, stress, and money. For instance, if you’re considering starting a business, a professional mentor can help you avoid costly mistakes and set you on the right path.

Conclusion

In conclusion, the strategies I’ve shared above are my personal opinions and research-backed insights. By implementing these strategies, I believe we can all take steps toward achieving financial stability.

Thank you for reading! I hope you enjoyed my entry and found it insightful. 😊

Flyer Design: Figma

Posted Using INLEO

Your strategies are wonderful and insightful.

If we can stick to such I believe financial stability will be a possibility. Thanks for sharing @katezauka

Definitely, Thanks for coming by...

Wow! You open some deep things on financial stability if one will be discipline enough to follow like 3 thoroughly. Thank you for sharing your thoughts with us ma'am.

You're always welcome

All thanks to @hive-reachout for giving us the opportunity to explore and advance our knowledge on finance🤗

Your Strategies are so wonderful Ma

For me I See like if someone reduces the depth accumulation some can go far Thanks for sharing.

Actually, one can end up accumulating depts he or she cannot pay at the end of the day. Thanks for reading through