$HIVE & $BTC Technical Analysis - 20.07.2025

Welcome to another edition of my $HIVE and $BTC technical analysis post. Sounds pompous, right? :D Ok, I am not this elegant usually, or better yet, this is not the place as we're all simple people, but seriously, if you're here and reading this analysis, thank you, I'm glad. Let's see what we have so far ans what we can expect next week as things are starting to move.

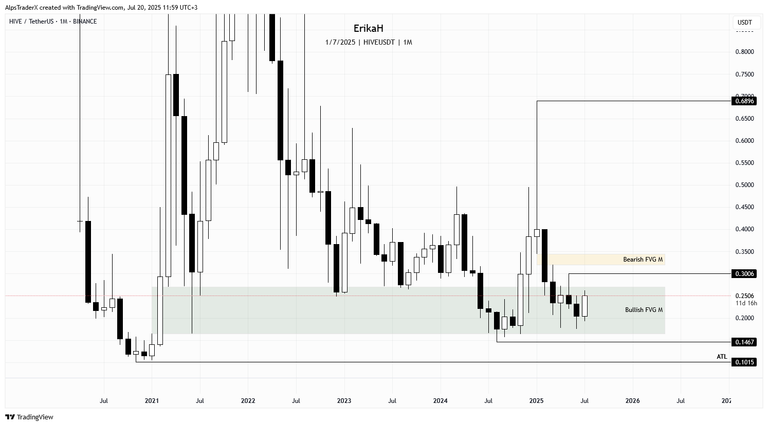

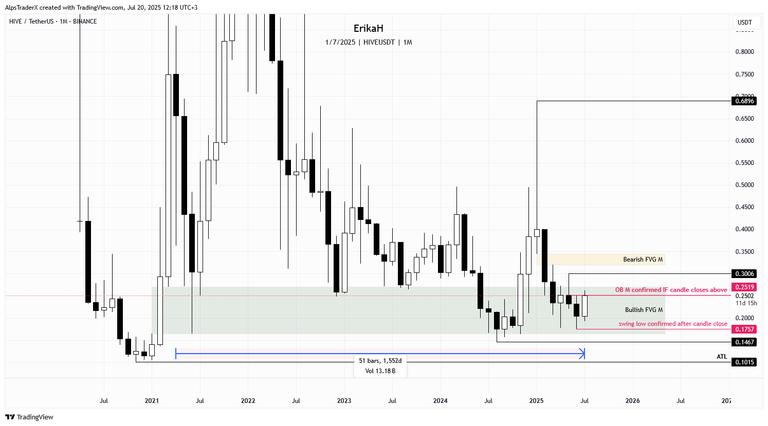

Usually there's not much to say about the monthly chart, before the candle close and we have 11 days left till the month ends, but in this case, we have to make an exception. Last week, at the time of my posting, $HIVE was trading at $0.2367. At the time of writing, price is at $0.2506 and the current candle (even though not closed yet) is a bullish engulfing candle, which suggest continuation to the upside. Again, we can't take anything for granted, till the candle close, but things have started to move.

I'm going to go ahead and draw up what we can expect. For bullish continuation, price needs to close above $0.2519, which would mean setting the bullish order block (OB) as well. After the candle close, $0.1757 will be confirmed as swing low.

As you can see, price has been in and above this bullish fair value gap (FVG) for 51 months, which means 1552 days. Once price closes above the gap and holds, which means $0.27, it's go time. I mean really GO TIME!!! In case of weakness (which no one wants to see at this point, but the big guys say there's always a flush before go time), $0.1467 is the next swing low for price to sweep.

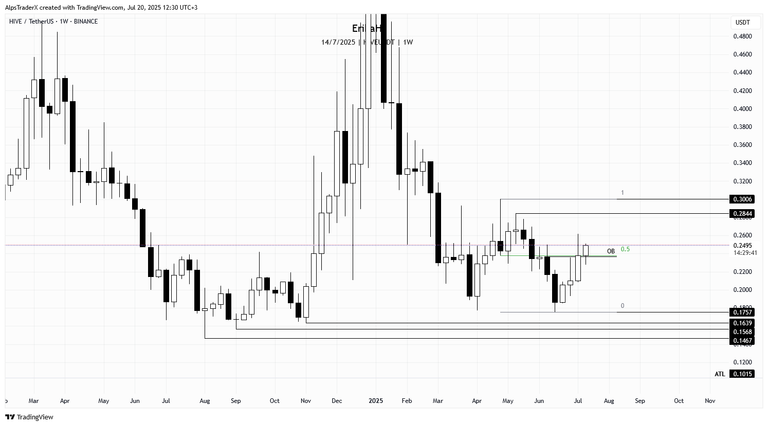

I like how the weekly chart looks, not that what I like or don't like matters though. This is technical analysis, we look at the chart, analyze data and facts. Last week's candle managed to close above $0.2366 and set the bullish order block (OB). That level is also our mid-range and at the time of writing, price is above it. There are still 14 hours to go till the candle is closing, but so far we have a bullish candle, with a nice body. In case this bullish momentum continues, there is not much to stop price to the upside as the price action is balanced, so I'm looking at $0.2844 and $0.3006 to be swept.

In case of a shift, or weakness in the market, the next low to be swept is $0.1757.

