$HIVE & $BTC Technical Analysis - 11.05.2025

Today I was really looking forward to do this analysis because I wanted to see what $HIVE is doing. It was a busy week for me and had no time to follow $HIVE, but know it made a move, so let's see how things stand right now.

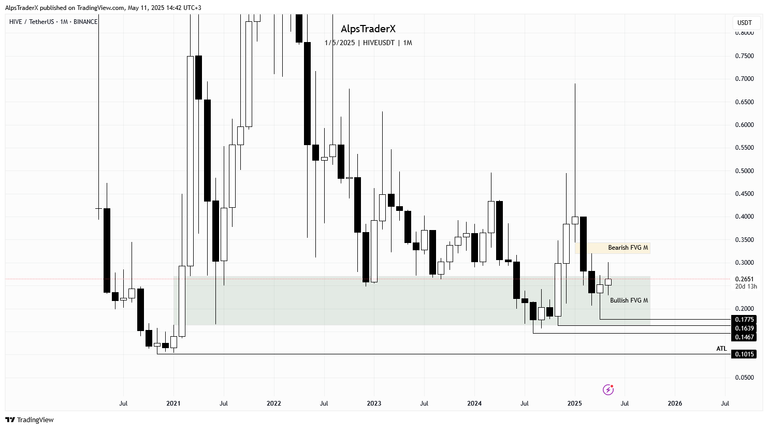

Today is the 11th day of the month, so we have 19 days till the candle close. So far we have a bullish candle with long upside and downside wick and a small body, which kinda suggests indecision, definitely no momentum yet, but we'll see when the monthly candle closes. So far the body of the candle is still inside the bullish gap that is holding price.

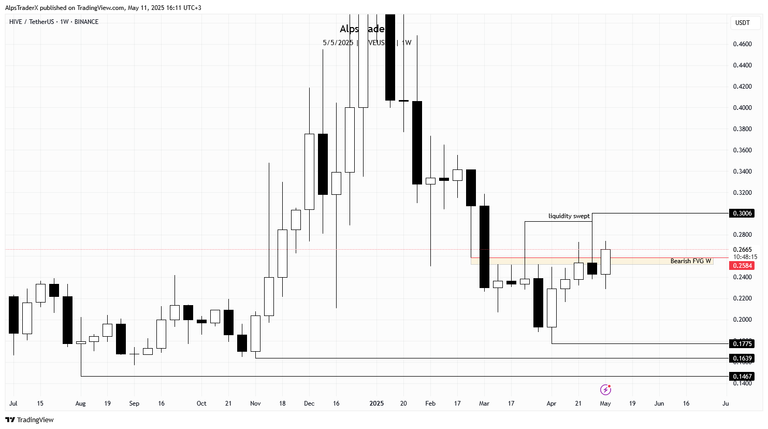

The weekly chart looks way better than last week. Last week I said:

Last week price had an attempt to invert that bearish gap, marked with yellow on the chart, but could not close above it. This week we saw price sweeping liquidity from $0.2929 level, which I mentioned in my last post, but could not close above $0.2584. That bl**dy gap is capping the market for 7 weeks now and keeping price hostage as well. This week's candle is not closed, there are 10 hours till the candle close, but by the look of it, we won't get the close that would indicate bullish continuation. source

And indeed, we didn't get the close we all needed as the candle closed inside the gap. This week we have a nice move to the upside and so far, even though the candle closes in about 10 hours, at the time of writing, it is above the gap and looks like a bullish engulfing candle.

So in order for everyone to understand, the current candle needs to close above $0.2584 (red line). In case that happens, it also confirms $0.3006 as swing high and that'll be the next liquidity pool to target.

In case of weakness (which I don't see at the moment), price could revisit the $0.1775 level, or lower, the swing lows marked on the chart, respectively $0.1639 and $0.1467. It's highly unlikely at this point, but you never know in this game. One Geo-political event can bring the whole market down, so better know what to expect and be prepared for.

