The Future of Tether & Circle

The crypto market is something unique thanks to its distinctive sides compared to the others. Cryptocurrencies diverge from the stock markets as they are not issued/minted by a company that has liquid funds, organizational structure, or immovable assets like the ones in the factories. Rather, in many cases, the coins are printed and then an organization is formed according to the demand the issuers perceive.

The "out of thin air" side of the market is unfortunately not sustainable and there will not be any place for such activities in the industrial part of our market. The regulations will be formed around tracking the transactions, reviewing the hodlings and monitoring the projects' operations to prevent any frauds.

In the advancement of our market, some projects have exclusive attributes such as stablecoins and Bank-to-bank or Business-to-business services. Although what they serve is nothing brand new, their on-chain transactions surely change the way certain things have been done so far.

Stablecoins had been viewed as spies in the market due to their close relations with the banks and policy makers. Yet, today we come to the conclusion that they are the gate that opens to the mass-adoption of our ecosystem. The primary source of liquidity has been the USDC or USDT coins issued by Circle and Tether to turn the market into green.

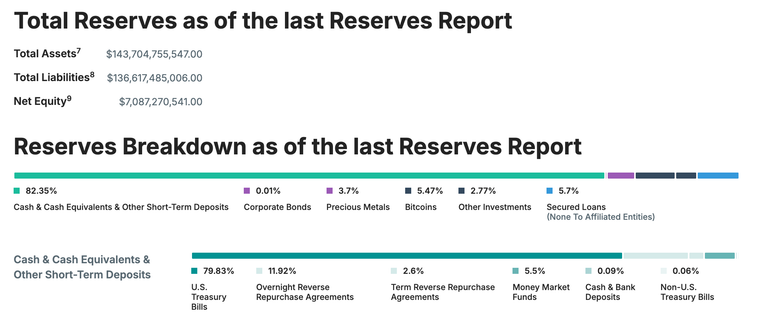

This is the Transparency report by Tether Inc.

You will directly notice the cash equivalents the company holds as a reserve for the USDT tokens issued on several chains.

The stablecoin projects' future has been shaped by a certain path: new buyer for Treasury Bills and Government Bonds. If a country represents itself as a crypto-friendly or crypto investor, you can expect it to work on the mechanisms that can enable the printing of the digital form of its fiat money to back it with the treasury bills automatically purchased by stablecoin issuers.

The more treasury bills or government bonds are sold by the countries, the lower interest rates will be paid. Also, those who put their money in these assets will notice an increase in the price of them in the secondary markets. So, creating money out of thin air can become an almost sustainable method of having more debts cheaper for the governments 😉

Stablecoins will be with us for a long time as long as they accept to adopt the new role assigned to them. So long as they can make gains from their businesses like Tether had $13B profit last year, the model can bring win-win for all.

What do you think about the future of stablecoins in crypto?

Share your thoughts below 👇

Hive On ✌️

Posted Using INLEO

We are very hopeful that crypto won't be ignored for long. Stablecoins is a gamechanger in the future of crypto mass adoption. However, Tether and Circle can't cover the need, hence the need for more stablecoins.