MicroStrategy's Bitcoin Strategy Beats Even Bitcoin

Numbers don't lie. Maybe they do. But they do tell an interesting story.

I think it is safe to say bitcoin has been the most valuable asset of this century so far. Its growth has been more than remarkable. Going from zero, then pennies, then dollars, to tens of thousands of dollars worth in a decade is has not just been impressive but disruptive in many ways. The bitcoin phenomenon not only paved the way for new type of thinking about money and technology, but also demonstrated the power of decentralization. It is a simple, yet one of the best innovations of our times. There have been many innovations in our history, but not many carry benefits of this scale. I can go on an on talking about bitcoin, but his post is about something else. It is about bitcoin strategy. Perhaps, MicroStrategy should rebrand to BitcoinStrategy.

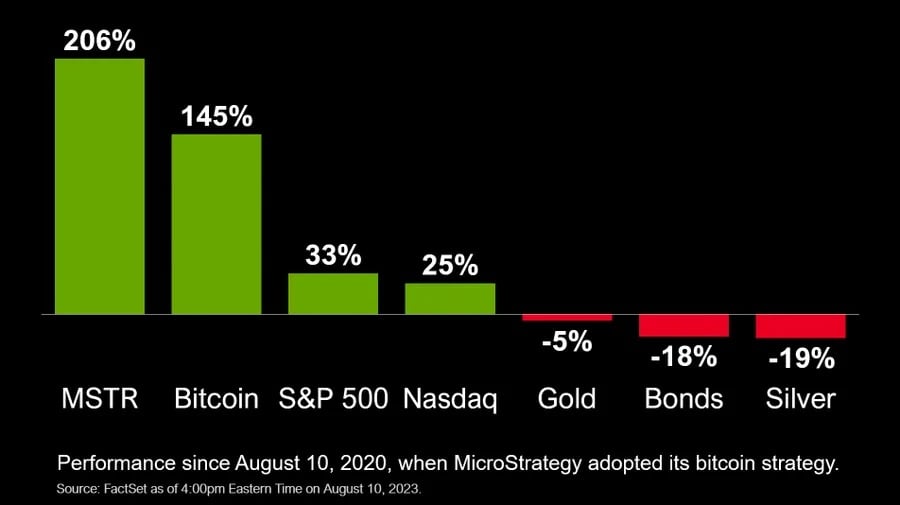

It has been three years since MicroStrategy has decided to buy bitcoin with their cash in the treasury. It was the first publicly traded company that made such move. Michael Saylor have explained this strategy extensively in many talks. It just made sense for the company to buy bitcoin to preserve its assets. Today, we can see how bitcoin have outperformed almost everything within last three years. What is more impressive is that MicroStrategy outperformed bitcoin too. MSTR is up 206% since they first put bitcoin into their balance sheet. In crypto world 206% up may not mean much, when there are occasions of assets going 10x, 20x, etc. But in general terms doubling the value in three years is really good. Especially, when these results are presented in bearish market, and better price action is yet to come.

The original plan for MicroStrategy was to preserve the company's wealth. They have half a billion dollars that wasn't being used for anything. If not invested, this cash would just lose its value over time. Saylor was quick to realize that. Not only he wanted to come up with a solution for the problem of preserving the value in their treasury, he needed a long term strategy that would work continuously with future profits. He has described at one time that the company was profitable and would generate $50 million a year. Reinvesting this money into the company wouldn't add any benefits. He had to come up with a way that they couldn't continue accumulating their profits and don't worry about losing the value of assets in their treasury. Otherwise, their profits would be negated with the inflation and dollar losing its value. After long and extensive research, Saylor concluded bitcoin was the way.

Since the moment Saylor came to the conclusion that bitcoin would be the best strategy fo the company, he never backed down, but continued improving company's bitcoin strategy. After realizing the potential of the bitcoin, the true nature of network and the asset, Saylor wasn't going to limit MicroStrategy's involvement in bitcoin only to its treasury cash and annual profits. They decided to borrow billions more of cash from banks and buy more bitcoin. Why not? If this strategy is as good as Saylor believe to be, why not get more loans at super low rates, buy more bitcoin, and wait. Especially when they can afford waiting for a very long time. There was a time when bitcoin's price was below the average price MicroStrategy paid for their total bitcoins. But that time was short lived, and it didn't take long for them to be in net profit. However, the strategy isn't even about net gains in bitcoin. We the retail hodlers may measure the gains by how much we bought the asset and what the current price is. But for MicroStrategy, the price doesn't matter. Their strategy seems, if price drops buy more, if price goes up buy more. It seems they will continue buying as long as they have some cash to do so.