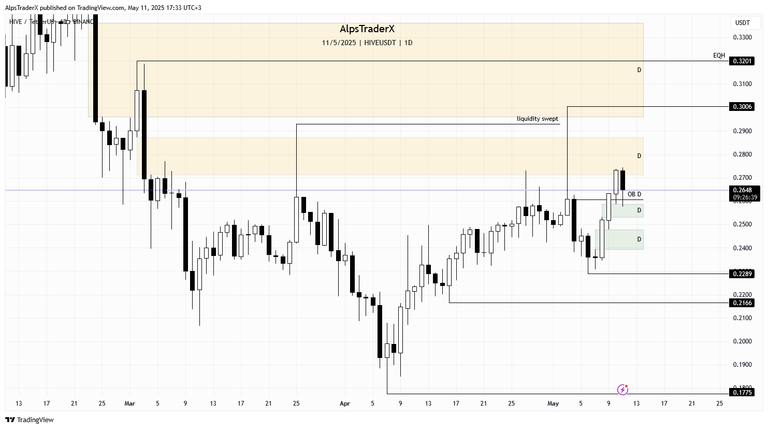

I like what I see on the daily chart. Since last week price made quite some progress, in terms of $HIVE of course, which in plain English means price swept liquidity down till $0.2322 and created a swing low at $0.2289. Price bounced nicely from there and a bullish order block (OB) was created on Friday. That OB was retested today, price bounced off of it and holding above it so far.

We have two bullish gaps on the leg up, or the buy side. One, the highest has been retested and holding price.

For bullish continuation price needs to close above the bearish gap (yellow), in which case the next liquidity pool is at the swing high at $0.3006, after which I'm expecting price to invert (close above and hold) the other bearish gap above the current one.

I rarely say this, because $HIVE is a crazy asset, you really have to know how it moves and be ready for crazy, unexplained (if you don't know the insights) swings, but the h4 chart looks nice. The gap I marked with green is an inverted bullish gap and holding price nicely so far.

Today it's Sunday, so no volatility, no volume, no news to move the market, but for bullish continuation price needs to close above $0.2761 and hold. That would establish a bullish OB and in that case the next liquidity pool is at $0.3006. In case of weakness, the next level I'm looking at is $0.2307 and $0.2289, which can be considered equal lows. The truth is, the buy side of the curve, meaning the leg up from $0.2289 till where price is not, is very balanced, there's not much to stop price.

$BTC is looking good here, but approaching resistance. This week on Thursday, price set the bullish OB, after which price created a bullish gap that has not been retested yet. Neither has the OB, but that's further lower.

Next week is going to be interesting. In case of bullish continuation, the upside targets I see are: $104,986 EQH, $106,421, $107,118 and ultimately ATH at $109,951.

In case price shows weakness, we could see a retest and rebalance of the gap, a retest of the OB, or the swing low at $93,333.

Next week is going to be interesting. We have three red folder days with important data announcement, which is going to create volatility and give room to manipulation as well.

Remember, technical analysis is not about forecasting price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

Come trade with me on Bybit.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

I confess I don't understand why geopolitical news should move the Hive price.

Is it down to speculators doing blind automatic selling when news comes out about tariffs or war?

$HIVE as any other cryptocurrency is a risk asset. When there are geo-political events, people are rushing to secure their wealth and usually that means out of risk assets and into something safer, like USD, gold or whatever they consider safer. High selling pressure triggers stop losses, which cascade and drives price down, a lot.

With all this uncertainty, it's great that Bitcoin is shining like a star. Ethereum has also started to recover. I think we may see a pump in June, if not in May. But my prediction is just a prediction, I don't have a serious analysis. I am new to crypto analysis. Thank you Erikah for this good analysis.

I don't have a prediction either, but once $BTC reaches ATH, retests it successfully, it's GO time. We don't know what the new ATH is going to be, but we'll see. The real fun is going to begin when ETH/BTC starts moving to the upside, because that means alts are going to start moving as well, if the market respects how used to work in the past. But we'll see. I'll try to keep everyone updated 😜

I'll keep reading your updates. Respect your analysis 🫡

Thank you @incublus 😎

Important red folder days and geo-political stuff on tariffs, Ukraine, Gaza and its just Monday 🙄

Sir ... @hivewatcher It has given me a month to complete the task. Please give me freedom after it is over.I think you didn't take my issue personally because through your work, you never personally hurt our small users.Yes, I admit that I made a mistake. The mistake is that I represented my post on the previous ID, that is, on the old ID.However, I have started working on this new account because you would get minus votes if you posted on the previous account.I don't know why, but I feel like I completed those hivewatcher missions.I would like to thank you for letting me work well from now on.

Congratulations @erikah! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 47000 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIt is incredible how a news or a world event can move this market, both up and down but there is our job to be informed, prepared with liquidity to take these opportunities. I hope that when I get settled in my house I can have some extra money to again take positions and have some savings, mmm more like an investment, now I have but I would like to continue doing it.

Indeed, these events happen all the time, and it's our job to protect our capital.

Hive always stand out and go with its own ride rather than follow the crowd

This is bullshit fredaig, and it shows you have no clue about it, you're just commenting to comment. This is not the first time, so better don't do it. Rather comment on something you understand.