I'm trying not to complicate my charts, for those of you who're not really familiar with how to read them, but I still have to respect the rules.

On the daily chart, price is inside a bearish fair value gap (FVG), which has already been rebalanced, but price has never been able to close above it and has rejected price each time. Today's candle close is very important. In case price manages to close above and hold $0.2538, the next high to be swept is $0.262, $0.2699, $0.2784, $0.2844 and ultimately $0.3006. Please note, above the current gap, there's another bearish gap, that has also been rebalanced, but never inverted. In case price has enough strength, it should not be an obstacle anymore and price should be able to invert it, to reach $0.3006, which is a crucial level and I'm expecting it to act as resistance.

In case of another rejection here, price could sweep the $0.228 swing low, below which we have a slim bullish gap, which should defend price.

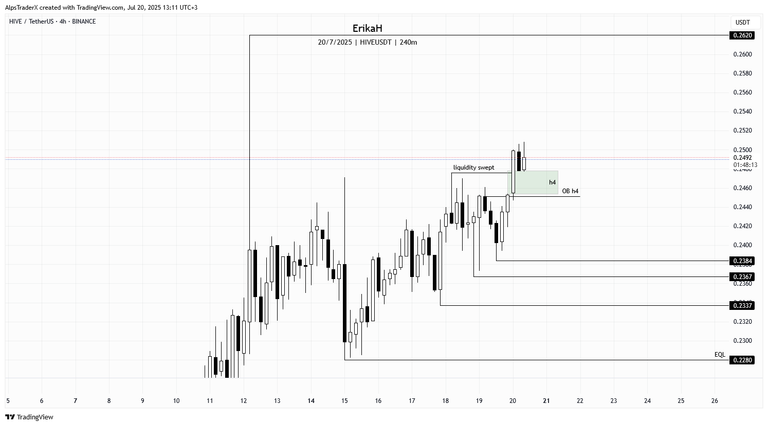

On a more granular scale, the h4 chart looks a bit tricky. Price had a nice expansion this morning, swept liquidity from the $0.2476 level and created a fair value gap, marked with green on my post. Price retested it with the current candle (which is not closed yet) and bounced off nicely. In case the gap manages to hold price, the next liquidity pool to the upside is at the swing high at $0.262. It's not going to happen overnight I suppose, unless Asia is buying heavily, so we might see a further dip into the gap tomorrow, a retest of the order bloc (OB), which would be a healthy move. In case the gap can't defend price sweeping the lows at $0.2384. $0.2367 or lower can happen.

$BTC created a new all time high (ATH) on Monday. On the daily time frame price has been consolidating since the new ATH on Monday, it is above the bullish gap marked with green on my chart and below mid-range. Price still has a bullish structure though.

During the weekend volatility and volume is low, so we had a doji yesterday and looks like today's candle will be similar, once the candle close. What we can expect is for price to sweep the swing low at $115,750, maybe go deeper and rebalance the gap as well and if the gap can't defend price, then ... we go lower. Basically no one knows if this is the cycle high or there's more room to the upside, so trade with caution.

It's time to pay attention to the BTC/ETH chart as well as it is a clear indicator of money flowing out of BTC into ETH, then high caps and so on.

The BTC/ETH pair had a nice expansion this week, rebalancing the bearish gap. The candle is not close yet, but if in 13 hours price still manages to stay above the gap, we have bullish continuation. However, this doesn't mean up only. Price may come back and try not to leave a huge gap, but time will tell, we're not here to speculate.

Next week we only have one red folder day, with unemployment claims, flash manufacturing and flash services, so most likely we are not going to have much volatility on Monday, Tuesday, Wednesday and Friday, but that doesn't mean there will not be opportunities.

Now that things tarting to move, most likely I'll be updating my analysis during the week, if something significant happens. Look out for updated in the comment section.

Remember, technical analysis is not about forecasting price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

Come trade with me on Bybit.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

Wow! I deeply love the way you broke down the analysis in the charts of $Hive & $Btc. Yes I also noticed it this morning when I checked my Binance charts for the improvements on $Hive. I don't really know much but what I can say is that this is an impressive technical analytics you provide for us. Keep up the great work

Oh how I love your pompous TA on btc and hive. I wish there were better exchanges with more liquidity and charts that would make it worth it to transfer and trade and bring back and power up.

I usually only swing trade hbd against hive slowing when it languishes in the mid 20s. With your TA I can set time more medium term buys and sells for the bigger swings.

Thanks again!

Aww, thank you! At least someone who's making use of what I post. Lovely!

Unfortunately $HIVE is a crazy asset, low liquidity makes it vulnerable and history proved how a slightly bigger order can create a spike out of nowhere. I tried to trade it, but it's very dangerous and not tradable with my system. I'm a scalper and low time frame charts look terrible.

Look at the m5 chart, it's so gappy I can't even look at it.

i really like the weekly charts, good buy candles there, i still belive in 0,30$ price (ok now that i said it it's gonna dump lol)

They say Sunday pump, Monday dump, which most likely is a frequent thing. Also, they say there's a flush before every alts run, to flush out high leverage, but know knows. Sooner or later $HIVE is going to hit higher highs constantly.

Congratulations @erikah! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPI love what $HIVE is doing now. Price retested the slim gap again, bounced off nicely and set a new order block (OB). Holding strong so far. Next target is the EQL at $0.262