SMAs are a lot harder than I thought.

This post is a continuation of my previous analysis of the Simple Moving Average strategy. Simple Moving Averages aren't that Simple.. Now, we tried different approaches earlier by adding the standard logic of 1:2 risk to reward on the Entry and with various SL (2%, 3%,1.5 ATR and 2 times ATR).

Having a rigid SL didn't work in my favour as the price went up; my SL stayed at the same level. And whenever the SL is triggered, I lost the opportunity the trade presented before. The thought process was to drop the target and follow the price with a trailing SL. And the results surprised me a lot.

THE BACKTESTING

Entry Rule - EMA9 is crossing over SMA50.

Timeframe - 1D

StopLoss - Not rigid, but trailing.

Target - Not Applicable

Time Period - From my last Financial Post to date (Oct 2024 - Sep 2025)

I am using the same data from SBIN from the previous post.

Again, the same entry points.

Trailing on Day's High

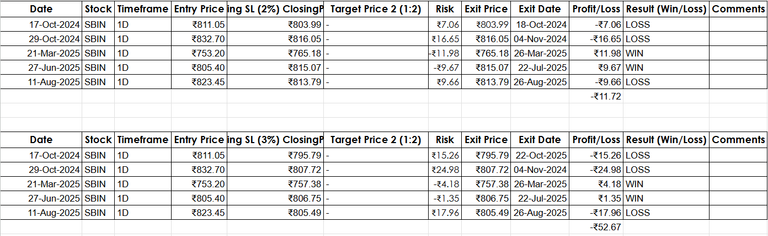

Let's set the SL at 2% of the day's high. This should help us with managing our losses.

The results are no different from those in previous cases. 2Wins and 3Ls. The key difference here is that while in the rigid SL the losing trade pushed me by INR 49.34, here the loss was of INR 23.47, but the winning trade's contribution also dropped, and I had to bear a net loss of 6.38.

Let’s see if the SL is tweaked to 3% of the day’s High. Still losing, but the numbers were magnified. The Push from the Losing trade was around INR 40.30. Results (2W /3Ls)

Trailing on Day's Close

Trailing the close prices seems to be a good Idea, Let's try that out and see if trailing the close price has any effect on our trade. It does, but in a negative way. It is worse than trailing the HighPoint.

Switching it up to 3%. Yup, just magnified the losses. And the only difference is that the trade duration is significantly increased. But still, the target is to improve net P&L and not to increase the Trade duration. Although if I have to highlight the silver lining, here is that there is a good chance that an increase in holding period can increase the chance of earning a Dividend.

Trailing on 2times the ATR on High and Close

I think I have identified the issue with my setup, but let's first run the 2 Times ATR trailing for High and then the closing price and check if that made any difference.

Not good, and I think the reason is my Exit strategy. Without a target, my stocks touch several peaks, but still, I couldn't convert that into Profits. Let's see if adding targets improves the odds.

Will test that in the next session and share the results.

Hi Folks,

I am having fun with this learning and sharing exercise.

You have no idea how long it's been since I used the logical formulas in Excel. Actually, I wanted to run the scenarios in Python, but I frequently ran into problems and errors. And that's why I decided to go hands-on with this one. While I was hoping to conclude this with an analysis here. But since I am having so much fun making this strategy, I am planning on running a backtest on all the NIFTY50 listed stocks.

See ya all soon.

♥️ ☮️

And a big thank you and hug to IndiaUnited and the BeAwesome community for helping and supporting me.

Posted Using INLEO

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited..

This post received an extra 15.06% vote for delegating HP / holding IUC tokens.

Sach mein bhai Youtube mein kuch bhi bakwas bol de rahe hain, Jab tak khud se test nahi kar lete bharosa nahi karna chahiye,

❤️☮️

ye to apne bilkul sahe kaha bade bhai. good night

Congratulations @inuke! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Congratulations @inuke! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Congratulations @inuke! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: