Economic & Crypto Calendar (June 26 - June 30)

We are starting a brand new week before July. The monthly closes of candles will be pretty important in crypto ecosystem. All eyes will be on Bitcoin as it is going to lead a Bitcoin cycle before a pump in the whole market.

In the world, we will see Powel twice! Most probably, his hawkish stance will turn the markets into red because he stated the expectation of 2 more interest rate hikes in 2023! He is likely to emphasize this situation to "tame" the bullish sentiment in the markets.

Let's talk about the next week's calendars!

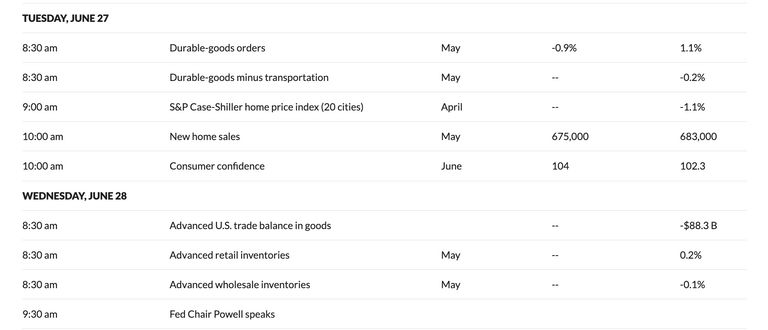

Economic Calender of the U.S.

Personally, I do not expect huge volatility in the markets as there will be 2 days of Powel exposure afterward. Unless a global problem, the party will start at 9:30 a.m. on Wednesday.

On Tuesday, we will expect fewer home sales because of increasing interest rates and the expectation of consumer confidence to increase by 1.7 points (?)

We will have Powel on Wednesday with all ears and eyes because he may impact the sentiment in the markets deeply.

Also, his speech will continue on Thursday. (What a week 😅)

I care about the data coming from initial jobless claims. The forecast is 1k more jobless claims. This data might be positive as it is believed to soften the rise of inflation. when people lose their job...

On Friday, there are lots of data to be watchful. Among all of them, I will be waiting for Core PCE and PCE year over year data. Powel emphasizes their concerns about the situation in the Core PCE index because it is less volatile.

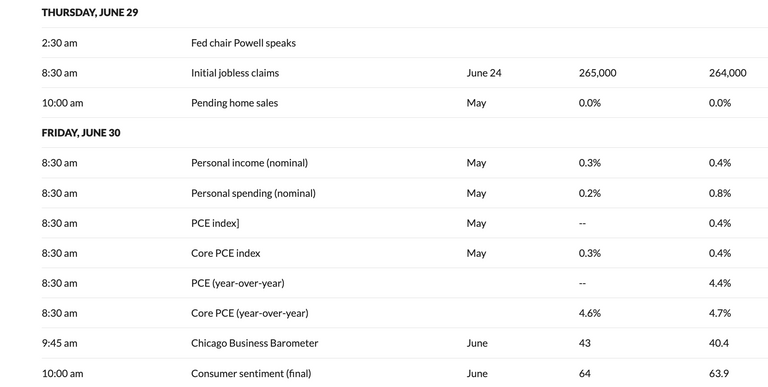

Economic Calender of G20

The economic calendar will be driven by the U.S. as the influence of Powel will be felt a lot.

We will get Gross Domestic Product rates of the U.K and this is likely to impact the value of GBP. the Median Forecast is 0.2% for year-over-year and there is expectation of stability in the monthly time frame.

What's more?

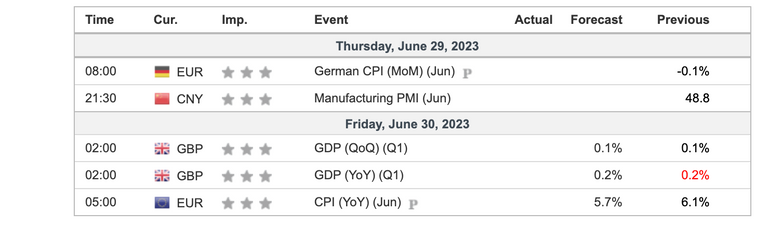

CPI of Euro Zone is coming!

Former CPI rates are provided.

It seems like there is a positive sentiment among the market speculators and the forecast is as low as 5.7% for this month.