It didn't take long for MicroStrategy and Saylor to realize that in the environment when there is no clarity regarding bitcoin as an asset from politician's and regulator's points of view, many funds that would like to be exposed to bitcoin wouldn't be able to directly invest in bitcoin. Not only the uncertainty may cause psychological barrier, legal policies or fund rules would prevent them to buy bitcoin. Until such legislative or regulative clarity is introduced, the only way for such funds to be exposed in bitcoin would be to buy stocks like MSTR. Some CEOs and executives have criticized this strategy. Because they emphasize focus on core business companies involved in. Additional investments to make money or make the stocks more valuable would serve as distraction in their views. But also many more executives praised the strategy, perhaps may have adopted similar ones themselves. At the very least, MicroStrategy being the first company to utilize bitcoin for its own advantage and executing it successful, may have opened the doors for others to follow.

Bitcion strategy may not be the right path for many companies. It is true focusing on core business, products and services may serve many companies better. But there companies in possession of cash that they don't utilize, just like MicroStrategy once did. Sooner or later they will have to realize the risks they have taking by not implementing bitcoin strategy. Some may have been implementing it in a stealth mode. Either way, the test phase for MicroStrategy has passed. While it may have seem to be a risky move three years or even two years ago, now MicroStrategy have positioned itself well and ready to surprize the rest that haven't been impressed so far.

It programmed for bitcoin to make significant moves in a year or two. This time is well below MicroStrategy's bitcoin strategy. Saylor have repeated many times when they first got into bitcoin that, they were in for long term, at least ten years. Over time this ten year timeframe turned into infinity. If anybody deserves to be rewarded for their bitcoin investment, it sure is MicroStrategy.

A company can be profitable without investing in Bitcoin, they made a bet and they get it right!

He's going to start looking really clever when Bitcoin recaptures its ATHs and beyond. Definitely better than returning the cash to investors who'd be hit with a tax for that as well.

Bitcoin is an important revolution both in economy and techlonogy. What I like most is that one can have financial freedom with Bitcoin or other coins.

I think it's a solid strategy but I just wonder what happens if the SEC/Feds goes after Microstrategy. After all, they have yet to get any approval for their ETF.

The earlier the better for companies to start adopting crypto especially Bitcoin in their strategy, to position themselves on the bullish season to come.

Looks pretty like a good strategy. Quite interesting to learn about microstrategy

Microstrategy is doing what every one of us should do with our extra cash, Buy the bitcoin and hold it for two or 3 years, YOu will see the different. No doubt Bitcoin has outperformed every other investment Opporunity in the last decade and it will continue to do so.

Bitcoin is evolving and it will be great for companies and even countries to adapt it. The sooner the better

Bitcoin has been relevant for so long and that is why I always say that it amy be hard for any other cryptocurrency to overshadow Bitcoin

It is the most popular and also the most valuable.

!PGM

!PIZZA

!CTP

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

$PIZZA slices delivered:

@torran(10/10) tipped @geekgirl

People who understand Bitcoin and believe in it the way we're seeing this person who's been buying it for a long time, we're going to see a lot more within the next two years. Profits will be in as the two years of trouble are over.

Numbers don't lie, indeed. It's such an irony of our times.

Can I do the same strategy with Hive? Investing unused cash and even getting a loan to buy more Hive.

I think that the "don't invest what you can't afford to lose" saying applies when stacking on cryptocurrencies and crypto tokens in general, Hive and #HiveEngine tokens included. 🤓 #NotFinancialAdvice 😅

!LOLZ !CTP

lolztoken.com

Blue paint

Credit: reddit

@rzc24-nftbbg, I sent you an $LOLZ on behalf of savvytester

(4/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

Congratulations @geekgirl! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 62000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: