LEO Power Up Day after Maya Protocol Integration

Today is LEO Power Up Day. For those who don't know what that means, here's an explanation.

Staking LEO still has its role in earning curation rewards and deciding how they are distributed. Ad revenue is temporarily on halt, but a replacer may come even sooner than an internal ad system is built by Inleo, which would make the ad revenue return.

Not truly a replacer of ad revenue, but more like a different feature that unlocks in tiers, based on the amount of LP held. Instead of a different revenue stream, that one would offer a discount.

What is this about?

On the LeoDex interface there are three types of fees:

- external fees

- internal LeoDex swap fees (known as affiliate fees in the world of Maya interfaces)

- bridge fees for HAT

LeoDex has 0.45% affiliate fees by default, for swaps above 150$, otherwise the fee is zero. These are the fees controlled by the LeoDex interface. Revenues collected from these fees are used to increase the liquidity in the LEO-CACAO pool.

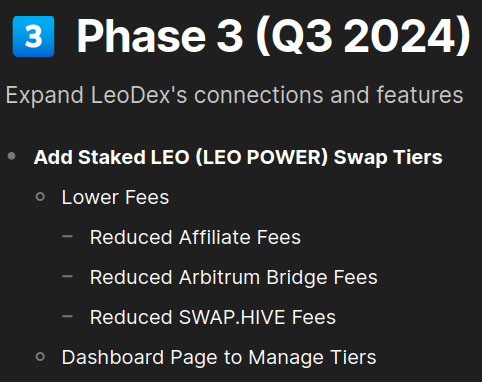

Khal mentioned that one of the perks of LEO Power holders on Inleo will be lower fees for swaps on LeoDex. He gave some examples, but we will see exact numbers when this feature will be implemented. But from the examples, we could see that large LEO Power holders (and even medium ones, to some degree) would have a significant reduction in fees, and that matters if they intend to use LeoDex. If we look around, we can see this on the roadmap for LeoDex:

Therefore, this would be an additional reason to build up the LEO Power these days, besides curation rewards.

On the other hand, a deeper LEO-CACAO pool (but also SWAP.HIVE-LEO on the Hive-Engine side), helps LEO, Hive, and presumably the person providing liquidity.

For the latter part of the equation, I can mention 4 existing or future benefits of providing liquidity to the LEO-CACAO pool:

- part of the swap fees are shared among liquidity providers (this already exists)

- Geyser rewards which will lead to a significant APR at the amount of liquidity in the pool now (not implemented yet; on the roadmap it says Q3, but my impression from Khal was that this would come quite soon)

- volume-based rewards (I'm not sure when they start, for what duration, or how much they will be, but in this case those who swap the most earn the most; and if more people swap, LPs earn more swap fees)

- lending fees (when Maya protocol introduces them - presumably soon - part of the lending fees will be distributed to LPs - we'll know more later)

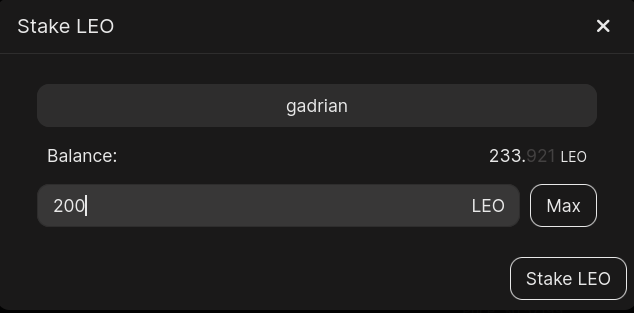

I am interested in the LEO-CACAO pool, but I also have a staking goal for LEO (relatively easy). I made some calculations to see if it made sense to lower my monthly powerup on LPUD from 200 to 150. It doesn't, as I would complete my goal close to the end of the year, and I don't like to be on the edge, when I can wrap up this goal in October.

But I will continue to push small amounts of liquidity to that pool regularly, as I get more LEO after LPUD.

As for today, the powerup continued as usual with 200 LEO:

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha

How can someone be a liquidity provider?

Depends on the platform. I'd suggest you to read about it some more if you never used liquidity pools. You can start with diesel pools on Hive-Engine. They might be more familiar than on other platforms, plus there are no fees on Hive, if you make any mistakes. Then, if you like and understand them, you can move on to others on different ecosystems.

Wow bro, building LEO Power is really smart, especially with the reduced fees on LeoDex. I like how you balanced staking with providing liquidity. It's a very very great strategy for long-term benefits. Good luck big brother !ALIVE

You described it well... It is a balancing. I could've set a higher LEO stake goal at the beginning of the year, back when LeoDex and LEO-CACAO didn't exist, but I thought it's a good idea to have some liquid LEO too, precisely because the staking level for the entire platform is somewhere at around 75%. Thanks and good luck to you too!

You're doing an absolutely perfect job on that big bro... Thanks for the luck, wishing you the very best too !PIZZA

How do I earn some Leo?

I’ve only earned Ecency points, Hive and HBD

The easy way and without investment is to use the Inleo front end. Then, when you get upvoted by someone with staked LEO (like myself), you also earn LEO.

You don't have to use Inleo all the time. I don't use it all the time either. Just form a habit and use it together with any other favorite front end you have (like Ecency).

Didn't know it was LPUD. Not that I have enough Leo to take part. I haven't visited the leo site for quite a time so no tokens to power up. Maybe next time. Leo remains one of the if not the most promising hive-based token for investments. Thanks for writing and a great weekend to you.

I understand... Everyone has their own favorite front end, and Inleo does have its bugs. Personally, I tend to use mostly two interfaces, and Inleo is one of them. But for example, I'm replying using PeakD now. Regarding LEO, it probably has the most use cases after HIVE itself and the Splinterlands tokens.

Congratulations @gadrian! You received a personal badge!

Thank you for participating in the Leo challenge.

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Nice powerup and I like the new way they are trying to involve LEO power. I would have preferred the ad revenue because I don't really use LeoDex much, but I guess something is better than nothing.

Yep, I guess most stakeholders would have preferred the additional ad revenue. That will probably come at some point, when they build that internal ad system.

Them giving better rewards to Leo stakers is really good. As the token gets more popular, having a big portion of them staked can really do well for it.

In this case it's a discount for swapping on LeoDex. But ad revenue, when it'll come back, will add to the rewards of Leo stakeholders again.

Lovely