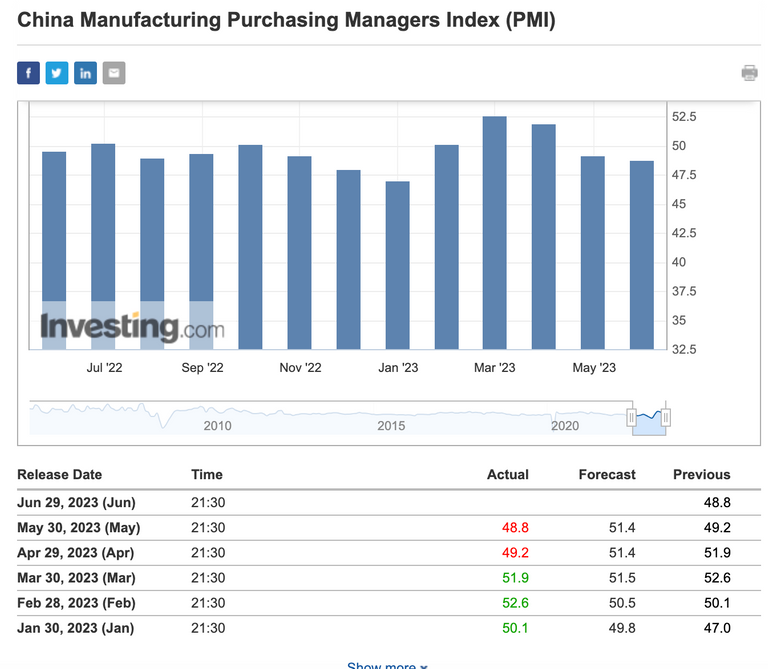

One last thing. CHINA's PMI!

As I always remind in economic calendars, we need stronger PMI and production from China as the world is fearful of a global recession.

If the rate is above 50, then we may have a positive atmosphere in the markets.

Crypto Calendar

Crypto will be affected a lot by the data coming from U.S, Euro Zone and China. Obviously, while there are too strong parameters to impact the market, we, naturally, expect volatility.

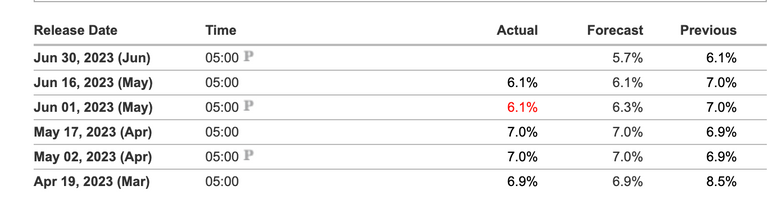

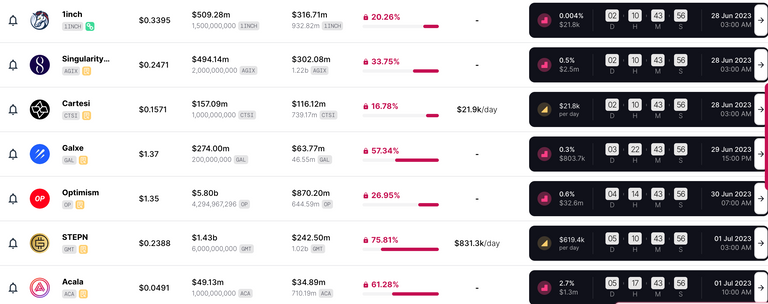

These are the token unlocks by popular projects. Sometimes they may have an impact on the markets as inflation of the circulation supply changes drastically.

In a June 9 update, Robinhood said it will end support for the three tokens starting on June 27 following a review. In a Twitter thread, the firm specifically cited the SEC’s actions as reasons for the delisting, saying the Coinbase and Binance lawsuits “introduced a cloud of uncertainty” around the tokens — the only three in the cases that Robinhood supported.

Robinhood will delist SOL, MATIC and ADA because they are accused of being unregistered securities by the SEC. If you have some funds of these tokens on Robinhood, you have 2 days to take action. What do you think about the effect of this event on the price of the tokens?

Share with us below 👇

Weekly Economic Tasks with the help of @anomadsoul!

Do you want to learn about macroeconomy and follow the news while creating content on LeoFinance?

Here we have 2 tasks for the week:

Mini Task: What happens when MATIC, ADA, SOL, and others are labeled as "securities"?

Please create your posts by Wednesday Midnight (EST)

Mid Task: Option 1: What is the ideal CPI for an average country?

Option 2: How should then countries deal with extremely high / low CPI?

Mid Task to be submitted by Saturday Midnight (EST)

Hive On ✌🏼

Posted Using LeoFinance Alpha

https://leofinance.io/threads/idiosyncratic1/re-idiosyncratic1-cumkfl1f

The rewards earned on this comment will go directly to the people ( idiosyncratic1 ) sharing the post on LeoThreads,LikeTu,dBuzz.

Can't wait to see those politicians and bankers coming on camera and telling us how we are doing... Gotta love it! 😃

From my point of view, these events are important to follow as what follows on the markets after them is what counts the most... Recently, I have noticed that many times markets didn't react at all, which is another indicator that I like to follow... The moment when people will say... "It's enough!"

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Exactly 🤡

Thanks for picking ✌🏼