Tax is meant for development but reverse is the case in my country.

This theme for this edition is quite timely because this is the phase my country has been for a couple of years now. Especially the present government we have in power now taxation is one of their major means of generating revenue that is meant to profer lots of solutions to the problem of the people but reverse is the case.

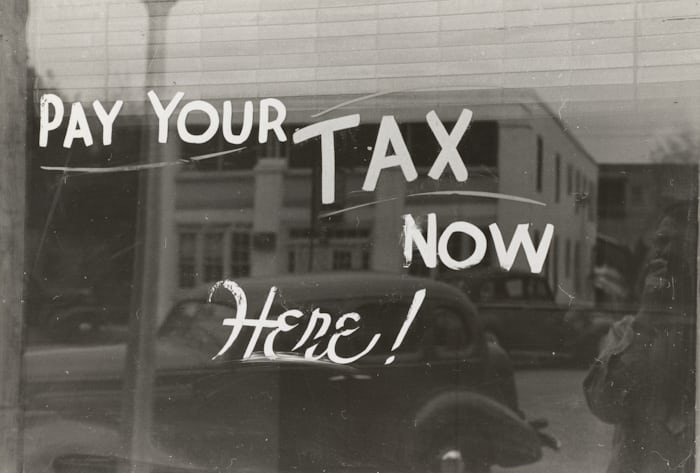

Taxes is payments that is made compulsory for individuals or citizens or businesses to the government or any organization. Taxes are public funds derived from people which the government supposed to use for development.

There are different types of taxes. It could be corporate. This is a situation where a company or organization is meant to pay tax based on their profits or earnings.

We also have income tax where individuals are meant to pay based on their salaries, wages or investments. There are different types which includes property tax, sales tax etc. there are many ways tax are received today.

Taxes are meant to be of great benefits to public, social and economic growth of any community or country. I have heard of stories of how many countries have been developed today via the instrument of taxes. In my dear country Nigeria, the people pay heavenly on tax but yet you can't trace any visible development as a result of such payments.

I can say virtually everything you do and have in my country you pay for it either directly or indirectly. Let's take for instance of the shops constructed by the government in our modern market. Every shop were made to pay 150,000 naira annually. This is a place where most of the traders or business people hardly make an annual income of 100,000 naira. How would they be able to pay such humongous amount of money. This is so sad. It has crippled some businesses instead of a source of encouragement to boost their businesses.

Right now in the communication system we're charged high for every calls and short messages sent. Anytime you recharge, you can't really see the value of what you paid for.

How bad are tax laws?

Hmmm is very bad because you can't experience the positive impact of taxation in any form. My country is good at making the law but is only the poor that suffers most because no matter how small your business is, you will pay something. I have a neighbor that owns a shop, suddenly we saw a task force that came to collect tax for signboards. Later another agency came that he should pay for the space hmmmm they aren't the landlord but how comes? These are all means to get something from people.

how much do i pay monthly?

In my area now, the vigilante comes around every month to collect money for security watch. What about light bills? I pay more than 2,000 monthly in my prepaid meter. What about water? I pay also. In summary, i pay for virtually everything i use now.

Ways which the government can leverage on taxes for meaningful development.

The government can use the taxes and build facilities like health care centers where the community would benefit. What about educational system? They can build classrooms and fix dilapidated ones. We need good roads, electricity etc.

If the taxes we pay were properly channel, we wouldn't have been where we are today.

Thanks for reading through my entry for this edition.

Our leadership are just pocketing the money meant for development of this nation and it's quite dishearting that what we could have achieved seems like an impossible dream because of how unacceptable our leaders are.

Hmmmm what a country

I repeat that no one will be bothered or concerned about taxes if the government have their right done. But not getting their right as government is what causes the problem.

Frankly speaking

Congratulations @fasacity! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 6500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP