Affirm - top BNPL facility to compete with credit cards

Introduction

We live in a world of credit cards. Basically, everything we pay for often involves using a bank-issued credit card. Little wonder that every purse or wallet almost always have at least one credit card in it. And when there is no money in the credit card, there are services that allow you to still spend money on purchases and pay when you have the money. So you probably know or use some Buy-Now-Pay-Later (BNPL) financial service. Affirm is one such service and deserves a second look.

This article is a review of Affirm and how they are putting smiles on the faces of clients. Affirm give users a lot of options when it comes to purchasing stuff on loan. A lot of unique pecks like free interest loans and no services fees make many users give Affirm big rating rating. Now lets dive right into what Affirm is trying to change in the BNPL space.

Easy Payment plans that keep you away from debt

Affirm makes it possible to combine many possibilities in one card. You could easily check out with your Affirm card at physical stores, using the mobile app, or while shopping online. There are at least two ways to use your affirm card. You can use it as your normal debit card that allows you to pay for stuffs on the go. Your Affirm card also doubles as a facility to obtain loans and settle bills when you are low on cash. When you use your Affirm card to pay for bills on loan, there are easy ways to return the loan without letting it accumulate huge debt.

So here is what the owners of Affirm BNPL has to say about why you should choose the service:

We started Affirm because credit cards aren’t working. They lure us in with perks, but end up costing a lot: The average U.S. household has $6,000 in credit card debt. With Affirm, you’ll never owe more than you agree to up front. Instead, you’ll always get a flexible, transparent, and convenient way to pay over time. source

One might start to wonder what level of spending would be possible with Affirm. We will get to that shortly. But then, lets start by checking some of the reasons why Affirm is better than others. Look at the loan repayment packages and other features of the service.

Settling the loan

So lets say a customer want to use the card to pay on credit, how will the loan repayment look like? What amount of loan could the card finance? Details below:

- Loan amount limit: The minimum purchase amount that can be paid for with an affirm card is $50. The maximum amount of loan depends on the duration of repayment. If a customer choose to repay in 4 installments of 2 weeks each, they are allowed to take a maximum loan amount of $5000. If the repayment period is to exceed 4 installments, then loan amounts in excess of $5000 are allowed and processed.

Note: Each store or partner might decide to alter the loan amount as desired. In this case, it overwrites the amounts stipulated above by Affirm.

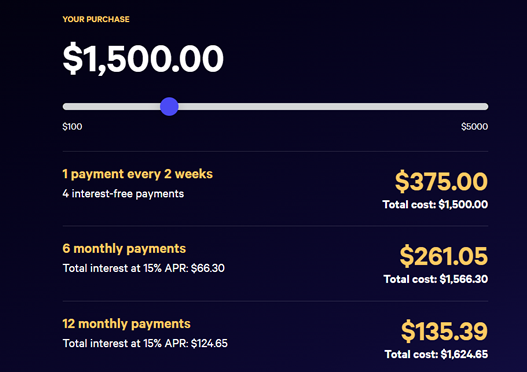

Repayment structure: A customer may choose to repay the loan in 4 installments. If this is the case, then each installment is paid once every two weeks. This covers loan amounts not exceeding $5000. The next package is for loans that are above $5000. In this case, the repayment is done in monthly installments and can cover a period of 60 months.

Interest: Every loan instrument often attracts interest. But Affirm has taken their innovative service further. For loan amounts not exceeding $5000 whose repayment is in 4 installments, the loan does not attract any interest whatsoever. This is really interesting - a big selling point for Affirm. Interests are only applied to loans in excess of $5000. The interest is often relative to the amount in question and number of repayment installments. Up to 36% interest could apply for such loans.

Service charges/Renewals: Unlike other BNPL services, Affirm does not deduct any service fees from the transactions. All transactions are processed free of charge. Besides, the card is a free subscription card. There are no monthly, yearly or other periodic renewal fees. Also, there are no card maintenance fees. No hidden charges as well. Every amount that is involved in Affirm loans are clearly stated and agreed upon by the client.

Down payment: Customers might be expected to deposit some initial amount during check out. This may apply to all loans no matter the number of installments involved.

What to pay for: Affirm loans cover everything. Whether you are shopping for groceries or fashion accessories, Affirm got you covered. If you are buy a plan ticket, paying for hotel reservation or simply settling your mortgages, Affirm loans covers all that you care about.

Below is a screenshot from the onsite loan calculator of a purchase amount of $1500.

Affirm Money

If you are not so much interested in loans, then you might want to check out Affirm Money. Thus is a normal bank account that yield high interest for the owner. In keeping with their fremium model, the bank account does not cost anything open and no overdraft fees are ever charged on customers. Below is a quick answer to your Affirm money question.

Is my Affirm Money Account FDIC-insured?

Yes, your account is FDIC-insured up to the federal limit of $250,000 through our partner, Cross River Bank, Member FDIC. Affirm is not an FDIC-insured bank. FDIC insurance covers accounts held with CRB in the event of a CRB failure. For more details, please check out the FDIC website or your account agreement. source

If you would like to learn more about your Affirm account features, check them out here

Finally

Affirm is changing what you know about BNPL options. Maybe you want to compare this service to similar services in your area. This article is just to create an awareness for Affirm. It does not in any way constitute financial advice or endorsement of this service. Dig deeper before getting involved.

Note: Thumbnail from pixabay

Posted Using InLeo Alpha

wow, i never knew about Affi

There are so many organizations that offer the option of buy now pay later but most of them have too much interest and sometimes most of them are not genuine, so it's very important to check before getting involved.

You are right. Hidden charges remain a big issue. Affirm seems to be transparent with their terms. And they have an excellent customer rating which lends to the fact that they seem to be doing well. Its worth a second look.

Wow bro it's surprising how many options are out there, but transparency and low fees are necessary. Affirm seems like a game-changer in the BNPL space. I might give it a try wow 😍😍😍

Sure a lot of options but this one seem to be top. I like the zero renewal and processing fee aspect. Plus their transparent pricing. Looks like it would be a nice try.

Absolutely right bro👌

I like the interest rate of Affirm. Looks like they are transparent with the few things you have written here

Thanks for sharing

Sure, they want to avoid hidden charges. Looks like everything is plane so customers could make informed decision.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

wow, i never knew that affirm money can be so beneficial, this is really a huge game changer.