Big Moves Ahead for Silver and it is Just Starting!

Today, I will be talking about my silver habits, some background on types of investment silver, and then I will give you some of my insights on what is and will be happening in the silver market toward the end.

It has been a really long time since I have posted anything here. It's not that I'm out of the silver or gold markets. The stuff I have sits in my vault and I don't think about it, but I do track prices daily and news that move the price.

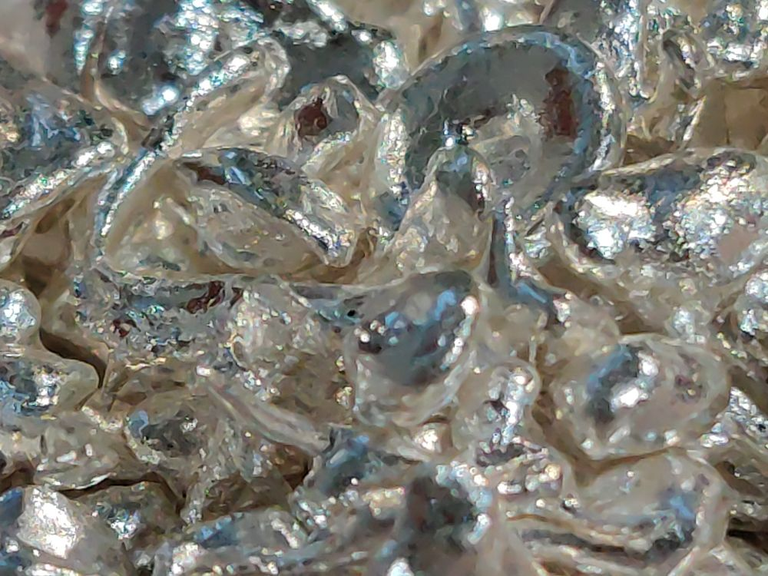

This one will be about silver, so I'm going to go over what has been happening with my silver buying since my last post. But first, I will let you know the types of silver that I normally buy. I buy silver coins, and I buy what you might call granulated investment silver which is sold in troy ounces. It's not actually granulated, they take liquid silver that they have melted and refined, and they pour it in a bucket of water. It looks more like droplets I suppose.

Here's what it looks like -just a small amount in the palm of my hand. The pieces can be very large or even smaller than a BB

I guess you might say, "there are no two alike." Once they let it dry, they sell it by the ounce or, where I live, by the kilo.

| For reference: There are 32.15075 troy ounces Per kilo.

In the beginning, I would buy a kilo of silver or even less if I were buying gold and just wanted my change in silver rather than paper dollars. I took the metal home and would store the smaller amounts in bags with the weight written on them. If I got even kilos, I would store them in peanut butter jars, plastic ones (very important so that you don't have to separate silver from glass if the worst thing happened).

Here is what 2 kilos looks like.

I paid $1,200 for this 2 kilo jar, or $600 per kilo. This is the oldest jar of investment silver that I have and I paid $18.66 per ounce.

Before ever purchasing physical silver, I was dealing with silver ETFs (exchange traded funds) on the New York stock exchange. I did that, until I deduced that ETFs did not hold silver enough to cover shares.

Recent Price Action

Since then, I have seen a very, very slow increase over the years, which makes silver a good investment, but it had not increased at levels I had expected it to have done..

In the last year I have ramped up my silver buying and I no longer put what I buy into jars because I ran out of jars. I now store my silver and 5 kilo bags.

It looks small in size but imagine if I were holding 10 bags of flour or 10 one pound packages of sugar. They would occupy a lot more space.

The last time I purchased silver it was $1,200 per kilo, making this bag that you see here worth $6,000. Compared to the price of my very first buy, 5kg would have cost $3,000, which makes now a great time to make this post, having doubled my (paper) money over the years, less so on subsequent purchases as the price increased for latter buys.

That's it on what has happened up to this date.

More Bullish Signs

I don't see any premiums being added to the silver prices where I live, but I do see them at other locations around the world. So what is a premium?

If the supply of physical silver is very low or even non-existent in a certain area of the country, or in my case 'of the world', dealers have to find silver to buy when their customers want it. That is, when customers keep coming in asking for silver, and dealer has to tell them "no" much of the time, the dealers will look for a supply of silver and pay a premium to obtain physical silver during those dry physical markets.

As an example of the above, there was a point in time when silver was published at $22 per ounce, and I bought a 1 oz coin for $30 - in other words, I paid an $8 premium to obtain that 1oz coin.

Next, I want you to imagine an industry that needs silver to make their products (products like solar panels, the solder used to put together computers, etc.). They must absolutely have silver in order to keep their doors open, make products, and sell them. Those companies are going to pay for premium to obtain silver that otherwise cannot be found. That means, some people who have silver will be offered a premium, more money than the published price, in order motivate them to sell their silver. If a dealer can successfully buy silver, at a premium, he can then supply those companies with it. The premium is set by the people or entities that have silver, and their willingness to part with it or lack thereof. I heard one of you asking, "who gets the premium?" That would be the unwilling seller. I believe this is happening all over the world, more so in some places than others, but it is happening.

In the last year, I have added upwards of 20 kilos to my holdings. I'm planning to ramp that up even further for the next 7 months till the end of the year. Probably more so as I hear more rumblings about shortages of silver in industry or even at the dealers.

As with anything you read online, do some research before you act. I do not expect people to follow the same pattern that I am about to execute, or that I have developed in the past. I'm just giving you my honest opinion about how I think things are going to go. If there are shortages, then prices will be higher. The more shortages there are, the higher the price of silver will be.

I do keep my ear to the ground related to metals year-round, every year. And I did want to update my blog before things get wild and silver becomes unattainable so that you are aware of what is happening while it is still at reasonable prices.

I am leaving you with one more look the product we've been talking about. I opened a five kilo bag and zoomed in on it for you, I hope my phone camera does it justice on your computer screen! Thanks!

The gold charts are moving like I have never seen before. Why so much silver? I would think it to be really hard to store all that bulk.

Congratulations @goldbuyer! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 36000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP